The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

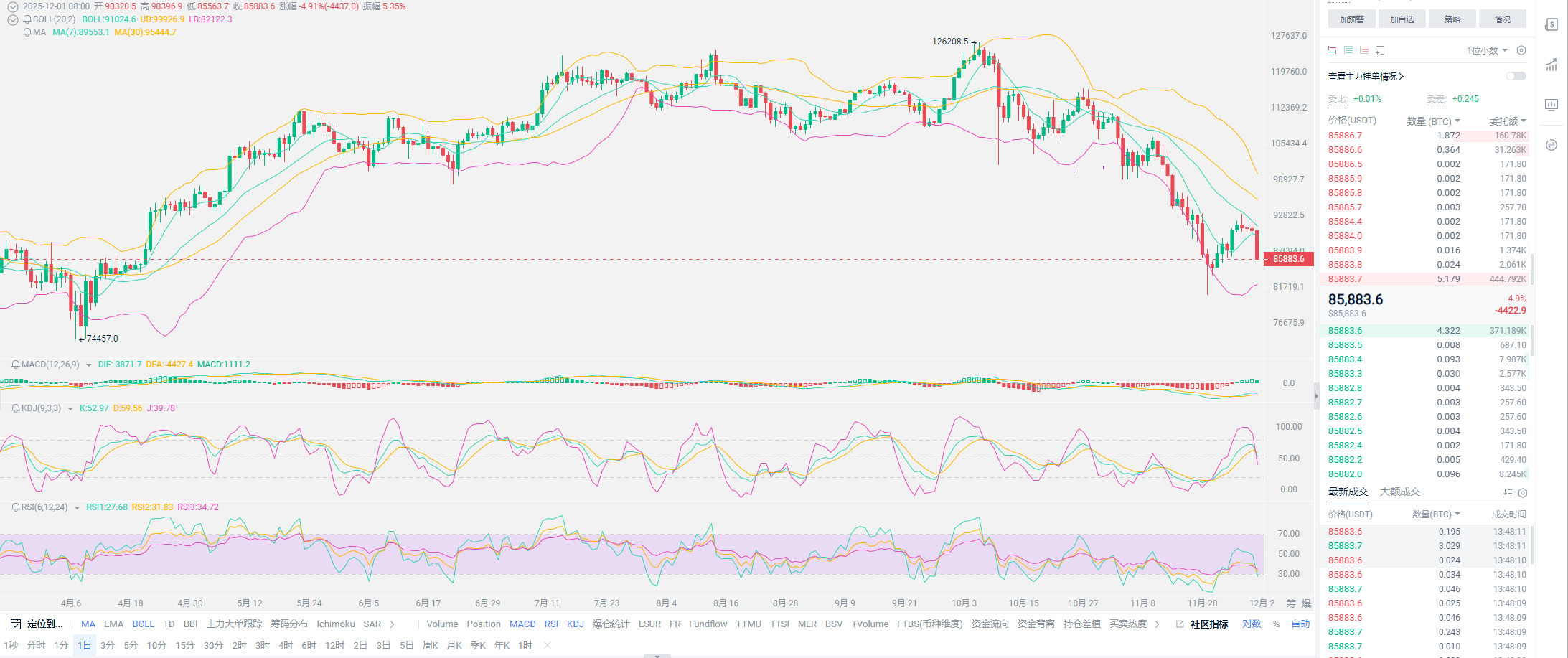

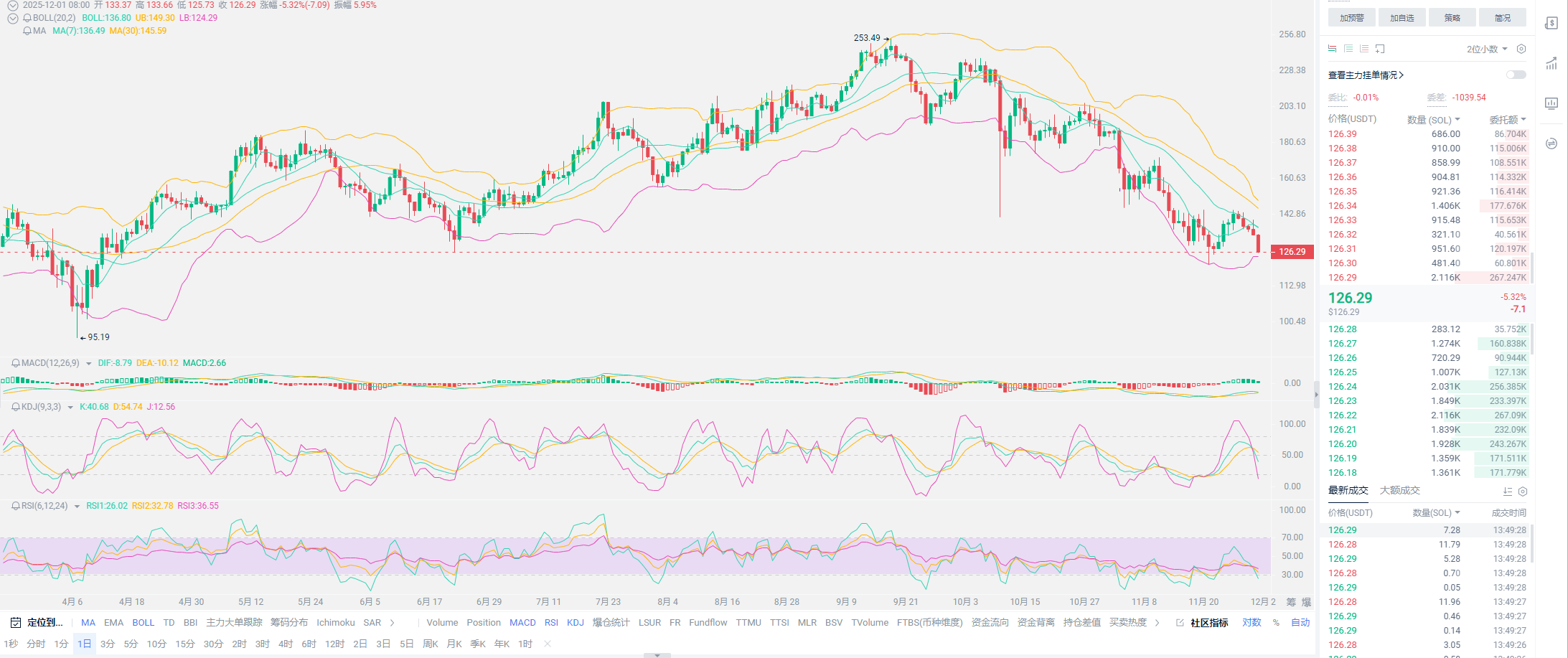

Just got up to face a wave of plummeting prices, Bitcoin has dropped from 90,396 to 86,181, over four thousand points, and there is still room for further decline, the downward trend has not yet stopped. Yesterday's analysis wanted to mention the short-term bearish factors, but ultimately did not speak out. A few days ago, I only mentioned domestic strategies, and Lao Cui has also suffered greatly; these factors cannot be elaborated on. Everyone can take a look at some domestic data, most of which can clearly indicate why the bearish impact this time is so severe. Many people are talking about the tightening in the domestic market not aligning with the mainstream; if we observe compliant countries, none are not in a tightening state? Europe has its own exchanges, Japan and South Korea do as well, and the U.S. has Coinbase; everyone is essentially building their own cars behind closed doors. The crypto circle will remain in a chaotic state for a long time, as no one is willing to support others. From Lao Cui's perspective, expelling domestic capital is a good thing, and I won't elaborate further.

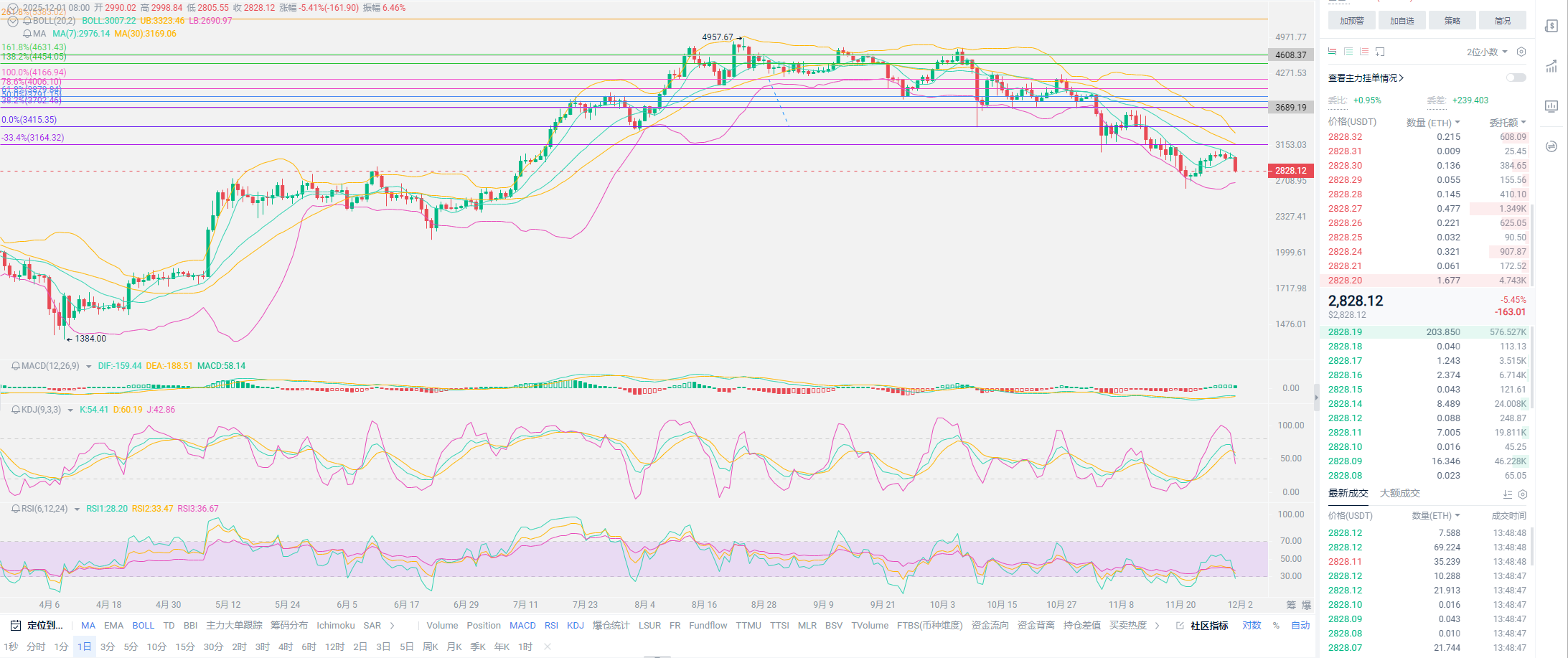

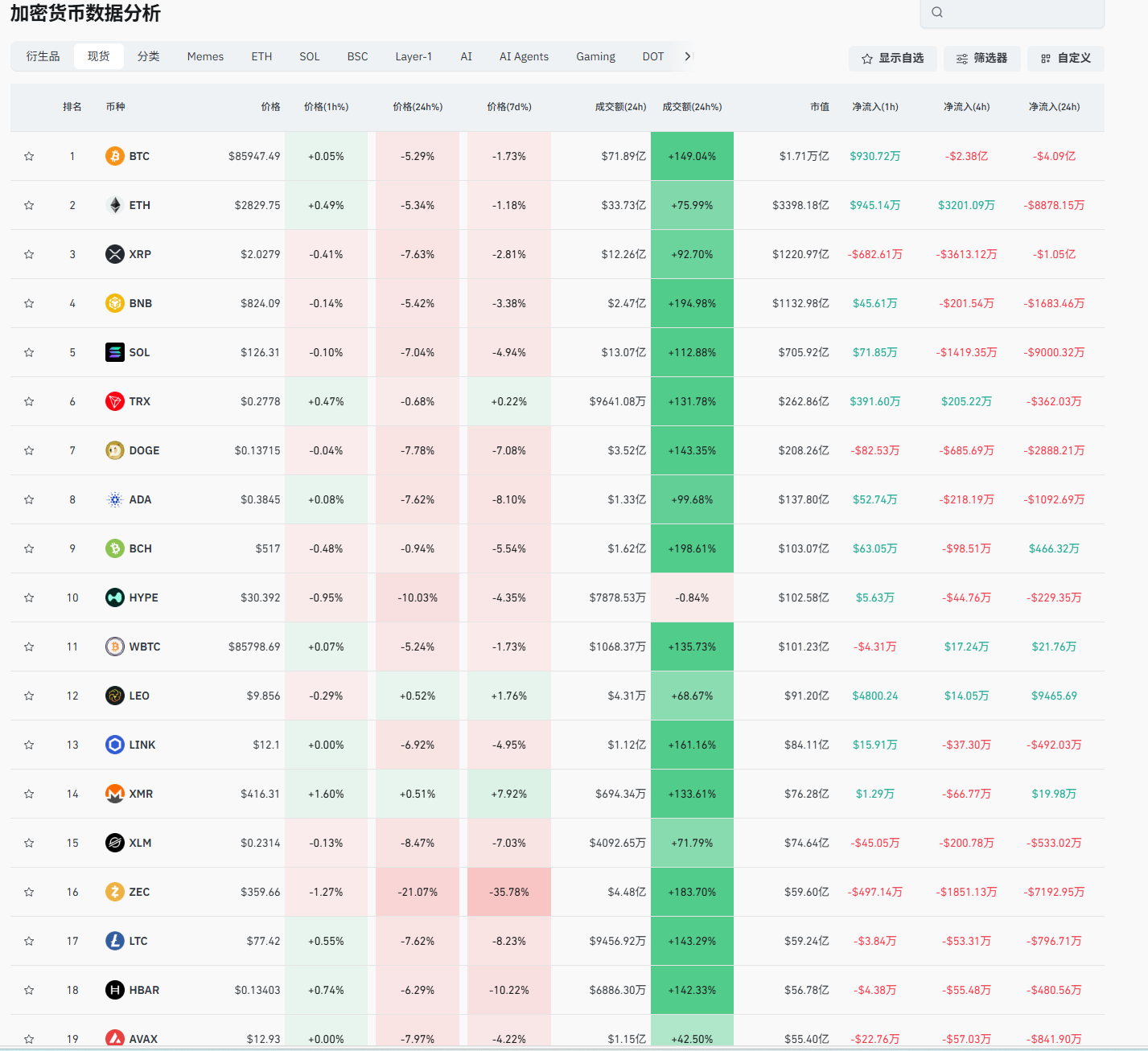

The second major bearish news is undoubtedly Japan hinting at an interest rate hike. Japan's interest rate hike caused the Nikkei index to plummet, and when the U.S. stock market opens in the evening, the crypto market will follow the U.S. stock market again. Currently, Bitcoin and ETH's movements are almost entirely following the stock market; Bitcoin at this stage can no longer break out into an independent market. To raise it to 200,000 means that stocks like Tesla and Nvidia must also double. Looking at the fundamentals, this seems almost impossible; the global stock market is one chessboard, and we must admit that the current stock market is at a high point. If the U.S. stock market crashes, Bitcoin will likely plummet as well. Don't think that Lao Cui is constantly changing his mind or direction; you can review the last sentence of yesterday's article. This strategy was analyzed by Lao Cui a few days ago, but after the analysis, it was quickly countered, and the bitter fruit was too great. If anyone is still interested in understanding the underlying logic, feel free to chat with Lao Cui personally; this article will not discuss politics.

Whether you are a practitioner or a personal trader, do not resent or resist these strategies. Looking at it from a long-term perspective, expelling domestic capital is beneficial for the country and the people. The short-term speculation on Powell's resignation is also very hot. Lao Cui does not have insider information, but logically deducing, it is highly likely that he will resign. Currently, the composition of the Federal Reserve is almost half occupied by Trump’s people, and Trump's strategy is extreme interest rate cuts, including the subsequent successor, who will also hold an open attitude towards the crypto circle. These previous officials were not in their positions and did not plan their policies; the strategies after taking office are still up for discussion. Do not blindly be bullish; at the same time, he will certainly be restrained. Such news will create a risk-averse sentiment in the short term. If there really is a resignation, for us investors, we can only wait for the signal to be established and then look at the next person's acceptance speech before making decisions on future trends. These three pieces of news are all short-term bearish signals, but as long as we get through this, we will welcome a new spring again.

As for the upcoming transition, Lao Cui is actually more optimistic about next year's market. Previously, Lao Cui held a pessimistic attitude towards the 2026 crypto market, but with this drop, breaking through the previous psychological bottom line gives Lao Cui a feeling that the market of 2026 has arrived early, and the bearish factors have been exhausted. Coupled with the transition, this market sentiment should have arrived in June next year; arriving early may just pave the way for American strategies. Starting today, the tapering will officially end, and in the past two days, it was revealed that the U.S. will start printing money in the future, which can form a closed loop here. Ending tapering - cutting interest rates - printing money - expanding the balance sheet; both cutting interest rates and expanding the balance sheet have been discussed before. The momentum of interest rate cuts is in the hundreds of billions of dollars, while expanding the balance sheet is in the trillions; the combination of the two is immensely powerful. Just looking at the money printing, during the mask period, the U.S. printed money, leading to inflation that continues to this day, which still cannot be fully eliminated. The feedback to the crypto circle has been experiencing a new round of bull market, resulting in Bitcoin reaching a new height of 70,000.

This entire process will fully explode again next year, which is highly probable. With a new official taking office, the data will certainly not be weaker than during Powell's time. From the perspective of American strategies, solving the inflation problem is generally a major concern for the next president; Trump will not care about the next president's survival, which aligns with his current persona. While being extremely optimistic, one must also be prepared to avoid risks. For next year, the biggest risk is undoubtedly the issue of capital choices. The crypto circle has seen its peak market value reach over 4 trillion this year, almost touching 5 trillion. Looking at the final results, Nvidia broke through 3 trillion to 5 trillion in less than a year; capital still favors the U.S. stock market more. Gold is similar; the turmoil in the pattern makes gold extremely attractive, and the momentum continues to break historical highs, which poses challenges for the crypto circle. The issue of attracting trillions of capital is not a big problem; BlackRock can contribute nearly half of the funds, but doubling must be cautious and not too greedy.

Lao Cui summarizes: Today's article is more like a forecast for next year's market. There is no blind bullishness, but next year will definitely revolve around a bullish trend; if you ask Lao Cui whether Bitcoin still has a chance for 200,000, Lao Cui can only say that he does not see such a long-term prospect for now. Including last year's outlook for this year, Bitcoin was positioned between 13,000 and 15,000, with various factors interfering, leading to a distance of 3,000 points from the 13,000 mark. There is still a whole month left; looking at it from a short-term perspective seems almost hopeless, but looking long-term, the expectations for December are still somewhat strong. Therefore, Lao Cui is currently not rational and will not make too many predictions. The impact of short-term bearishness will continue for a while, but do not imagine it will be like May 19; the domestic crypto assets are not many, and the impact on the bearish side will more depend on Japan's interest rate hike situation. If confirmed, it will at least affect the inflow of funds at the Japanese level (the proportion of funds is much larger than domestically). For the short-term decline, contract users can try, but do not hold until new lows; just try it, as it will still drop for a while. This drop may be the last one before the bull market starts; consider it, as next year is worth looking forward to. At the end of the article, if you have any questions or misunderstandings, just ask Lao Cui!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, feel free to contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。