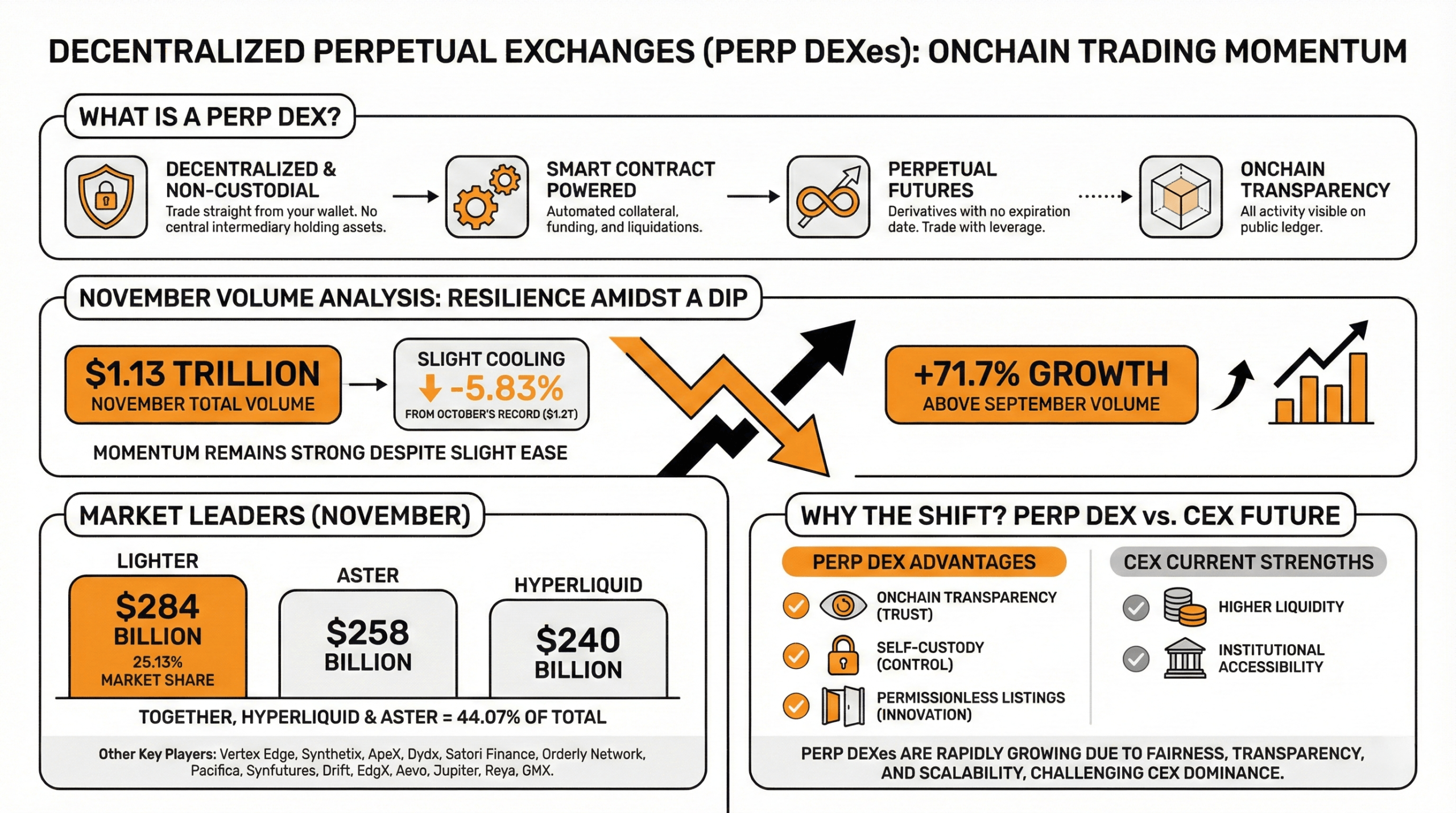

At its core, a perp decentralized exchange (DEX) in DeFi operates as a DEX where traders lean on smart contracts to trade perpetual futures contracts — derivatives with no expiration date — straight from their own wallets, often with a pinch of leverage.

Everything remains onchain and non-custodial, letting collateral, funding payments, and liquidations play out in full view without a centralized hall monitor meddling in the process. Last month, data from defillama.com shows perp protocols pulled in $1.2 trillion in volume, marking their highest tally to date.

November’s perp DEX volume cooled a bit, slipping just 5.83% after stacking up $1.13 trillion over the 30-day stretch. Defillama.com figures show more than $240 billion flowed through Hyperliquid, while Aster chimed in with $258 billion during the same period. Together, Hyperliquid and Aster logged 44.07% of the total volume. Lighter grabbed the bigger slice, racking up $284 billion — a full 25.13% of the total.

Read more: Blackrock Credits Bitcoin ETFs With Leading Its Global Revenue

The remaining share flowed to perp protocols such as Vertex Edge, Synthetix, ApeX, Dydx, Satori Finance, Orderly Network, Pacifica, Synfutures, Drift, EdgX, Aevo, Jupiter, Reya, and GMX — with EdgX and ApeX both putting up notably competitive volume tallies for November.

Over the long run, people believe perp DEXes will outpace centralized exchanges (CEXes) mainly because perp DEXes offer onchain transparency, self-custody of assets, and permissionless listings, which build trust and foster innovation in derivatives trading.

Although CEXs currently lead in liquidity and institutional accessibility, perp DEXs are rapidly growing in volume due to their fairness, transparency, and evolving scalability. As November wrapped, the takeaway was clear — even with a slight cooldown, perp DEXes kept the tempo high enough to remind everyone they’re not fading from the main stage anytime soon.

- What is a perp DEX?

A perp DEX is a decentralized exchange that lets traders swap perpetual futures contracts onchain without relying on a centralized intermediary. - How much volume did perp DEXes handle in November?

Perp DEXes recorded $1.13 trillion in November, slipping just 5.83% from October’s all-time high. - Which platforms led November’s perp DEX activity?

Hyperliquid, Aster, and Lighter dominated the month, collectively handling a large share of total onchain derivatives volume. - Why are traders shifting toward perp DEXes?

Traders favor perp DEXes for transparency, self-custody, and permissionless access, which continue to draw volume from centralized exchanges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。