Highlights of This Issue

This week's newsletter covers the statistical period from November 21 to November 27, 2025. The RWA market has entered a phase of stock optimization, with the total on-chain market capitalization growth further slowing to 1.10%. However, the number of holders continues to rise, indicating a shift in the market from scale expansion to user engagement. The total market capitalization of stablecoins is nearing zero growth, while monthly active addresses have surged by 24.84%, highlighting the strengthening of on-chain payment settlement functions and the activity of small, high-frequency trading. On the regulatory front, the G20, European Central Bank, and South African Reserve Bank have all warned of the regulatory risks associated with RWA and stablecoins. In contrast, South Korea's STO bill has passed its initial review, and Bolivia plans to integrate stablecoins into its financial system, reflecting a trend of regulatory divergence globally. At the project level, traditional finance and tech giants continue to integrate crypto projects to develop stablecoins: QCAD has been approved as Canada's first compliant Canadian dollar stablecoin, Klarna plans to launch its own stablecoin on the Tempo chain in 2026, and the United States' Credit Union is testing a self-developed stablecoin on Stellar, indicating that stablecoins are becoming a new battleground for various market participants.

Data Insights

RWA Track Overview

According to the latest data from RWA.xyz, as of November 28, 2025, the total on-chain market capitalization of RWA reached $35.96 billion, a slight increase of 1.10% compared to the same period last month, with growth momentum significantly weakening to a near six-month low. The total number of asset holders has risen to approximately 551,400, an increase of 8.02% compared to the same period last month. The total number of asset issuers stands at 251, showing stagnation in growth, reflecting a structural contradiction between the expanding base of market investors and the bottleneck in asset supply.

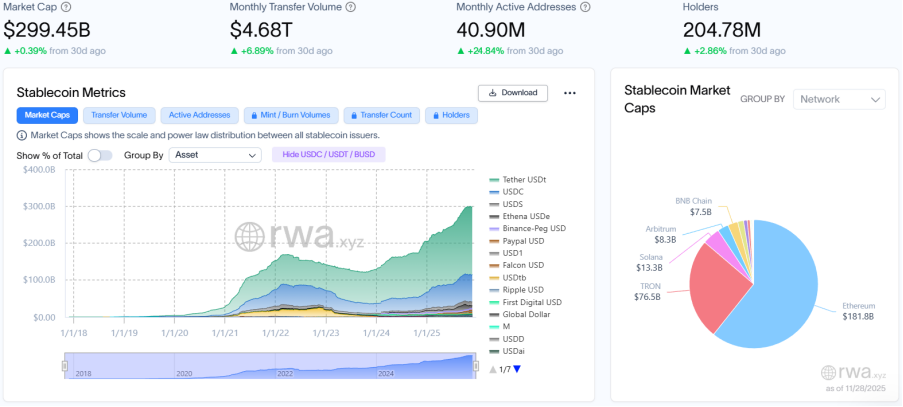

Stablecoin Market

The total market capitalization of stablecoins reached $299.45 billion, a slight increase of 0.39% compared to the same period last month, with growth momentum continuing to slow towards stagnation. The monthly transfer volume remains high at $4.68 trillion, up 6.89% compared to the same period last month. The total number of monthly active addresses has surged to 40.90 million, a significant increase of 24.84% compared to the same period last month. The total number of holders has steadily grown to approximately 205 million, a slight increase of 2.86% compared to the same period last month, both validating that the market has entered a new phase of "stock optimization." In the context of nearly zero growth in market capitalization, user activity and capital turnover efficiency have improved simultaneously, reflecting the continuous strengthening of on-chain payment settlement functions. Data indicates a robust resonance between institutional settlement and retail trading, with the growth rate of active addresses significantly outpacing that of transfer volume, reflecting an increase in the activity of small, high-frequency trading and an improvement in market structure health. The leading stablecoins are USDT, USDC, and USDS, with USDT's market capitalization slightly increasing by 0.25% compared to the same period last month; USDC's market capitalization slightly increased by 0.38%; and USDS's market capitalization rose by 3.26%.

Regulatory News

G20 Financial Regulators Call for Close Monitoring of Private Credit and Stablecoin Development

According to Reuters, Andrew Bailey, Chair of the G20 Financial Stability Board (FSB), stated in a letter to G20 leaders that the rapid development of private credit markets and stablecoins urgently requires enhanced global regulatory cooperation. He warned that differences among countries in the regulation and prudential framework for stablecoins could increase systemic risks and called for the establishment of a cross-border compliance mechanism. He also emphasized that major economies are making slow progress in implementing the Basel III global banking capital standards, which should also be a concern.

The European Central Bank today released a preview of its financial stability review (the formal report will be published on Wednesday), indicating that as of November 2025, the total market capitalization of stablecoins has surpassed $280 billion, accounting for about 8% of the entire crypto market. USDT and USDC together account for nearly 90%, with reserve assets reaching the scale of the top 20 global money market funds.

The ECB report pointed out that if stablecoins are widely adopted, it could lead households to convert some bank deposits into stablecoin holdings, weakening banks' retail funding sources and increasing financing volatility. Although MiCAR has prohibited European issuers from paying interest to curb such transfers, banks are still calling for similar restrictions to be implemented in the U.S. Additionally, the rapid growth of stablecoins and their association with the banking system could trigger concentrated withdrawals during a crisis. The report emphasizes the risks of a cross-border "multi-issuer mechanism," warning that EU issuers may struggle to meet global redemption requests, calling for pre-access safeguards and promoting global regulatory alignment.

According to South Korean media Electronic Times, the amendments to South Korea's Electronic Securities Act and Capital Markets Act have passed the review of the National Assembly's Administrative Committee, marking a key step towards the institutionalization of the Security Token Offering (STO). If this meeting passes next month, blockchain-based physical assets such as real estate, artworks, and music copyrights will be legally "tokenized" and traded on legal platforms. Currently, three major consortiums are competing for STO trading platform qualifications. The industry expects South Korea to become an Asian hub for token securities.

South African Reserve Bank Lists Cryptocurrencies and Stablecoins as New Financial Risks

According to Bloomberg, the South African Reserve Bank has warned that crypto assets and stablecoins, due to a lack of comprehensive regulation, have become new risks threatening the country's financial industry. In its semi-annual Financial Stability Assessment Report, it pointed out that the digital and cross-border nature of cryptocurrencies allows them to evade current foreign exchange control laws, while digital assets have not yet been included in regulation. The bank's chief macroprudential expert, Herco Steyn, stated that the risks stem from an "incomplete regulatory framework." He expects progress next year but warns that if progress stalls, "regulation will be overwhelmed."

Currently, the South African Reserve Bank is working with the Treasury to develop new regulations to oversee cross-border crypto asset transactions and amend foreign exchange control laws to include digital assets. The bank emphasizes that as the adoption rate of crypto assets increases, the domestic regulatory framework must continuously adjust to market developments and risks. Data shows that the South African crypto industry is dominated by three platforms: Luno, VALR, and Ovex. As of July, registered users approached 7.8 million; by December 2024, total assets are expected to reach 25.3 billion rand.

Bolivia Plans to Integrate Stablecoins into the National Financial System

According to Solid Intel, Bolivia's Minister of Economy announced plans to integrate stablecoins into the country's formal financial system.

Domestic Developments

Pan Gongsheng, Governor of the People's Bank of China, recently attended the launch ceremony of the China-UAE payment cooperation project alongside UAE Vice President Mansour and Central Bank Governor Khaled. The two parties signed a memorandum of understanding on cross-border payment connectivity, announcing the interconnection of the two countries' rapid payment systems to support online rapid cross-border remittances for businesses and individuals; witnessed the first transaction of the "UnionPay-Jaywan" dual-brand card; and officially launched the UAE's multilateral digital currency bridge project JISR to enhance bilateral financial cooperation and improve cross-border payment efficiency.

Project Progress

The Sign team has released the sovereign Layer2 architecture "SIGN Stack," built on BNB Chain and opBNB, designed specifically for countries to deploy digital infrastructure and compliant stablecoins. This solution features customized Sequencer permissions, a DID identity system, gas-free stablecoin transfers, and on-chain functionality for national real-world assets (RWA), aiming to establish BNB Chain as the settlement layer for global sovereign blockchain infrastructure.

AI Company Caesar to Collaborate with Centrifuge to Explore On-Chain Equity Issuance

AI company Caesar has announced a collaboration with Centrifuge to explore on-chain equity issuance, becoming the first AI enterprise to attempt this mechanism.

Mu Digital has announced the completion of a $1.5 million Pre-Seed round of financing, with investors including UOB Venture Management, Signum Capital, CMS Holdings, Cointelegraph Accelerator, and Echo. Mu Digital focuses on bringing real assets from Asia's $20 trillion credit market on-chain, planning to launch the Monad mainnet on November 24. Products include the Asia Dollar (AZND) with a targeted yield of 6-7% and muBOND with yields of up to 15%.

Ondo Invests $25 Million in YLDS Stablecoin Issued by Figure to Enhance OUSG Yield Strategy

According to Ondo Finance's official website, Ondo has invested $25 million in the yield-bearing stablecoin YLDS issued by Figure's subsidiary FCC, to support its flagship tokenized short-term U.S. Treasury fund OUSG. The fund currently has over $780 million locked, with a portfolio that includes funds issued by institutions such as BlackRock, Fidelity, Franklin, and WisdomTree.

QCAD Approved as Canada's First Compliant Canadian Dollar Stablecoin

According to PR Newswire, Stablecorp announced that its QCAD Digital Trust has received a final receipt for its prospectus from Canadian securities regulators, making QCAD the first compliant CAD stablecoin issued under the current stablecoin regulatory framework. QCAD is backed by a 1:1 Canadian dollar reserve held in custody by regulated institutions, providing near-instant, low-cost cross-border and domestic transfers; reserves will be audited regularly and disclosed publicly.

Klarna Plans to Launch Its Own Stablecoin on the Tempo Chain in 2026

According to Solid Intel, Swedish fintech company Klarna plans to launch its own stablecoin on the Tempo blockchain network, supported by Paradigm and Stripe, in 2026.

Wyoming Stablecoin Commission Launches tFRNT Testnet Faucet

According to an official announcement from the Wyoming Stable Token Commission, the U.S. Wyoming Stablecoin Commission has launched a faucet for the Frontier Stable Token testnet, allowing users to connect their wallets on the official website, select from 8 testnets, and receive up to 1,000 tFRNT every 24 hours. tFRNT is not backed by any reserves and is merely a testnet token for simulating mainnet contracts, used for developer integration testing and novice experience of the FRNT mechanism. Currently, it supports testnets such as Arbitrum, Avalanche, Base, Ethereum, Hedera, Optimism, Polygon, and Solana, with relevant import instructions available on its FAQ page.

According to The Block, U.S. Bancorp has stated that it is testing its self-developed stablecoin on the Stellar blockchain. The bank's choice of the Stellar blockchain appears to be based on considerations of transaction security and control. Mike Villano, Senior Vice President of Corporate Innovation at the bank, stated, "For our banking clients, we must consider additional protective measures around the 'Know Your Customer (KYC)' principles, such as the ability to reverse transactions. After conducting more R&D on the Stellar platform, we found that one of its significant advantages is that its underlying operational layer can freeze assets and suspend online transactions."

According to data from the Federal Reserve, as of September 30, U.S. Bancorp is the fifth largest bank in the U.S., managing assets totaling $671 billion.

Pruv Finance has completed approximately $3 million in Pre-A financing, led by UOB Venture Management, with participation from Saison Capital, Taisu Ventures, Ascent, Spiral Ventures, and Royal Group. Pruv claims to be the first digital finance platform approved by Indonesia's OJK regulatory sandbox, addressing the "compliance and liquidity" conflict in RWA, supporting asset transfers without whitelist restrictions, cross-chain transfers, and compatibility with DeFi natively.

Deutsche Börse to Integrate Third Euro Stablecoin EURAU

According to Cointelegraph, Deutsche Börse has announced that it will integrate the euro stablecoin EURAU issued by AllUnity as part of its digital asset strategy, having previously supported Circle's EURC and Société Générale's Forge department's EURCV. EURAU will initially provide institutional-grade custody services through its central securities depository Clearstream, with plans to cover its full-service system in the future.

It is reported that EURAU is issued by an electronic money institution licensed by Germany's BaFin and is aligned with the MiCA framework. Deutsche Börse has a total market capitalization of approximately $2.23 trillion for its domestic stocks, with 474 listed companies.

KakaoBank Advances KRW Stablecoin and On-Chain Settlement Infrastructure Development

According to Decrypt, South Korean IT giant Kakao's digital bank KakaoBank is accelerating the development of a technical system to support KRW stablecoins and tokenized assets, covering smart contract execution, token standards, full nodes, and issuance management backends; its blockchain partner Kaia has submitted at least four trademarks for KRW-pegged stablecoins in August. Sam Seo, chairman of the Kaia Foundation, stated that they are in discussions with multiple parties regarding the KRW stablecoin POC, but details are not disclosed due to confidentiality.

According to The Block, on Wednesday, Securitize received regulatory authorization from the EU for its distributed ledger technology (DLT) pilot, allowing it to operate a regulated trading and settlement system, becoming the first institution with compliant tokenized infrastructure in both the U.S. and the EU. The Spanish National Securities Market Commission (CNMV) has approved its operation of the system throughout the EU. As part of the system launch plan, Securitize will deploy a European trading and settlement platform based on the Avalanche blockchain, due to its near-real-time settlement capabilities and customizable institutional-grade architecture. The first issuance of tokenized securities based on the new authorization is expected to take place in early 2026.

According to official news, Ripple announced that its dollar-backed stablecoin Ripple USD (RLUSD) has been recognized by the Abu Dhabi Financial Services Regulatory Authority (FSRA) as a "recognized fiat-backed token" for use in the Abu Dhabi Global Market (ADGM), the international financial center in the capital of the UAE.

Visa Partners with AquaNow to Accelerate Settlement Speed Using Stablecoins

According to Jin10, Visa (V.N) has partnered with AquaNow to achieve faster settlements through the use of stablecoins.

Bybit and Mantle Launch USDT0 Cross-Chain Stablecoin Service

Bybit today officially announced that it will support deposits and withdrawals of USDT0 on the Mantle network, becoming one of the first mainstream exchanges to support this new cross-chain USDT standard. Users will be able to directly deposit and withdraw USDT0 between Bybit and the Mantle network, enjoying a limited-time zero-fee withdrawal promotion.

USDT0 is built on the LayerZero full-chain homogeneous token standard, using a mint-burn architecture to maintain strict 1:1 backing, eliminating fragmentation bridging issues. This collaboration makes Mantle the Layer 2 network with the highest total value locked (TVL) related to exchanges.

MSX Platform Achieves $1.26 Billion in 24-Hour Trading Volume, Setting a New Daily Record

As of around 10 AM on November 28, the MSX platform's 24-hour trading volume reached $1.26 billion, setting a new daily record. Currently, the cumulative trading volume of RWA on the MSX platform exceeds $13.15 billion, with over 200 RWA tokens launched and approximately 166,000 users. MSX is a decentralized digital asset trading platform focused on U.S. stock token assets and contract trading, utilizing blockchain technology to achieve efficient and transparent digital asset trading and management, promoting the digitization and liquidity enhancement of traditional assets.

Insights Collection

Coinbase Ventures: RWA Perpetual Contracts, the Trend of Perpetualization of Everything

As RWA regains market attention, investors are seeking new types of risk exposure. Perpetual contracts, as the most mature trading product in the crypto space, offer a faster and more flexible participation path compared to the underlying assets of RWA. Thanks to recent improvements in Perp DEX infrastructure, RWA perpetual contracts have created risk exposure to off-chain assets through perpetual contracts. We observe that RWA perpetual contracts are evolving in two directions: first, bringing alternative assets on-chain; since perpetual contracts do not require holding the underlying assets, the market can revolve around almost any underlying, pushing everything from private equity to economic data into the "perpetualization" process. Second, as cryptocurrencies and macro markets become increasingly intertwined, more mature trading groups are no longer satisfied with merely going long on crypto assets but are seeking richer investment products. This has generated demand for exposure to macro assets on-chain, allowing traders to hedge or build positions using tools linked to crude oil, inflation hedging, credit spreads, and volatility.

BIS Report: Tokenized Money Market Fund Size Surpasses $9 Billion

According to Cryptopolitan, the latest report from the Bank for International Settlements (BIS) indicates that the total assets of tokenized money market funds have surged from $770 million at the end of 2023 to nearly $9 billion, becoming a key source of collateral in the crypto ecosystem. The institution warns that while these assets possess the "flexibility of stablecoins," they also bring substantial operational and liquidity risks.

BIS identifies liquidity mismatch as the primary risk of tokenized money market funds. It points out that while investors can redeem tokenized fund shares daily, the underlying assets still follow the traditional T+1 settlement mechanism. During periods of market stress, concentrated redemption demands will expose this structural risk. Subsequently, the organization noted that the market is still in its early development stage, and solutions are continuously being improved, such as the distributed ledger repo (DLR) system launched by fintech company Broadridge, which enables same-day settlement of tokenized government bond transfers.

Swiss Gold Giant MKS PAMP "Returns" to Compete in Gold Tokenization

PANews Overview: Swiss top gold refiner MKS PAMP is re-entering the gold tokenization field, leveraging its deep industry background (with a complete supply chain from refining, certification to trading and LBMA authority qualifications). It has restarted the DGLD token project, which had been dormant for six years due to an immature market, through a full acquisition of the project party. This restart includes key upgrades: shifting from the previously niche Bitcoin sidechain to mainstream public chains like Ethereum to enhance compatibility and liquidity, while focusing on serving institutional investors and providing liquidity support for the tokens through its own trading department. Compared to existing tokens like PAXG and XAUT, MKS PAMP's core competitive advantage lies in its strong physical gold background, a flexible redemption threshold as low as 1 gram, and a strategy of waiving related fees in the initial restart phase, making it a strong "traditional giant" player in the emerging gold RWA (real-world assets) space.

PANews Overview: The development of RWA (real-world assets) is entering a new stage driven by both "stable assets" and "innovative assets," with its landscape significantly expanding from traditional government bonds and real estate to diverse fields such as catastrophe bonds, tech equity, agriculture, and even fan economy. This "dual-peak divergence" strategy is very clear: on one end, using low-correlation assets like catastrophe bonds, which are unrelated to market fluctuations, as a trust foundation to meet institutional demands for safety and defensiveness; on the other end, through fan economy assets like K-pop concerts and short drama IPs, transforming investors into consumers and dissemination nodes, creating strong ecological value and viral dissemination effects. These two are not opposing but are developing in parallel under compliant frameworks in places like Hong Kong—stable assets establish a trust moat for the entire sector, while innovative assets inject traffic and growth potential, jointly promoting RWA from mere "asset tokenization" towards "systemic value reconstruction" that enhances accessibility and liquidity and redefines participation rules, indicating that 2026 will be a key year for its transition from concept validation to large-scale application.

Compliance Panorama Guide for Tokenization of Private Company Equity

PANews Overview: The tokenization of private company equity involves converting company shares into digital tokens on the blockchain, with its core value lying in significantly enhancing the efficiency of capital markets through technological means, providing investors with liquidity conveniences such as 24-hour trading, fractional investment, and global access, while opening new possibilities for companies in global fundraising, automatic compliance, and reducing operational costs. However, the key to achieving all this is not technology but compliance. Major jurisdictions worldwide (such as the U.S., EU, Singapore, and Hong Kong) generally recognize it as securities and include it within existing regulatory frameworks. Therefore, successful tokenization projects must be meticulously designed in legal structures (such as using SPV indirect holdings or hybrid models) and properly address compliance details like custody and shareholder register management, ultimately achieving the goal of "not evading regulation but digitizing compliance." This marks a deep integration of traditional finance and blockchain technology and is an important direction for the future transformation of financing methods.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。