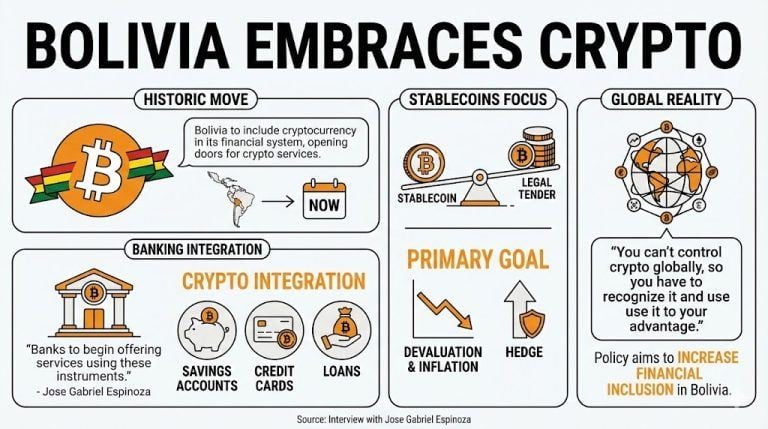

Bolivia is on the verge of embracing cryptocurrency as part of its financial system, marking a historic move across Latin America.

In a recent interview, Jose Gabriel Espinoza stated that the country would start including cryptocurrency in its banking system, opening the doors for banks to begin offering services using these instruments.

Among these services, he detailed savings accounts, credit cards, and loans, all based on crypto.

The focus of the proposal would be on stablecoins, which, due to the ongoing exchange controls, have become an alternative for citizens to hedge against devaluation and inflation.

In this sense, Espinoza stated that this measure would be taken so that stablecoins “begin to function as a legal tender payment instrument.”

“You can’t control crypto globally, so you have to recognize it and use it to your advantage,” he stated, signaling that this new policy might also help increase financial inclusion in the country.

Bolivia’s latest measure on crypto completes a change of stance that took the country from banning banks from servicing customers purchasing crypto, to now integrating these tools as part of its payments system.

The rise of crypto adoption in Bolivia after the abolition of the crypto ban was explosive, with trading volumes hiking over 100% only months after the ban was lifted.

More importantly, this pivot could also push stablecoins to become an important element in procuring energy imports. The former government eliminated the possibility for this to happen, with an executive order, but this can also be reversed by the recently elected President, Rodrigo Paz.

Read more: Bolivia Bans State Oil Company From Using Crypto for Energy Settlements

While Bolivia is a small economy in a big world, the adoption of cryptocurrency and stablecoins might become a blueprint for other nations to follow, if positive. It remains to be seen how this experiment will progress and how it might affect the established financial rails.

What significant change is Bolivia making regarding cryptocurrency?

Bolivia is preparing to integrate cryptocurrency into its banking system, allowing banks to offer services such as savings accounts, credit cards, and loans based on crypto.What types of cryptocurrencies will be focused on in this initiative?

The emphasis will be on stablecoins, which have become a popular alternative for citizens to hedge against devaluation and inflation due to ongoing exchange controls.How does this mark a shift in Bolivia’s stance on cryptocurrency?

This move represents a significant shift from previously banning banks from servicing customers involved with crypto to now incorporating these tools into the financial system.What potential impact could this shift have on Bolivia’s economy?

The integration of stablecoins could enhance financial inclusion and may facilitate energy imports, a possibility previously restricted by former government policies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。