Cryptocurrency News

November 28 Highlights:

1. The Uniswap "UNIfication" proposal passed preliminary voting with an overwhelming majority, launching a $15.5 million bug bounty program.

2. Several high-inflation countries are accelerating the adoption of crypto assets as alternative store-of-value tools.

3. Europe's largest asset management company, Amundi, has launched the first tokenized share class of its euro money market fund.

4. Wall Street maintains an optimistic outlook on emerging markets for 2026.

5. Blockrise has obtained a MiCAR license, offering BTC staking loans and plans to raise €15 million.

Trading Insights

During trading, the following practical methods can help you avoid most traps and better grasp market trends! 1. Identify highs and lows; do not rush to exit during high-level consolidation, as the market often follows with a new high; do not blindly buy at low levels during sideways trading, as it is likely to test new lows; wait for a clear change in market direction before acting to avoid being trapped by entering too early. 2. During sideways periods, control your hands; most short-term losses stem from "itchy hands" during sideways trading. When the market lacks a clear direction, buying and selling is essentially blind guessing, which not only incurs unnecessary fees but also risks getting stuck in losing positions. 3. Watch the candlesticks for signals; use daily candlesticks as a reference, enter the market when a bearish candle appears, and decisively take profits when a bullish candle appears. Following the trend signals given by candlesticks is more certain than guessing based on feelings. 4. Understand rebounds and judge the rhythm; when the downward rhythm slows, subsequent rebounds are often sluggish; if the decline suddenly accelerates, it is more likely to trigger a rapid rebound; you need to predict the strength of the rebound based on the downward rhythm to avoid misjudging the timing. 5. Build positions using the "pyramid" method; buy more as prices drop, but be more cautious with position size as the number of purchases increases. This method effectively controls risk and is one of the core principles of short-term position management. 6. Continuous rises and falls lead to trend changes; after a series of rises or falls, the market will inevitably enter a sideways adjustment phase. Do not liquidate all positions at high levels or fully invest at low levels; after the sideways phase, a trend change is likely; if the trend change is downward from a high level, you need to liquidate positions in time to avoid falling risks.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White Community this week. Congratulations to the friends who followed along; if your trades are not going well, you can come and test the waters.

Data is real, and each trade has a screenshot from the time it was issued.

**Search for the public account: *Big White Talks Coins*

Bilibili and YouTube account: Daquan 777

BTC

Analysis

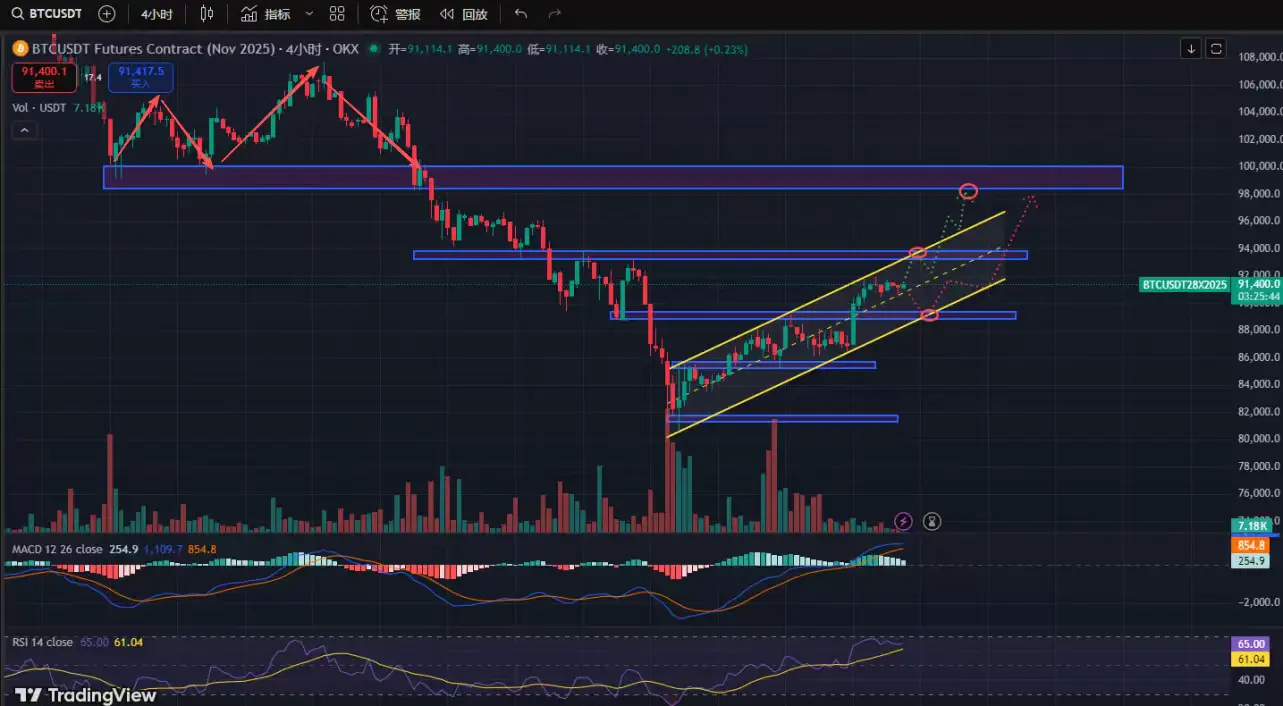

The market continues to reflect the Federal Reserve's expectations for a rate cut in December, and investor sentiment is gradually improving. In the absence of new data, this may be the easiest time; even the price of Bitcoin has the potential to continue rising this week, especially with Black Friday tomorrow, which is only half a day, likely not producing significant changes, followed by the weekend. This week shows a bullish engulfing pattern; the key is whether it can recover around 94,000 to form a strong reversal; otherwise, it may likely consolidate. On the daily chart, it has reached a key resistance area of 91,500-94,000. If it successfully breaks through the descending trend line pressure around 93,500 (descending trend line + Bollinger Band middle line), there is a high probability of a reversal, continuing to challenge the second resistance area of 97,500–100,500 (M top neck line + POC trapped area); daily indicators MACD and RSI show a golden cross, indicating continued upward movement; for short-term levels, focus on the 4-hour chart, where short-term opportunities may arise. In the 4-hour level, it continues to oscillate upward; if it does not break below the middle line of the rising channel, there is a chance to directly surge towards the 93,500-94,000 resistance (consolidation platform resistance), with the next resistance around 98,000 (M top neck line resistance). If there is a pullback, pay attention to the lower boundary of the channel around 89,500 (also the upper support of the rectangular consolidation); if it does not break below, maintain the rising channel; if it breaks, watch the lower boundary support of the rectangle. For smaller levels, the 1-hour chart, pay attention to the rectangular consolidation platform A area, where both upward and downward movements may show false breaks in the M area, forming an AMD pattern. In terms of indicators, both MACD and RSI are recovering upwards, supporting an upward rebound.

ETH

Analysis

In the short term, keep an eye on the Russia-Ukraine conflict; I just saw Putin's speech, which was not very friendly. However, next week, a U.S. delegation will visit Russia, mainly to discuss a ceasefire. If this can be achieved, it would greatly help U.S. inflation, and helping U.S. inflation means assisting the Federal Reserve in cutting rates. The quicker the rate cuts, the lower the probability of economic recession. Similarly, continue to monitor Bitcoin's movements; if Bitcoin can close above the key level of 90,800, Ethereum will almost certainly challenge the key level of 3,370 after recovering 3,157.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag; if you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。