Original Title: In Defense of Exponentials

Original Author: @hosseeb

Translated by: Peggy, BlockBeats

Editor's Note: Over the past two years, the mainstream narrative in the crypto market has shifted from "financial nihilism" to "financial cynicism": it's not about denying the existence of crypto assets, but rather a widespread belief that valuations are absurd, growth is capped, and the potential for exponential expansion of smart contract chains has long been lost. The pessimism surrounding L1, the collective mockery of new chains, and the "revenue logic" of measuring blockchain value by price-to-earnings (P/E) ratios have gradually become the dominant trend on social media.

The author of this article attempts to question: if we are using a linear framework to understand an inherently exponential industry, could that be the greatest risk?

Looking back at the trajectory of crypto development over the past decade, from a TVL in the millions to stablecoins in the hundreds of billions, from experimental DeFi to daily on-chain transaction volumes exceeding tens of billions, the exponential curve has not disappeared but has been obscured by short-term fluctuations.

The author draws on early misjudgments in e-commerce, Amazon's long period of losses, and the principle of "open wins" on the internet to attempt to re-establish a long-cycle perspective: when a trend is inherently exponential, pessimistic conclusions based on short-term revenue, P/E ratios, and early penetration rates often become distorted.

In this emotion-driven moment, this is a rare "declaration of exponentialism" that seeks to re-establish long-term confidence.

The following is the original text:

I used to tell entrepreneurs: when you launch your new chain, the external reaction is not "hate," but "indifference." By default, no one cares about your new chain.

But now I have to take that back. Monad just launched this week, and I have never seen a chain that was attacked so much right after its release. I have been investing in crypto for over 7 years. Before 2023, most chains I saw at launch were either warmly welcomed or completely ignored—very few faced such intense hostility.

Now, new chains are born surrounded by boos. Projects like Monad, Tempo, and MegaETH have seen an unprecedented number of detractors even before their mainnets went live.

I have been trying to judge: why is this happening now? What kind of psychology does it reflect in this market?

Worse than the disease

A heads-up: this might be the most "ambiguous" blockchain valuation post you've ever read. I have no refined metrics, nor am I here to promote any charts. What I want to express is a counter to the current mainstream sentiment on Crypto Twitter, and for the past few years, I have almost always stood on the opposite side.

In 2024, I feel that what I am opposing is a form of "financial nihilism." Financial nihilism believes: these assets don't matter; ultimately, they are all memes; everything we build is essentially worthless.

Fortunately, that atmosphere has passed, and we have finally emerged from that spell.

But the current mainstream sentiment, which I call "financial cynicism":

Well, maybe these things have some value, maybe not all of them are memes;

But their valuations are absurdly high, and it's only a matter of time before Wall Street realizes this;

It's not that all chains are worthless, but their current valuations are probably only 1/5 to 1/10 of what is reasonable (have you seen these P/E ratios?).

We can only pray that Wall Street doesn't expose our bluff, or the market will be uprooted.

Thus, there are now quite a few bullish analysts trying to construct more optimistic L1 valuation models, expanding P/E ratios, gross margins, and DCF models to counter this sentiment.

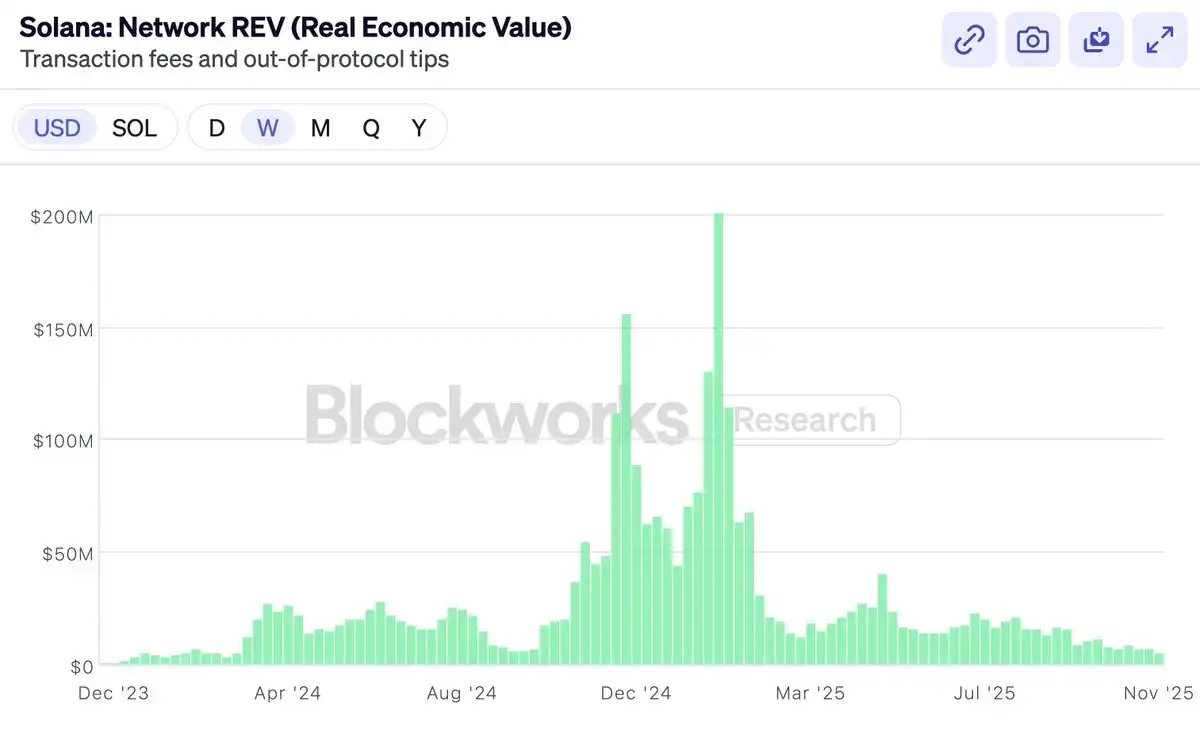

At the end of last year, Solana proudly embraced the REV metric, believing it could finally prove the valuation of SOL was reasonable. They proudly announced:

We, and only we, are no longer bluffing to Wall Street!

However, as expected: once REV was hyped, it plummeted (although the performance of $SOL shows it is more resilient than REV itself).

There is nothing wrong with REV itself. REV is a very smart metric. But the focus of this article is not on "which metric to choose."

Then came the launch of Hyperliquid. A DEX with real revenue, buybacks, and a P/E ratio. The chorus of comments then shifted to—look, I told you so! For the first time, we have a token that is genuinely profitable and can be measured with a standard P/E ratio. (BNB? Forget it, we never mention it.) Hyperliquid will swallow everything because clearly, neither Ethereum nor Solana is making money, and we can stop pretending to value them.

Hyperliquid, Pump, Sky—these tokens with significant buybacks are great. But the market has always been able to invest in exchanges. You could always buy Coinbase, BNB, or something else. We also hold $HYPE, and I think it is an excellent product.

But that is not why people initially invested in ETH and SOL. L1 does not have the same profit margins as exchanges, and that is not why people bought them in the first place—if they wanted that kind of profit margin, they could just buy shares of Coinbase.

If I am not here to criticize the financial metrics of blockchain, you might think I am about to discuss the original sin of the "token industrial complex."

Clearly, everyone has lost money on tokens over the past year, and VCs have too. This year, altcoins have performed very poorly overall. Therefore, another half of the sentiment on Crypto Twitter is discussing who to blame. Who has become greedy? Are VCs greedy? Is Wintermute greedy? Is Binance greedy? Are farmers greedy? Or are the founders greedy?

The answer, as always, is: everyone is greedy. Everyone.

VCs, Wintermute, farmers, Binance, KOLs—everyone is greedy, and so are you. But that doesn't matter. Because no properly functioning market requires participants to act against their own interests. If our judgment of the crypto industry is correct, then even if everyone is pursuing their own interests, investing can still succeed. Trying to analyze a declining market through "who is greedy" is as futile as launching a witch hunt. I guarantee no one started being greedy in 2025.

So, this is not what I want to write about.

Many people hope I will write an article about why $MON should be worth X, or $MEGA should be worth Y. But I am not interested in that, nor will I advocate for you to buy any specific asset. In fact, if you don't believe in them, you probably shouldn't buy them.

Will new challenger chains prevail? Who knows. But if it has a non-zero and significant probability of success, its pricing will be based on that probability. If Ethereum is worth $300 billion and Solana is worth $80 billion, then a project with a 1-5% chance of becoming the next Ethereum or Solana will be priced by the market according to that probability.

Crypto Twitter is shocked by this. But it is no different from biotech stocks. A drug for Alzheimer's with a success rate of less than 10% can still be valued in the billions by the market, even though it has a 90% chance of failing phase three clinical trials and ultimately going to zero. This is math—and it turns out the market is very good at math. The pricing of binary outcomes is based on probability, not on current revenue status or moral judgment. This is the valuation method of the "shut up and calculate" camp.

I don't think this issue is worth writing about. "Is the chance 5%? No way, it's clearly 10%!"—for individual tokens, this should be left to the market to decide, not dictated by articles.

So what I really want to write about is: Crypto Twitter now seems to no longer believe that chains themselves are valuable.

I don't think this is because they don't believe new chains can gain market share. We witnessed Solana's rapid rise from the ashes to dominate market share less than two years ago. It is not easy, but it is certainly possible.

More people's view is: even if a new chain wins, there is no prize worth winning. If $ETH is just a meme, if it can never earn "real income," then even if you win, you won't be worth $300 billion. The competition itself is not worth participating in because these valuations are fake, and before you get the trophy, the entire market will collapse.

Staying optimistic about chain valuations has become unfashionable. It’s not that no one is optimistic; clearly, there are still optimistic people. Every seller corresponds to a buyer; despite the cool kids on Crypto Twitter being keen to mock L1, people are still willing to buy SOL for $140 and ETH for $3000.

But the current market perception is: the smartest people are no longer buying smart contract chains.

Smart people know the game is almost over. If not now, then soon. Those still buying now are fools—Uber drivers, Tom Lee, and those KOLs who will say "trillions." Maybe even the U.S. Treasury. But it won't be smart money.

This is nonsense. I don't believe it, and you shouldn't either.

So I feel I must write a "declaration of the smart" to explain why general-purpose blockchains are valuable. This article is not defending Monad or MegaETH, but defending ETH and SOL. Because if you believe ETH and SOL are valuable, everything else flows downstream.

In principle, defending the valuation of ETH and SOL is not my job as a VC. But who cares, if no one else is willing to do it, then I will write.

Feeling the "exponential curve"

My partner Bo experienced the explosion of the Chinese internet as a VC. He often hears others say "crypto is like the internet," which has made me numb by now. But every time I hear him tell stories from back then, I am reminded of how costly it can be to get such issues wrong.

One of his most frequently told stories is from the early 2000s when all the early VCs in e-commerce (the circle was small back then) would have coffee together. They discussed: how big could the future market for e-commerce really be?

—Would it mainly be electronics (maybe only tech geeks would use computers)?

—Would women buy (maybe they rely too much on touch)?

—Could food be sold (maybe fresh produce is impossible to manage)?

These questions were crucial for early VCs—they determined what to invest in and how much they were willing to pay.

The answer, of course, is: everyone was wildly wrong.

E-commerce ended up selling everything, with the target audience being the entire damn world.

But at that time, no one truly believed that. Even if someone believed it, it was so absurd they wouldn't dare say it out loud.

You just have to wait long enough for the exponential curve to tell you the answer itself.

Even among the "believers" at that time, only a very few believed that e-commerce would grow to such an extent. And those few, simply by not selling out, ended up becoming billionaires.

All the other VCs, as Bo says, because he was one of them, sold too early.

In the crypto world, "believing in the exponential curve" has become unfashionable.

But I believe in the exponential curve of crypto. Because I have witnessed it firsthand.

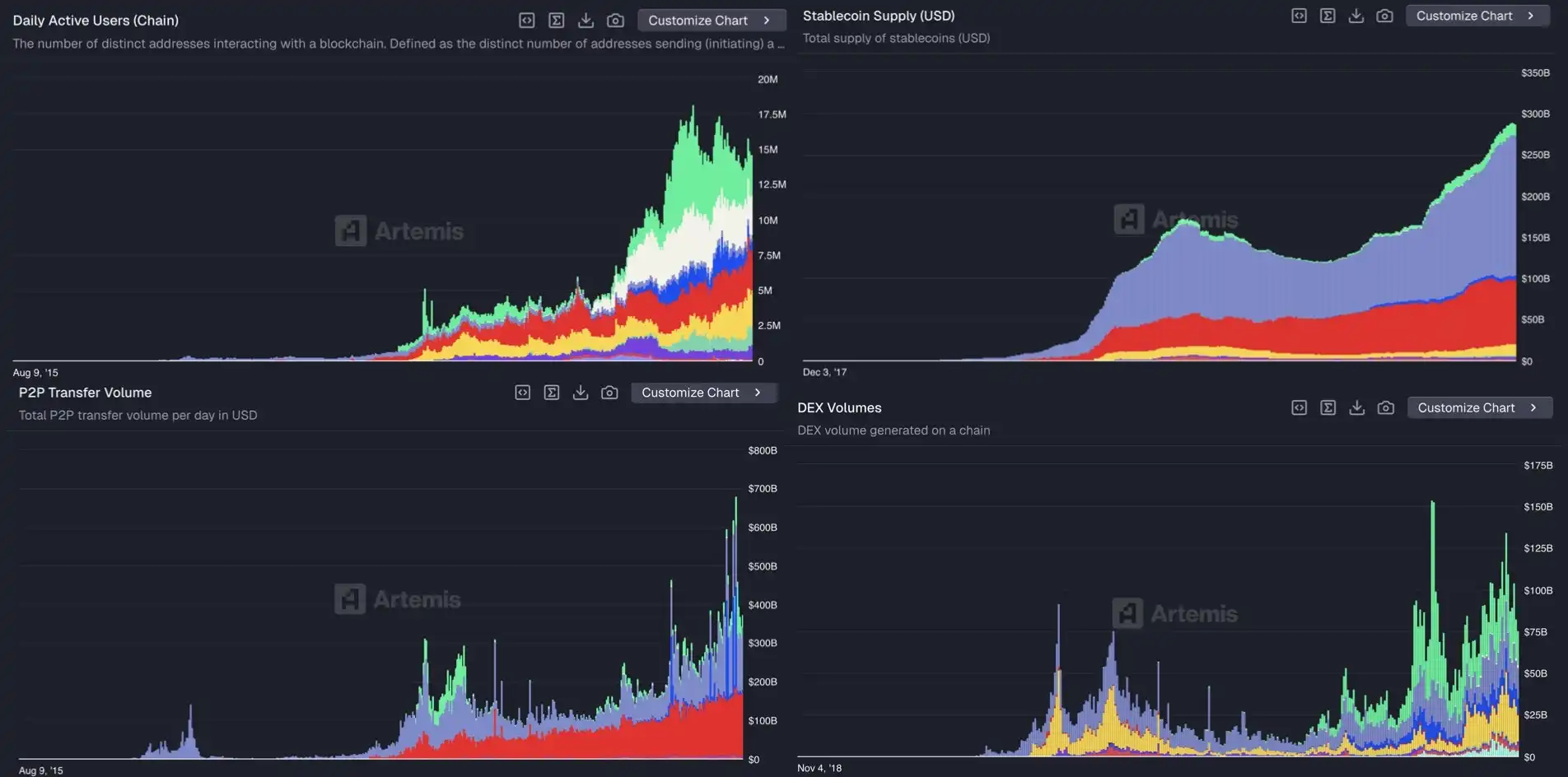

When I first entered crypto, no one was using these things. It was pitifully small, ridiculously broken, and utterly terrible. The TVL on the chain was only a few million dollars.

We invested in the first generation of DeFi, MakerDAO, Compound, 1inch, when they were still just scientific experiments. I remember when trading on EtherDelta, a daily trading volume of a few million dollars for a DEX was considered a "huge success." It was basically garbage.

Now we easily trade tens of billions of dollars on-chain every day.

I remember a sense of absurdity back then: Tether's total issuance surpassed $1 billion, and it was reported by The New York Times as a Ponzi scheme on the verge of collapse.

Now stablecoins exceed $300 billion and are regulated by the Federal Reserve.

I believe in the exponential curve because I have witnessed it many times.

But you might counter: "Okay, stablecoins may be experiencing exponential growth, and DeFi may be experiencing exponential growth, but this growth won't flow back to ETH or SOL. The value won't be captured by the chains."

My response is: you still don't believe in exponentials.

Because the exponential curve always has one answer: it doesn't matter.

These things will be much larger in the future than they are today. So large that it will be absurd, overflowing all arguments.

When it gets that big, you will make it all back in scale.

Look at this chart.

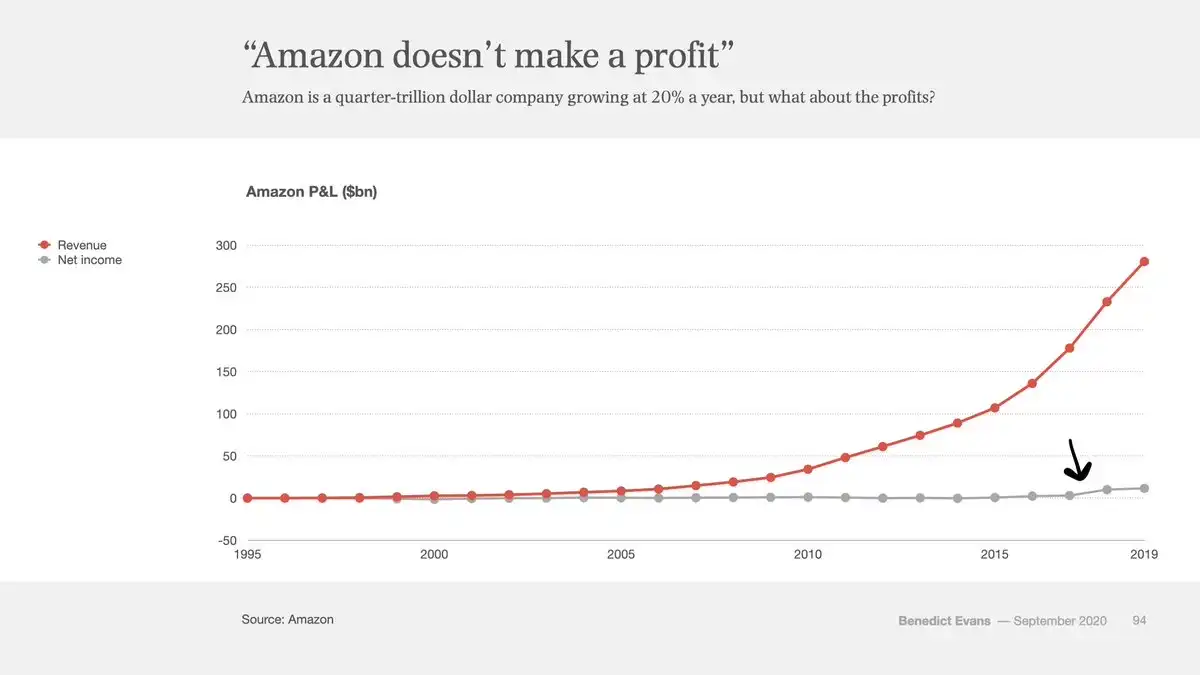

This is Amazon's profit and loss statement from 1995 to 2019, a total of 24 years. The red represents revenue, and the gray represents profit. Do you see that tiny bump at the end? The place where the gray line starts to rise? That was the moment 22 years after Amazon was founded when it finally started to make a profit.

Amazon, in its 22nd year, was the first time the net profit gray line moved above 0. In every year before that, there were editorials, critics, and short-sellers shouting: "Amazon is just a Ponzi scheme that will never make money."

Ethereum just turned 10.

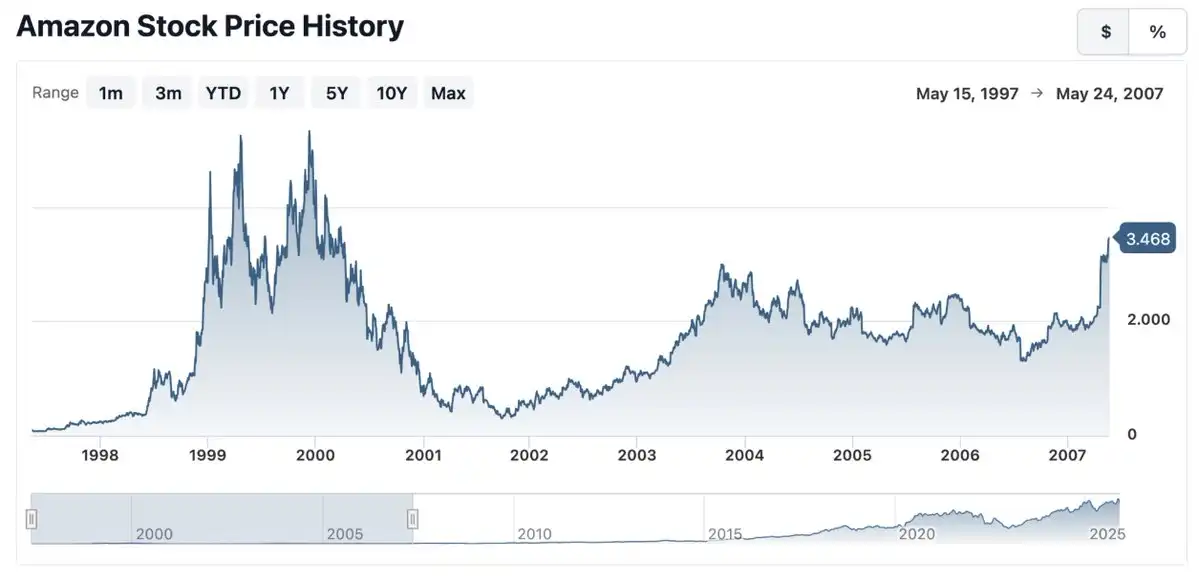

And here is Amazon's stock price performance in the first 10 years after its IPO:

Ten years of sideways fluctuations. During those ten years, Amazon was surrounded by skeptics: Isn't e-commerce just a public service subsidized by VCs?

They sold cheap, low-quality small goods, attracting only bargain hunters; what was the point?

When would they actually make real money like Walmart or General Electric?

If you were discussing Amazon's P/E ratio back then, you were standing in the wrong worldview.

P/E ratios belong to a world of linear growth, while e-commerce is not a linear trend at all.

Therefore, everyone who debated Amazon's P/E ratio for a full 22 years was wildly wrong.

No matter how much you spent back then, or in which year you bought in, you were not bullish enough.

Because that is the law of exponential technology.

In the face of a true exponential curve, no matter where you think the scale will rise to, it will continue to grow larger.

This is something Silicon Valley has always understood better than Wall Street.

Silicon Valley was raised by the exponential curve, while Wall Street grew up in linear thinking.

And in recent years, the focus of the crypto industry has gradually shifted from Silicon Valley towards Wall Street. You can clearly feel this change.

Admittedly, the growth curve of crypto is not as smooth as that of e-commerce.

It resembles explosive pulses, with surges and stagnations.

This is because the crypto world discusses "money," which is highly influenced by macro factors; at the same time, the regulatory pull it endures is far more intense than that of e-commerce.

Crypto directly strikes at the core power of the state: currency. Therefore, it is more unsettling for governments than e-commerce.

But the inevitability of exponential growth has not diminished because of this.

This is a rough argument, but if crypto is an exponential trend, then this rough argument holds.

Zooming out.

Financial assets inherently pursue freedom. They want to be open, interconnected, and callable anytime, anywhere.

Crypto turns financial assets into a "file format," making it as easy to send a dollar or a stock as sending a PDF.

Crypto makes "everything can talk to everything" possible, making it 7×24 hours, global, interconnected, and open.

This model will prevail. Openness will always win.

If the internet has taught me one important lesson, it is this.

Incumbents will resist, governments will oppose, intimidate, and pound their chests—but in the end, they will all lay down their arms in the face of the speed of technology adoption, derivative power, and efficiency advantages.

The internet has done this to every industry.

Blockchain will consume the entire financial and monetary system in the same way.

Yes, given enough time, it will consume everything.

There is a saying: people overestimate what can happen in two years but underestimate what can happen in ten years.

If you believe in the exponential curve, if you pull the perspective far enough, then everything now is still ridiculously cheap.

And what you should remain humble about is: every day, holders persist longer than sellers and doomsayers.

Big capital's time scale is much longer than the short-term players casually going long and short on CT.

Big capital has learned throughout history: do not bet against major technological trends.

Do you know? The grand narrative that made you buy $ETH or $SOL? Big capital still believes in it and has never stopped.

So what am I really arguing?

I am arguing that applying a P/E ratio to smart contract chains (the so-called "revenue logic meta") is equivalent to declaring abandonment of the exponential curve.

This means you are categorizing this industry into a framework of linear growth.

It means you truly believe: 30 million daily active users on-chain, accounting for less than 1% of M2, is the limit.

Crypto is just a small thing in the world, a side show.

It hasn't won, nor is it inevitable.

Most importantly, I want to defend a belief—not a short-term belief, not a shallow belief, but a long-term belief.

I am arguing that this exponential growth will be the biggest trend you have participated in during your lifetime.

This is your e-commerce era.

One day when you are old and look back, you will tell your children: "I was there. Not everyone believed this was possible. Not everyone believed that the entire society would be changed, that all currencies and finance would be completely reshaped by programs running on decentralized computers we all own. But that all really happened. It changed the world. And I was a part of it."

Disclosure: The above are all my personal views. Dragonfly has invested in $MON, $MEGA, $ETH, $SOL, $HYPE, $SKY, and many other tokens. Dragonfly believes in the exponential curve. This is not investment advice, but a different kind of advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。