Trump's statement that "the stock market will continue to hit new highs" is backed by a grand strategy of replacing income tax with tariffs, and the market is already positioning itself for this potential transformation.

“The stock market will continue to hit new highs.” On November 28, U.S. President Trump reiterated his firm confidence in the U.S. stock market during a speech to U.S. military personnel.

He proposed a more radical policy idea: to almost completely eliminate federal income tax through tariff revenues.

This bold proposal coincides with the continuous rise of U.S. stocks driven by expectations of interest rate cuts and the AI boom. However, beneath this optimistic sentiment, concerns about the feasibility of replacing income tax with tariffs, the risk of overvaluation in U.S. stocks, and the divergence between the cryptocurrency market and U.S. stock trends have sown seeds of uncertainty in the market.

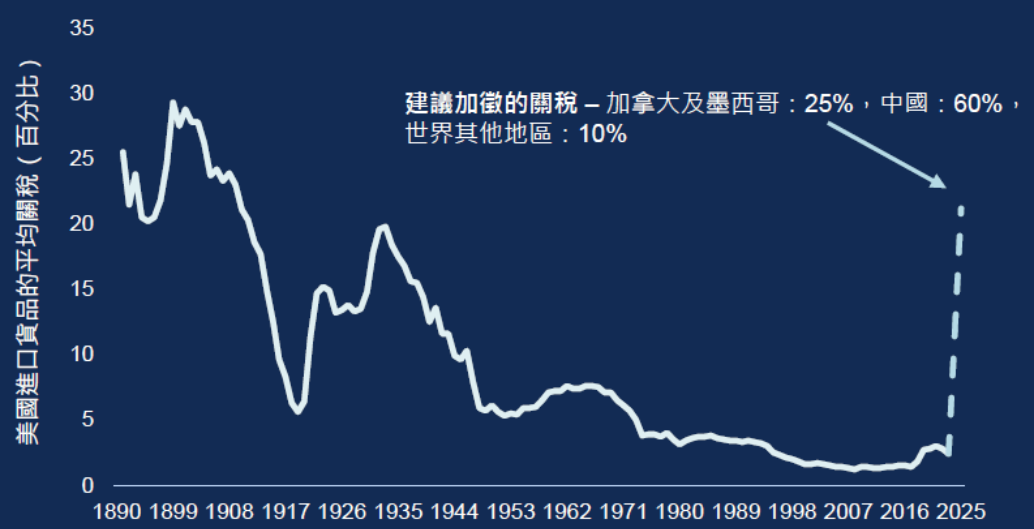

1. Trump's Tariff Revolution

● In his speech on November 28, Trump outlined his grand economic policy blueprint. He declared: “In the coming years, we will significantly reduce, and possibly even completely eliminate income tax.” He argued that the logic of this feasibility is direct and clear—tariff revenues will be able to compensate for the loss of fiscal revenue from eliminating income tax.

● Trump has long praised the role of tariffs. As early as January 2 of this year, he posted on Truth Social emphasizing: “Tariffs, and only tariffs, have created this enormous wealth for our country.”

● His policy proposals are not just verbal. Since returning to the White House, Trump has imposed tariffs ranging from 10% to 50% on most imported goods. He defends these tariff measures on the grounds that they can increase federal revenue and encourage consumers to switch to American-made products.

2. The Reality of U.S. Stock Performance

Despite the controversy surrounding Trump's tax ideas, U.S. stocks have indeed shown strong momentum even before his remarks.

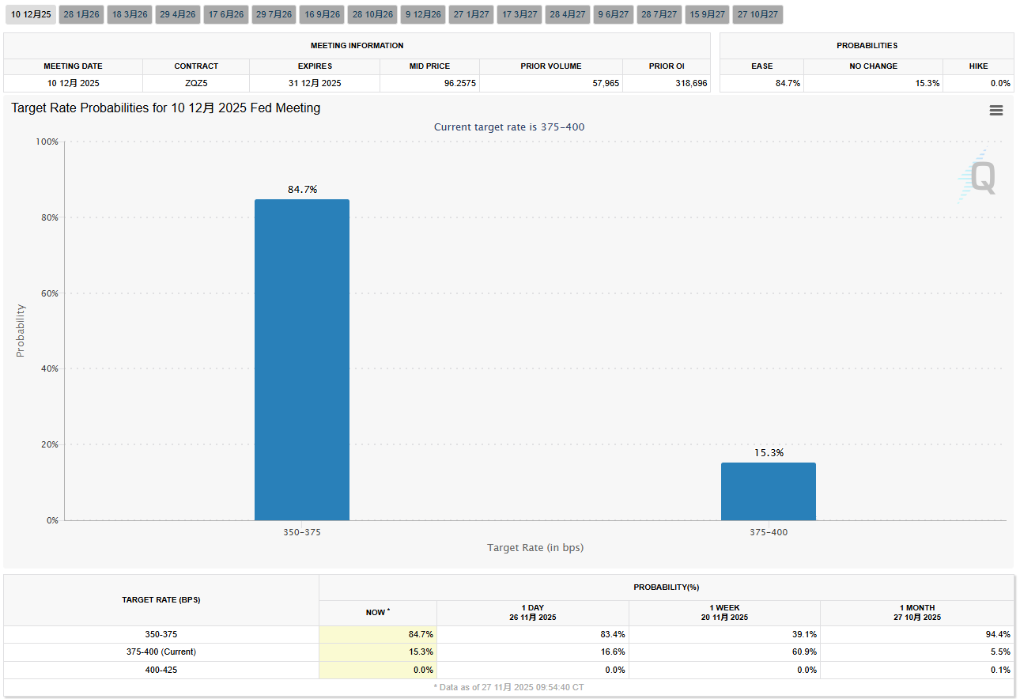

● As of November 26, the three major U.S. stock indices closed higher collectively. The Dow Jones Industrial Average rose by 0.67%, the S&P 500 rose by 0.69%, and the Nasdaq Composite rose by 0.82%. The core driving forces behind this round of increases come from two aspects. On one hand, market expectations for Federal Reserve interest rate cuts continue to heat up.

● According to the CME FedWatch tool, the probability of the Federal Reserve cutting rates in December has reached 84.7%. On the other hand, the strong performance of technology stocks, particularly chip stocks and AI concept stocks, has played a significant role.

● The stock market performance since Trump took office has indeed been remarkable. He has just broken the "curse" that the S&P 500 must fall in the election year after August for presidents seeking re-election for 75 years, with the index rising by 1.9% in August 2025. Since he won the election, the S&P 500 has risen by about 4.5%.

3. Technology Stocks and AI Driving Forces

● In this round of recovery, technology stocks have performed particularly well. The "seven tech giants," represented by Nvidia and Apple, are investing recklessly in building AI infrastructure.

● The AI boom has become an important narrative driving the stock market upward. Industry predictions suggest that by 2030, AI could bring about $15.7 trillion in GDP growth, reminiscent of the internet revolution of the 1990s.

● The strength of technology stocks is also reflected in the performance of the Nasdaq index and related ETFs. Nasdaq ETFs like Invesco QQQ have seen nearly 39% growth over the past year, reflecting extreme optimism in the technology sector, especially among AI-related companies.

● Institutions like Allianz Investment point out that under the potential for more fiscal stimulus measures and a relaxed regulatory environment from the Trump administration, the upward momentum in the technology sector is expected to extend to other areas of the U.S. stock market.

4. Divergence in the Cryptocurrency Market

● In contrast to the rise in U.S. stocks, the cryptocurrency market has recently shown signs of weakness. In late November, Bitcoin's price fell below $81,000.

● Major cryptocurrencies have generally experienced declines, with Ethereum, XRP, and Cardano all showing similar drops. Meanwhile, cryptocurrency trading volume has decreased by about 15%, indicating a cooling of trading enthusiasm.

● This contrast highlights a shift in investor preferences. Against the backdrop of rising U.S. stocks and declining bond yields (with the 10-year Treasury yield reaching 4%), funds are shifting from high-risk digital assets to traditional stock markets.

However, in the long run, statements from the Biden administration regarding economic success and diplomatic achievements may still serve as catalysts for bullish sentiment in risk assets like Bitcoin and Ethereum.

5. Underlying Risks in the Market

● Behind the current prosperity of U.S. stocks lies a risk that cannot be ignored. The valuation issue is particularly prominent—the Shiller price-to-earnings ratio (adjusted for inflation) has exceeded 39, far above its 154-year historical average of 17.28.

● We are currently in the third most expensive bull market in history. Historical experience shows that when the Shiller price-to-earnings ratio remains above 30 for several months, it is usually accompanied by a 20% crash.

● Trump's tariff policy may also have negative impacts. These measures essentially represent a supply shock to the U.S. economy, which could lead to a significant rise in U.S. inflation in the short term. Some analyses estimate that tariffs could push the year-on-year inflation rate of the overall U.S. Consumer Price Index to 4.5% or higher in the fourth quarter of this year.

● The Tax Foundation's analysis has further dampened enthusiasm for Trump's tariff dividend plan. The analysis points out that the new tariffs Trump plans to impose in 2025 are expected to generate only $158.4 billion in revenue.

● Meanwhile, his $2,000 "tariff dividend" plan, even in its most limited version, would cost $279.8 billion, with the broadest version reaching as high as $606.8 billion—almost four times the expected tariff revenue.

6. Investor Response Strategies

In light of the current market environment, investors are adjusting their strategies. Institutions like Eastspring Investments hold a more cautious stance on U.S. stocks, believing that Europe and emerging markets may continue to outperform the U.S. market in the short term.

● ETFs have become an important tool for investors to participate in the market. S&P 500 ETFs like SPDR S&P 500 ETF Trust (SPY), Vanguard S&P 500 ETF (VOO), and iShares Core S&P 500 ETF (IVV) are favored for their low fees and high liquidity.

● Small-cap stocks have also attracted some investor attention. Since small-cap companies are more reliant on the domestic market, they are expected to perform better when the economy improves, and the proposed corporate tax rate cuts and deregulation will also boost small company profits.

● Allianz Investment suggests that investors adopt a broader diversification strategy, including private market assets, gold, and even carbon credits or volatility, which have low correlation with other market sectors.

On Wall Street's trading terminals, the green line continues to extend upward. Analysts have raised the target for the S&P 500 to 6,600 points, indicating an approximately 11% increase from current levels. However, amidst the celebration, few have noticed the Tax Foundation's calm analysis report: Trump's tariff dividend plan may require $6 trillion in funding, while tariff revenues are far from sufficient to cover it.

This enormous funding gap will ultimately need to be filled by the market or taxpayers. History has never hesitated to remind us: when the celebration reaches its peak, risks are quietly approaching.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。