In just a short month and a half, Tether and Circle have injected $17.25 billion in liquidity into the crypto ecosystem, with massive funds accumulating outside exchanges, signaling a major shift is brewing.

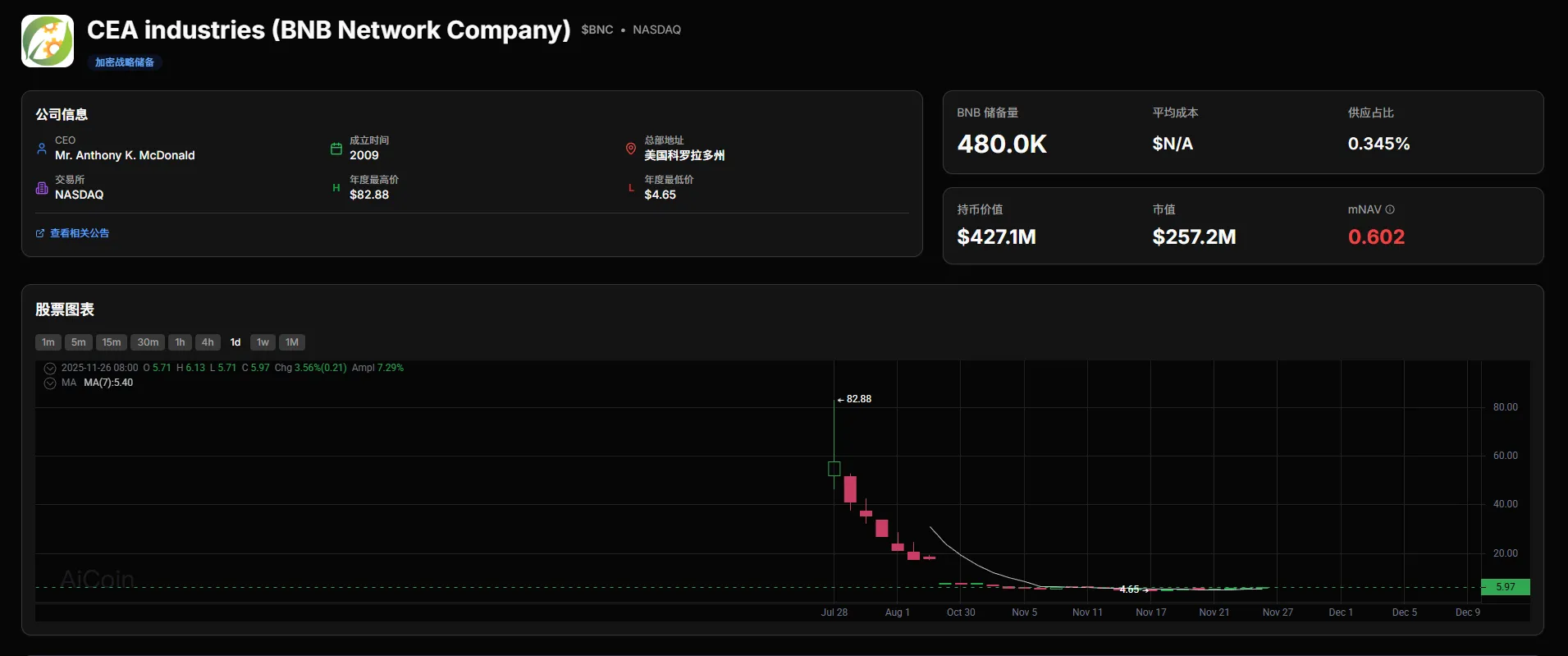

Since the sudden crash in the cryptocurrency market on October 11, there has been a rare influx of funds into the stablecoin market. According to AiCoin data, as of the end of November, the two major stablecoin giants, Tether and Circle, have collectively minted $17.25 billion worth of USDT and USDC.

This large-scale influx of funds coincides with Bitcoin's stagnation around the critical $90,000 level. The concentrated issuance of stablecoins provides ample "ammunition" for the market and fuels investor expectations for future trends.

1. Massive Issuance: Data Reveals the Scale of Fund Influx

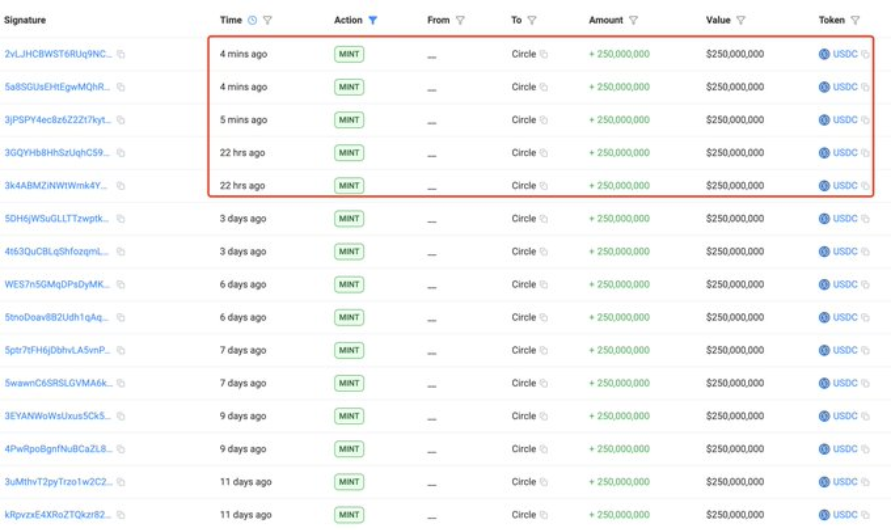

The issuance of stablecoins is not a one-time event but shows clear phased characteristics. Data indicates that this round of issuance began after the market crash on October 11 and has continued to accelerate.

● As of November 27, monitoring data shows that the total issuance by the two companies amounts to $17.25 billion.

● In terms of daily issuance scale, there have been multiple instances of large minting recently. On November 27, Circle minted $1.25 billion USDC in one go. Earlier, on August 27, Tether also issued $1 billion USDT in a single day. This pace of issuance indicates that stablecoin issuers are actively responding to the enormous market demand.

● Structurally, USDT accounts for the vast majority of the $17.25 billion issuance, which aligns with USDT's dominant position in the stablecoin market. Although USDC has a smaller share, it has also maintained a trend of synchronized growth.

2. Drivers of Issuance: Multiple Factors Fueling Stablecoin Demand

This round of large-scale stablecoin issuance is driven by profound market logic and multiple factors.

● Market crash spurring risk aversion is the primary factor. The market flash crash on October 11 created strong risk aversion among investors, leading to a significant shift of funds from volatile crypto assets to stablecoins. Stablecoins played a "safe haven" role during this process, allowing investors to preserve capital amid market turmoil.

● Providing liquidity buffer for the market is equally crucial. A market crash can lead to overall liquidity tightening, necessitating new stablecoin injections to maintain normal operations. These newly minted stablecoins effectively inject new dollar liquidity into the crypto ecosystem, helping to stabilize market sentiment and provide the necessary fuel for trading activities.

● Institutional investment intentions cannot be overlooked. Such a large issuance volume may partly stem from institutional investors preparing to enter the market. They convert fiat currency into stablecoins to quickly purchase Bitcoin, Ethereum, and other crypto assets at the right moment.

3. Fund Direction: How Stablecoins Affect Market Prices

Historically, large-scale issuance of stablecoins often signals significant market changes. These newly minted stablecoins are like "ammunition" stockpiled outside exchanges, ready to convert into purchasing power and drive market prices up.

● The historical correlation between issuance and price changes is quite evident. Data analysis shows that after similar concentrated stablecoin issuance events, trading volumes for Bitcoin and Ethereum typically see a 10-30% increase. A substantial influx of liquidity often helps major cryptocurrencies test or break through key resistance levels.

● In the current market environment, the potential flow of these stablecoins is worth monitoring. Some funds may flow into mainstream assets like Bitcoin and Ethereum, while others may surge into altcoins like Solana and Avalanche, amplifying price volatility for these assets.

● The DeFi ecosystem will also benefit. Stablecoins are a primary source of liquidity for decentralized finance protocols, and the newly injected stablecoins may bring more staking and yield farming opportunities, further energizing the DeFi market.

4. Issuer Comparison: Differentiated Strategies of USDT and USDC

Although both are dollar-pegged stablecoins, USDT and USDC have demonstrated different strategies and characteristics during this issuance wave.

● In terms of market share, USDT continues to maintain its dominant position. As of the end of November, USDT's circulation was approximately $184 billion, nearly twice that of USDC (around $73.8 billion). This scale advantage naturally gives USDT a larger share in stablecoin issuance.

● Transparency and regulatory compliance are important distinctions between the two. USDC is jointly launched by Circle and Coinbase and is subject to strict oversight by the U.S. banking system and regulatory agencies, with audit reports published monthly. In contrast, USDT is issued by Tether, which operates in a more centralized manner, with relatively limited disclosure of reserve asset details.

● Use cases also differ. USDT has a rich array of trading pairs and low slippage, making it suitable for high-frequency traders and users sensitive to transaction fees; USDC, due to its transparency and compliance, is more favored by institutional investors and long-term holders. Many seasoned traders use both, flexibly adjusting based on different needs.

5. Market Expectations: Forecasting Trends Behind Massive Fund Influx

In light of the $17.25 billion influx, market participants have formed various expectations for future trends.

● Short-term bullish sentiment is clearly on the rise. Historical data shows that after large-scale stablecoin issuance, the market often experiences a noticeable increase within 1-2 months. Newly minted stablecoins act like "dry gunpowder," easily converting into purchasing power under favorable market conditions, driving prices up.

● The probability of breaking key levels significantly increases. A substantial influx of liquidity may help Bitcoin break through the critical resistance level of $100,000 and initiate a push towards historical highs. Other major cryptocurrencies like Ethereum are also expected to benefit from the spillover effect of funds.

● Potential risks should not be overlooked. If these stablecoins do not genuinely flow into the market, the anticipated price increase may not materialize. Additionally, regulatory risks faced by stablecoin issuers and issues related to the quality of reserve assets may be amplified during market volatility, raising investor concerns.

6. How Ordinary Investors Should Respond

For ordinary investors, formulating a reasonable investment strategy in the face of such large-scale stablecoin issuance is crucial.

● Monitoring fund flow indicators is the primary task. Investors should closely observe whether these newly minted stablecoins are flowing significantly into exchanges. On-chain data shows that when the stablecoin balance on exchanges increases significantly, it often indicates that buying pressure is about to emerge.

● Timing entry points requires comprehensive consideration. Stablecoin issuance provides a reference signal for market bottoms, but the specific timing for entry should also be judged in conjunction with technical indicators and market sentiment. Gradually building positions and setting stop-loss levels are effective means of controlling risk.

● Optimizing asset allocation is also key. Against the backdrop of large-scale stablecoin issuance, mainstream assets like Bitcoin and Ethereum typically benefit first, followed by funds potentially flowing into quality altcoins. Investors can allocate investment ratios based on their own risk preferences.

The large-scale issuance of stablecoins has become an important barometer for the crypto market. This $17.25 billion influx provides ample liquidity for the market and ignites investor expectations for future trends.

History does not simply repeat itself, but it often rhymes. In the highly volatile cryptocurrency market, the issuance of stablecoins provides not only liquidity but also a reflection of market confidence. As these "ammunition" gradually convert into purchasing power, a far-reaching market shift may be on the horizon.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。