The probability backed by real money is becoming a new window into the truth of the world.

In the world of cryptocurrency, a prediction market platform called Polymarket is stirring up a storm. This decentralized prediction market built on blockchain set a historical record in October 2025, with weekly nominal trading volume surpassing $3 billion for the first time, becoming an important source for institutional investors, media, and even government departments to gauge event probabilities.

Starting in 2020 from a temporary restroom office, Polymarket has now become the most promising "real-world application" in the cryptocurrency space. Its rise not only reflects the explosive growth of prediction markets but also reveals the potential for humanity to seek truth in a completely new way.

1. Prediction Markets: A New Trend in the Cryptocurrency Space

● A prediction market is simply a platform that allows users to bet on future events using cryptocurrency. Participants can trade tokens related to the outcomes of real-world events, with token prices directly reflecting the probability of the event occurring.

● This concept is not new. The modern model of prediction markets originated from the Iowa Electronic Markets in 1988, which first proposed the idea that "price equals probability." During the 1988 U.S. presidential election, IEM achieved accurate predictions with small-scale operations, and subsequent studies showed that its election prediction accuracy was higher than 74% compared to polls from 1988 to 2004.

● The involvement of cryptocurrency has revitalized this field. By implementing trustless settlement through blockchain smart contracts, prediction markets have significantly enhanced their resistance to censorship and lowered the compliance operational threshold.

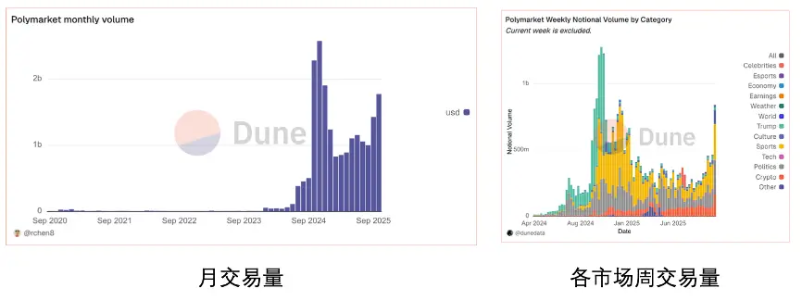

2. Market Explosion: Growth Trajectory Revealed by Data

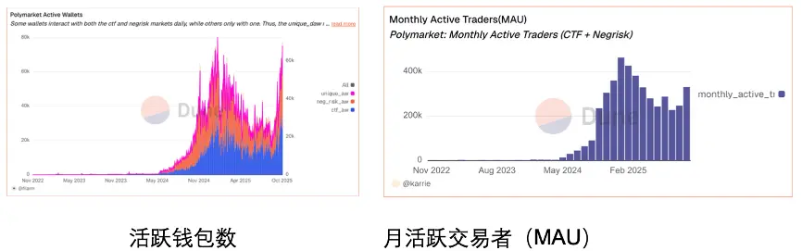

In 2025, prediction markets experienced a structural explosion. The market shifted from being driven by single events to continuous financial trading activities, with both funding depth and user base reaching historical highs.

● In terms of trading volume, the market experienced two significant peaks. The first was driven by the U.S. elections in October-November 2024, with weekly trading volume approaching $2 billion. The second explosion began in July 2025 and set a historical high in October 2025, with weekly trading volume surpassing $2.5 billion, exceeding the peak during the election period.

● User growth was equally impressive. In October 2025, the total number of weekly active users across the market exceeded 225,000, indicating a continuous and genuine influx of new users. Polymarket's monthly active traders peaked at 450,000 in January 2025, maintaining over 260,000 active users even after the election fervor subsided.

● Funding depth signifies that the market has moved beyond mere short-term speculation. During the 2024 election, the total open contracts across the market reached nearly $800 million. Entering the second half of 2025, the total open contracts have steadily rebounded and stabilized in the range of $500 million to $600 million.

3. The Competitive Landscape of Polymarket and Kalshi

The prediction market is characterized by a duopoly competition between Polymarket and Kalshi.

● Polymarket, as the leader in decentralized prediction markets, exhibits strong "event explosiveness." Its historical cumulative trading volume has surpassed $18.1 billion, with a monthly peak occurring during the November 2024 elections, reaching $2.63 billion, which is approximately 1000 times higher than early data from December 2020.

During the peak of the 2024 elections, "political/economic" trades accounted for over 60%, with weekly trading volume exceeding $1 billion at one point.

By 2025, the trading focus gradually shifted towards "sports" and "crypto assets," with trading volume for Super Bowl-related contracts around $1.1 billion and Bitcoin prediction market trading volume exceeding $15.5 million.

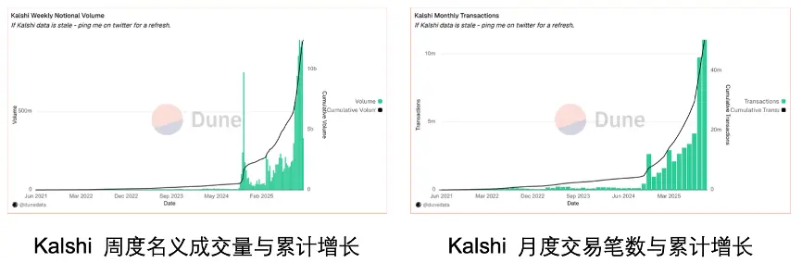

● Kalshi demonstrated the strongest growth momentum in 2025. As of October 2025, its weekly trading volume accounted for 55%-60% of the entire market, officially replacing Polymarket as the most liquid prediction market platform.

Kalshi leveraged its compliance advantages to tap into Web2 channels, with cumulative trading volume exceeding $10 billion and total transactions surpassing 40 million.

4. The Underlying Logic of Prediction Markets

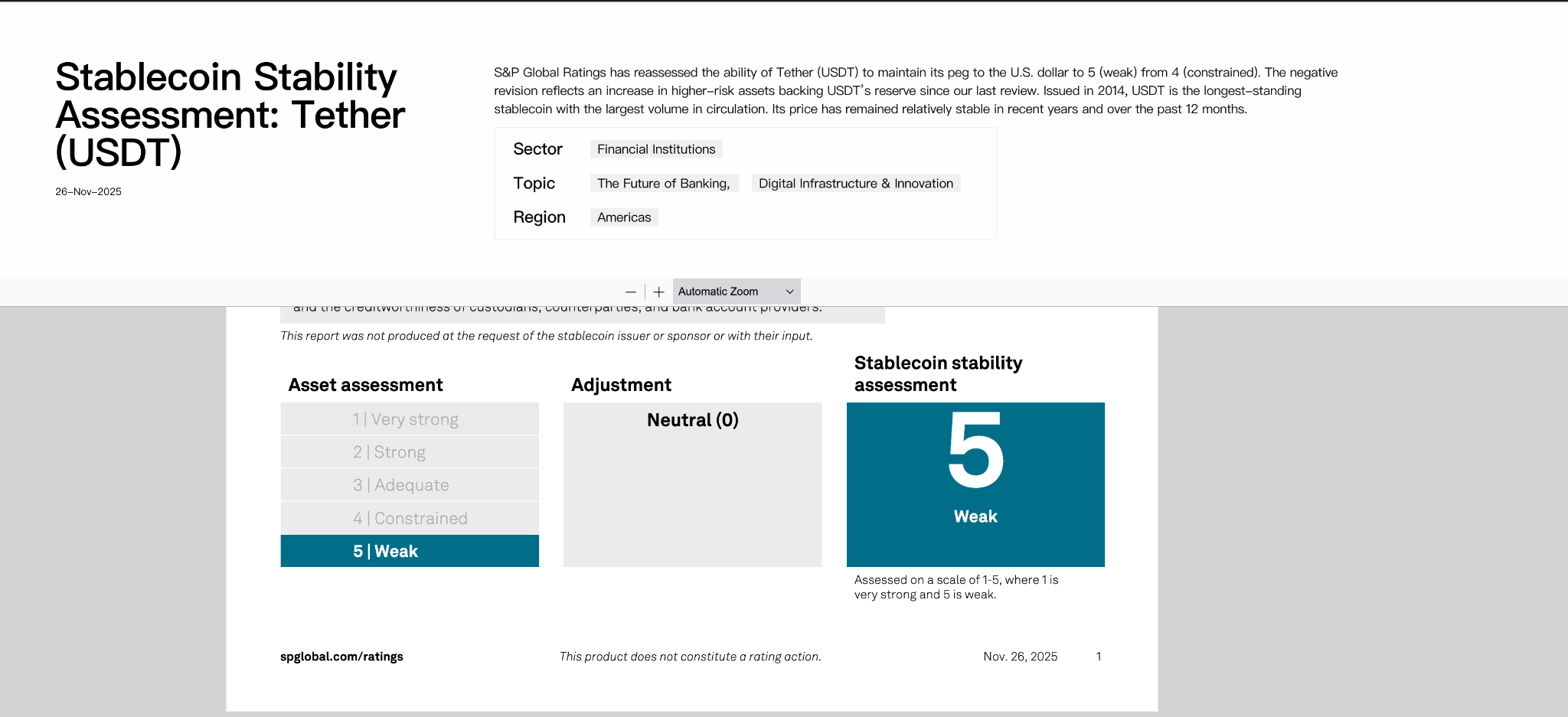

Prediction markets have a natural symbiotic relationship with cryptocurrency. The vast majority of prediction platforms, including Polymarket, use USD stablecoins as the settlement method, providing users with a seamless deposit and withdrawal experience.

● Cryptocurrency culture is also deeply integrated into the operational mechanisms of prediction markets. In 2025, with the introduction of token incentive models, a craze for "liquidity mining" emerged in prediction markets. Users can not only find mispriced assets and engage in arbitrage but also earn token incentives, reminiscent of the early days of Hyperliquid.

● Machine learning teams have become important participants in prediction markets. Teams like Sportstensor, Synth, Sire, and Billy have significantly invested in prediction markets, refining their signals and models.

Synth follows a "high-frequency hedge fund" model in prediction markets, using its own signals to predict the prices of crypto assets over 1 hour and 24 hours, and placing bets in prediction markets, growing from $3,000 to $15,000 within a month, achieving a 500% return.

● Prediction markets essentially repackage options into a more accessible product that everyone can participate in and profit from. Instead of grappling with a bunch of Greek letters and complex terminology, users only need to buy Yes or No shares, significantly lowering the participation threshold.

5. From the Crypto Circle to the Mainstream World

Prediction markets are making the leap from the crypto circle to the mainstream world, unfolding through multiple dimensions:

● Political predictions have demonstrated the accuracy of prediction markets. During the 2024 U.S. elections, Polymarket set Trump's winning probability at 99% at 1:30 AM ET, while Fox News did not announce the result until 1:47 AM, and other media outlets delayed even longer.

● Macroeconomic predictions have become a focal point for institutions. In 2025, the market on Polymarket regarding the Federal Reserve's interest rate decision saw trading volume exceeding $50 million, allowing users to hedge risks by betting on the probability of "a 25 basis point rate hike."

● Entertainment and sports have garnered widespread public attention. In 2025, a prediction market on Kalshi regarding the engagement of Taylor Swift and Travis Kelce saw a trader buy a contract for $0.37, ultimately profiting $50,000, which attracted extensive media coverage and drove users from the entertainment industry to join.

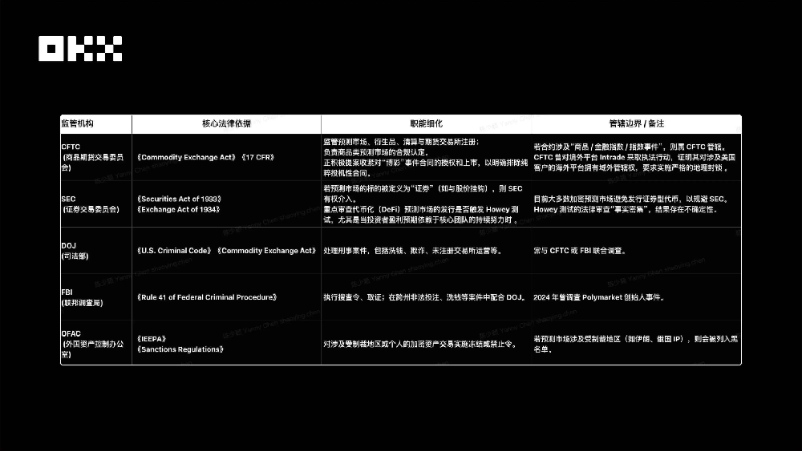

6. The Dual Game of Regulation and Technology

The development of prediction markets still faces multiple challenges, with regulation being the primary obstacle. Prediction markets exist in a gray area between gambling and financial derivatives. In September 2025, the U.S. CFTC approved Polymarket's return to the U.S. market, but Commissioner Kristin Johnson warned of insufficient regulatory safeguards and a lack of visibility into the market.

● Liquidity shortfalls are also a limiting factor. Most prediction markets have their funding pools concentrated on a few popular events, leading to a lack of liquidity in long-tail markets, which diminishes the reference value of prices. A 2025 report indicated that low liquidity resulted in unmet large hedging demands, affecting accuracy.

● Despite this, the future of prediction markets remains full of potential. With technological upgrades, the participation threshold for prediction markets is continuously lowering through forms like AMM+NFT and lightweight entry points. Polymarket's mobile optimization in 2025 drove a 20% increase in user growth.

● Even more exciting is the potential for prediction markets to deeply integrate with DeFi and AI, ushering in a "dynamic DeFi era." New DeFi protocols could automatically leverage or de-leverage based on the predicted prices of underlying assets, automatically rebalancing LP positions, all driven by AI and machine learning.

The parent company of the New York Stock Exchange, ICE, plans to invest approximately $2 billion in the decentralized platform Polymarket, an action seen by the industry as top-tier financial infrastructure recognition of the Web3 model. When people bet real money on their beliefs, the market becomes the closest place to the truth.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。