Written by: Nishil Jain

Translated by: Block unicorn

Preface

ICOs are back, and various Launchpads are rushing in to get a piece of the pie.

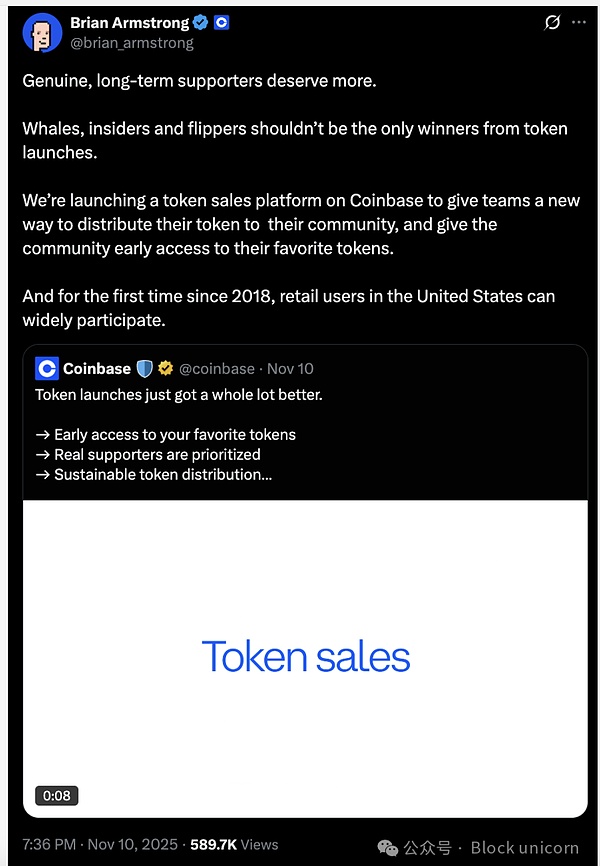

In October, Coinbase acquired Echo and launched its token sale platform earlier this month; in September, Kraken partnered with Legion. Meanwhile, Binance is closely tied to Buildlpad, while PumpFun is attempting to issue utility tokens through Spotlight.

These developments come as investor interest and trust in ICOs are warming up.

Umbra Privacy raised $156 million against a fundraising target of $750,000 on MetaDAO, while Yieldbasis was oversubscribed by 98 times within less than a day of launching on Legion. Aria Protocol was oversubscribed by 20 times on Buildpad, attracting over 30,000 users.

As ICOs begin to raise funds at multiples of their issuance price, filtering out the noise becomes particularly important.

In a previous article titled "Capital Formation in the Cryptocurrency Space," Saurabh elaborated on how capital formation in the cryptocurrency sector has evolved. He explored how new financing structures, such as the investment model of Flying Tulip and the ICO of MetaDAO, attempt to address potential conflicts of interest between teams, investors, and users. Each new model claims to better balance the interests of all parties involved.

While the success of these models remains to be seen, we observe that various Launchpads are trying to resolve the conflicts between investors, users, and teams in different ways. They achieve a curated investor roster (Cap Table) by allowing project teams to choose their investors in public token sales.

In today’s article, I will explain the reasons and methods behind investor selection.

First-Come, First-Served Selection of Token Holders

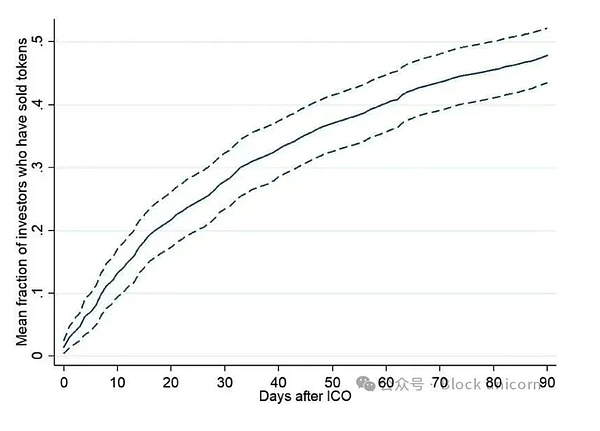

Between 2017 and 2019, ICO investments mostly adopted a first-come, first-served model, with investors rushing in to enter at lower valuations, often aiming for quick profits in the early stages of projects. Research on over 300 ICO projects shows that 30% of investors exited within the first month after the project launch.

While quick returns always tempt investors, project teams are not obligated to accept every wallet reaching out for funds. A truly visionary team should be able to select their ICO participants, filtering out those committed to long-term development.

Here’s what Ditto from Eigencloud discussed regarding the shift from a first-come, first-served (FCFS) sales model to a community-centered sales system.

The issue with the current ICO cycle is that it has ultimately fallen into the "lemon market" dilemma. Too many ICO projects have emerged, including scams or traps, making it difficult for people to distinguish between quality and subpar projects.

Launchpad platforms cannot conduct strict audits on all listed projects, leading to a lower trust level among investors regarding ICOs. Ultimately, the number of ICOs surged, but the funds willing to support them were insufficient.

Now, it seems the situation is beginning to shift again.

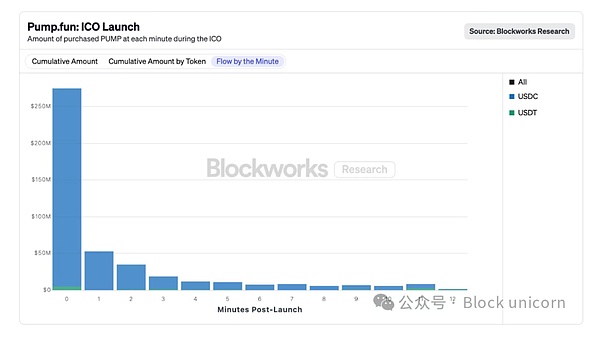

Cobie's fundraising platform Echo has raised $200 million for over 300 projects since its launch. Meanwhile, in some independent fundraising projects, we have also seen millions of dollars vanish in just a few minutes. Pump.fun successfully completed its ICO, raising $500 million in less than 12 minutes; Plasma raised $373 million against a target of $50 million in its public sale of the XPL project.

This shift is reflected not only in token issuance but also in the Launchpads themselves. Emerging platforms like Legion, Umbra, and Echo promise to provide founders and investors with greater transparency, clearer mechanisms, and more comprehensive structures. They are eliminating information asymmetry, allowing investors to discern the quality of projects. Today, investors can clearly understand a project's valuation, fundraising amount, and related details, thereby better mitigating the risk of being trapped in a project.

This has led to a resurgence of capital flowing back into ICO investments, with project subscription amounts far exceeding expectations.

The new generation of Launchpads is also focused on building an investment community aligned with the long-term vision of projects.

After Coinbase acquired Echo, it announced the launch of its own token sale platform, emphasizing the selection based on user-platform fit. Currently, they achieve this by tracking users' token selling patterns. Users who sell tokens within 30 days of the sale start will receive lower allocation amounts, and more fit metrics will be announced soon.

This shift towards a community-centered allocation philosophy is vividly reflected in the carefully designed airdrop plans of Monad and the ICO allocation plans of MegaETH, both centered around community members.

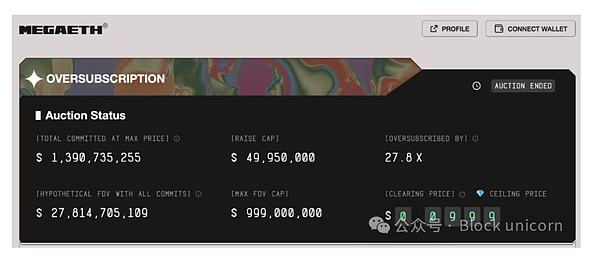

MegaETH's subscription multiple was approximately 28 times. The project required users to link their social media profiles and wallets with on-chain history to filter out the token holders they believe align best with the project's vision.

This is the transformation we are witnessing: as funds participating in ICOs become abundant again, project teams need to choose who to allocate funds to. The new generation of Launchpads is established to address this issue.

Next-Generation Launchpads

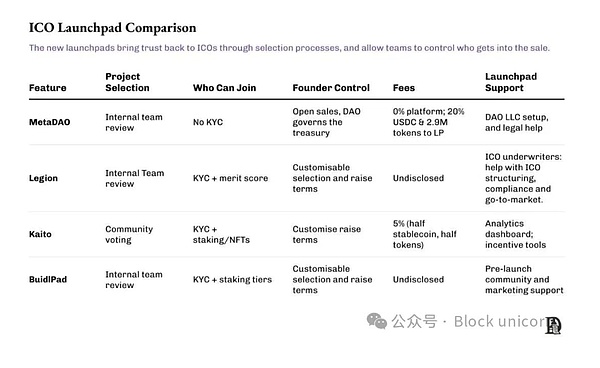

Currently, platforms like Legion, Buildlpad, MetaDAO, and Kaito are emerging as representatives of the new type of Launchpad. The first step is to audit ICO projects to ensure investor trust in the Launchpad platform; the next step is to audit participating investors to ensure that fund allocations meet project standards.

Legion adheres to a performance-oriented allocation philosophy, providing the most comprehensive community member ranking system. The platform has successfully completed 17 token issuances, with the most recent token issuance being oversubscribed by approximately 100 times.

To ensure that tokens in oversubscribed sales reach the right hands, each participant is assigned a Legion score, which comprehensively considers their on-chain history and activities across protocols, developer qualifications (e.g., GitHub contributions), social influence, network reach, and qualitative statements regarding their intended contributions to the project.

Founders launching products on Legion can choose to assign weight to metrics such as developer engagement, social influence, KOL (Key Opinion Leader) participation, or community education contributions, and allocate weights accordingly.

Kaito takes a more targeted approach, allocating a portion of shares to "speakers" who actively participate in Twitter discussions. Participation is weighted based on users' voting credibility and speaking influence, the amount of staked $KAITO, and the rarity of the genesis NFT. Project teams can choose from these types of prioritized supporters.

Kaito's model helps projects attract influential social media participants as early investors. This strategy is particularly useful for projects that heavily rely on early exposure.

Buidlpad's core philosophy is based on fund allocation. The more funds users stake, the more tokens they receive from participating in the token sale. However, this also means that only wallets with funds can participate.

To balance this capital-based system, Buidlpad introduces a "team system," awarding leaderboard points and additional rewards for community actions such as content creation, educational promotion, and social promotion.

Among these four Launchpads, MetaDAO is the most unique. The funds raised through the MetaDAO ICO are placed in an on-chain treasury and utilize a market-based governance mechanism called Futarchy. Futarchy essentially involves futures trading of the underlying tokens, but the trading is based on governance decisions rather than prices.

All raised funds are stored in the on-chain treasury, and every expenditure is verified by conditional markets. The team must propose a plan for fund usage, and token holders bet on whether these actions will create value. Only when the market reaches a consensus can the transaction be completed.

Participation in the MetaDAO ICO is permissionless and completely open, with each investor receiving a corresponding token allocation based on their invested funds. However, community building and alignment of interests among token holders occur after the ICO ends. Each proposal in Futarchy is a market where traders can sell tokens when proposals pass or buy more. Thus, the community of token holders will form based on the final decision.

While this article focuses on curated allocation schemes, from the project team's perspective, there are many other factors to consider before deciding to launch an ICO, such as project selection criteria, founder flexibility, platform fees, and post-launch support. The following comparison table can help you clearly understand all these factors at a glance.

Web3 can bring together users, traders, and contributors through incentive mechanisms based on verifiable reputation systems. Without corresponding mechanisms to weed out bad actors or attract suitable participants, most community token sales will remain in an immature stage, filled with both believers and non-believers. The current Launchpads provide teams with an opportunity to improve the token economic system and take the right first steps.

Projects need tools to identify suitable users in the ecosystem and reward their actual contributions. This includes users with influence and active communities behind them, as well as founders or builders creating practical applications and experiences for others. These user groups play a crucial role in driving ecosystem development and should be incentivized to stay long-term.

If the current momentum can be maintained, the next generation of Launchpads may help address the community launch issues in the cryptocurrency space, a problem that airdrops have consistently failed to solve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。