Bitcoin slowly crept up to $92,000 on Thanksgiving Day, but few understood why. Just a day before, on the eve of America’s traditional fall feast, ETF options platform Nasdaq International Securities Exchange (ISE) asked the SEC to quadruple the exchange’s position limit of 250,000 Blackrock Bitcoin ETF contracts to 1,000,000.

“The Exchange believes that increasing the position limit (and exercise limit) for options on IBIT to 1,000,000 contracts would enable liquidity providers to provide additional liquidity to the Exchange,” Nasdaq wrote in its submission.

(IBIT open interest or the number of open and active options contracts, is almost 8 million / barchart.com)

Traders use options contracts to make bets on bitcoin’s price without actually holding the asset. The more active contracts there are, a metric dubbed “open interest,” the more liquid the market becomes. Similarly, Blackrock Ishares Bitcoin Trust (IBIT) options contracts represent bets on IBIT’s price direction, whose shares are merely a proxy for bitcoin. IBIT currently has about 8 million open contracts, but traders are only allowed a maximum of 250,000 contracts per position.

Read more: Will Bitcoin Break $100k Again by Christmas?

Nasdaq’s move to raise that limit signals increased institutional appetite for BTC. Previously, the exchange had a 25,000-contract limit. That was expanded to the current 250,000 ceiling in July, and now, a request for 1 million is a signal that traders want more of the cryptocurrency. “$IBIT is now the biggest bitcoin options market in the world by open interest,” said Bloomberg Senior ETF Analyst Eric Balchunas.

But perhaps even more importantly, quadrupling the maximum, which serves as a guardrail against market manipulation, means the SEC is confident bitcoin derivatives are mature enough to be traded alongside other world-class assets. There hasn’t been much good news for bitcoin lately, but for BTC investors, this move by Nasdaq deserves a little dance, especially on Thanksgiving.

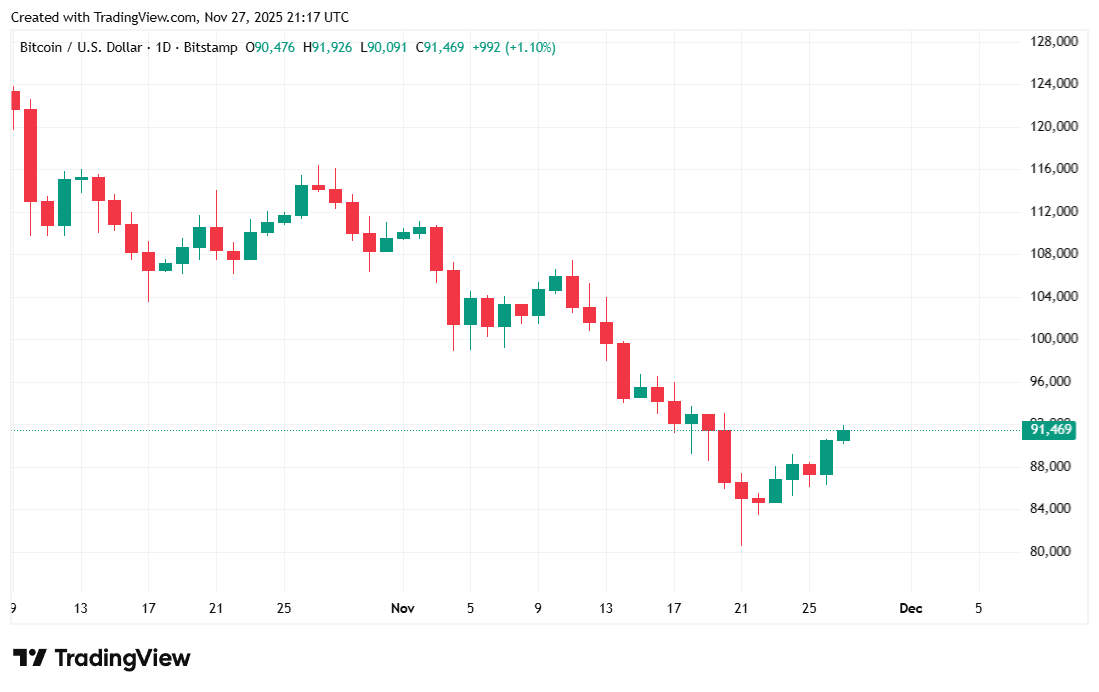

Bitcoin was up 1.63% on Thanksgiving Day and was trading at $91,351.49 at the time of writing, Coinmarketcap data shows. Weekly performance was also positive at 5.38%. Volatility was relatively low, with BTC’s price fluctuating between $89,824.37 and $91,897.58 over 24 hours.

( BTC price / Trading View)

Daily trading volume eased slightly, given the holiday, dropping 8.73% to $59.79 billion. Market capitalization rose to $1.82 trillion, in line with today’s price action, and bitcoin dominance also moved up 0.37% to reach 59.14%, regaining some of its lost mojo.

( BTC dominance / Trading View)

Total bitcoin futures open interest was largely flat at $60.19 billion, according to Coinglass data. Liquidations trended lower and totaled $76.19 million, dominated by bearish short sellers who lost $66.68 million in liquidated margin. Long investors were largely spared but still lost $9.51 million on overzealous bets.

- Why did bitcoin jump on Thanksgiving?

Bitcoin rallied partly because Nasdaq secretly filed to boost IBIT options limits from 250,000 to 1,000,000 per trader. - What does Nasdaq’s request actually do?

It allows significantly larger positions in BlackRock’s bitcoin ETF options, increasing liquidity and institutional participation. - Why does this matter for bitcoin investors?

Raising the cap signals that U.S. regulators view bitcoin derivatives as mature and safe enough for higher institutional exposure. - Is IBIT really the largest bitcoin options market now?

Yes, IBIT options now lead global bitcoin options markets by open interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。