Today is Nov. 26, 2025, which leaves roughly 35 days before the calendar resets. Over the past 330 days, crypto has cycled through its share of renaissances — from the loud return of meme tokens to the unexpected comeback of aging “Dino coins.” The latest wave, however, belongs to privacy-focused assets, a corner of the market that hasn’t enjoyed this kind of renewed attention in quite a while.

Not long ago, privacy coins were steadily losing momentum — not only in market performance but in their availability on major trading platforms, where they were being routinely delisted. Those who stayed committed — along with believers in a future shaped by privacy-enhanced assets — have enjoyed substantial gains over the past 11 months.

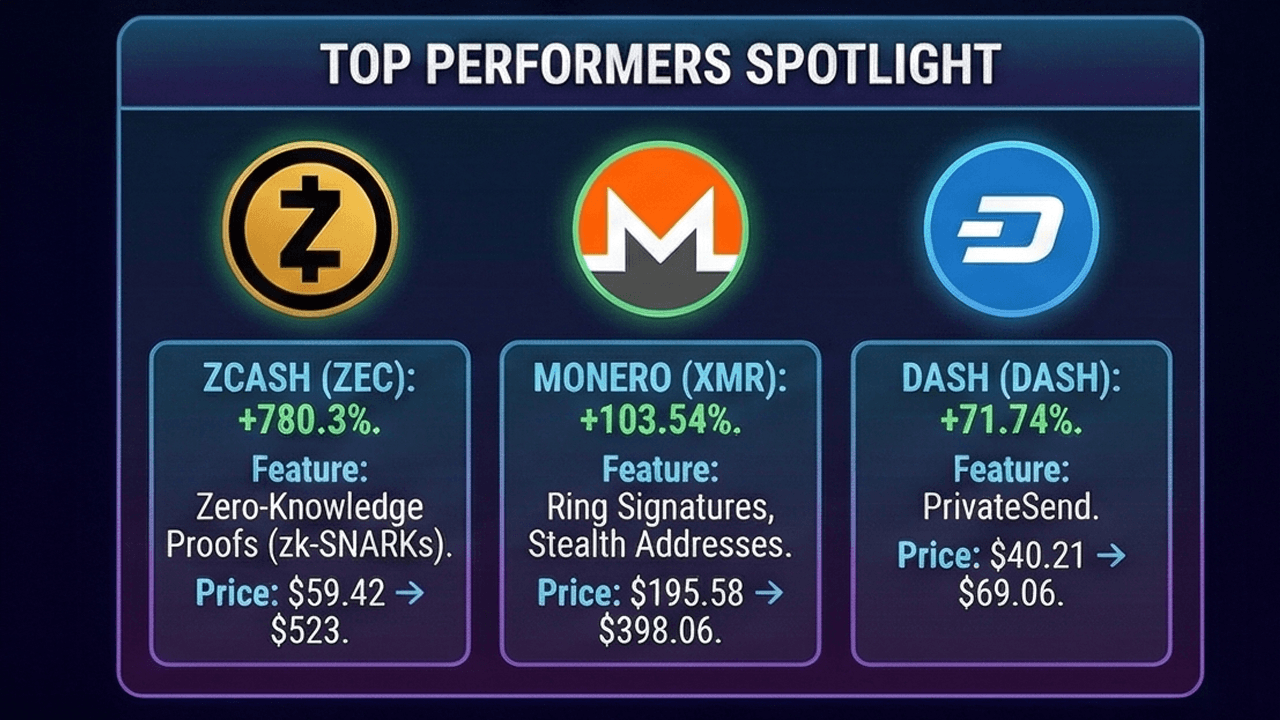

With that in mind, we took a closer look at the data to see how the top ten privacy coins, by market cap, have fared in year-to-date market performance measured against the greenback. The first on the list is zcash (ZEC), a cryptocurrency that leverages zero-knowledge proofs to facilitate completely private transactions. On Jan. 1, ZEC traded at $59.42, and by Nov. 26 it reached $523 per coin — a hefty 780.3% climb. Zcash has been the standout market leader of the bunch.

Market metrics for this post were logged on Nov. 26, 2025.

Monero ( XMR), the privacy-driven cryptocurrency that relies on ring signatures, ring confidential transactions, and stealth addresses, climbed 103.54% this year, moving from $195.58 to $398.06 per unit. Alongside it, dash ( DASH) — known for its privatesend feature — opened the year at $40.21 and now sits 71.74% higher at $69.06.

Beldex (BDX), built on the Cryptonote protocol and employing ring signatures, posted a modest 3.27% increase since Jan. 1. Decred (DCR) began the year at $15.15 and, after climbing 66.14%, now trades at $25.17 per coin. Mimblewimblecoin recorded a 19.89% increase, moving from $24.53 to $29.41.

Read More: Vitalik Buterin Calls for Full‑Stack Openness and Verifiability to Secure a Digital Future

Horizen (ZEN), a blockchain platform that supports privacy through its sidechain framework, failed to gain market traction in 2025. It traded at $31.05 in January, and as of today sits at $12.72 per ZEN, marking a 59% decline over that period. The privacy coin zano (ZANO) opened the year at $15.83 per coin and now trades at $13.94, reflecting a more moderate decline of roughly 11.94%. Verge (XVG), the ninth-largest privacy coin on Coingecko.com’s list, has endured a 45.58% year-to-date decline.

XVG slipped from $0.014 per coin to its current price of $0.0076187. In the tenth spot, COTI has fallen more than 75%, dropping from $0.1255 to its current level of $0.0304. Most privacy coins logged meaningful jumps this year. Still, a handful lagged behind, proving that even within a revitalized niche, not every asset has benefited equally from the momentum.

In a year defined by shifting narratives and ever-changing market darlings, privacy coins have reclaimed a measure of relevance that was surprising to some. Their mixed performances — from triple-digit climbs to some corrections — reveal a sector still wrestling with its identity, yet undeniably anchored by a loyal base that values discretion in an increasingly monitored financial world.

- What sparked the renewed interest in privacy coins in 2025?

Some say growing concerns over regulatory monitoring and data collection pushed more users toward privacy-focused assets. - Which privacy coin saw the largest year-to-date increase?

Zcash (ZEC) led the sector with a year-to-date gain of more than 780%. - Did all privacy coins perform well in 2025?

No, a few coins posted declines despite the broader sector’s revival. - Why are privacy coins gaining attention again?

Rising demand for financial privacy has made these assets appealing to users seeking greater transactional discretion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。