A new report, published on cryptoquant.com, details a sharp acceleration in exchange inflows across major assets, with its researchers warning that big players appear to be trimming exposure as markets cool.

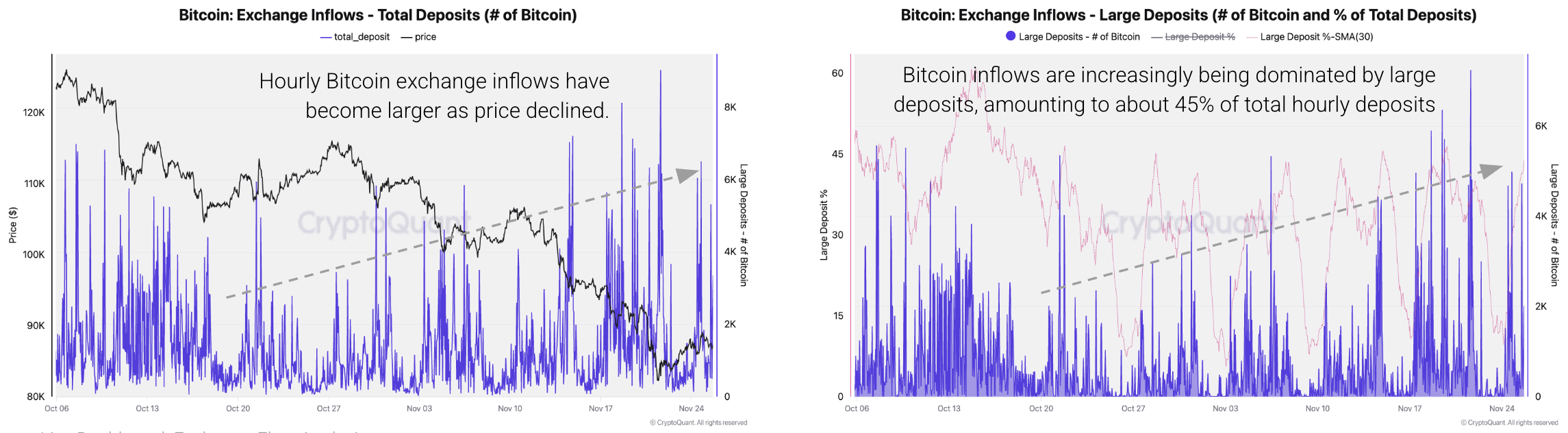

The crypto analytics firm notes bitcoin slid to a seven-month low near $87,000 last week, setting the stage for what it describes as a “large-holder-led rush” into centralized platforms. Cryptoquant’s analysts highlight that 9,000 BTC moved into exchanges on Nov. 21, with 45% of those flows coming from hefty, 100-BTC-plus deposits.

The firm links this pattern directly to selling pressure brewing among long-term holders and larger traders, a dynamic it says could extend the market’s recent softness. Onchain charts included in the report show a clear divergence between rising inflow size and declining price momentum.

The research team adds that the average bitcoin deposit hit 1.23 BTC, a one-year high, jumping from 0.6 BTC just a week prior. On Binance specifically, Cryptoquant flags a leap from 12 BTC per average deposit in early November to 37 BTC in recent days — a shift it interprets as large holders using the exchange to quickly reduce BTC exposure.

Ethereum is seeing a similar, if gentler, pattern. Cryptoquant reports that while total ETH inflows have not surged, large deposits now dominate activity, pushing the daily average deposit to 41.7 ETH, the highest level in nearly three years as the asset traded around $2.9K. The researchers suggest that ETH holders may be quietly repositioning while avoiding the dramatic spikes seen in BTC.

Read More: Vitalik Buterin Calls for Full‑Stack Openness and Verifiability to Secure a Digital Future

Altcoins, however, are where the report turns especially lively. According to the analysis, 40,000-plus altcoin deposits per day have become the norm since July, with a recent high of 78,000 on Oct. 17. Charts in the report show consistent, elevated inflow activity across exchanges, which the firm interprets as a broad, multi-asset reaction to market turbulence — and not merely a bitcoin-centric event.

Cryptoquant’s researchers conclude that the market is still digesting these flows, noting that persistent deposit strength across BTC, ETH, and altcoins typically signals caution among larger cohorts. The firm warns that if these trends continue, prices could remain under pressure until inflows normalize.

FAQ 🧭

- What does Cryptoquant identify as the main driver of recent inflows?

Cryptoquant attributes the spike in exchange deposits to large holders reducing exposure during market weakness. - How significant are bitcoin’s exchange inflows according to Cryptoquant?

The firm reports 9,000 BTC in deposits on Nov. 21, with nearly half coming from large 100-BTC-plus transactions. - What trend does Cryptoquant highlight for ethereum?

Cryptoquant says ethereum’s average deposits hit a three-year high as large transfers increasingly dominate activity. - What does Cryptoquant note about altcoin exchange deposits?

Researchers observe consistently high altcoin deposit counts, often above 40,000 per day since July.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。