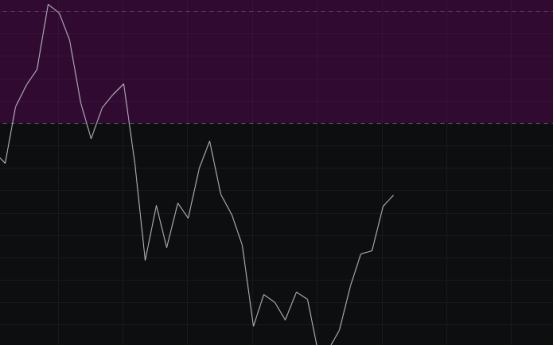

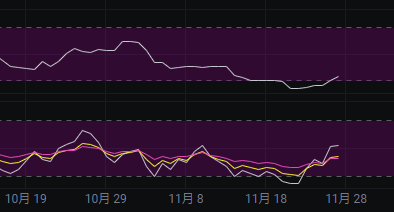

Yesterday we mentioned that we would look for fluctuations going forward. Today, the market surged above the BBI. If the market consolidates or declines here, we will consider this as a temporary high point, marking the formation of the first leg, with the subsequent target being a downward move to complete the second leg.

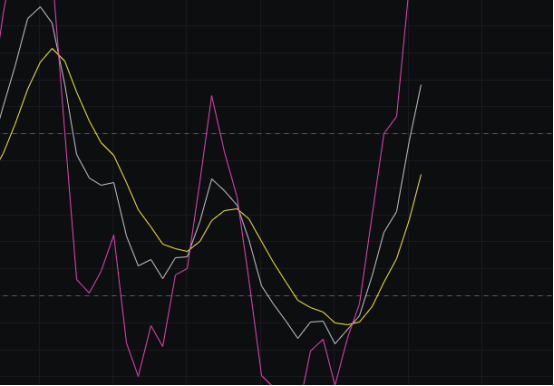

From the MACD perspective, today the MACD has crossed above the zero line, but to stabilize, it needs to maintain consecutive bullish closes to solidify this position. We will observe whether the market can sustain this movement.

Looking at the CCI, with the recent surge, the CCI has shown some recovery, but it is still quite far from -100. Therefore, the best scenario moving forward would be for the market to oscillate here, allowing the CCI to gradually recover and approach -100.

From the OBV perspective, there has been a noticeable inflow in the past few days, but there was significant outflow earlier. To continue rising, sustained inflow is necessary. However, since it has already risen for several days, the likelihood of maintaining inflow is relatively low, so we expect to see consolidation or a decline moving forward.

Regarding the KDJ, it has currently crossed above 50, with the next target being 80. However, there is also the possibility of it returning before reaching 80, so we will watch how the KDJ behaves.

In terms of MFI and RSI, the MFI has now exited the oversold zone, aligning with our previous assessment of the MFI. Meanwhile, the RSI has entered a neutral range, indicating potential movement in either direction, depending on the next choice.

From the moving averages perspective, the price has reached above the BBI and has faced a pullback due to BBI resistance. Theoretically, the first time hitting the BBI should result in resistance, so we expect the coin price to pull back here.

Looking at the Bollinger Bands, the lower band is tending to flatten, which aligns with our previous assessment of the Bollinger Bands. Once it flattens, the downward channel ends, and we will look for oscillations up and down. Here, the price is likely to continue declining under BBI pressure.

In summary: Today, the price surged and then retreated, facing BBI resistance. The market may continue to decline and adjust in the future. Today's resistance is seen at 91500-92500, with support at 90000-88500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。