Written by: Oliver, Mars Finance

In the early hours of November 27, Beijing time, S&P Global, the oldest rating agency on Wall Street, dropped a bombshell in the cryptocurrency world. In its latest stablecoin assessment report, S&P downgraded the rating of Tether, the world's largest stablecoin issuer, from restricted to the lowest rating of Weak, bluntly warning that the decline in Bitcoin prices is eroding USDT's solvency.

In response to this century-old institution, which holds the power of global credit, Tether's CEO Paolo Ardoino showed no signs of panic, even carrying a disturbing mockery.

"We take pride in being hated by you," he wrote on social media.

This tough stance is not just bluster. At the same time S&P released its short report, Reuters disclosed an explosive report from investment bank Jefferies. The data showed that this company, viewed as the bad boy on Wall Street, not only hoarded 116 tons of physical gold but also became the world's largest gold buyer in the recently concluded third quarter—purchasing more than any central bank.

This is no longer a war of words about compliance and transparency; it is a collision of two financial forces. One side is the old-world gatekeeper trying to measure everything with Excel spreadsheets and volatility models; the other is a digital giant evolving into a shadow central bank, holding hard currency and Bitcoin, and even beginning to influence global commodity pricing.

5.6% vs. 3.9%: Wall Street's Death Arithmetic

S&P's timing for this attack was extremely precise, almost perfectly capturing the pulse of the crypto market.

Looking back over the past month, the crypto market experienced a sharp correction, with Bitcoin prices dropping nearly 20%. For ordinary holders, this is just a fluctuation in paper profits and losses, but for S&P's analysts, it violated the sacred rules of traditional accounting.

According to S&P's calculation logic, Tether's balance sheet has a fatal mathematical flaw: the proportion of Bitcoin assets it holds is about 5.6% of total reserves, while Tether's proud capital buffer only accounts for 3.9% of total assets.

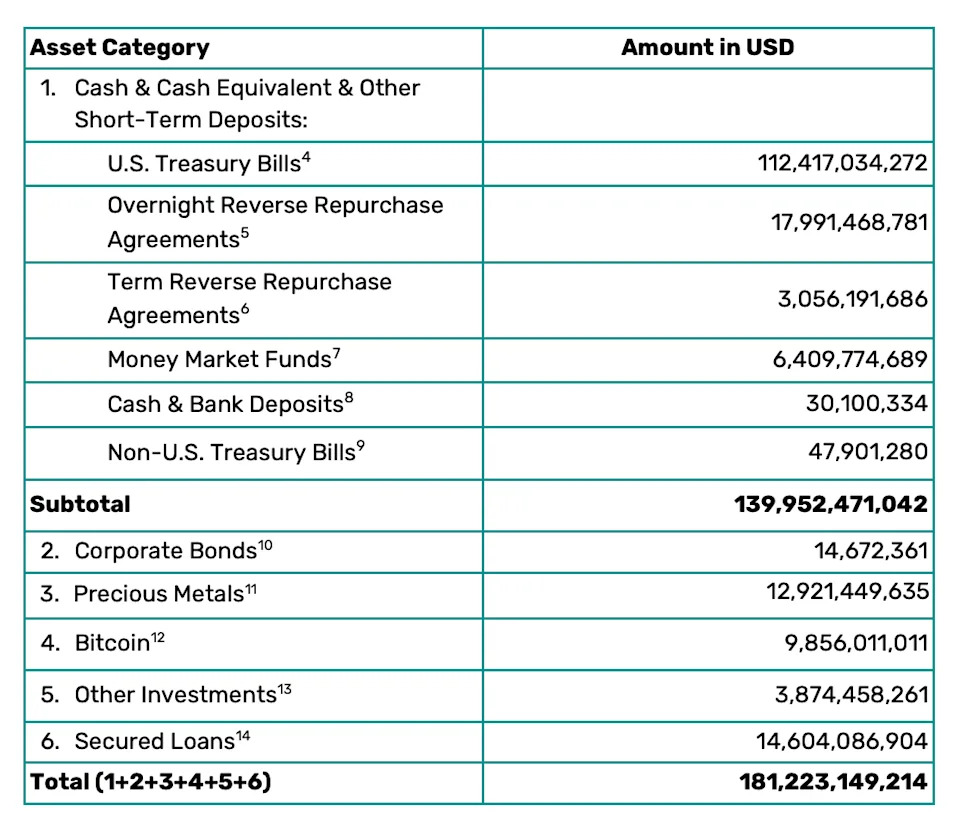

Tether's latest disclosure of asset details makes this accusation more specific and controversial. The data shows that as of now, Tether has up to $112.4 billion in U.S. Treasury Bills on its books. This means that this company rated "Weak" by S&P holds "the world's safest asset" in a scale that even exceeds many sovereign nations' treasuries.

However, S&P's microscope selectively ignores this $112.4 billion in U.S. Treasury Bills, focusing intently on the $9.85 billion in Bitcoin holdings.

This is a simple yet cruel subtraction problem. From Wall Street's perspective, if Bitcoin prices collapse further, Tether's capital buffer will be instantly breached. At that point, each USDT will no longer have a sufficient $1 backing. S&P believes that Tether's core reserve consists of high-volatility risk assets (Bitcoin), which is a betrayal of the word "stable" in stablecoin.

However, this logic is seen by Tether as filled with the arrogance of the old era. Paolo Ardoino pointed out that S&P's rating system is essentially designed for traditional banks that rely on partial reserve systems and are filled with toxic credit assets. In that system, Lehman Brothers still held an investment-grade rating on the eve of its collapse, and Silicon Valley Bank was also seen as having good assets before its bankruptcy.

The Rise of the Shadow Central Bank: Buying Out the Central Bank of Kazakhstan

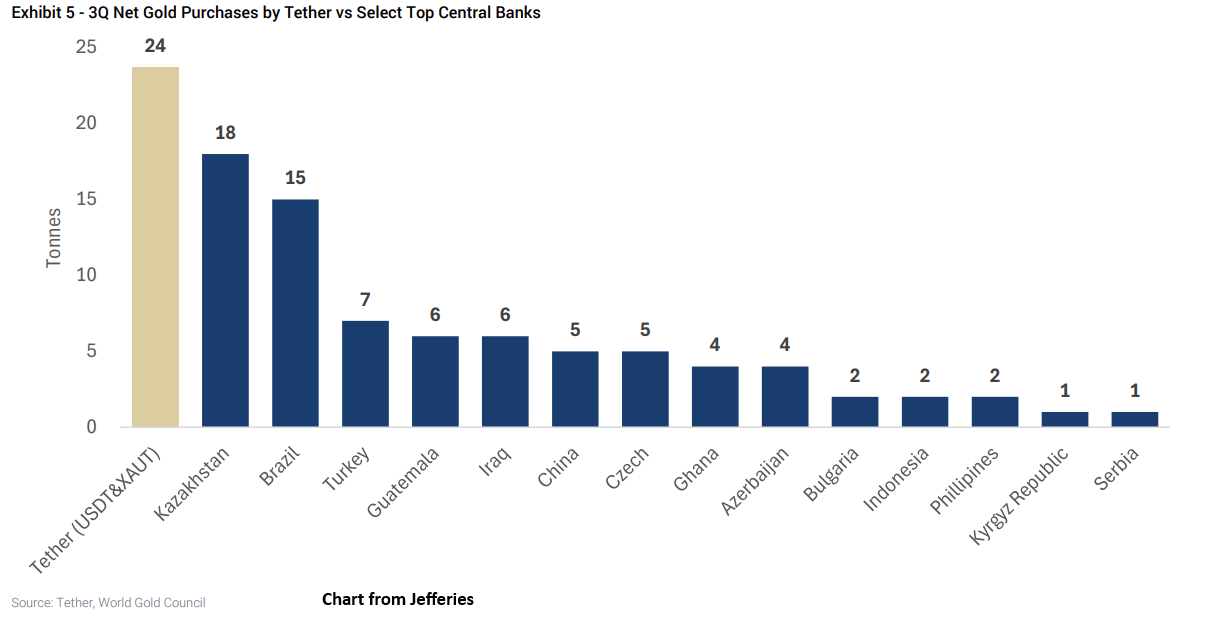

If the debate with S&P was still a war of words, then Jefferies' latest charts showcase Tether's chilling dominance.

In 2025, gold prices surged by 56%, marking the best year since 1979. Wall Street's narrative typically attributes this to geopolitical turmoil or fiscal deficits, but the data reveals an overlooked driving force: Tether.

Jefferies' statistical chart shows that in the recently concluded third quarter, Tether net purchased 24 tons of gold. What does this number mean? It surpassed the single purchase volume of all central banks globally during the same period. The second-ranked Central Bank of Kazakhstan bought 18 tons, and the third-ranked Central Bank of Brazil bought 15 tons.

Even more intriguing is the coincidence in price trends. This year's gold surge occurred in two waves: the first wave in April, driven by a weak dollar; and the second wave from August to October, where gold prices bizarrely jumped by $1,000 without a weakening dollar.

Jefferies pointed out that the timing of this second wave of surges perfectly coincided with Tether's frenzied accumulation. In just the third quarter, Tether's purchases accounted for 12% of total global central bank purchases. In other words, this crypto company is no longer a passive market follower; it has become a "market maker" capable of influencing the pricing of global safe-haven assets.

Currently, the 116 tons of gold held by Tether is valued at approximately $14 billion. In the single dimension of gold reserves, a private company established only ten years ago has already surpassed the financial depth of central banks in countries like South Korea, Hungary, and Greece.

GENIUS Act: A Public Rebellion Against Regulation

Behind Tether's frenzied gold hoarding lies a thrilling game with U.S. regulators.

In July of this year, the U.S. passed the landmark GENIUS Act, aimed at establishing a regulatory framework for stablecoins. One clear red line in the act is: prohibiting compliant stablecoin issuers from using gold as reserve assets.

By common sense, Tether should have immediately sold off its gold to seek compliance. But what did Tether do?

The data not only did not decrease but actually increased. In the months following the passage of the act, Tether accelerated its gold acquisitions, bringing its USDT gold reserves to 104 tons, with another 12 tons supporting its gold token XAUt.

This is not just a business decision; it is a political declaration. Paolo Ardoino has mentioned plans to launch a new token USAT (not backed by gold) in compliance with the GENIUS Act, but he clearly refuses to let the core product USDT succumb to "failed gravity."

Jefferies' analysts were also puzzled in their report: "Why did Tether increase the gold backing for USDT after the act was passed?"

The answer may lie in Paolo Ardoino's phrase "breaking free from failed gravity." The traditional financial system (and its regulators) attempts to sever the connection between cryptocurrencies and hard currency, locking them into a cycle of dollar debt. Meanwhile, Tether, by holding Bitcoin (decentralized digital gold) and physical gold (the traditional king of safe-haven assets), is constructing a completely trustless cost-free closed loop, even disregarding the act's red lines.

Historical Review: Who is Swimming Naked?

When we examine S&P's liquidity warning for Tether, we must incorporate historical data for a review.

In May 2022, the collapse of LUNA/UST triggered a chain reaction in the crypto market; in November of the same year, the FTX empire collapsed. During those darkest moments, Tether faced short-term redemption pressures of up to tens of billions of dollars. At that time, countless Wall Street institutions and short sellers asserted that USDT would de-peg and drop to zero.

What was the result? Tether processed every redemption request without delays or defaults. In contrast, those CeFi institutions with beautiful audit reports and strict regulations (like Celsius and BlockFi) collapsed amid liquidity crises.

Historical data tells us to see the essence clearly: the risks in traditional rating agency models often stem from the mechanical application of rules; while true safety comes from the hardness of the assets themselves.

S&P's warning that a decline in Bitcoin would lead to Tether being insolvent is a static assumption. In fact, Tether's profitability is astonishing—projected to be $15 billion in profits by 2025, this cash flow itself is the strongest buffer. As long as Tether does not experience large-scale misappropriation or fraud, mere market fluctuations are unlikely to breach such a thick wall of profits.

Conclusion: The Emperor's New Clothes

S&P's downgrade of USDT to "Weak" is less a risk warning than a stress response from the traditional financial elite facing a new species they cannot control.

They cannot understand why a company with no thousands of compliance officers dares to buy banned assets in large quantities while regulatory bills are still fresh; they are even less able to accept that this company is using earned dollars to influence the craziest gold bull market since 1979.

Paolo Ardoino says the fragility of the old system makes those in power uneasy, and this is not an exaggeration. When a private company's purchasing power for gold surpasses that of sovereign nations, and when its Bitcoin holdings are sufficient to influence market pricing, it is no longer a simple stablecoin issuer.

In this collision between the new and old worlds, S&P's rating may just be a piece of waste paper under the fading light of the old era. For Tether, the real rating is not in Wall Street's offices, but in the interest from $112.4 billion in U.S. Treasury Bills, in the 116 tons of heavy gold in its vaults, and in the market value that continues to rise after every regulatory crackdown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。