Author | @0xTulipKing

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Prediction markets are not yet fully understood, and that is where your opportunity lies. We are witnessing a complete reconstruction of market structures, the way information is priced, and even "how the future is shaped." If you haven't started paying attention now, you will miss the biggest trading opportunity since the advent of electronic options.

iPhone Moment

Every technological revolution goes through a wonderful phase: people cannot see the disruption because they are still using old mental models to understand new things. In 2007, Nokia executives looked at the iPhone and said, "It doesn't even have a keyboard." They were comparing it to existing phones rather than comparing it to computers. The iPhone was not competing with existing phones—it was replacing the concept of "single-function devices."

The current prediction market is at exactly the same moment. Many people see Polymarket and think it is just a strange, illiquid betting site. They compare it to DraftKings' sports betting or CME's derivatives market and conclude that it "doesn't work." They are repeating Nokia's mistake. Polymarket is not a "better betting site"—it is replacing the very concept of "professional financial markets." Think about it: when you strip away all the complexity, what are financial instruments really:

- Options: Betting YES / NO on whether a price reaches a certain level

- Insurance: Betting YES / NO on whether a disaster occurs

- Credit Default Swaps: Betting YES / NO on whether a company goes bankrupt

- Sports Betting: Betting YES / NO on the outcome of a sports event

We have built a multi-trillion dollar industry around these essentially "binary questions," each with its own infrastructure, regulatory framework, and monopolistic intermediaries, all taking a cut of the profits.

Polymarket simplifies all of this to a basic element: creating markets around any observable event, allowing people to trade, and then settling when reality provides the answer. It is not a better sports betting platform than DraftKings, nor a better derivatives platform than CME; it is doing something more fundamental—simplifying all markets to their most basic units and then rebuilding from there.

Polymarket is like the iPhone; everything else is just an application.

Multidimensional Trading

When all trading occurs in the same venue, new possibilities are unlocked. Imagine you wanted to express this viewpoint five years ago: "I think the Federal Reserve will raise interest rates, but tech stocks will still rise because Trump might tweet something positive about AI." You would need to open different accounts at different institutions, face different regulatory frameworks, and use different leverage tools. Moreover, the dimension of "whether Trump mentions AI" simply did not exist as a tradable market.

On Polymarket, this can be done with just three clicks. More importantly, it is not three isolated bets, but expressing a complete worldview through interconnected positions: buy NO "the Fed pauses interest rate hikes," buy YES "the Nasdaq hits a new high," buy YES "Trump mentions AI in his next speech." Correlation itself is the key to trading.

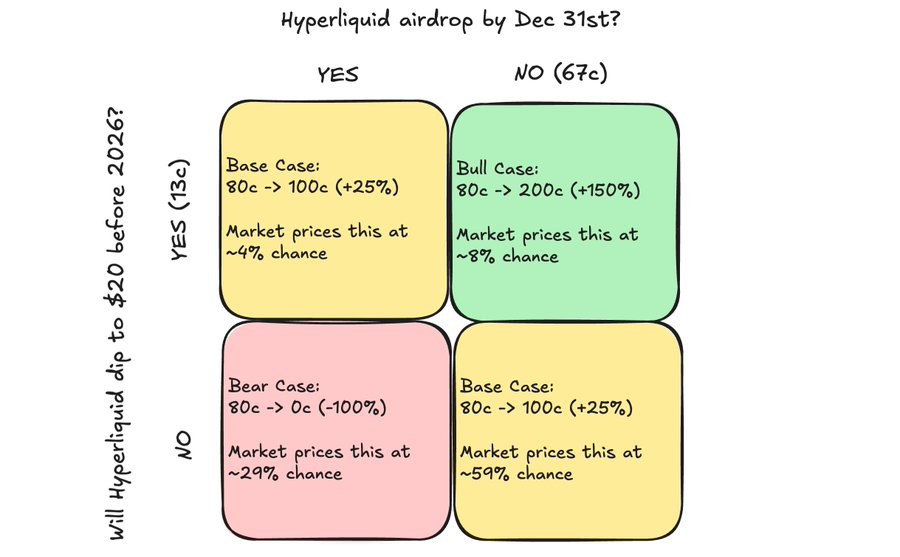

You should view prediction markets this way. Here’s a real example. Last month, you could construct this combination on Polymarket:

- Buy NO "Hyperliquid will airdrop before December 31" for $0.67;

- At the same time, buy YES "Hyperliquid will drop to $20 before 2026" for $0.13.

Consider this outcome matrix:

- Your biggest gain is: Hyperliquid does not airdrop this year, but the price still drops to $20. Given the current market conditions, this does not seem unreasonable; its pricing should be above the current 8% market yield, and you are buying the outcome you believe in at a low price.

- You will make a small profit: Hyperliquid airdrops, and the price drops to $20; or the price drops to $20 without an airdrop. These two scenarios have the highest probability, at 63%.

- If Hyperliquid airdrops and the price stays above $20, you will lose everything. Given that the market is very concerned about the new supply from team unlocks, an airdrop further increasing market supply seems likely to face strong opposition. The probability of this scenario should be less than 29%, so you are selling a possibility you believe is unreasonable at a high price.

This sounds like hedging risk, but it is much more than that. It expresses a complex view on "how the market handles new token supply," a view that cannot be expressed elsewhere.

Traditional markets force you to compress complex worldviews into rough directional bets. You might have a nuanced theory that Nvidia will greatly exceed expectations, but the stock price drops instead because the market has already priced in those expectations. In the options market, you can only choose between bullish or bearish, or construct a clumsy spread strategy that barely expresses your intent but requires paying hefty premiums. In Polymarket, you can accurately express your view by simply buying "Nvidia exceeds earnings expectations" and "Nvidia's stock drops 5% after earnings report."

Cross-Market Odd Correlations

The real skill lies in when you start paying attention to seemingly unrelated events that have correlations. For example: Florida is about to be hit by a hurricane, while the Pirates are playing in Detroit. Traditional logic assumes the two are unrelated, but you have a hypothesis: if the hurricane really ravages Florida, NFL referees will surely favor the Pirates to create an uplifting story. So, you bet on "Pirates win" and lose, with odds of 60 cents; while betting on "hurricane hits Florida" succeeds, with odds of 20 cents. You are not betting on the outcome but on the correlation structure. You profit by understanding how narratives influence referee decisions.

This is why I say prediction markets are not competing with existing markets—they operate on a completely different level of abstraction. Traditional markets give you one lever; Polymarket gives you countless, and more importantly, it allows you to choose specific combinations of options based on your understanding of how the world works.

Why "Experts" Keep Getting It Wrong

The first criticism you hear about prediction markets is always about liquidity. "Oh, you can't really trade." "The spreads are too wide." "It's just gamblers betting their lunch money." But this is not a flaw—this is your opportunity.

Think about the mechanisms behind why liquidity is about to explode. Traditional market making is relatively simple because there are clear relationships between commodities: stock options correspond to stock prices, futures correspond to spot prices, the models are clear, and the correlations are defined, allowing giants like Citadel and Jane Street to market-make thousands of contracts.

Prediction markets are completely different; each type of market requires independent specialized intelligence models:

- Sports markets need models that can update with every score, every injury report, and every weather change.

- Political markets need natural language processing technology to analyze polls, speeches, and social media sentiment.

- Event markets need machine learning systems that can calculate benchmark rates based on historical data.

- "Mention" type markets need language models trained on thousands of text records.

A market maker cannot dominate all markets because different fields require completely different specialized skills.

In the long run, this actually benefits liquidity. We will no longer see a few giants monopolizing all market making; instead, we will see an explosive growth of specialized market makers. Some teams will focus on "mention markets," some on weather-related events, and some on celebrity behavior. What seems like fragmentation will actually lead to a deeper and more stable liquidity structure.

In the next five years, a new type of financial institution will emerge: specialized market makers for prediction markets. They will not deal in stocks or bonds; they will trade on "reality itself." The first company to truly master this technology at scale will become the Citadel of the new financial system.

The Unsettling Truth About Truth

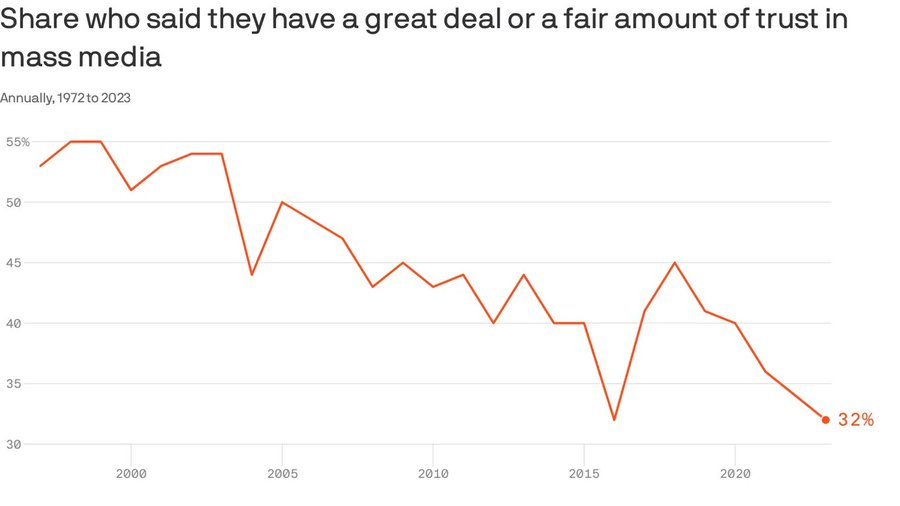

Now, let’s talk about something truly important: prediction markets are not about predicting per se, but about establishing an economic incentive mechanism that encourages truth. We live in an extremely absurd time: everyone has an opinion on everything, but almost no one has to bear the risk of those opinions. Your favorite Twitter analyst has predicted 12 recessions, but only two have actually occurred; those commentators on CNBC have been banned countless times yet continue to appear on air. They keep making mistakes without facing any consequences.

This model is unsustainable, and deep down, we all know it. The information system we have built rewards participation rather than accuracy; being loud is more important than being correct. Social media exacerbates the problem—now, the most popular statements win, regardless of their factual accuracy. The person with the most followers becomes the expert, and the definition of an expert has turned into the one with the most likes.

Prediction markets completely overturn this. Suddenly, predicting correctly comes with a cost, and predicting incorrectly also comes with a cost. The market does not care whether you graduated from Harvard, whether you have a blue checkmark, or whether you have written books on the market. It only cares whether your predictions are correct. When you establish a system that rewards only accuracy, wonderful things happen: those who predict accurately suddenly have a reason to speak, while those who predict incorrectly finally have a reason to be quiet.

But it is not just about transferring wealth from those who should not have it to those who should. Prediction markets are building a parallel information system that operates in stark contrast to our current media ecosystem.

In the old world: Information spreads through social networks via "viral propagation."

In prediction markets: Information is priced according to "reality."

These two filtering mechanisms are completely different, and the outcomes will naturally be completely different.

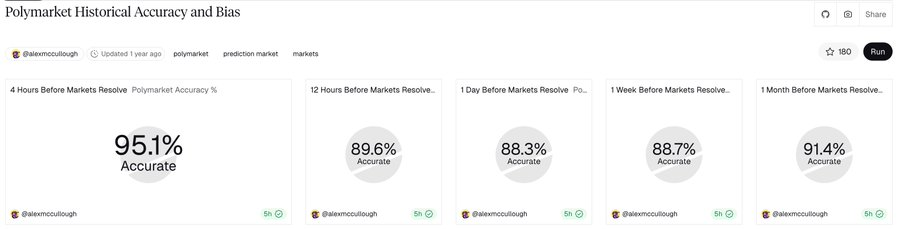

Although Polymarket is still in a relatively early stage, it has already demonstrated astonishing accuracy.

We have witnessed this in real-time on Polymarket: the predictive power of political markets has surpassed that of any polling aggregator; markets related to the Federal Reserve often show fluctuations before economists update their predictions; earnings report markets reflect results in prices weeks in advance, while this information takes a long time to appear in analyst reports. The reason is not that traders are smarter, but that their incentive is to "ensure predictions are correct," rather than chasing hype.

No longer "prediction markets," but "bounty markets"

Now things start to get really strange, and this is the key dynamic that I believe most people completely overlook. We still call them "prediction markets," but this is like calling Bitcoin "digital gold"—technically correct, but missing something more essential. True prediction markets are passive observers; they price probabilities but do not change outcomes. A weather futures market does not change the weather itself. But Polymarket is not passive, and that is the key: as long as there are human participants in the market, it inherently contains a mechanism for "implied bounties" to change outcomes.

Let me be more specific. When there is a market betting on "whether someone will throw a green object in a WNBA game," someone calculates as follows:

- Buy YES for $1.5, worth $10,000.

- Throw the object themselves.

- When the market settles as YES, collect $66,000.

- After deducting legal fees and a lifetime ban, the net profit is about $50,000.

The equilibrium dynamics presented here are extremely intriguing. Theoretically, this "bounty for disrupting the WNBA" will automatically settle at a balance point:

Profit = Criminal Costs + Social Shame + Lifetime Ban + Required Effort

If the price is too high, imitators will emerge; if the price is too low, no one will act. The market will find that balance point just enough to drive behavior.

The so-called "prediction markets" have now turned into bounty markets—they are no longer predicting whether something will happen, but providing a clear amount to encourage someone to make it happen. This is not a flaw or manipulation, but rather a core characteristic of prediction markets that is rarely discussed.

Imagine a thought experiment: I decide to run for mayor of New York City. The market gives me a 0.5% chance of winning. At these odds, I can buy 20 contracts worth $5,000 each for $100,000. If I win, each will pay $1 million.

What’s more interesting is when I distribute these contracts as rewards to my campaign team. I hire 20 people and promise that if we ultimately win, each will receive $1 million.

I have just created something that should not exist in reality: a market-funded political campaign, and the lower the probability of winning, the higher my leverage. The market is essentially saying, "This outcome is too unlikely, so we are willing to give you 20-to-1 odds to give it a try." Prediction has turned into a bounty. The market is no longer just observing reality; it is funding certain specific versions of the future.

Certain events are hardly influenced by the bounty mechanism—such as becoming president, which is already highly valuable, making the additional incentives from prediction markets negligible. But for thousands of other events—from corporate decisions to cultural phenomena to sports outcomes—the bounty mechanism exists and is active.

What we ultimately get is not the "future politics governed by market wisdom" envisioned by Robin Hanson, but something stranger: a market system that pays to make certain futures a reality.

Conclusion

My prediction is that within ten years, Polymarket's model will consume most of the traditional financial system. The reason is not that it has lower fees or a better experience, but because compressing all markets into a single primitive and rebuilding from the ground up is far more efficient than maintaining countless specialized market structures.

The dominoes will fall in the following order:

- DraftKings — Sports betting is essentially just a prediction market with lower odds.

- CBOE — Options are essentially complex binary bets on price levels.

- Insurance — Just a prediction market that can only go long.

- Credit markets — Essentially pricing bankruptcy probabilities, just with a few layers of structure added.

These industries will resist and regulate, but ultimately they will have to yield, because they will eventually realize—they are not facing a better product, but a set of superior physical rules.

What we are truly witnessing is a complete reconstruction of how markets operate. You are no longer betting on prices, interest rates, or volatility; you are betting on events, the correlations between events, and most importantly, the probabilities of events occurring.

Smart money should start positioning itself now—not just buying tokens or participating in trades, but thinking: what happens when any observable event can have a liquid market? When every corporate decision has a market? Every bill has odds? Every cultural trend has a price? Entrepreneurs can raise funds by selling "shares of low-probability success"? Anyone with faith in the future can directly convert that faith into leverage?

What we are building is not just a better market; we are building a mechanism that incentivizes people to create the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。