S&P Global Ratings has downgraded Tether's stability rating to the lowest level, putting the quality and transparency of the reserves of the world's largest stablecoin under the spotlight.

On November 26, 2025, S&P Global Ratings announced that it has lowered the stability rating of Tether's issued stablecoin USDT from "4 (restricted)" to "5 (weak)", which is the lowest grade in the assessment system.

This decision stems from concerns over the significant increase in the proportion of high-risk assets in USDT's reserve assets, particularly as Bitcoin's share has reached 5.6%, exceeding USDT's 3.9% over-collateralization buffer.

1. Rating Downgrade: Core Reasons Explained

The downgrade of Tether's USDT stablecoin rating to the lowest level by S&P Global Ratings is not coincidental, but based on a series of concerning data and risk assessments.

Surge in High-Risk Asset Allocation

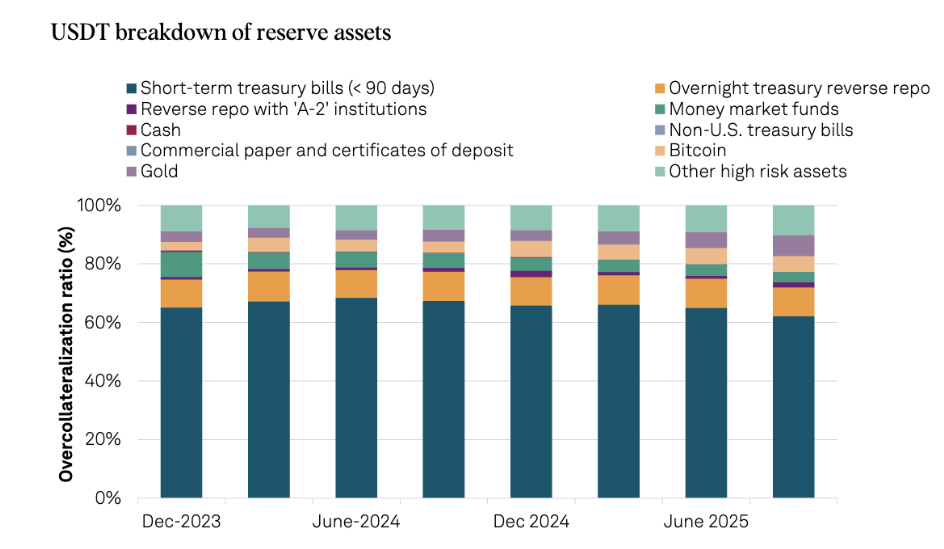

● The S&P report clearly states that the proportion of "other assets" in Tether's reserves, including Bitcoin, corporate bonds, gold, and secured loans, has increased significantly from 17% a year ago to 24%.

● This change has significantly altered the composition of USDT's reserves, with low-risk short-term U.S. Treasury bills accounting for only 64%, plus an additional 10% in overnight reverse repos.

● The risk concentration of Tether's reserve assets has reached a concerning level, with Bitcoin alone accounting for 5.6%, which not only exceeds the risk threshold of many traditional financial products but also surpasses USDT's own over-collateralization buffer.

Transparency and Regulatory Deficiencies

● S&P emphasized in the report that Tether has limited transparency in reserve management and risk appetite, and lacks a robust regulatory framework. Tether does not publish audited financial reports but hires BDO Italia to prepare quarterly reserve snapshots, which are unaudited.

● More concerning is that Tether lacks an asset segregation mechanism to protect investors from the impact of issuer bankruptcy. S&P pointed out that Tether has not disclosed information about its custodians, bank account providers, and counterparties, making it difficult to accurately assess the true risks of its reserve assets.

2. Stability Risks: The Alarm of Insufficient Collateral

Weak Security Buffer

● As of the end of September 2025, USDT's circulation was $174.4 billion, with reserve assets of $181.2 billion, resulting in a collateralization rate of 103.9%. This figure seems to provide reasonable over-collateralization, but S&P's analysis reveals a key issue: the 5.6% allocation to Bitcoin has already exceeded the 3.9% over-collateralization guarantee rate.

● This means that if Bitcoin's price were to drop significantly, the resulting losses would directly erode USDT's principal protection, potentially leading to a situation of insufficient collateral for the world's largest stablecoin.

Concerns of Regulatory Arbitrage

● Tether moved its company to El Salvador this year and applied for a digital asset license in the country. The regulatory requirements in El Salvador are lower than those in Europe and the U.S., only requiring Tether to maintain at least a 1:1 reserve backing, with at least 70% of the reserves being liquid within 30 days, and does not require asset segregation.

● This "regulatory arbitrage" behavior, while reducing compliance costs, increases investors' risk exposure and further undermines USDT's reliability as a stablecoin.

3. Market Impact: A Chain Reaction in the Crypto Ecosystem

Potential Changes in the Stablecoin Market Landscape

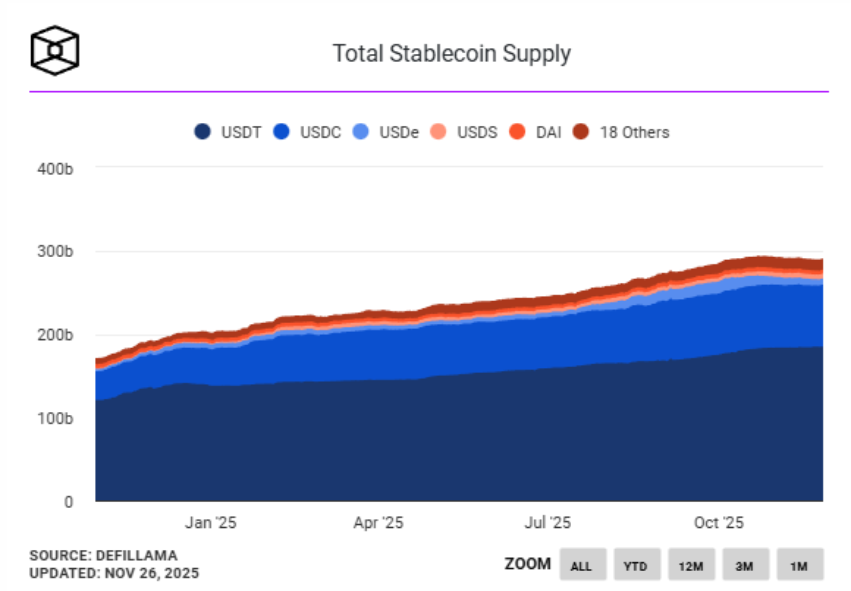

● As of November 2025, Tether remains the largest stablecoin in the world, with a market capitalization of approximately $184 billion, accounting for about 71% of the market share. Its closest competitor, USDC, has a market capitalization of about $75 billion.

● S&P's downgrade action may prompt some cautious investors to shift towards USDC and other stablecoins that are perceived to have more transparent reserves and stricter regulations, potentially altering the competitive landscape of the stablecoin market.

Systemic Risks Cannot Be Ignored

● S&P's warning aligns with a broader pattern of concern, as the agency has also assigned speculative-grade ratings to companies like MicroStrategy that are heavily invested in Bitcoin, due to their facing similar liquidity risks. This indicates that the entire cryptocurrency ecosystem is facing risk assessments and scrutiny similar to those in the traditional financial system.

● If market concerns about USDT trigger a massive wave of redemptions, it could impact liquidity in the cryptocurrency market, further amplifying market volatility.

4. Tether's Response: Firm Denial and Counterattack

Emphasizing Past Resilience

● In response to S&P's downgrade report, Tether issued a strong rebuttal, "strongly denying" its conclusions. The company stated: "The report relies on outdated analytical frameworks that fail to reflect the characteristics, scale, and macroeconomic significance of digital native currencies, and ignores data that clearly demonstrates USDT's resilience, transparency, and global utility."

● Tether emphasized that its stablecoin has maintained "complete resilience" during various banking crises, exchange failures, and extreme market volatility.

Defending Transparency Measures

● Tether claims that it has continuously published quarterly independent audit certification reports since 2021 and has never refused any verified user's redemption requests. The company states that its transparency standards exceed those of many regulated financial institutions.

5. A New Balance of Regulation and Market

Regulatory Frameworks are Strengthening

● This event occurs after the passage of the U.S. GENIUS Act, which prohibits the use of illiquid assets as collateral for stablecoins. The EU's MiCA (Markets in Crypto-Assets Regulation) is also reshaping the regulatory landscape for the stablecoin industry.

These regulatory developments indicate that stablecoin issuers will face stricter disclosure requirements and reserve asset limitations in the future.

Limited Options for Tether

● S&P noted in the report that if Tether reduces its exposure to high-risk assets and provides more comprehensive disclosures regarding reserve composition and the credibility of custodial partners, its stability assessment may improve.

● However, in the current increasingly competitive stablecoin market, Tether faces a dilemma: either maintain a high-risk allocation to pursue returns or lower its risk appetite, which may weaken profitability.

Market data shows that Tether remains an undeniable force in the cryptocurrency ecosystem, with a market capitalization of nearly $185 billion, making it the 17th largest holder of U.S. Treasury bonds globally, even surpassing South Korea.

However, S&P's downgrade decision sends a clear signal to the market: size does not equal stability, and market capitalization does not equal safety. As global regulators refine the regulatory framework for stablecoins, Tether and its competitors will face a more stringent regulatory environment.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。