The economy shows little change, consumer spending is K-shaped, and the job market is weak—this extraordinary period's Beige Book is injecting strong momentum into the Federal Reserve's interest rate cut decision.

The latest Beige Book survey report released by the Federal Reserve on November 26 paints a mixed picture of the U.S. economy.

The report indicates that U.S. economic activity has "changed little" in recent weeks, but consumer spending has further declined, and there are signs of weakness in the job market. Compiled by the Dallas Fed and based on information collected up to November 17, the report's significance has increased ahead of the December FOMC meeting due to the U.S. government shutdown, which has led to the absence of key economic data.

I. The "Economic Thermometer" in Extraordinary Times

● At the time of this Beige Book's release, the U.S. economic data ecosystem is in an unusual vacuum. The recent U.S. government shutdown has resulted in a significant delay in the collection and release of key economic data.

● Federal Reserve officials are unable to obtain most labor market and inflation data for October and November before the policy meeting on December 12-13. In this context, the Beige Book, based on field research from 12 regional Federal Reserve banks, has significantly increased in importance.

This report is no longer just a supplement to traditional economic data but has become one of the core decision-making bases for policymakers.

II. Economic Overview: Coexistence of Cold and Warm

The Beige Book reveals a complex picture of the U.S. economy, with vastly different experiences across sectors, regions, and income groups.

● Overall economic stagnation. The report shows that the U.S. economy has "changed little" or "not much" during the survey period. Among the twelve Federal Reserve districts, only one reported moderate growth, two reported moderate declines, and the rest remained basically flat.

● Consumer market shows a distinct "K-shaped divergence". The report clearly states that while high-end consumer spending remains resilient, overall consumer spending has further declined. Several regions, including New York, Atlanta, and Minneapolis, reported that high-income consumers are "unconstrained," while the spending power of middle- and low-income households has significantly weakened.

This divergence is fully reflected at the regional level. The San Francisco Fed reported that low-income groups continue to cut non-essential spending, while high-income consumers' demand remains stable. The St. Louis Fed observed that the frequency of visits by regular customers in the dining industry has dropped from daily to two or three times a week, with fewer items ordered.

● Signs of cooling in the job market. The Federal Reserve noted that half of its twelve districts reported a decline in employers' hiring intentions. More companies are opting for strategies to save labor costs, such as freezing hiring and natural attrition, instead of direct layoffs. Some retailers in the Cleveland Fed district have begun to reduce staff due to declining sales.

● Price pressures persist. The manufacturing and retail sectors are generally facing rising input cost pressures, which businesses attribute to tariff impacts. A brewery in the Minneapolis Fed district reported that the cost of aluminum cans has risen. However, in the context of weak demand, businesses' ability to pass on costs to consumers is limited.

III. Structural Changes: Three New Trends

This Beige Book also reveals several deep structural changes affecting the U.S. economy.

● Artificial intelligence begins to impact the job market. The report indicates that a few companies explicitly state that artificial intelligence is replacing entry-level positions or increasing the productivity of existing employees to the extent that it suppresses new hiring.

This marks a shift from theoretical discussions about AI's substitution effects on employment to tangible impacts in the real economy.

● The aftershocks of the government shutdown continue to impact the economy. This survey was primarily conducted during the period when the U.S. government ended its shutdown on November 12.

The report shows that some retailers claim the shutdown has negatively affected consumption. Community organizations report an increase in food assistance demand due to the interruption of the Supplemental Nutrition Assistance Program (SNAP) benefits during the shutdown.

● Economic performance varies across regions. Reports from various Federal Reserve districts show significant regional differences:

- The Boston Fed reports slight expansion in economic activity, with housing sales regaining momentum.

- The New York Fed observes a moderate decline in economic activity and a slight decrease in employment.

- The Philadelphia Fed states that economic activity was already on a downward trend before the government shutdown.

- The Atlanta Fed indicates that overall economic activity is basically flat.

IV. Policy Game: The Balance Tips Toward Rate Cuts

The complex economic picture presented in the Beige Book provides evidence that both sides can reference in the Federal Reserve's internal debate about the future path of interest rates.

● Reasons supporting rate cuts: Weak consumer spending, a cooling job market, and the negative impact of the government shutdown on the economy provide dovish officials with grounds to support rate cuts. Recent statements from officials like New York Fed President John Williams further reinforce market expectations for rate cuts.

● Reasons opposing rate cuts: At the same time, moderate price increases, resilient high-income consumption, and ongoing cost pressures provide hawkish officials with reasons to maintain the current stance.

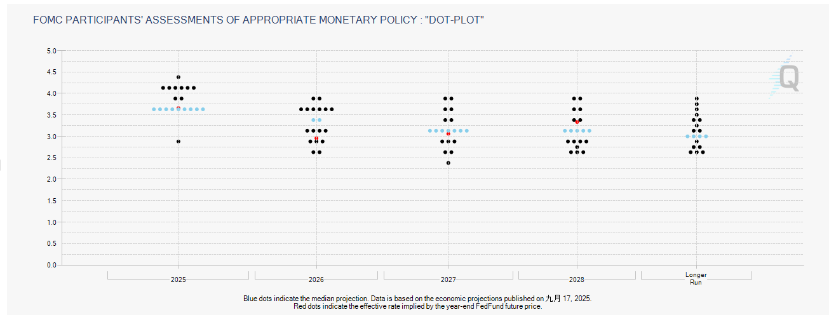

Despite the differences, market expectations have clearly tilted toward rate cuts. According to CME's "FedWatch," as of November 27, the probability of a 25 basis point rate cut by the Federal Reserve in December has risen to 85%. JPMorgan quickly revised its forecast, now believing the Federal Reserve will cut rates in December, changing its previous judgment that the Fed would delay cuts until January.

V. Market Impact and Institutional Predictions

In light of the economic picture revealed by the Beige Book, major financial institutions have adjusted their expectations for Federal Reserve policy.

● JPMorgan economists have changed their forecast, believing the Federal Reserve will initiate rate cuts in December, reversing their judgment from a week ago. Led by Michael Feroli, the research team noted that several heavyweight Federal Reserve officials support recent statements for rate cuts, prompting them to reassess the situation.

● Goldman Sachs recently stated that the Federal Reserve will implement its third consecutive rate cut at the December meeting. The firm also expects the Federal Reserve to cut rates twice in March and June 2026, ultimately bringing the federal funds rate down to a range of 3.00%-3.25%.

● Meanwhile, market expectations for the future of U.S. stocks remain optimistic. Deutsche Bank strategists predict that the S&P 500 index will rise to 8000 points by the end of 2026, implying about an 18% upside, supported by strong earnings and increasing stock buybacks.

The release of this Beige Book coincides with a critical juncture in the Federal Reserve's policy path. Both the market and the Federal Reserve are focused on the FOMC meeting scheduled for December 9-10. With recent dovish statements from heavyweight figures like Fed Governor Waller and New York Fed President Williams, the market's bet on a rate cut in December has surged to 85%.

JPMorgan has quickly "ripped up the report," reversing its prediction from a week ago, now believing the Federal Reserve will initiate rate cuts in December. The economic fractures depicted in the Beige Book have become a powerful catalyst for a shift in the Federal Reserve's monetary policy.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。