The king-level Layer 1 project Monad went live this Monday night, carrying the high expectations of being an "Ethereum killer." However, shortly after the TGE, it briefly fell below the issue price of $0.025, hitting a low of $0.0203, a nearly 20% drop. Although it later surged to a high of $0.038, Monad, as the first project on Coinbase's Launchpad, raised a total of $269 million, only exceeding the target by 144%, which is quite disappointing.

(Figure 1: Monad's moment of breaking the issue price (Data source: AiCoin PC version))

In the past bull market, it was common to "earn by closing your eyes during new token launches" and "collect airdrops effortlessly." Now, however, frequent failures have become the norm: Gas fees, time costs, and high thresholds easily outweigh airdrop profits, leading retail investors to incur losses and abandon the market. Next, we will take the recent highly competitive Binance Alpha airdrop as a starting point to analyze: In the current market correction, does the on-chain wealth effect still exist? How should we operate with new token launches and airdrops moving forward?

I. How Competitive is Binance Alpha Now

Since November 15, the airdrop threshold for Binance Alpha has not dropped below 240 points.

This means that to fully participate in one round of airdrops, one must accumulate at least 16 points daily for 15 consecutive days (1 point balance + 15 points trading volume).

Based on the current ecosystem, the daily real cost (transaction fees + price difference + slippage) is approximately between $1.5 and $2.5. Taking the average value of $2, the hard cost over 15 days is $30.

However, the 240 points you painstakingly accumulated usually only yield an airdrop value of $20-30—this does not account for slippage when selling and the market's sudden downturn. If you fail to sell immediately after listing, the actual amount received may be halved to $10 or even lower.

The result is that the vast majority of participants work hard for 15 days, only to bounce back and forth between "slightly breaking even" and "small losses." This is a stark contrast to the September era of "earning 800 U monthly with a single account" and "receiving airdrops four times in one cycle."

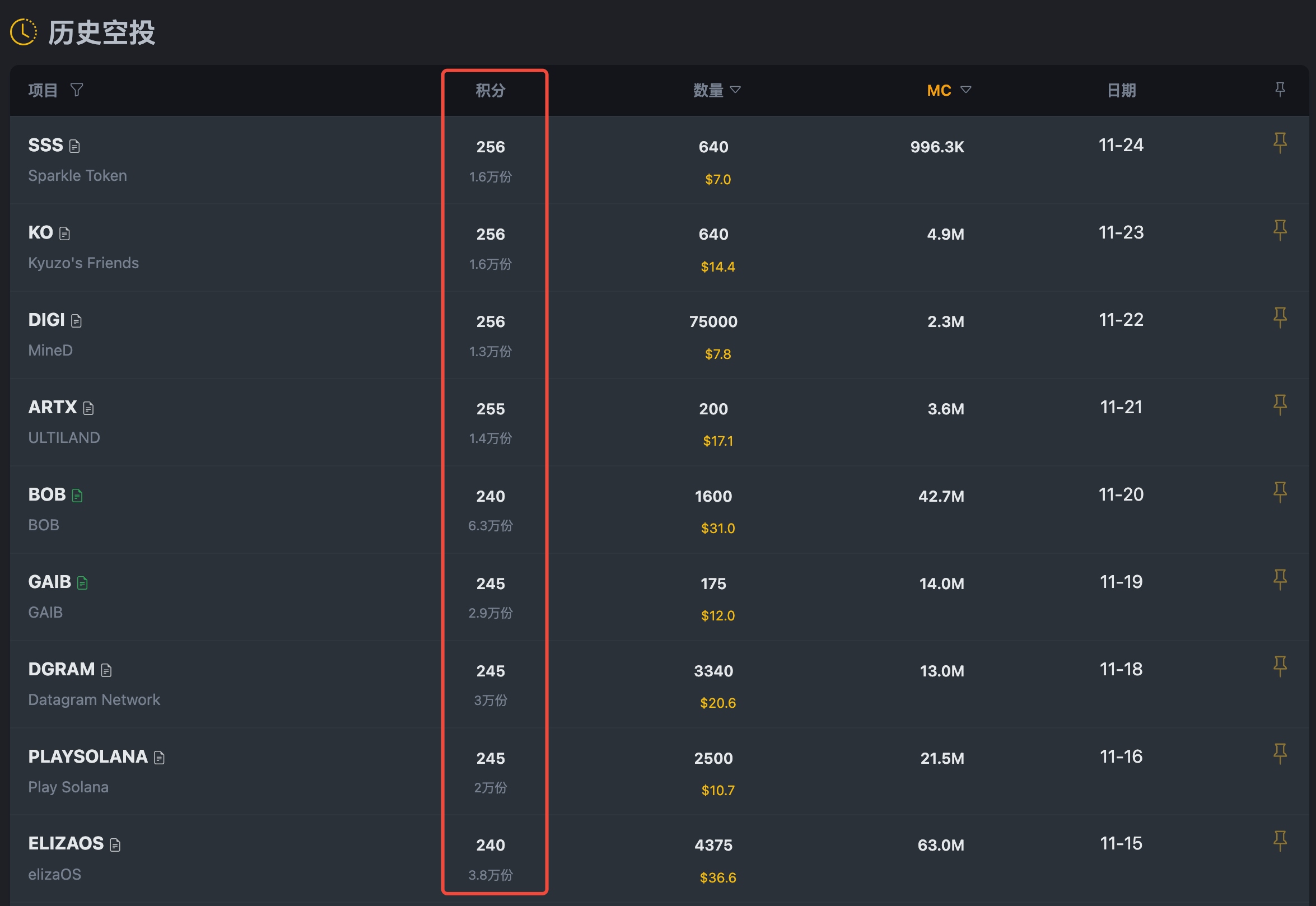

(Figure 2: Recent scores for Binance Alpha (Data source: https://alpha123.uk/zh/history.html))

To make matters worse, the number of participants in Binance Alpha has remained high, reaching up to 300,000. Among them are many who feel disappointed with the current market and are eager for stable returns, making the already competitive airdrop even harder to grab. Everyone sees Alpha as their last lifeline, leading to a frantic scramble for resources in an increasingly smaller pool.

(Figure 3: Number of participants in Binance Alpha (Data source: https://alpha123.uk/zh/history.html))

Looking back at the overall market, BTC has retraced nearly 35% from its peak, and market liquidity has been drained to the bottom. New tokens almost cannot escape the fate of "peaking upon listing"; a slight delay in selling leads to a crash, extinguishing the profit effect and causing retail investors' willingness to buy to plummet—no one wants to be the last one holding the bag.

The quiet market has directly scared off project teams: TGE enthusiasm has sharply declined, and what used to be a few projects launched in a day has now turned into barely one or two every couple of days, further amplifying the situation of too many monks and too little porridge.

Data speaks volumes:

In early November (1-10), 14 Alpha projects were launched, averaging 1.4 projects per day, with a maximum of three projects in one day; however, by mid-November (11-20), only 8 projects were launched in ten days, cutting the frequency by nearly half.

(Figure 4: Projects that were "drowned" upon launch (Data source: AiCoin PC version))

II. What to Do at This Stage

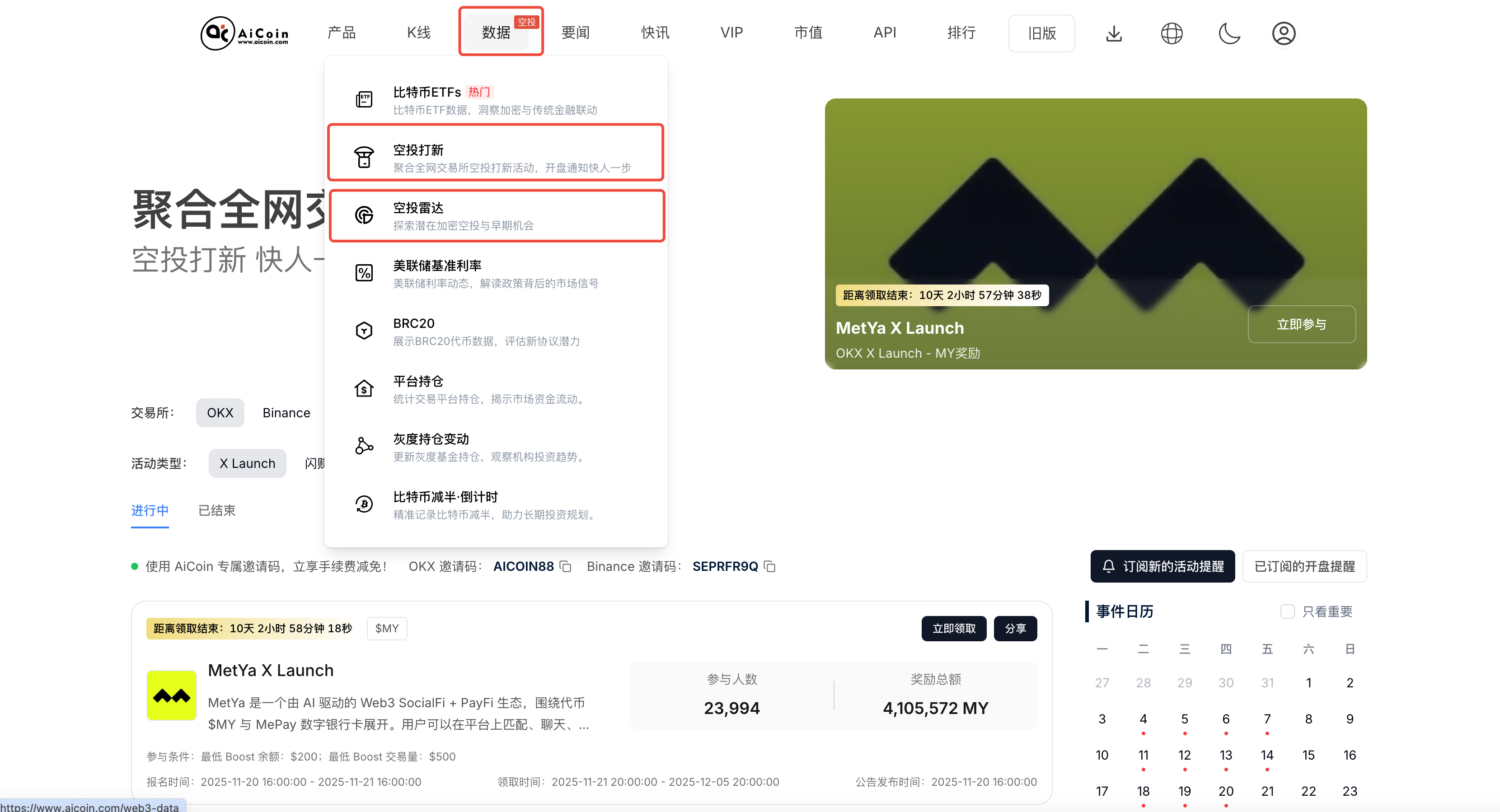

In fact, it is far from being a "completely hopeless" situation. As long as we switch tracks and change strategies, there are still opportunities to be had. The simplest way to switch: open the AiCoin web version → top bar "Data" → click into "Airdrop New Launch" and "Airdrop Radar," where the latest and most lucrative opportunities are pushed in real-time, ensuring you don't miss any big profits.

(Figure 5: Airdrop section on AiCoin web version (Data source: AiCoin web version))

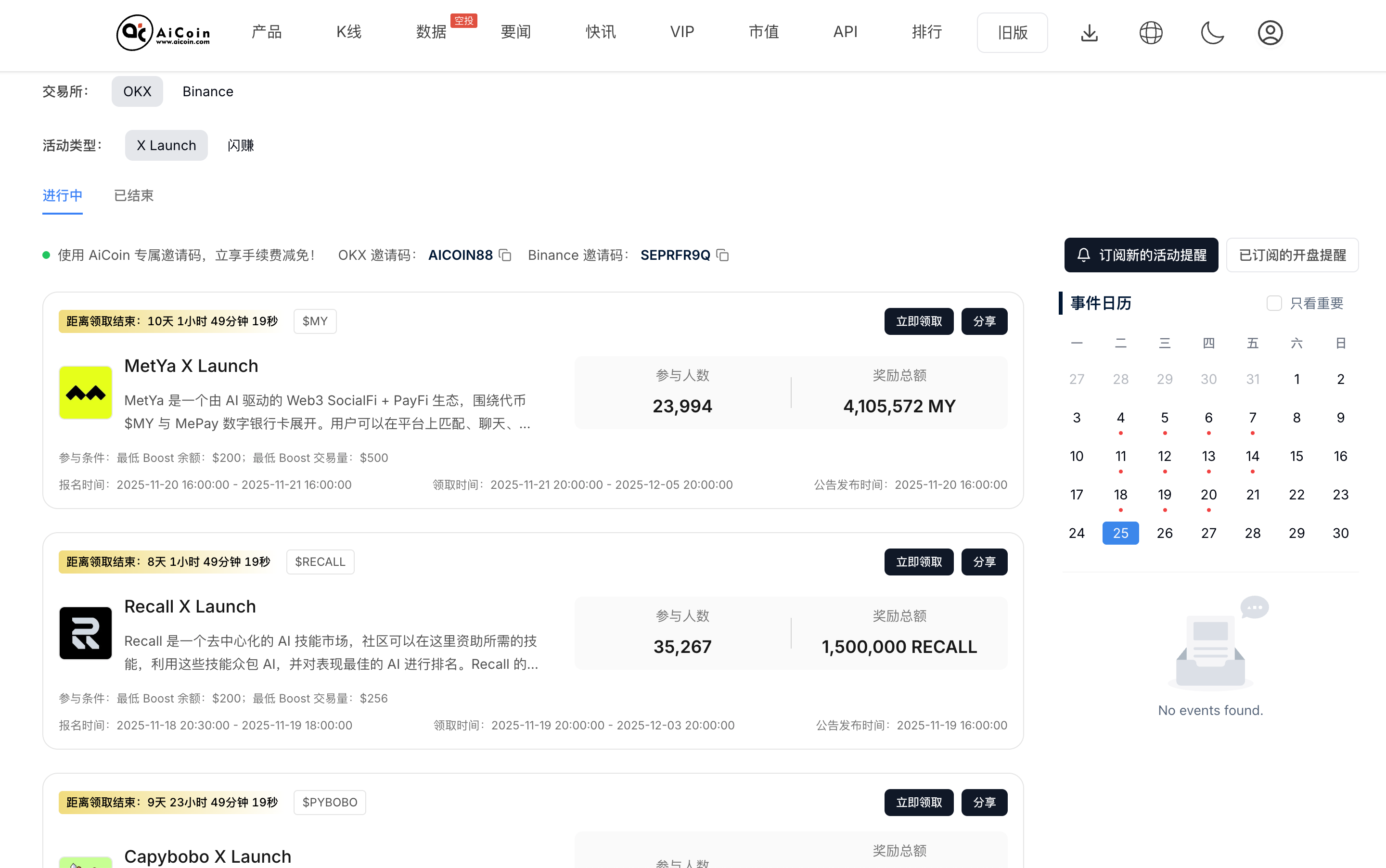

Since the returns from Binance Alpha have decreased, we can choose to participate in OKX's Boost. Recently, Boost's returns have been better than Alpha, allowing us to compete in less crowded areas. If more people leave Alpha later, we can always return to Alpha, and you can use our invitation code to help reduce fees: OKX invitation code: AICOIN88; Binance invitation code: SEPRFR9Q.

(Figure 6: OKX Boost project on AiCoin web version (Data source: AiCoin web version))

Additionally, we can further reduce costs and elegantly "lower our dimensions" to earn passively.

In the past, to reach 16 points, I had to push for 15 points in trading volume every day; now I can reduce it to just 14 points—cutting transaction fees in half while still reliably reaching 15 points (1 point balance + 14 points trading). Over 15 days, the points will land around 225. Some may ask, "Won't fewer points make it harder to grab?"

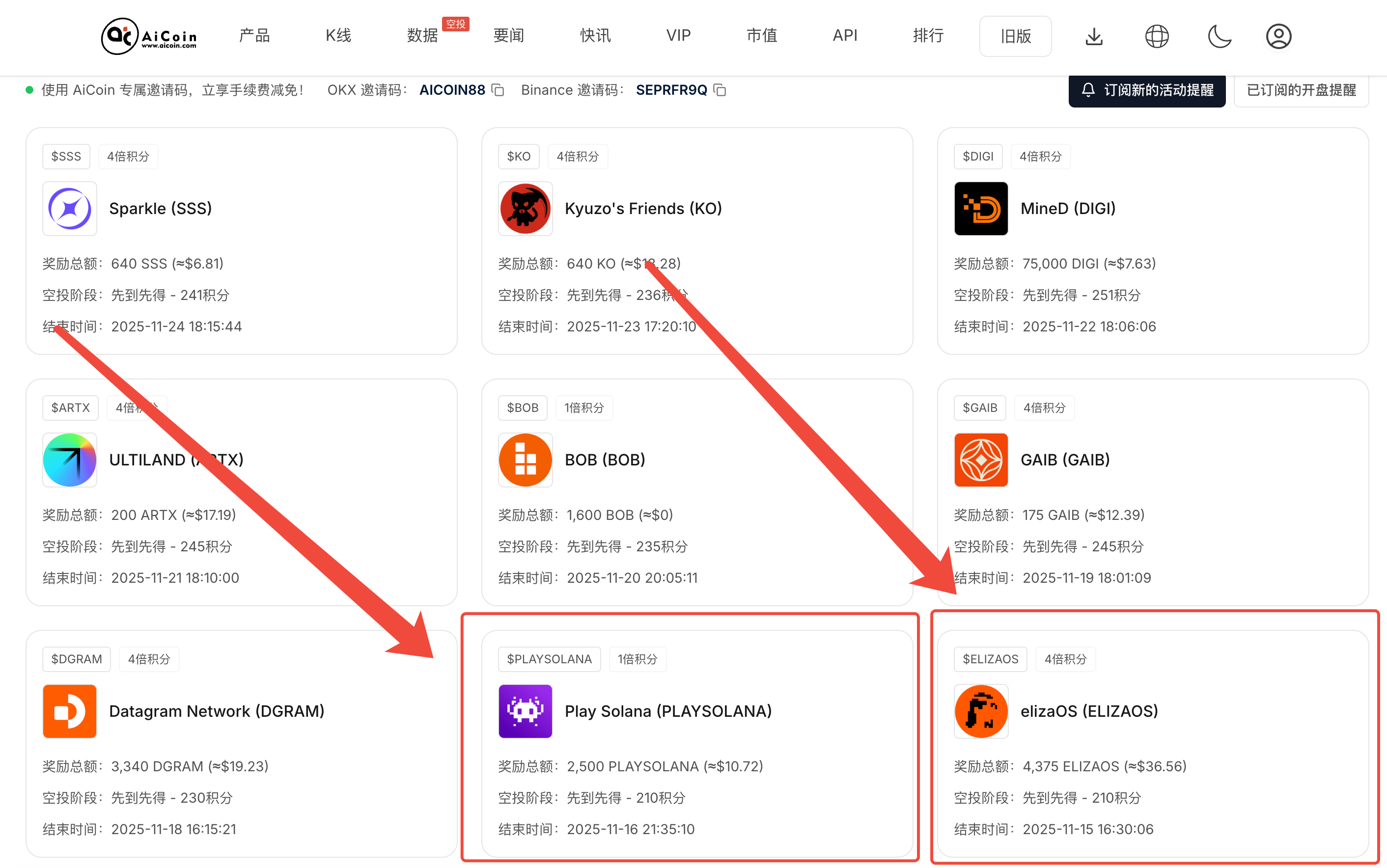

No need to worry; Binance Alpha has a magical mechanism—after a token is listed, the threshold decreases by five points every five minutes. For example, if the original airdrop required 240 points, it will drop to 235 points if not fully claimed after five minutes. By opening the AiCoin web version → top bar "Data" → clicking into "Airdrop New Launch," we can see the minimum points required for previous airdrops. Taking the elizaOS project as an example, due to the large number of airdrop shares, it took a full half hour to claim, dropping by 30 points to complete, with a threshold of only 210 points. By accumulating 15 points daily, we can claim airdrops twice, which is also a good way to pick up bargains.

(Figure 7: Recent performance of Binance Alpha (Data source: AiCoin web version))

Conclusion

As the number of participants in Binance Alpha gradually declines, truly high-quality projects are lining up to prepare for Alpha. Coupled with the market being severely oversold and the potential for a rebound igniting at any moment, the profit effect of Binance Alpha will inevitably make a comeback.

Instead of waiting for the profit effect to fully return and then chasing after it, it is better to start accumulating points now while the number of departures increases, getting ahead of others. In short: open the AiCoin web version now to get a one-stop understanding of all airdrop information: not only can you subscribe to event reminders, but you will also never miss any big profits, and the "Airdrop Radar" will push on-chain new launch opportunities in real-time.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group: https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。