There are $13 trillion sitting in U.S. 401k plans.

How much of that could BTC capture?

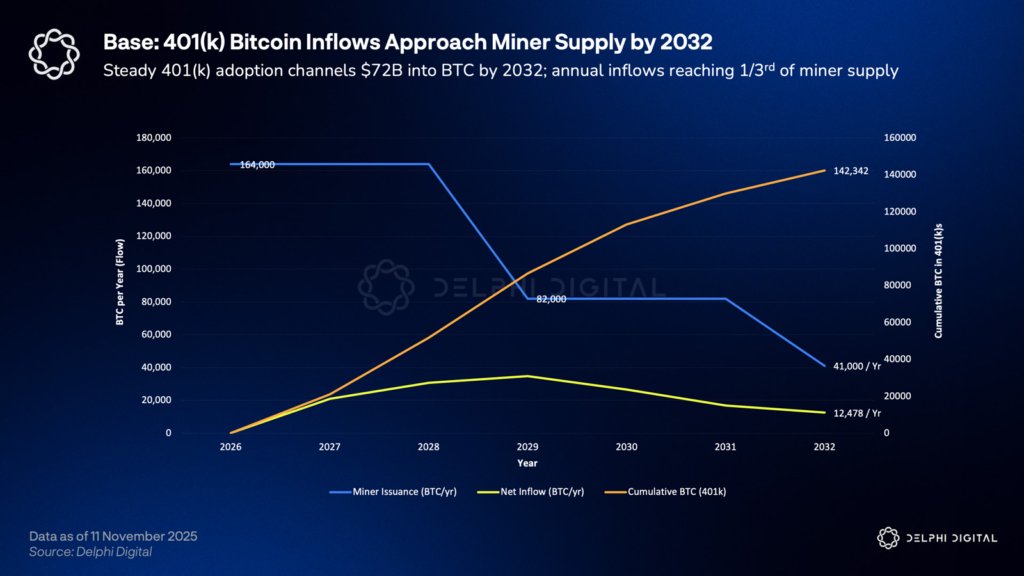

The Base Case envisions Bitcoin's measured normalization within U.S. retirement infrastructure as regulatory clarity improves.

By 2032, Bitcoin reaches 0.6% of 401k assets, roughly $79 billion in desired exposure. By 2029, inflows absorb around 20% of miner issuance, rising to 30% by 2032. This is not enough for a full supply deficit, but enough to establish a stable demand source that operates independently of price action.

The Medium Case reflects more limited adoption, reaching 0.3% of assets or about $39 billion by 2032. This scenario introduces Bitcoin to the retirement system without meaningfully shifting its structural demand profile.

The Aggressive Case is where things get interesting. At 1.5% of 401k assets, total exposure hits roughly $195 billion by 2032. More importantly, annual retirement inflows of about 76,500 BTC overtake miner output of roughly 41,000 BTC. For the first time, retirement demand would exceed new supply.

The Conservative Case with just 0.025% allocation ($3.3 billion) still creates a low intensity, high duration bid that compounds quietly in the background of an increasingly supply constrained asset.

Retirement infrastructure represents a fundamentally different demand profile that is long term, contribution based, and insensitive to volatility. This is slow accumulation that tightens the free float annually.

Retirement adoption could become a demand sink for BTC if adopted.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。