The company highlighted Zcash’s zero-knowledge cryptography and privacy features as central to the token’s long-term relevance, adding that “as privacy becomes foundational across crypto, we view ZEC as a key contributor to a well-balanced digital asset portfolio.”

The trust, created in 2017 as a private placement product, aims to convert into an exchange-traded fund (ETF) listed on NYSE Arca under the ticker ZCSH, according to the preliminary prospectus. The ETF would track the price of zcash held by the trust, minus fees and expenses. Grayscale said the product is intended to provide cost-efficient exposure to ZEC without requiring direct token custody.

Zcash, launched in 2016, uses zk-SNARKs to offer shielded transactions that can conceal sender, receiver, and transaction amounts while still allowing selective disclosure when needed. Grayscale noted that this system is designed to bring onchain privacy through cryptographic proofs rather than mixers or external technology layers.

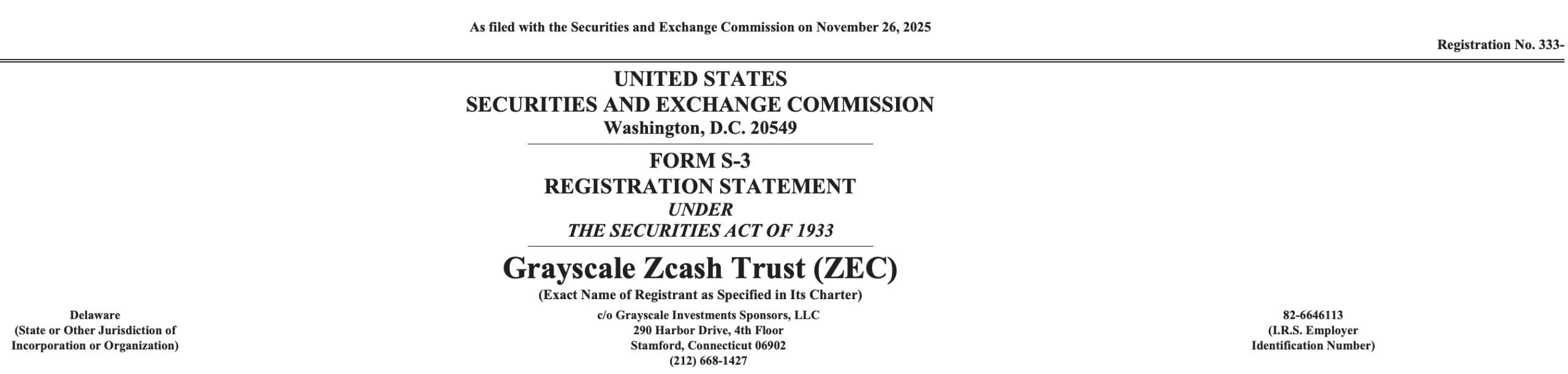

The Grayscale ZEC ETF filing.

In its X statement, Grayscale included standard regulatory language reminding investors that the Zcash Trust “is speculative and entails significant risk, including possible loss of principal,” and directed readers to the SEC’s EDGAR database for official filings.

The prospectus shows the trust intends to issue and redeem shares in 10,000-unit baskets. At the time of filing, a basket required roughly 817 ZEC. The trust currently accepts only cash orders facilitated by a third-party liquidity provider, though in-kind creations and redemptions could be added later if NYSE Arca receives additional regulatory approval.

If approved, the ETF would join Grayscale’s broader effort to convert its single-asset trusts into fully regulated exchange-traded products. The firm said the move could help reduce the longstanding discount between the trust’s shares and the value of its underlying ZEC, a gap that has fluctuated widely over the past several years.

Read more: U.S. Bank Explores Stablecoin Issuance on Stellar Network

The filing also outlined ongoing risks for ZEC, including regulatory uncertainty, the potential classification of Zcash as a security, liquidity limitations, and the evolving treatment of privacy-focused digital assets in the United States and abroad. The news comes as an onslaught of crypto ETFs have arrived on the scene.

Grayscale’s X post emphasized Zcash’s role in the broader ecosystem and reaffirmed its view that privacy-preserving blockchains will continue to play a meaningful role in digital asset markets. “Zcash brings onchain privacy via zk-SNARK–powered shielded transactions,” the company wrote.

- What did Grayscale file with the SEC?

Grayscale submitted a Form S-3 to begin the process of converting its Zcash Trust into an ETF. - Where will the proposed Zcash ETF trade?

The company intends to list the shares on NYSE Arca under the ticker ZCSH. - Why is Zcash significant to Grayscale?

The firm cites Zcash’s zk-SNARK privacy features as a key piece of the evolving digital asset market.

What risks did Grayscale highlight?

The trust warned of market volatility, regulatory uncertainty, and the possibility of losing principal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。