Bitcoin and ether enter Wednesday’s session with heavy derivatives momentum, as traders prepare for one of November’s largest options expiries on Deribit. With bitcoin priced at $87,278 and ether at $2,936, both assets sit well below their respective max pain levels heading into the Friday 8 a.m. UTC (3 a.m. EST) expiration.

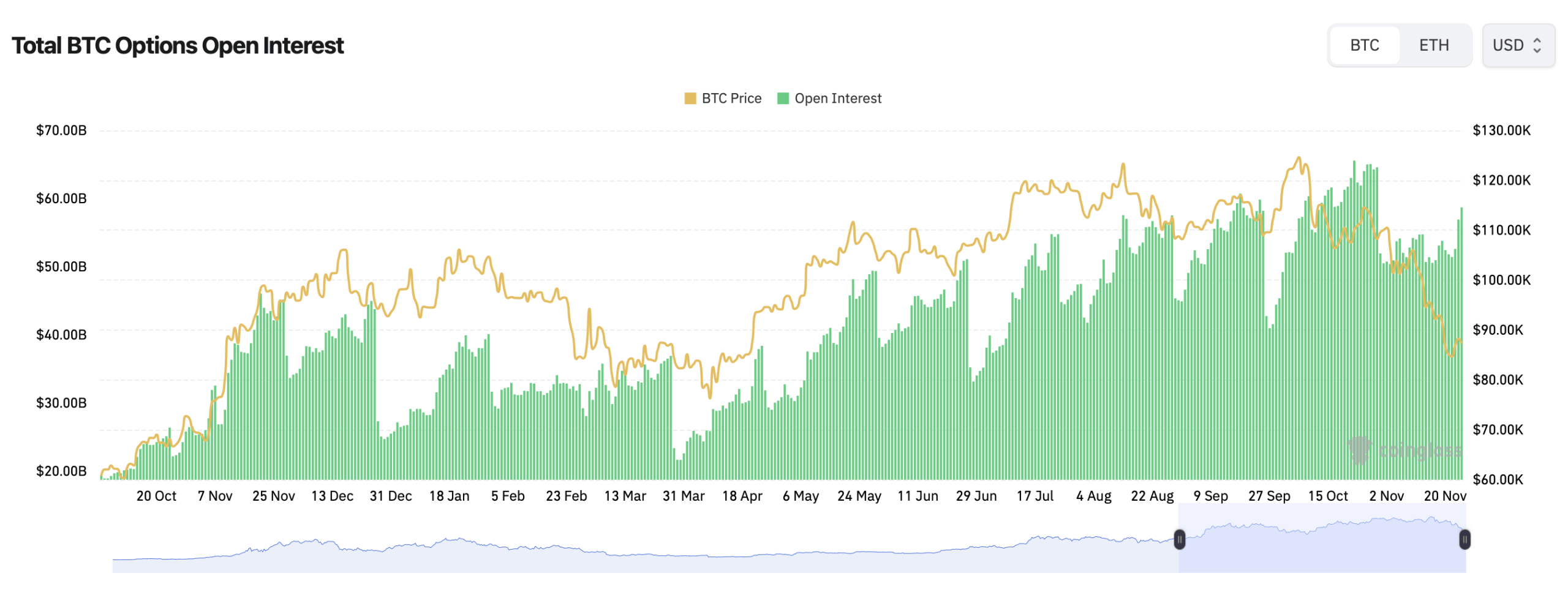

Roughly 150,000 BTC in open interest—worth about $13.19 billion—notional are scheduled to expire this week. The max pain level is pinned at $101,000, signaling a sizable gap between spot and the level where option writers experience the least loss. The put/call ratio stands at 0.61, reflecting a market that remains tilted toward calls even with recent market softness.

Bitcoin options open interest on Nov. 26, 2025, via coinglass.com.

Deribit’s open interest ranking shows call-heavy positioning clustered between $100,000 and $140,000 strikes for December 2025 expiries. Calls at $100,000 and $112,000 lead the board with more than 15,000 BTC open each. The top puts land notably lower, with the heaviest action at $85,000. While puts aren’t absent, they lack the gravitational pull seen in the lofty call strikes hovering above spot.

In the 24-hour volume rankings, near-term expiries on both calls and puts maintain strong traction. Short-dated $85,000 puts and $100,000 calls dominate trading, indicating traders are bracing for volatility but unwilling to abandon the long-term upside narrative embedded in December 2025 strikes.

Charts reveal a rising max pain curve that peaks just above $100,000, consistent with traders’ long-dated strike preferences. This suggests that despite the spot drawdown, options flows still lean toward high-strike optimism.

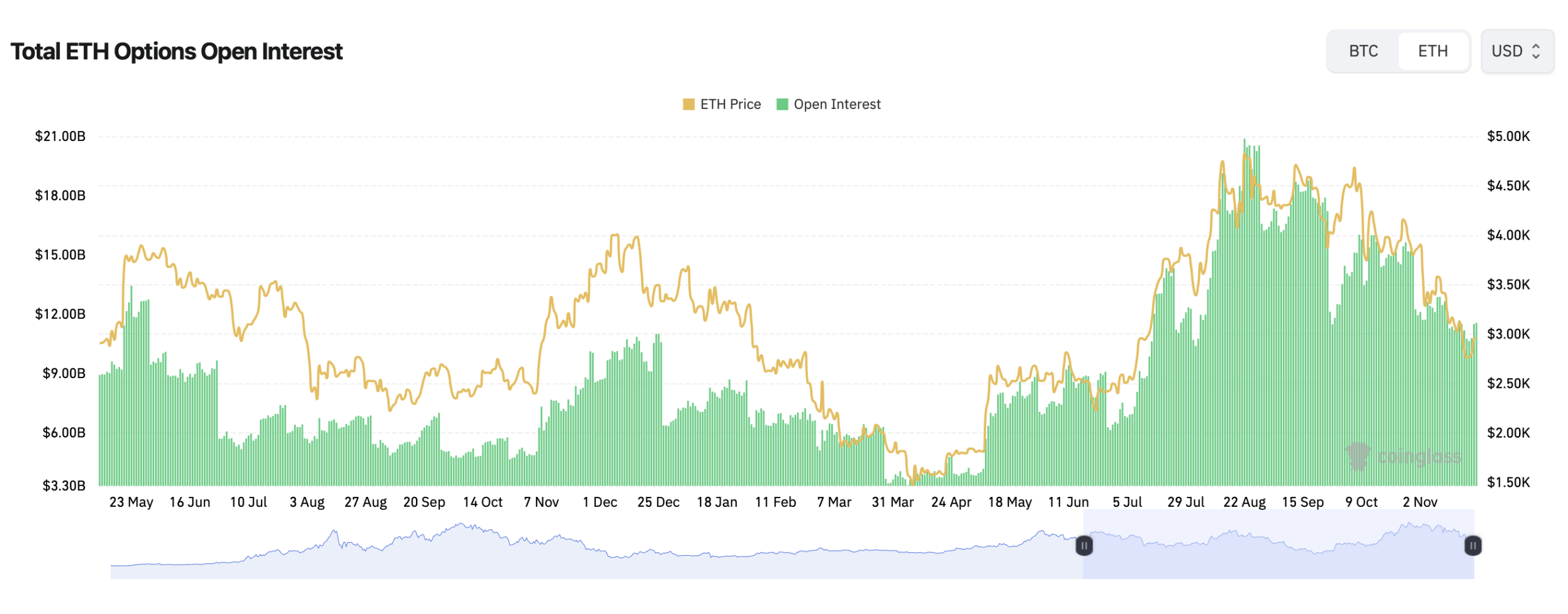

Ethereum’s options slate brings in $1.66 billion in notional value for Friday’s expiry. The max pain level is fixed at $3,400—comfortably above current spot at $2,936. The put/call ratio of 0.50 shows a heavier call bias in ETH compared with BTC.

Open interest is thickest at high-value calls, led by the $6,000, $4,000, and $5,000 strikes, each with more than 50,000 ETH in open interest. Puts are clustered around $2,600 and $3,000, but they remain lighter than the towering call blocks that define ETH’s options landscape.

Ethereum options open interest on Nov. 26, 2025, via coinglass.com.

In 24-hour volumes, both calls and puts display balanced activity, though calls hold a slight lead. The most active trades are shorter-dated premiums, particularly near $2,650 and $3,000, suggesting traders are positioning for a potential spot recovery or volatility spike ahead of Friday.

Read more: Bitcoin Price Watch: $86K Support Holds — But for How Long?

ETH’s max pain sits at $3,400, a number increasingly relevant as open interest grows across both long-dated and short-term expiries. Charts indicate sustained growth in ETH options OI throughout the year, even during periods of market cooling, hinting at persistent institutional involvement.

The combination of high notional expiries, call-heavy OI, and max pain levels well above spot suggests that Friday’s event may exert short-term pressure while keeping long-term bullish structures intact. Whether spot drifts toward max pain or traders simply roll into the next cycle, the expiry is primed to set the tone for the week’s closing sessions.

- What is bitcoin’s max pain for Friday?

Bitcoin’s max pain level for the upcoming Deribit expiry is $101,000. - What is ethereum’s max pain level?

Ethereum’s max pain price for Friday’s expiry sits at $3,400. - How large is the BTC options expiry?

About 150,000 BTC worth $13.19 billion are set to expire this Friday. - How big is the ETH expiry?

Ethereum’s options expiry totals roughly $1.66 billion in notional value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。