Yesterday we mentioned that a market can’t go far on one leg, and it seems the market will drop again. Currently, it has already declined for two consecutive days. However, we shouldn't be overly bearish here, as we find the downward momentum is weak, and we expect a period of consolidation ahead.

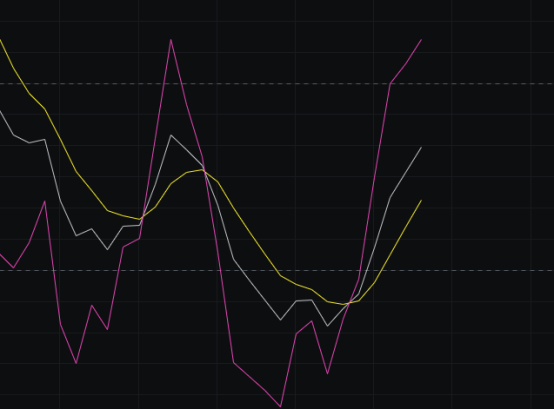

From the MACD perspective, the energy bars are retracting, and the fast line is moving upwards, which is favorable for the bulls. Even if the market cannot rise directly, it also won’t drop significantly.

Looking at the CCI, it has been rising continuously over the past few days, indicating that the downward momentum is insufficient, and the bulls are beginning to counterattack. The best scenario moving forward would be to consolidate and repair the CCI, allowing it to gradually approach -100 or even the zero line.

From the KDJ perspective, after the golden cross, KDJ continues to move upwards, which is also favorable for the bulls. However, even if KDJ rises in the short term, the market is unlikely to see significant gains.

In terms of MFI and RSI, MFI is still in the oversold zone, while RSI has returned to a weak zone. Since we expect consolidation in the future, it is understandable that these two indicators are not in sync.

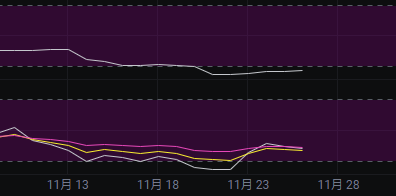

Looking at the moving averages, several moving averages are still pressing down, but the BBI trend has slowed down, indicating that the previous downward trend has ended. Therefore, even if there is a decline in the future, it will be within a consolidation range and not very significant.

From the Bollinger Bands perspective, it is still within a downward channel. If the market continues to weaken over the next few days without a significant drop, the downward channel will come to an end, and we will reassess afterward.

In summary: After a downward trend, the market has experienced a rebound. We believe that it won’t go far on one leg and expect further declines. At the same time, we see the downward momentum is weak, so even if there is a drop, it won’t be substantial. Today’s resistance is seen at 88500-89800, and support is at 86000-85000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。