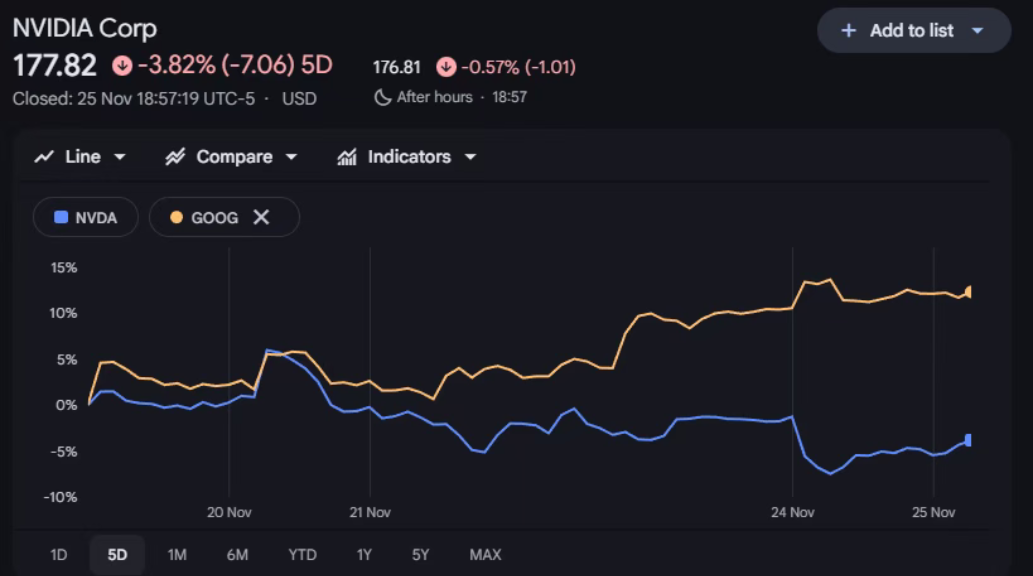

The sudden shift in market sentiment coincides with a rare counterattack from a tech giant. Nvidia's stock price experienced a thrilling roller coaster on Tuesday, plummeting over 7% in early trading, with a market value evaporating by nearly $350 billion, ultimately closing down 2.6%, marking a new low in over two months.

Meanwhile, Google's parent company Alphabet saw its stock rise against the trend by 1.6%, reaching a record closing high for the third consecutive trading day, with its market value approaching the $4 trillion mark.

This dramatic fluctuation in the capital market stems from an impending battle for dominance in AI chips. In response to market skepticism, Nvidia made a rare public statement, claiming its GPU technology is "a generation ahead of the industry."

1. Polarization Among Tech Giants

The U.S. stock market on Tuesday displayed a rare polarization among tech stocks. Nvidia experienced a thrilling trading day, with its stock plunging over 7%, marking the largest single-day drop in recent times.

This drop is not an isolated incident, as several companies related to Nvidia were also caught in the whirlpool.

● Server manufacturer Super Micro Computer (SMCI) fell 2.5%, Nvidia's data center operator CoreWeave dropped 3.1%, and its main competitor AMD also declined by 4.15%.

● In stark contrast, Google's parent company Alphabet rose 1.6%, achieving a historical closing high for the third consecutive trading day.

● This divergent trend indicates that investors are repositioning in the AI sector, shifting their focus from traditional hardware suppliers to tech giants demonstrating full-stack capabilities.

● Nvidia's stock price has shrunk by over $700 billion from its peak market value of $5 trillion less than a month ago, a figure that exceeds the total market value of most tech companies.

2. The Challenge of Google's TPU

The direct trigger for this shift in market sentiment is the competitive threat posed by Google's AI chip TPU.

● Last week, Google released the Gemini 3 model, which is considered to surpass OpenAI's ChatGPT, and this model was trained using Google's own TPU rather than Nvidia chips.

● Even more shocking to the market, media reports indicate that Google is marketing its TPU to potential clients, including Meta, considering the adoption of Google's self-developed chips in future data centers.

● Like OpenAI, Meta has been one of Nvidia's key clients.

● Analyst Mike O'Rourke from Jones Trading stated that the release of Gemini 3 "could prove to be a more subtle yet more significant version than DeepSeek." This view represents a consensus in the market: Google is transitioning from a laggard to a leader in the AI race.

● Nomura Securities strategist Charlie McElligott pointed out that Alphabet's latest model has "rearranged the chessboard of the AI landscape," pushing the market toward "a new DeepSeek moment."

3. Nvidia's Response: A Rare Market Soothing

In the face of the market's intense reaction, Nvidia adopted a rare public response strategy.

● Nvidia took to the social media platform X, claiming its GPU technology is "a generation ahead of the industry," and stated that its chips are "the only platform capable of running all AI models and applicable across various computing scenarios."

"We are pleased with Google's success—they have made significant progress in AI, and we will continue to provide products and services to Google." Nvidia stated in its announcement.

● Nvidia also emphasized that its chips offer "higher performance, versatility, and interchangeability" compared to Google's TPU and other application-specific integrated circuit (ASIC) chips, which are typically designed for a single company or function.

This public soothing of the market is not common in Nvidia's history.

● Analyst Gil Luria from D.A. Davidson commented, "This memo itself makes Nvidia appear very passive, and not sharing it publicly makes the situation look worse. We agree with many of the answers they provided, but a company of this scale does not need to respond to every question raised outside of earnings reports."

4. Deep Crisis: Divergence Between Fundamentals and Market Expectations

Nvidia's real dilemma lies in the significant gap between its performance and market expectations.

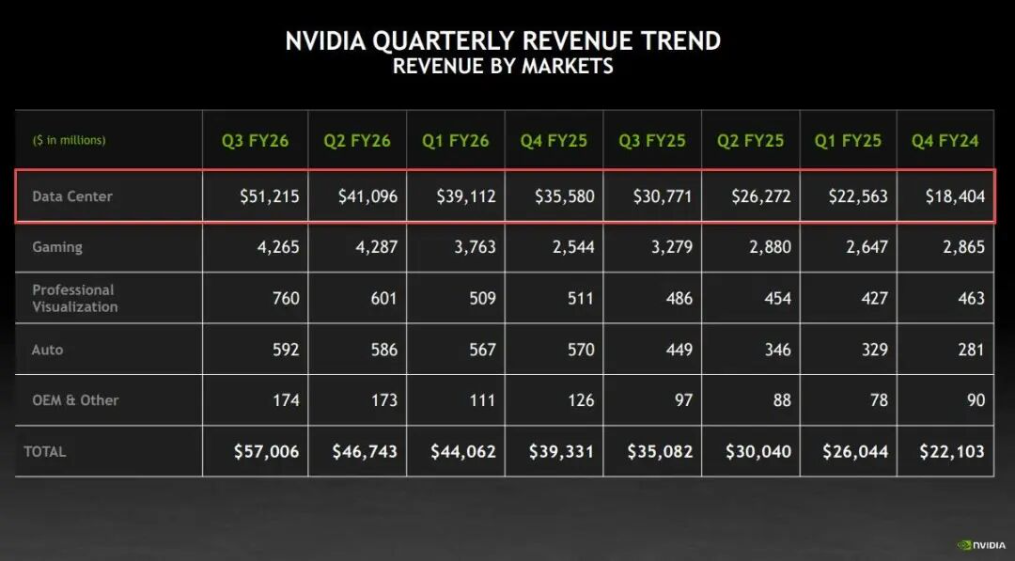

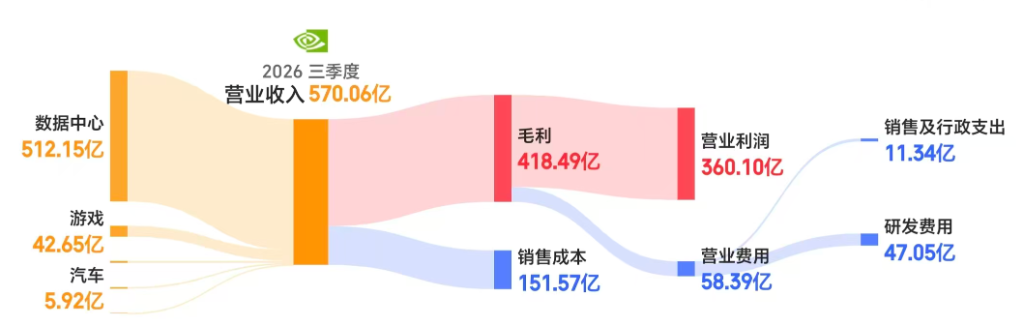

● Fundamentally, Nvidia's business performance remains strong. In the third quarter of fiscal year 2026, the company reported revenue of $57 billion, a year-on-year increase of 62%; adjusted net profit reached $31.9 billion, a year-on-year increase of 65%.

● More importantly, the company's guidance for the next quarter's performance reached $65 billion, far exceeding analysts' expectations of $61.66 billion. CEO Jensen Huang revealed during the earnings call that Nvidia's total AI chip orders for 2025 and 2026 have reached $500 billion.

● However, the better-than-expected performance did not translate into a rise in stock price. After the earnings report, Nvidia's stock initially rose nearly 6% in after-hours trading, but the next day it closed down 3.15%. The evaporation of market value stems from skepticism about Nvidia's long-term growth logic.

● On one hand, major tech companies are increasingly developing their own chips to reduce reliance on Nvidia. Google's TPU is just one example; Amazon, Microsoft, and others are also developing their own AI chips.

● On the other hand, investors are beginning to focus on the return cycle of AI investments. While enterprises, cloud service providers, and startups continue to expand their computing infrastructure, the actual returns at the application layer have yet to be fully realized.

5. Jensen Huang's Dilemma: Anxiety of a "No-Win Situation"

Behind the stock price fluctuations, a series of recent statements from Nvidia CEO Jensen Huang reveal an unusual sense of anxiety. In an internal all-hands meeting, Huang candidly stated that the company is currently in a "dilemma":

● "If we deliver a poor quarter, the market will say this proves the AI bubble; but even if we deliver an excellent quarter, some will say we are just fueling the bubble."

● Huang even joked, "You should see some of the memes online saying we basically tied the Earth down and held it up; it sounds a bit exaggerated, but it's not entirely wrong."

● When discussing the drastic fluctuations in the company's market value, he spoke humorously but revealed his helplessness regarding market sentiment: "No one has ever lost $500 billion in a few weeks."

These remarks reflect the multiple pressures Nvidia faces as a bellwether in the AI industry—maintaining market confidence in the AI sector, responding to changes in the competitive landscape, and addressing the divergence between valuation and fundamentals.

6. Heated Debate Over the Bubble

Concerns surrounding Nvidia also include doubts about whether there is "circular financing" in the AI industry. Some analysts point out that the $100 billion deal Nvidia recently reached with OpenAI has a unique structure:

Nvidia will invest in OpenAI to build data centers, while OpenAI will equip these data centers with Nvidia's chips.

● One analyst bluntly stated: "Simply put, I am Nvidia, I want OpenAI to buy more of my chips, so I give them money to buy. This kind of operation is common in small-scale transactions, but it becomes unusual at the scale of hundreds of billions."

● Similar transaction structures have also appeared in collaborations with companies like CoreWeave. OpenAI reached a deal worth billions with CoreWeave—CoreWeave will lease chip computing power from its data centers to OpenAI in exchange for equity in CoreWeave.

● Meanwhile, Nvidia, which also holds a stake in CoreWeave, has committed to absorbing all unused data center computing power from CoreWeave by 2032.

These complex transaction structures have raised market doubts about the authenticity of AI demand, with some investors concerned that the current AI boom has structural issues similar to those during the internet bubble.

7. A New Phase in the AI Race

Despite facing short-term challenges, Nvidia's dominant position in the AI infrastructure sector remains solid. Huang has publicly stated that Nvidia will transform into a global AI infrastructure company over the next decade, predicting that investments in AI infrastructure will reach $3 to $4 trillion by the end of this century.

● Nvidia's Chief Financial Officer Colette Kress also emphasized: "We believe that in the construction of AI infrastructure amounting to $3 trillion to $4 trillion annually, Nvidia will be the optimal choice."

● A statement from a Google spokesperson highlighted the diversified strategies of large tech companies in AI infrastructure: "The demand for our custom TPUs and Nvidia GPUs is accelerating. We will continue to support both."

Currently, the AI chip market is not a "zero-sum game"; rather, it is more likely to see a coexistence of multiple solutions. Google's TPU may excel in specific areas, but Nvidia's GPUs still hold broad advantages in versatility and flexibility.

Nvidia's pullback seems to be a confluence of multiple factors at the same time: valuation pressure, changes in industry sentiment, the real challenges of AI investment returns, and fluctuations in macro liquidity.

Recently, Huang candidly admitted that the company is caught in a "no-win situation": excellent performance will be accused of fueling the AI bubble, while poor performance will be seen as evidence of the bubble's burst.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。