Author: Yokiiiya

In recent weeks, while communicating with investors, payment industry practitioners, and friends interested in stablecoin businesses, I frequently heard the same message: RedotPay is currently the leader in the U-card sector; this company has emerged as the fastest and largest player in the market.

For a stablecoin payment company established for less than two years to achieve this in the highly challenging cross-border payment industry is worth studying. Stablecoin payment cards are not a new field; there have been many attempts in the past few years, but there are very few cases that have truly achieved global scale and penetration in multiple regions.

Thus, the questions naturally arise:

Why has RedotPay been able to emerge? What structural opportunities has it tapped into? Is its growth driven by product, team, compliance structure, resource integration, or a window of opportunity? And—does this growth have sustainability?

To satisfy my curiosity, I began to systematically analyze this company, trying to understand why it has been able to emerge in such a short time and what the real driving forces behind it are.

This article is based on publicly verifiable information (company press releases, investor disclosures, public information from Hong Kong and Singapore, industry media reports), combined with my discussions with some industry insiders, aiming to answer these questions in as objective, restrained, and mechanism-based a manner as possible.

1. What kind of company is RedotPay?

The table below is a basic profile of RedotPay that I compiled based on public information, covering its establishment time, team background, financing situation, compliance structure, and business positioning, to quickly establish a relatively clear company outline.

Based on the table above, it is clear that RedotPay's company characteristics are very distinct, which explains why it has been able to emerge in a short time.

First, it is a young company established for less than two years, but from day one, it chose the most challenging path in the industry—integrating stablecoins into the real-world payment system. This path requires it to possess multiple capabilities, including on-chain asset handling, payment networks, card organization cooperation, clearing systems, KYC/AML, etc., making it a typical "high-threshold, multi-chain" business.

Second, from the public information, the team has solid experience in the payment field.

Members come from banking systems like HSBC and DBS, internet companies like Alibaba and Baidu, as well as crypto infrastructure organizations like HashKey and ChainUp. This combination of expertise across finance, internet, and on-chain infrastructure provides them with practical experience in payment products, card organization integration, channel building, risk control, and cross-border compliance, which are precisely the most critical aspects of stablecoin payments.

Third, its financing structure spans Web2 and Web3, with very high capital quality.

Completing two rounds of financing totaling $87 million within a year, with investors including Lightspeed, Sequoia China, Accel, DST, Galaxy, Vertex, and Coinbase Ventures, indicates that its direction is viable in both traditional tech capital and crypto capital.

Fourth, RedotPay's compliance structure is presented as a "multi-region splicing" model.

With a Hong Kong MSO, Money Lender License, a Singapore entity, and partners like Cactus Custody, Fireblocks, and StraitsX, it covers key aspects of custody, card issuance, clearing, and payment links. Building this structure is highly challenging and requires capabilities, timing, and resources to be synchronized.

In summary:

The essence of RedotPay is a company building the "infrastructure for stablecoin real-world payments": choosing a difficult path, possessing experience in payment and channel building, and rapidly expanding under the combined effects of capital, cooperation, and compliance structure.

2. Why are there many companies making cards, but only RedotPay has truly emerged?

In the stablecoin payment card sector, there has never been a shortage of projects; almost every payment company has a card business, but very few can achieve scale. Many companies can issue cards and create an app, but some things cannot be solved by merely "creating a feature." To understand why it is RedotPay and not others, we need to break down the real challenges in the industry.

(1) It is not creating "card-issuing products," but running "the actual consumption pathways for stablecoins."

Issuing cards is not difficult; the challenge is: can the cards you issue be used for consumption? Can they be stable? Can they handle volume? This pathway includes on-chain custody, clearing, BIN sponsorship, risk control, 3DS, card organization review… This is not something a single department in one company can handle; there are only a few companies in the entire industry that can successfully navigate this.

At least from public information, we can see:

It has a card issuance partnership with StraitsX (BIN sponsor)

It collaborates with Fireblocks/Cactus Custody for custody/on-chain asset management

Its official website clearly states "Crypto-to-Card" and "Global Payment"

These indicate that it is not just "issuing a card to users," but genuinely building out the pathway.

In the past few years, FTX cards, Binance cards, and Crypto.com cards have all faced suspensions or regional contractions (with public news), which actually proves that running the pathway is much more challenging than merely issuing cards.

(2) It does not compete for "holding scenarios," but directly enters "spending scenarios."

A typical issue in the stablecoin industry is: everyone is trying to get users to deposit money, but almost no one is solving "how to spend." RedotPay's product positioning is very clear:

You use the app not to check your coins

Nor to trade

But to spend USDT

It consistently focuses on "using money" to create features: virtual cards, physical cards, payouts, global consumption. User demand happens to have a gap in this area—especially among cross-border developers, overseas teams, small traders, contractors, and freelancers. These individuals are not here to "speculate"; they are here to "solve payment problems." This is a naturally occurring demand point in the industry, and RedotPay is perfectly positioned on it.

(3) The team genuinely has payment experience, not just crypto knowledge.

This point is not something the company loudly proclaims, but it is very clear from public information and job postings: the team includes members from HSBC, DBS, Alibaba, Baidu, HashKey, and ChainUp, with many job postings related to BIN, channels, 3DS, risk control, and clearing. These are terms that are not needed for crypto wallet development.

However, they are crucial for global payments. This indicates that RedotPay is not using crypto logic to do payments, but rather using payment industry logic to connect stablecoins to the real world. Many teams in the industry excel in technology but are weak in payments. RedotPay, on the other hand, is strong in payments while also understanding crypto. This is a rare capability.

(4) Its compliance structure is not a single point but a complete set of combinations.

This is very critical and can be verified publicly:

Hong Kong MSO

Money Lender License

Singapore entity

Custody (Fireblocks/Cactus)

Card issuance (StraitsX)

These are not "icing on the cake"; they are the infrastructure necessary for stablecoin payments to scale. You can understand it as:

Others create products that can operate in one country or a specific channel.

RedotPay builds a system that can operate across countries and scenarios.

This is not a matter of "having good resources," but rather "being able to integrate." Many projects in the industry are stuck on compliance, and public news can be found everywhere.

(5) It has indeed tapped into a window of opportunity.

From 2023 to 2024, there are three obvious trends: it is becoming more difficult to obtain US dollars in many parts of the world → stablecoins become an alternative, Visa/Mastercard are beginning to actively collaborate with stablecoin companies (there is public news), and the cross-border flow of people, goods, and data is accelerating (remote work, overseas e-commerce, contractors).

The combination of these three factors means:

Users want to use USDT, institutions are willing to cooperate, and the market is lacking stablecoin consumption tools.

RedotPay launched its product at this time, making it naturally easier to grow. This is not just "good luck"; it is about doing the right thing at the right time.

(6) It has basically avoided typical competitor issues.

The industry is generally stuck at two points:

Unstable channels → cannot handle volume

Compliance cannot expand → can only operate in one country

Public cases include Binance cards, Crypto.com cards, and FTX cards, all of which have faced suspensions. This does not mean "RedotPay is better," but rather: the sector is inherently challenging. At least from its user coverage, feature rollout pace, and financing scale—RedotPay has not been stuck at the first step or the second step. This is enough for it to emerge.

RedotPay's emergence is not due to excelling in a single point, but because it has truly navigated a pathway that others "want to do but cannot."

What it is building is not just a "card," but an "entry point for stablecoins into the real world."

3. Can RedotPay's growth be sustained? (Risks, Bottlenecks, Industry Comparisons)

In the first two parts, we analyzed why RedotPay has been able to emerge: the direction is correct, the team has payment experience, the product is "solid," the capital background is strong, and the window of opportunity is appropriate. However, to determine whether it can become "the true infrastructure of the stablecoin payment industry," we must discuss a more important question—

Can the company's current growth be sustained?

Stablecoin payment cards are not a light business; they are a complex system connecting on-chain assets, card organization networks, cross-border payment channels, and multi-national regulations. Any change in one link can affect its rhythm.

Below, I will expand on four main lines: regional risks, business model risks, regulatory and compliance issues, and organizational and governance capabilities. I will also incorporate the development trajectories of peers to make the overall judgment more solid.

(1) Regional risks: the broader the business coverage, the greater the risk exposure.

Regarding the regions where its user growth is rapid, there has long been a phenomenon in the industry: "the early growth of stablecoin payments often comes from regions with unstable payment systems." This does not refer to a specific company but rather a structural trend in the entire industry.

Public research, international reports, and on-chain data repeatedly mention:

In some Middle Eastern countries, due to restrictions on the US dollar and capital account controls, the use of stablecoins is very high.

In certain regions of Africa, the cross-border payment infrastructure is weak, leading to a high reliance on stablecoins.

Cross-border freelancers and contractors are concentrated in these areas, creating a strong demand for "spending USDT."

South Korean media reported that users paid in Korean won directly using USDT with RedotPay cards at convenience stores (as reported by Korea Times).

These regions also exhibit characteristics of "high demand + high risk":

Weak remittance systems.

Inconsistent KYC requirements.

Long-term money laundering risks highlighted by the FATF (public information).

Higher proportions of telecom fraud and underground financial activities in certain countries (as explicitly pointed out in international agency reports).

This does not mean that any company is engaging in illegal activities, but it is a fact:

As long as your users come from high-risk areas, you must face more complex regulatory requirements and compliance pressures than others.

For RedotPay, finding a balance between expansion speed and regional risk will be a key challenge in the future.

(2) The essence of the model: seemingly light, but actually heavy

RedotPay is building a pathway, presenting users with "USDT → card payments, payouts," not just an app. To enable stablecoins to be spent across regions, it must maintain long-term:

Custody (Fireblocks, Cactus Custody)

Multi-country KYC/AML

Card issuance partnerships (StraitsX/Xfers)

Multiple payment channels

Clearing systems

Transaction monitoring

Risk control models

Local withdrawals (payouts)

All of these can be found in public information. This is not SaaS; businesses that become easier with more users are the opposite for stablecoin payment cards:

The more users, the more regions, and the more complex the transactions, the "heavier" the business becomes.

Costs, risk control, and channel pressures will increase exponentially. This means that while rapid initial growth is normal, the "accumulation of costs and risks after growth" is the real challenge. In the long run, whether it can bear this weight will determine if it can enter a stable phase.

(3) Regulatory structure: the window of opportunity will not remain open forever

2023-2024 is a golden window for stablecoin payments: demand for stablecoins is surging in the Middle East, Africa, and Latin America, and Visa/Mastercard are relaxing their cooperation with crypto (official press releases can be checked). Users in various regions are beginning to be willing to spend USDT. However, this window is not a permanent state. The current trends are:

The US is introducing a regulatory framework for stablecoins (public draft).

The EU is about to implement MiCA, imposing strict requirements on the circulation of stablecoins.

The Hong Kong stablecoin licensing system is being advanced.

Card organizations are tightening their scrutiny of crypto (public reports).

The general truth in the stablecoin payment card industry is:

Early stages are about growth, mid-stages are about regulation, and later stages are about licensing and ongoing compliance.

RedotPay's next phase is not "growth," but "increased compliance," which will determine whether it can continue to expand.

(4) Organization and governance: transitioning from "being able to run" to "being able to stabilize" is more difficult than imagined

From public information, RedotPay has a high frequency of product updates (Credit Account, new payout features), covers many countries, has numerous partners, and rapidly expands its product line, which is a good thing. However, anyone who has worked in payments, cross-border operations, or risk control knows: the faster the business grows, the slower compliance must be. The faster the product develops, the more stable the organization must be.

The most common failure scenario in the global payment industry is not "growth failure," but "inability to keep governance in line after expansion."

RedotPay is transitioning from the "startup phase" to the "payment institution phase"—in this phase, the company is not about "running fast," but about "running without crashing." Can it stabilize "regulatory rhythm + risk control system + channel governance + internal processes" like traditional payment companies? If it cannot, the faster it expands, the more painful the contraction will be later.

(5) Peer case comparisons: what has happened in the industry in the past will serve as a mirror for its future

To make the above risks more concrete, I selected three publicly verifiable and sufficiently typical peer cases, each corresponding to challenges at three stages.

Case 1: Revolut — the world's most successful fintech, also repeatedly interrupted by regulation

Revolut is the fastest-growing fintech globally, with over 30 million users and billions in financing, but:

The UK banking license has been delayed (public reports).

While advancing its license in Europe, it has repeatedly had to provide additional information and has faced repeated requests from regulatory agencies (ECB reports).

It has temporarily suspended some operations in Australia and the US due to regulatory issues.

Regional regulatory differences have led to "fragmented expansion," preventing comprehensive rollout.

This shows that even a company with complete scale, brand, funding, and manpower like Revolut must slow down in the face of regulation, making it even less likely for stablecoin payment companies to have a smooth path.

This is a ceiling that the entire industry must confront: the long-term limitations of cross-border payments have never been technological but regulatory.

Case 2: Binance Card — even global giants are forced to contract

Public information shows that the Binance Card has suspended services in multiple locations in Latin America and Europe. The official explanation includes the withdrawal of partner banks, changes in compliance reviews, and adjustments in card organization policies. Binance, despite its massive scale, still cannot avoid sudden interruptions in cross-regional payment operations.

This is not about "who does better," but rather the industry's "structural risks": channels, bank partnerships, and regulations can change suddenly.

Case 3: Crypto.com — early entrants must also face regional regulatory pressures

Crypto.com was once one of the most successful crypto payment cards, but it also faced issues: suspending new user applications in certain countries, declining channel stability in some regions, and increased regulatory requirements hindering expansion.

This industry is not a technical issue but a governance issue, regulatory issue, and regional strategy issue.

Case 4: Wirex / Oobit — growing fast, but not necessarily able to sustain that growth

Wirex (established in 2014) is one of the earliest crypto card companies; Oobit has seen rapid growth in recent years as a "USDT consumption solution." However, public information shows that they have both encountered: regional restrictions, unstable channels, changing compliance requirements, service suspensions in certain countries, and mismatches between expansion speed and governance capabilities. Stablecoin payment cards are not a business where "growth determines everything"; their ceiling lies in "regulation and compliance."

RedotPay has emerged because it has tapped into the right direction and window of opportunity; but whether it can continue to run depends on whether it can effectively integrate the four critical lines of "channels, compliance, risk control, and regional governance." The true barrier in the stablecoin payment card industry lies not in the product but in long-term governance. The window of opportunity explains why it is growing quickly, but sustainability depends on whether it can stabilize.

4. RedotPay's user growth strategy: how to effectively execute the GTM for U-cards

In the previous section, we analyzed RedotPay's challenges from the perspective of sustainability. However, if we shift our perspective—looking at its path from the viewpoint of growth and commercialization—we arrive at a completely different conclusion:

**It has emerged not because of the card itself, but because it placed the "card" at the end of the growth chain rather than at the front. The most underestimated aspect of this company is that it is not driven by "technology" for growth, but rather by *business chain design* to drive growth. This is a point that traditional payment professionals and the crypto circle often overlook.**

(1) RedotPay does not start with the product but with "the users with the highest motivation."

If you break down its user base, you will find that it has hardly exerted effort to compete for so-called "crypto users." It has precisely targeted a group that traditional payments have completely overlooked: cross-border income earners / overseas workers / small traders / freelancers / outsourced contractors.

These individuals do not "want to use stablecoins"; they have to use them. What they need is:

Faster money

Cheaper channels

Usable currency

No waiting for banks

No need to explain the source

No worries about chargebacks

No queues, no reviews, no need to open business accounts

In other words, their pain points are "cross-border finance," not "crypto finance." This explains the statement in the third section: RedotPay's growth comes from the window of opportunity, but user motivation stems from structural demand. This is also why it has expanded so rapidly in certain emerging markets—not because it is promoting harder, but because it has tapped into a market where "whoever can solve the problem will grow."

(2) It is not doing "card business," but "shortening the pathway."

If you map out its user journey, you will find that it does not resemble a card organization company but rather a "cross-border traffic optimization company":

Money coming in should be simple.

Money going out should be smooth.

Money should be spendable and usable.

Costs should be low.

No platform hopping.

No complex on-chain steps.

No need for users to think.

Most companies place the card as the first step: issue the card → educate users → teach users to buy coins → recharge → use. RedotPay's logic is completely the opposite: it first creates demand, then allows users to naturally arrive at the card step. This is not a crypto mindset but a traditional growth mindset. Moreover, you will clearly see that this company is extremely sensitive to "reducing pathway length," as each step shortened in the pathway increases growth efficiency.

This connects perfectly with the analysis in the third section: the faster the growth rate, the more challenging future governance will be, but its ability to explode in the short term is due to its smart pathway design.

(3) It addresses the "first principles of cross-border finance"—ensuring smooth circulation of money.

This may be its most essential point. You will find that it is consistently focused on three of the most "labor-intensive" tasks:

Making fiat currency easier to bring in (Currency Account).

Making stablecoins easier to take out (Payout, multi-market withdrawals).

Simplifying crypto transactions (P2P markets, low-cost pathways).

These three steps are the hardest to accomplish, the least glamorous, the most resource-consuming, the most troublesome, and the most compliance-heavy. Yet they form the core closed loop for cross-border users: income → stablecoin → consumption/payment → withdrawal → new income. The essence of commercialization is not "adding another feature," but "finding the segment in the user lifecycle that needs optimization the most."

RedotPay compresses the entire user lifecycle into a single app, avoiding the need for users to "jump platforms." This design is far more important than "how many features the card has." The real challenge of stablecoin cards is not the card itself, but the "continuity of the pathway." RedotPay first establishes the pathway and then scales up. This is a commercial mindset, not a crypto mindset.

(4) Its growth relies not on advertising, but on a "user brings user" scenario structure

The Redot Angels program may seem like just a community activity to many, but from a commercialization perspective, it is a "localized viral system." Cross-border users are highly community-oriented:

Outsourcing contractors in Telegram groups

Freelancers on Discord/Reddit

Small B merchants in Facebook groups

E-commerce sellers in WhatsApp groups

Digital communities in Latin America/Africa rely on personal networks

In this environment, advertising is the least effective, while "one person teaching another" is the most effective. Therefore, its growth model is not "marketing-driven," but user structure-driven + scenario-driven + word-of-mouth-driven.

(5) Why is its approach worth referencing for other U card teams?

Not because it has good technology, not because it issues cards quickly, and certainly not because it operates in gray areas. But because every growth action it takes points to one essence: "In cross-border scenarios, finance is not an option; it is a basic survival tool."

Thus, its GTM logic is: find the users with the highest pain points, catch them with the simplest entry, shorten the pathway to the shortest, and reduce costs to what users can bear. Create a viable withdrawal capability. Use the community effect of real users to expand, making the card a natural behavior, not an educational one.

In summary:

Its growth is not a crypto-style explosion, but a natural growth driven by cross-border demand. It does not rely on features, but on pathways. It does not depend on marketing, but on scenarios. It is not about buying users, but about catching users.

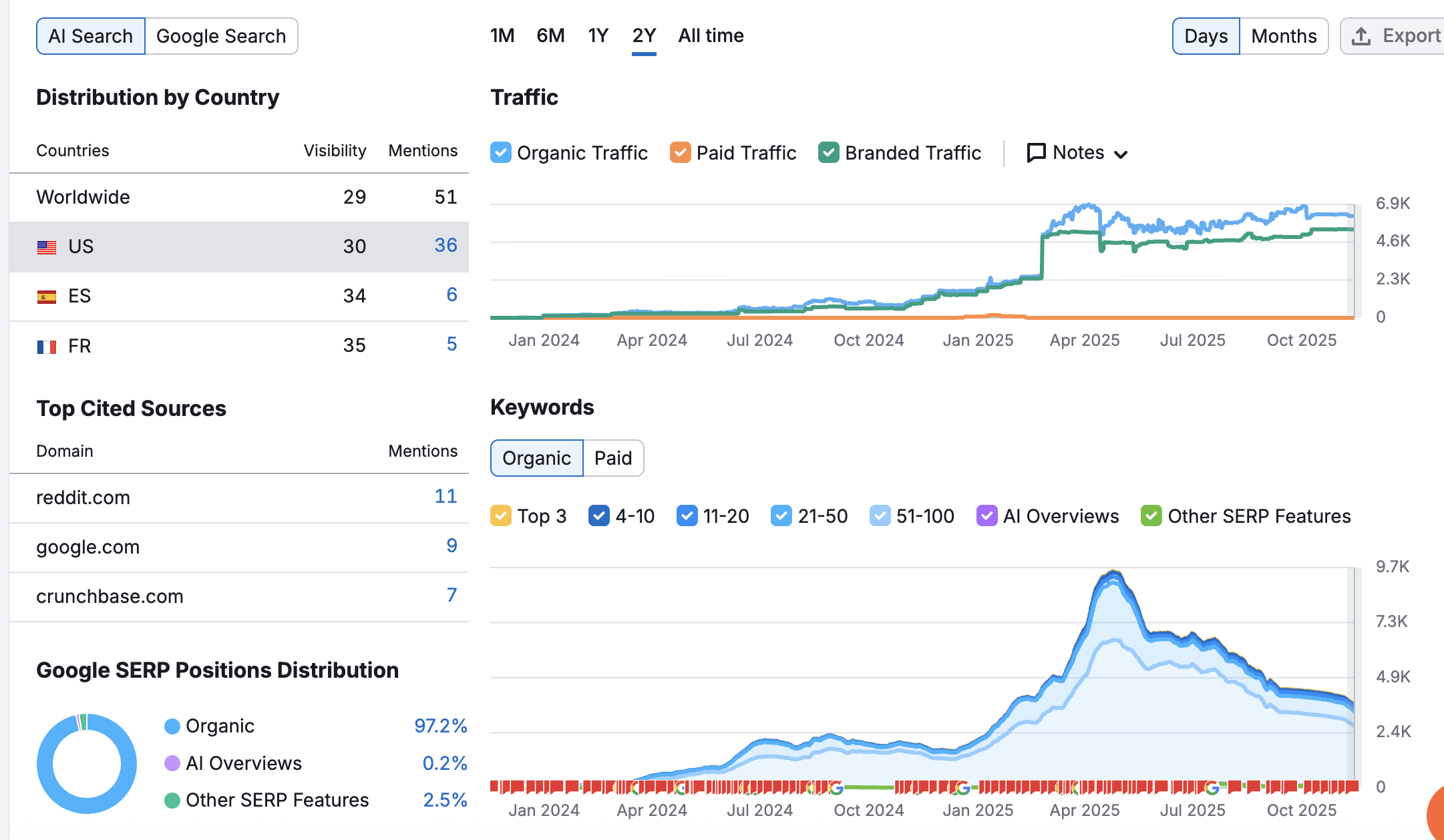

To validate my judgment on RedotPay's growth path, I checked its traffic data on SEMrush for the past two years. The data presents a very clear image: this company is not running on advertising but on demand.

Here are several key signals:

1. Almost 100% of traffic comes from organic search, with zero paid traffic

This indicates that RedotPay has not taken the "buying traffic" path, nor has it created an SEO content farm; its growth is not "pushed out," but "pulled out." In other words: users actively seek it out, rather than it actively seeking users.

This aligns perfectly with its product positioning: it does not serve the consumption desires of crypto players, but addresses the essential needs of "cross-border income + cross-border living."

2. A traffic leap occurs in early 2025, rather than a slow climb

This is a typical structural jump: between February and April, traffic suddenly steps up, stabilizing at a higher plateau. This means that "something truly capable of changing user behavior" happened at that time, rather than just a marketing campaign. Possible triggering factors include:

The launch of multi-country withdrawal capabilities

High usage of the P2P entry point

Large-scale word-of-mouth spread within certain country communities

Improved card success rates/channel stability

Decreased regional pathway costs

All of these align with the core mentioned in the fourth section—RedotPay's growth is not about "growth techniques," but rather "the pathway being naturally pulled by market demand."

3. The most cited source is Reddit, not the media

Reddit's user profile is very clear: freelancers, global remote workers, small traders, cross-border income groups from Latin America/Middle East/Southeast Asia, crypto pragmatists, and no-KYC card seekers, which aligns closely with RedotPay's actual user base. This also indicates that growth comes from the community, not from advertising. It comes from real cases, not brand marketing.

4. Traffic distribution is concentrated in the US and Europe, but this does not mean users are in these regions

This is a common phenomenon for cross-border products: users in the US and Europe are more accustomed to using Google for searches, with strong Reddit and Google Q&A cultures, high concentration of freelance groups, and high information transparency.

However, the actual large-scale daily usage often comes from: Asia, the Middle East, Latin America, and Africa, which forms a typical cross-border financial growth trajectory of "searching in the North, using in the South."

5. 97% of SERP results are organic, with no deliberate content optimization

This further indicates that growth is not driven by SEO but by user growth. It is not exposure that leads to traffic, but usage that leads to searches. This traffic structure is very healthy, authentic, and harder to replicate.

Combining the above data, RedotPay's growth does not stem from "how well the card product is made," but from its alignment with the real user demand pathway. SEMrush's external data provides strong circumstantial evidence: this demand curve has indeed seen a large influx of users in the past year, rather than being pushed out by marketing. Therefore, it is indeed at the forefront of the U card track. However, this growth method is so "hardcore" and so reliant on real usage that future governance challenges will also be more complex.

5. What do they really want to do after U cards?

A close observation of RedotPay's product rhythm over the past year reveals that U cards are merely its "front-end touchpoint," not the core business itself. The larger strategic intent lies in its continuously expanding wallet functions, withdrawal networks, P2P markets, and multi-currency account capabilities. This company rarely emphasizes the "card" itself in all public materials, instead repeatedly highlighting two keywords: account and global payment network. In its 2024 annual review, RedotPay clearly stated that they will continue to expand payment options, enhance security protocols, and create "a more personalized account experience." This is a typical signal of "transitioning from card products to account systems."

Interestingly, they emphasize "community co-creating the product roadmap." In the introduction to Redot Angels, they openly state: users are not only users but also part of the future product direction. This expression resembles a "payment network that builds infrastructure" rather than "a tool company that does card business." It implies that the future product form will not be a single scenario but a complete lifecycle system revolving around cross-border payments, withdrawals, consumption, and stablecoin management.

From the features they currently offer (including multi-country withdrawals, local currency accounts, P2P trading entry points, card payments, and stablecoin wallets), it can be inferred that RedotPay's next strategic step will naturally extend from "U cards" to "cross-border stablecoin account systems"—a trajectory closer to Airwallex, Revolut, or Stripe, rather than the "card-issuing company" logic in the crypto space. Its goal seems to be to enable cross-border individuals and small merchants to easily receive, store, spend, and withdraw stablecoins, and to circulate freely between different countries.

If U cards are the entry point, then the account system, withdrawal network, and a more complete money flow pathway are its true strategic axes. Based on its continuously expanding country coverage and account functions, what RedotPay aims to do is likely not to "become a better card company," but to become a global cross-border payment gateway in the era of stablecoins.

6. The emergence of RedotPay actually reveals that the entire industry is changing tracks

Observing RedotPay's growth path, many people may view this company as a "successful case of U cards." However, if we extend the timeline a bit, you will find that its emergence signifies far more than the success or failure of a single company; it indicates that stablecoin cross-border payments are entering a new structural phase.

The most noteworthy point is that the users of such products do not come from the traditional crypto circle, but rather from a group of "cross-border individuals" who have long been overlooked by the mainstream financial system—freelancers, outsourcing contractors, digital nomads, small cross-border merchants, and those living mobile lives in emerging markets. They are not seeking to experience on-chain products, but rather to move money "quickly, safely, and at low cost." The reason RedotPay can scale up in a short time is fundamentally not because "the card is well made," but because it has tapped into a previously unresolved demand.

This also indicates that U cards are not where the opportunity in the track lies. The real opportunity comes from a deeper trend: stablecoins are becoming the underlying liquidity tool for cross-border finance, rather than just a trading tool. When a user can receive, store, spend, and withdraw money using stablecoins, and move it between different countries without going through traditional cross-border systems, the underlying logic of the payment industry has already changed. This is a new pathway, not an optimization of the old system.

Therefore, RedotPay's emergence signifies that the entire industry is shifting from "concept-driven" to "application-driven." Stablecoins are no longer just used for exchanges and investments, but are being utilized by real-world users to solve specific problems. Whoever can build shorter pathways, more stable channels, and more direct user value will stand out in this phase.

In this sense, RedotPay is not the answer for the industry, but a signal: stablecoin cross-border payments are becoming the infrastructure of the real world, rather than just a narrative.

From tools to pathways, from cards to accounts, from crypto users to cross-border users, the focus of this track is quietly shifting. The real competition will not occur in "card vs. card," but at a more fundamental structural level—entry points, pathways, clearing capabilities, regional compliance, and whether it can truly reduce users' cross-border friction. This is the industry truth revealed by RedotPay's emergence.

Conclusion

The emergence of RedotPay is not accidental; it is simply the first to run out. The larger context is that cross-border finance is being reorganized by stablecoins, and the real needs of users are driving the formation of new infrastructure. U cards are just an entry point in this process. In the future, who can win will not depend on feature stacking, but on who can make the money flow pathway shorter, more stable, and more transparent. The industry is already changing tracks, and the story is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。