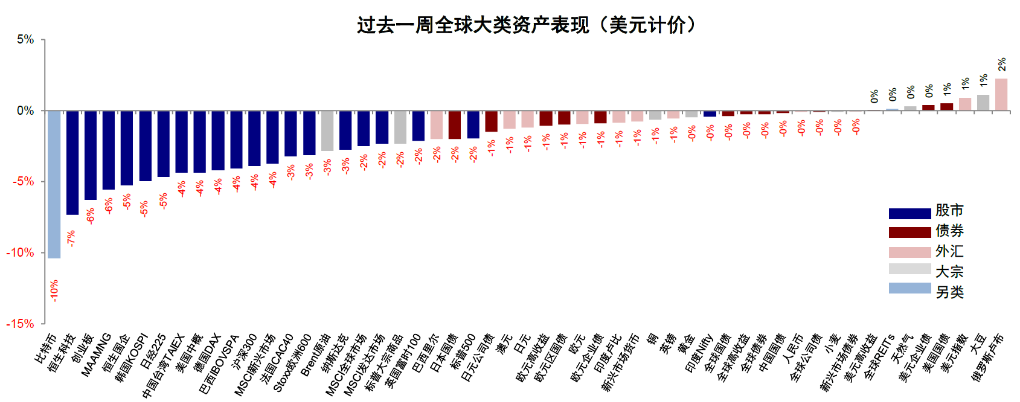

Recently, global technology stocks have collectively retreated, and concerns about an AI bubble have resurfaced. The current market may resemble the situation from 1996 to 1998, far from a bubble burst. Recently, AI-related stocks in the global market have significantly corrected, with the MSCI Global Index dropping about 2.1% last week, the "Seven Sisters" of U.S. stocks falling by 6%, and the Hang Seng Tech Index plummeting by 7%.

This round of decline has triggered widespread investor concerns about the bursting of the AI bubble. At the same time, factors such as the U.S. government shutdown, tight liquidity in the repurchase market, and cooling expectations for Federal Reserve interest rate cuts are also suppressing risk appetite. The key discussion about the AI bubble is not about denying the bubble, but about confirming which stage we are currently in.

1. How to Properly View the Bubble

● A bubble itself is a neutral term; to some extent, it is the investment impulse that drives industrial development.

● Looking back at history, during the formation period of the internet bubble from October 1998 to March 2000, the Nasdaq index rose 256% over 15 months, with an annualized return of up to 144%.

● Exiting too early may result in missing out on the huge returns during the bubble formation period. The key to discussing bubbles is not to deny them, but to confirm which stage we are currently in.

● We need to distinguish between capital market bubbles and industry bubbles. If it is more of a bubble in the secondary market, stock price adjustments will bring better allocation opportunities; however, if the industry trend is falsified, even if the valuation bubble is digested, it is not worth increasing positions.

● For example, at the beginning of the year, the rise of DeepSeek led to a nearly 20% correction in the "Seven Sisters" of U.S. stocks, but with the valuation correction and the falsification of concerns, it also welcomed reallocation opportunities. Conversely, if the industry trend has been falsified, even if the valuation bubble is digested, it is not worth increasing positions.

2. Dual Dimensions for Judging Bubbles

● For the industry itself, the core issue is whether investment matches demand and capability. Accelerated investment does not equal a bubble; a bubble occurs when investment far exceeds demand and far exceeds one's own capacity.

● For the equity market, continuous rises, high valuations, or concentration of leading companies do not equate to a bubble; only when pricing deviates from fundamental support is it a bubble.

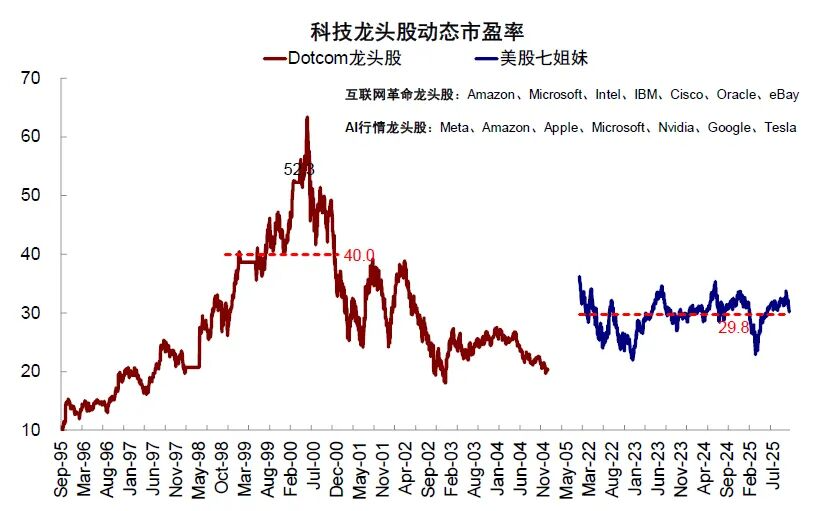

● Compared to the internet bubble period in 2000, the performance of both primary and secondary markets this round is more rational. Primary market funds are more focused on high-quality leading enterprises, and the valuations of the "Seven Sisters" in the secondary market are also far below the "bubble" levels of the internet era.

3. Current AI Demand Status

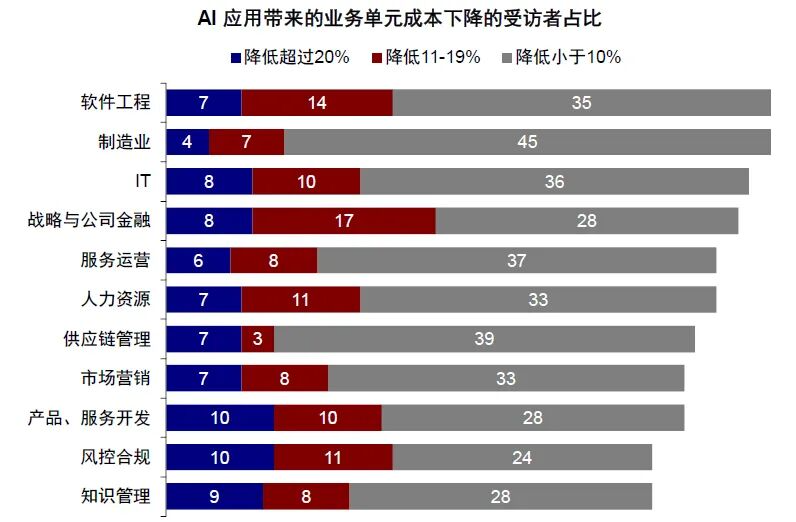

AI demand can be analyzed from two perspectives: endogenous cost reduction and efficiency improvement and exogenous innovation demand.

● In terms of endogenous cost reduction and efficiency improvement, AI applications have begun to bring significant cost savings. A McKinsey survey shows that using AI can reduce costs by 9-11%. From the S&P 500 perspective, the total scale of SG&A is about $3 trillion, which could save $300 billion in costs annually.

● Labor productivity is improving at a faster pace. Since 2023, labor productivity in the U.S. non-farm business sector has increased by 5.6%, outpacing the speed during the 1995-2000 internet revolution.

● In terms of exogenous innovation demand, the adoption rate of generative AI technology has risen to 79% since the release of ChatGPT, a speed that far exceeds the 22 years and 12 years it took for personal computers and the internet to reach this level.

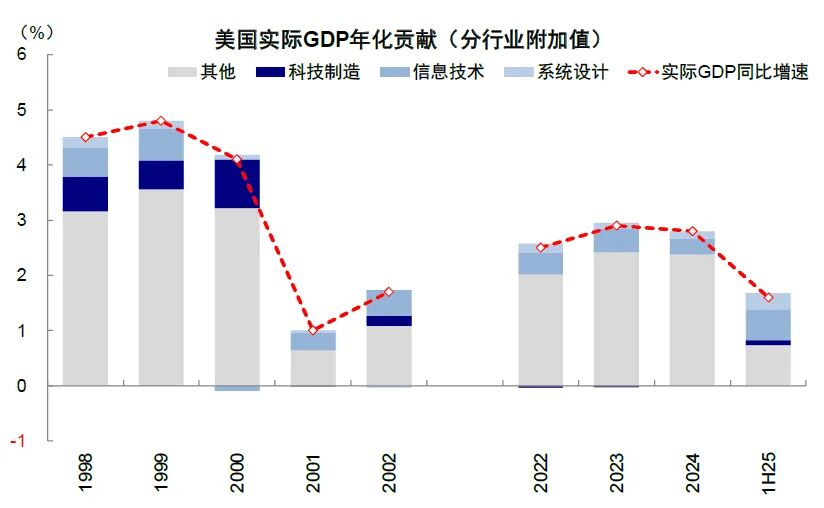

● From the perspective of its contribution to the economy, the technology industry is expected to contribute about 0.95 percentage points to the 1.6% growth of U.S. real GDP in the first half of 2025, accounting for nearly 59%, higher than the 20-30% during the internet revolution.

4. Is Investment Excessive?

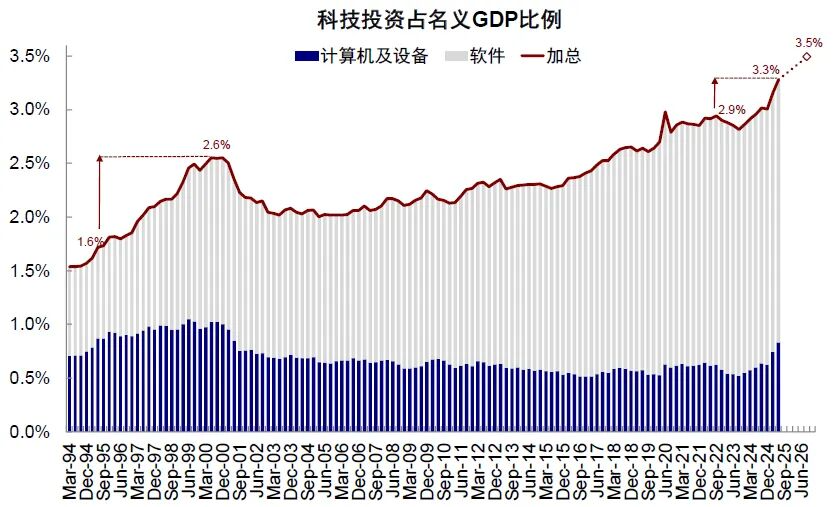

● At the macro level, the scale of AI investment is still in its early stages. The proportion of technology investment to nominal GDP has only increased by 0.4 percentage points since 2023, less than half of the increase during the internet revolution.

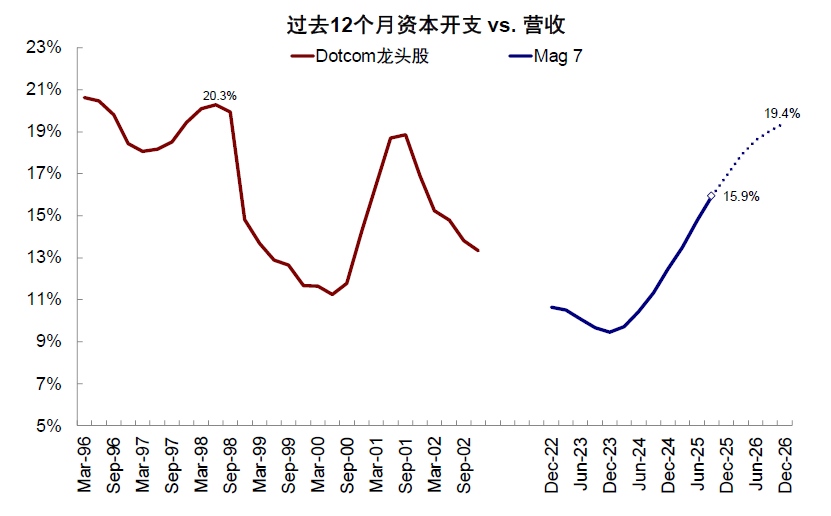

● At the corporate level, the investment intensity of leading companies in AI remains reasonable. In this round of AI market, the capital expenditure to sales ratio of the "Seven Sisters" has risen from about 9% in the fourth quarter of 2023 to about 15.9% in the third quarter of 2025, below the peak of about 20% in 1998.

● In terms of financing structure, current AI investments rely more on endogenous cash flow and have low dependence on debt financing. The debt-to-equity ratio of the "Seven Sisters" is about 81%, significantly lower than the approximately 124% during the peak investment period of internet companies.

● During the internet bubble period, leading companies had a strong reliance on debt financing for capital expenditures, whereas in this round of the AI market, the capital expenditure sources of the Magnificent Seven are relatively diversified, and debt financing does not have a significant marginal impact on capital expenditures.

5. Capital Market Performance

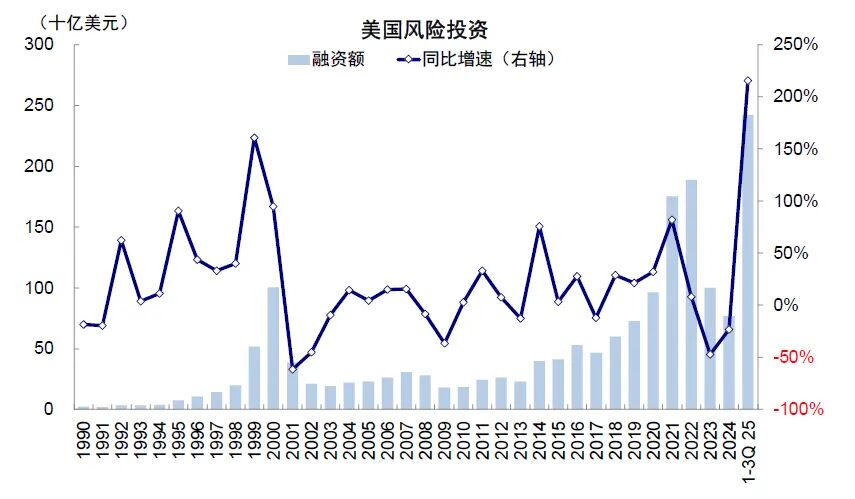

The primary market is approaching the heated level of 1999 but has not yet reached the bubble peak of 2000. In the first three quarters of 2025, U.S. venture capital reached $240 billion, an increase of 1.4 times compared to the financing scale at the rise of the AI industry in 2023.

The valuation of the secondary market is close to the end of 1998. The dynamic price-to-earnings ratio of the "Seven Sisters" has fallen from around 33 times at the end of October to about 28 times, similar to the level in November 1998, significantly lower than the peak of 60 times during the internet bubble.

The concentration of leading companies has further strengthened, with the market capitalization of technology leaders accounting for 29% of U.S. stocks, higher than the 22% during the internet bubble. However, the current technological path determines that only leading companies have the capability to achieve breakthroughs in models, revenue, and demand.

In terms of investor sentiment, the net bullish ratio of AAII individual investors has fallen back to -5%, significantly different from the 46% in January 2000. However, leverage levels have reached an all-time high, which may amplify short-term volatility.

6. Outlook

Considering the three dimensions of demand, financing capacity, and market pricing, the current market may be more in line with the situation from 1996 to 1998, rather than on the eve of the bubble burst in 1999-2000.

● This means: first, high valuations and high expectations will lead to volatility. Since 2023, whenever the valuation of the "Seven Sisters" approaches 35 times, it has triggered market concerns about a bubble, leading to corrections.

● Second, the long-term industry trend is still in place, so there is still investment value. The improvement in productivity and the expansion of application scope indicate that AI technology still contains potential, and short-term fluctuations in the secondary market do not affect the investment value of the real industry.

● Third, the structure will become differentiated. Companies that can deeply integrate leading models with diverse business scenarios to form scalable commercial closed loops will have better opportunities to benefit.

Although there is a certain bubble in AI currently, it is far from the point of bursting. The Vanguard Group points out that the AI bubble does exist, but we are still in the early stages, and it is not yet time to panic.

Compared to the internet bubble in 2000, while current technology stock valuations are high, they are still reasonable, and the quality of earnings is significantly better than during the internet bubble. Moreover, the substance of the investment is more of a real infrastructure "arms race" rather than conceptual speculation.

The next 2-3 years will be an important observation period to verify whether "AI can change the world." If substantial changes are still not visible by then, it will be the right time to discuss "bubble bursting."

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。