Yesterday, although there was a rebound for two consecutive days, we still believe that the overall trend is dominated by the bears. Today, the market is again declining, which aligns with our judgment from yesterday. This is because a bottom cannot just shoot up immediately; at least, it needs to come down again to form a second bottom. Therefore, we believe that one leg cannot go far.

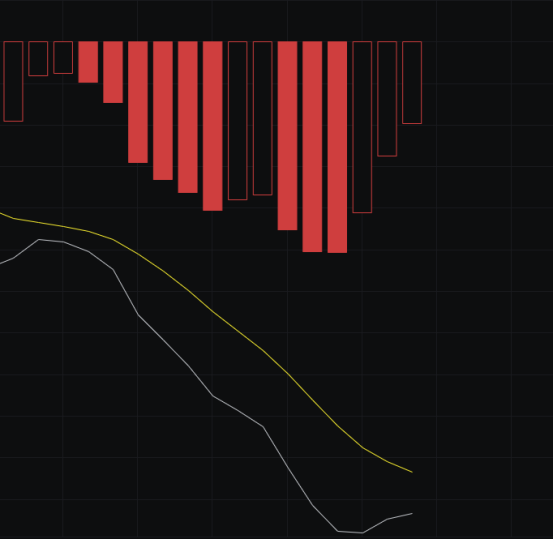

From the MACD perspective, the current energy bars are retracting, and the fast line is tending to flatten. However, if we are to come down to form a second bottom, the fast line will not quickly rally. Here, the fast line can either move down or flatten to complete the second bottom.

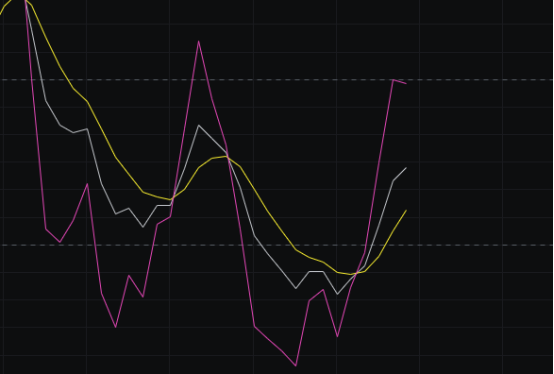

From the CCI perspective, the CCI has seen a slight recovery in the past few days, but the magnitude is not large. The best solution would be another decline followed by a rebound, which would help repair the CCI, gradually bringing it closer to -100 or even the zero line during the repair process.

From the OBV perspective, there has been some inflow in the OBV during the rebound over the past two days, but the volume is not significant. Today's decline has seen a slight outflow, and the slow line is still under pressure, so we continue to view the OBV as bearish.

From the KDJ perspective, after the KDJ golden cross, it continues to push upward, but the upper band is not moving much. If there are consecutive declines ahead, the KDJ will likely turn downward again, although the downward movement will not be significant.

From the MFI and RSI perspective, the MFI is still in the oversold area, and the RSI is in a weak zone. Both indicators lean towards bearishness. If we are to look bullish, the MFI must first exit the oversold area, so we will watch for when the MFI leaves the oversold zone.

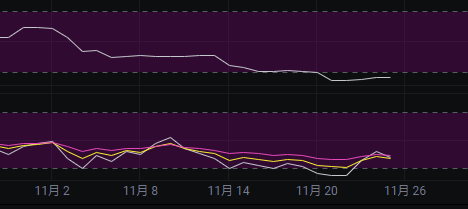

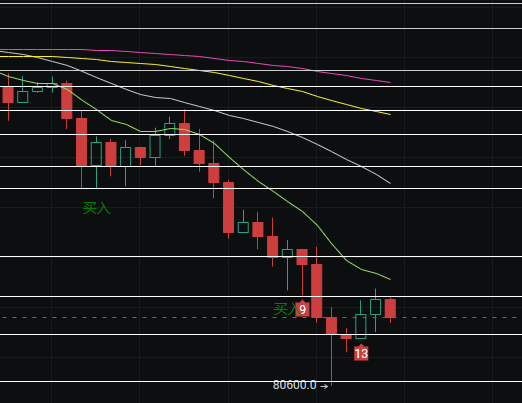

From the moving averages perspective, several moving averages are still under pressure. However, with the rebound over the past two days, the BBI shows signs of flattening. To see a stop in the decline, the price must first touch the BBI, and then we will see whether it continues to be suppressed or stands above the BBI.

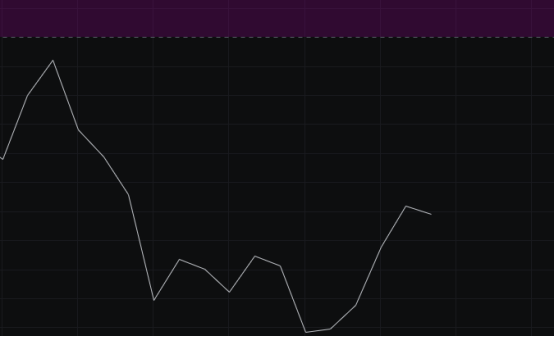

From the Bollinger Bands perspective, the current Bollinger Bands are still maintaining a downward channel, so we continue to hold the view of a downward trend until the lower band flattens, at which point we will reassess the situation.

In summary: If we consider this to be a bottom, since we are forming a bottom, the market will not go up directly. Therefore, we expect that after the rebound, it will need to come down for a second test of the bottom. If the test is successful and the decline stops, it may indeed be a bottom. If the test fails and breaks down, it will continue to decline. Thus, we have not been bottom-fishing these past few days. Today's resistance is seen at 88500-90000, and support is at 85000-84000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。