Bitcoin ETFs Fall Back Into Red With $151 Million Outflow

The market opened the new week with a familiar narrative: uncertainty swirling around bitcoin exchange-traded funds (ETFs), renewed optimism lifting ether ETFs, and a still-growing wave of demand behind solana ETFs. It was a day where the direction of flows told the entire story, and each asset class played its part with surprising clarity.

After a brief reprieve on Friday, bitcoin ETFs fell back into outflows on Monday, Nov. 24, with a $151.08 million retreat. The day was overwhelmingly shaped by Blackrock’s IBIT, which posted a massive $149.13 million exit, effectively dictating the market direction on its own.

Additional outflows came from ARK & 21Shares’ ARKB, shedding $11.65 million, and Bitwise’s BITB, which slipped by $5.79 million. There was a small counterbalance: Fidelity’s FBTC brought in $15.49 million, but it barely dented the broader negative momentum. Trading activity remained strong at $5.44 billion, while net assets dropped to $116.20 billion, reflecting the renewed outflow pressure.

First consecutive days of inflows for ether ETFs over the past two weeks.

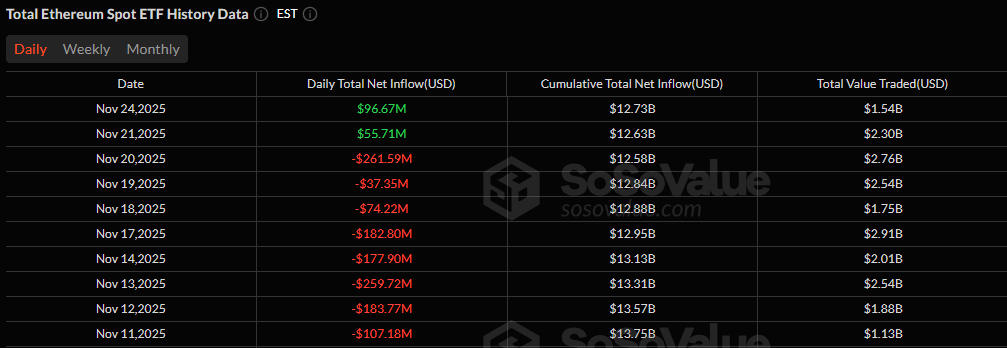

For ether ETFs, it was a sharp recovery from last week’s weakness, delivering a solid $96.99 million net inflow. The day belonged to Blackrock’s ETHA, which brought in a commanding $92.61 million, lifting sentiment across the board. Grayscale’s Ether Mini Trust added another $9.81 million, and 21Shares’ TETH contributed $742,320.

A pair of modest outflows of $4.26 million from Bitwise’s ETHW and $2.23 million from Fidelity’s FETH failed to meaningfully offset the surge of capital. Total trading volume reached $1.54 billion, with net assets climbing to $18.44 billion.

Read more: Bitcoin Bleeds, Ether Struggles, Solana Shines in Weekly ETF Flows

Solana ETFs delivered yet another strong day, securing $57.99 million in inflows and extending a multi-week streak of green. The leader, once again, was Bitwise’s BSOL, drawing in $39.47 million.

Fidelity’s FSOL added $9.74 million, Grayscale’s GSOL brought in $4.66 million, and Vaneck’s VSOL contributed $3.14 million. 21Shares’ TSOL rounded out the group with a steady $970,540 inflow. Total value traded reached $62.25 million, and net assets surged to $843.81 million, marking another milestone for the growing solana ETF segment.

The sustained demand for solana ETFs has seen the asset class attract over $550 million in net inflows since launch. Bohdan Opryshko, co-founder and COO of Everstake, an institutional staking company, says solana is being prioritized due to its native staking yields.

Institutional and retail segments are treating solana as a yield-generating asset rather than a speculative trade, a behavioral alignment driven by native staking rewards. For a growing part of the market, staking yield has become a primary driver of allocation.

As the week begins, the contrast is unmistakable: bitcoin stumbles, ether rebounds, and solana continues to shine.

FAQ📊

- Why did bitcoin ETFs start the week with losses?

Bitcoin ETFs saw a $151 million outflow driven mainly by large withdrawals from Blackrock’s IBIT. - What fueled the strong rebound in ether ETFs?

Ether ETFs surged with nearly $97 million in inflows, led by Blackrock’s ETHA attracting major capital. - Why are solana ETFs continuing to climb?

Solana ETFs extended their multi-week inflow streak with $58 million, highlighting sustained investor confidence. - What does this divergence mean for the market?

The split in flows shows investors rotating away from bitcoin toward faster-growing assets like ether and solana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。