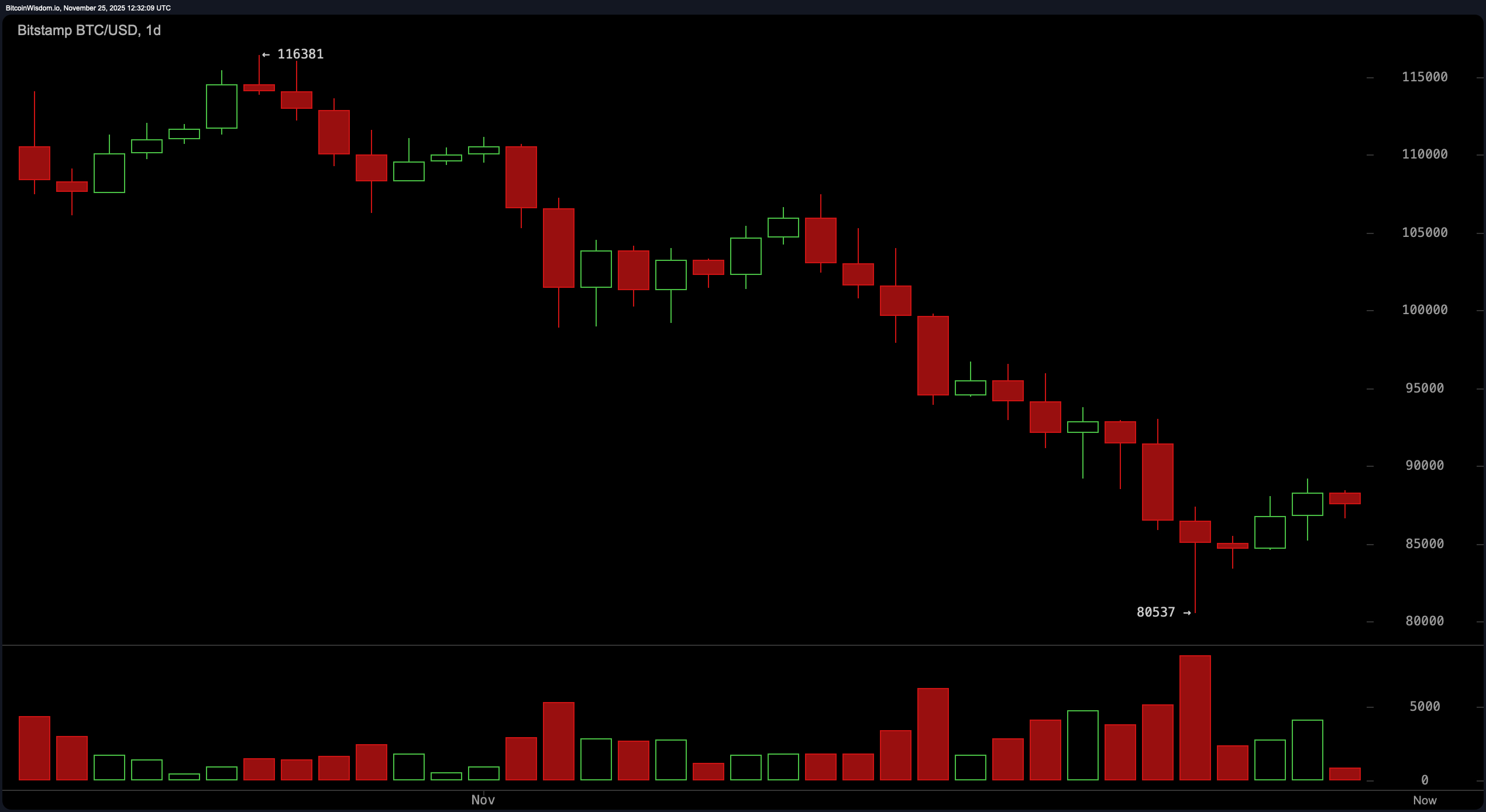

On the daily chart, bitcoin is attempting to crawl out of the hole it dug during its plummet from around $116,000 to just over $80,500. There’s a whiff of a relief bounce, with support firm at $80,537 and resistance looming stubbornly near $90,000. Volume has perked up slightly, though let’s not call it a comeback yet.

A mild bullish divergence—where price dipped but selling volume didn’t match pace—suggests bears might be getting winded. Yet until the $90,000 level is shattered with high-volume bravado, this could just be a textbook dead cat bounce masquerading as recovery.

BTC/USD 1-day chart via Bitstamp on Nov. 25, 2025.

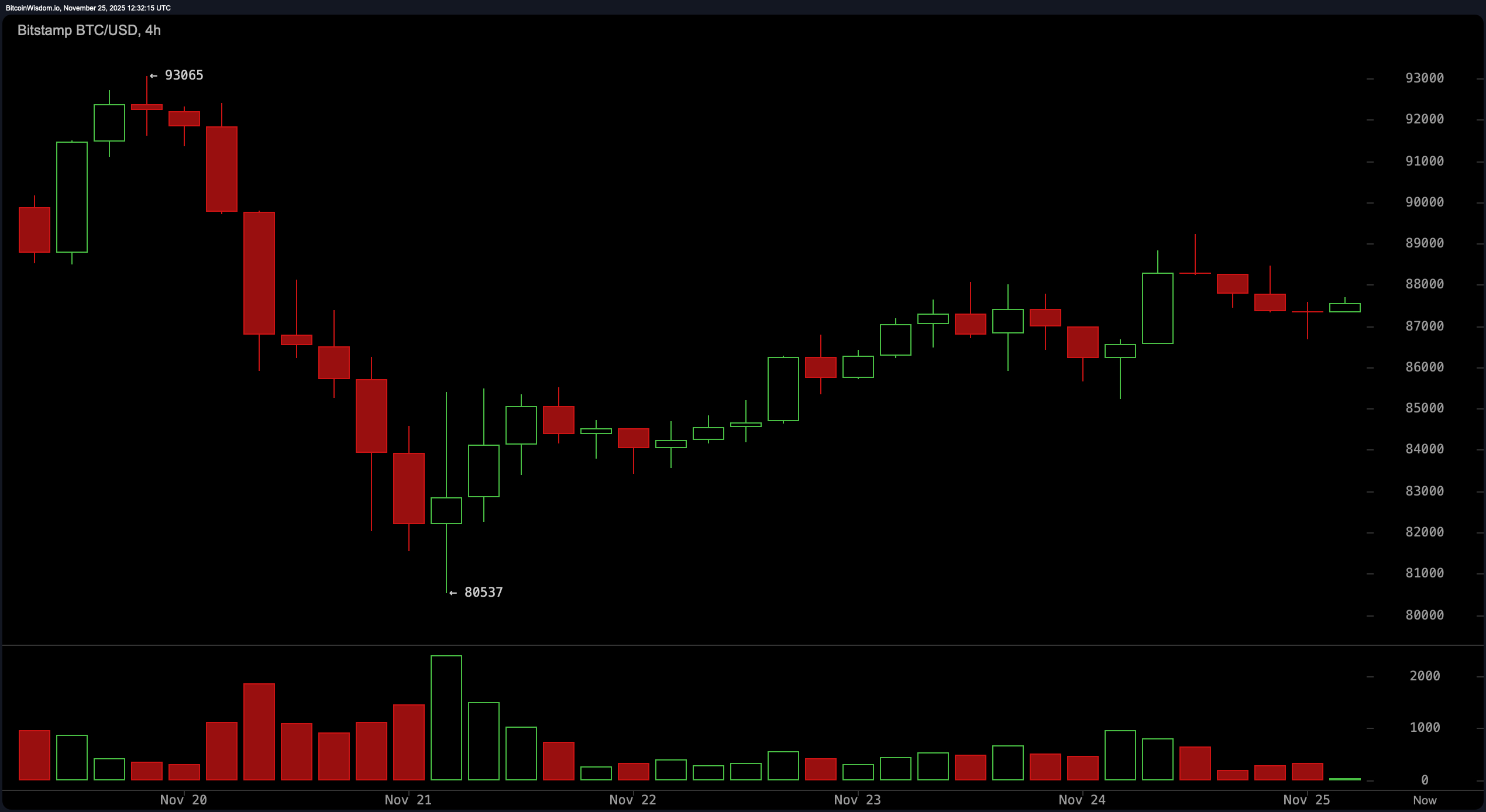

The 4-hour chart paints a slightly more optimistic picture. Since bouncing from its local low near $80,500, bitcoin carved a modest short-term uptrend, now consolidating between $85,500 and the $88,500–$89,000 resistance zone. The uptick in volume between November 21 and 23 hinted at buyer curiosity, but that enthusiasm is fizzling—volume’s now slipping as price coils below resistance. If it’s a bull flag, the breakout could be spicy. But if buyers hit snooze again, we may be back to whimpering below $85,000.

BTC/USD 4-hour chart via Bitstamp on Nov. 25, 2025.

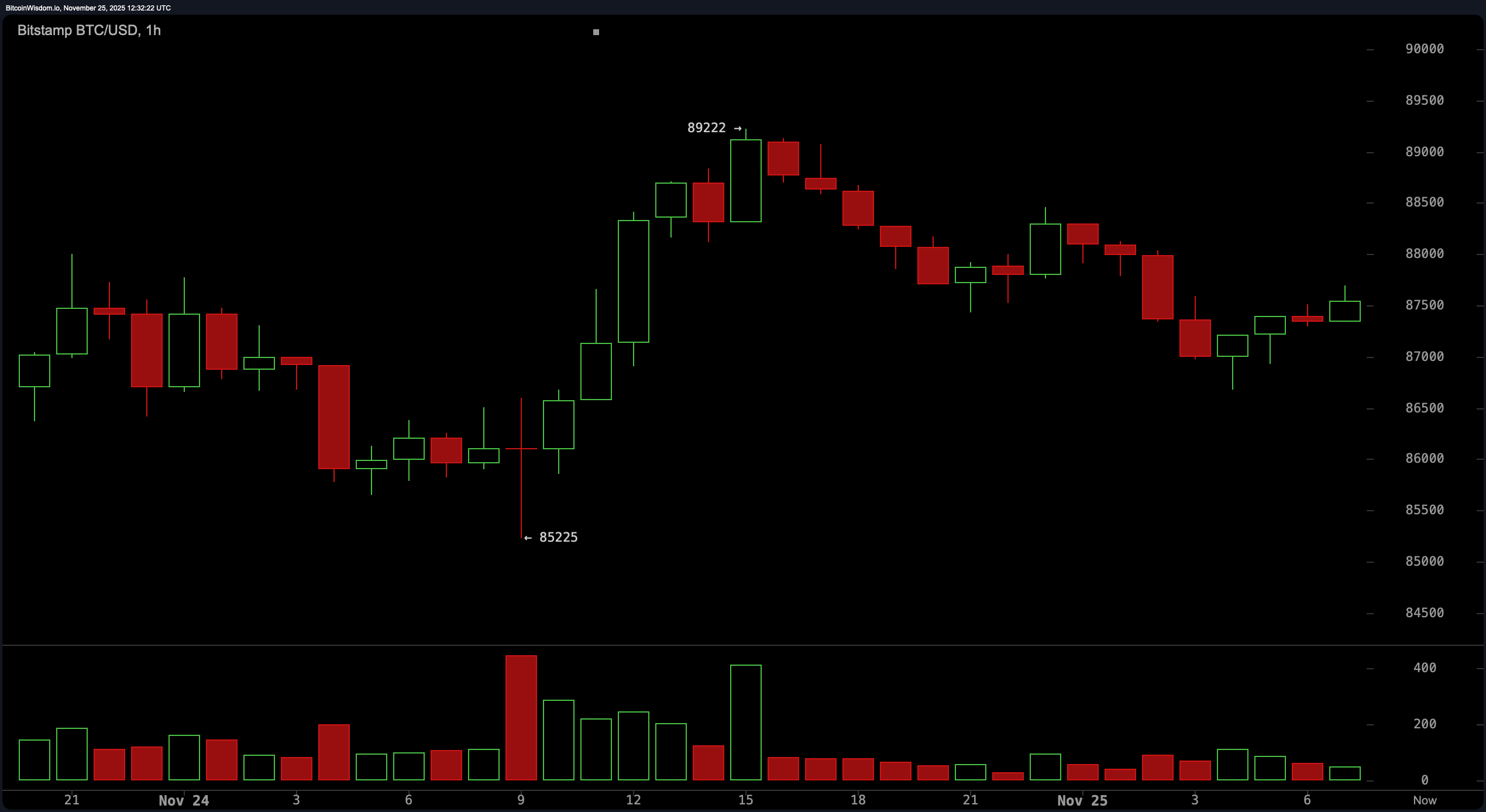

Zooming into the 1-hour timeframe, bitcoin’s showing off with higher highs and higher lows, recovering neatly from a dip around $85,200. Short-term support is pegged at $87,000, with resistance shadowing recent highs near $89,200. Volume here, however, is doing its best disappearing act—down significantly from the burst seen around November 21. This could mean consolidation before a pop, or just a tired market running on fumes. Price holding $87,000 is crucial; break that, and the party might be over before it starts.

BTC/USD 1-hour chart via Bitstamp on Nov. 25, 2025.

Oscillators are as indecisive as a caffeine-deprived day trader. The relative strength index (RSI) at 32, the Stochastic at 27, and the commodity channel index (CCI) at -81 all flash neutral. Average directional index (ADX) at 46 suggests a strong trend is in place—though it doesn’t say which way the wind’s blowing. Meanwhile, momentum (-7,944) and moving average convergence divergence (MACD) level (-5,599) clearly lean negative, showing downward force hasn’t completely left the building.

The moving averages are rolling out the red carpet for the bears, with all ten indicators—ranging from the 10-period exponential moving average (EMA) at 89,603 to the 200-period simple moving average (SMA) at 110,060—positioned above the current price. That’s not just a ceiling, that’s a penthouse full of rejection. Unless bitcoin decides to sprint past those layers of resistance, any upward effort might end up in a whimper.

Bull Verdict:

If bitcoin can decisively break above the $89,000–$90,000 resistance with strong volume, there’s potential for a short-term trend reversal. Momentum on lower timeframes supports a cautious upside scenario, but any bullish thesis hinges entirely on holding $87,000 and building strength above it.

Bear Verdict:

With all major moving averages stacked ominously above price and momentum indicators still pointing downward, the broader trend remains bearish. Unless bitcoin can reclaim the $90,000 level convincingly, the recent bounce risks becoming just another lower high in a longer-term downtrend.

- What is bitcoin’s price today?

Bitcoin is trading at $87,647 as of November 13, 2025. - What’s the market cap and volume for bitcoin?

Market cap is $1.74 trillion with $19.95 billion in 24-hour trading volume. - Is bitcoin in an uptrend or downtrend?

It’s consolidating short-term, but the broader trend remains bearish. - What key levels should traders watch?

$90,000 is the major resistance; $85,000 is critical support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。