After a round of adjustments last week, the US stock market is approaching a relatively good allocation range. The strategy for US stocks is actually simpler than that for A-shares and the crypto market: buy big on big drops, buy small on small drops, closely follow the big players, copy their homework, and in the long run, it’s bound to be right!

As an old investor in US stocks for nearly 10 years, I closely monitor the movements of the 13F reports from major funds every quarter. Recently, the 13F reports from various funds have been gradually disclosed, and this time the Q3 2025 holdings report is particularly interesting—Bridgewater, Oaktree, ARK, and Pershing Square, four institutions with vastly different styles, have invested real money into completely different “market scripts.” This corresponds to different investment styles, allowing investors to find a match based on their risk preferences. Let’s break it down:

1️⃣ Bridgewater: Bridgewater's style has always been a conservative strategy, focusing on diversification and hedging, like wearing a bulletproof vest. As one of the largest hedge funds in the world, its style remains that of a “conservative with a bulletproof vest,” always fearing black swans, hence its positions are extremely diversified. Its Top 3 holdings are:

• S&P 500 ETF (#IVV) 10.62%: Directly buying “the US stock market,” and increased by 4.84%! Bridgewater is telling you with real money: “Don’t mess around, the market has dropped enough, it’s time for a rebound.”

• S&P 500 ETF (#SPY) 6.69%: Also buying the market, but SPY is a “more flexible ETF,” with a slight decrease of 1.73%, indicating that Bridgewater is “balancing risk”—wanting to ride the market rebound while fearing it may not be sustained, hence diversifying with different ETFs.

• Tech stocks “selling while buying”: Google (-52.61%), Microsoft (-36.03%), and Nvidia (-65.28%) are being sold, but Lam Research (#LRCX, +111.38%) and Adobe (+73.09%) are being aggressively bought.

This is not contradictory but rather a “structural adjustment”: selling “overpriced giants” (Google, Microsoft, and Nvidia have surged this year) and buying companies with “technical barriers and reasonable valuations” (like semiconductor equipment maker #LRCX and software company #Adobe).

Bridgewater’s cautious approach: It also hides a large amount of “non-US stock assets” (the left bar chart shows green for emerging markets and blue for healthcare finance), but the 13F only reports US stocks, so it is actually more conservative than it appears—typical of “putting eggs in ten baskets, not panicking if one basket breaks.” Bridgewater operates like an “experienced driver,” not chasing hot trends or betting on a single industry, suitable for those with low risk tolerance who want to “make steady profits” (as shown in Figure 1).

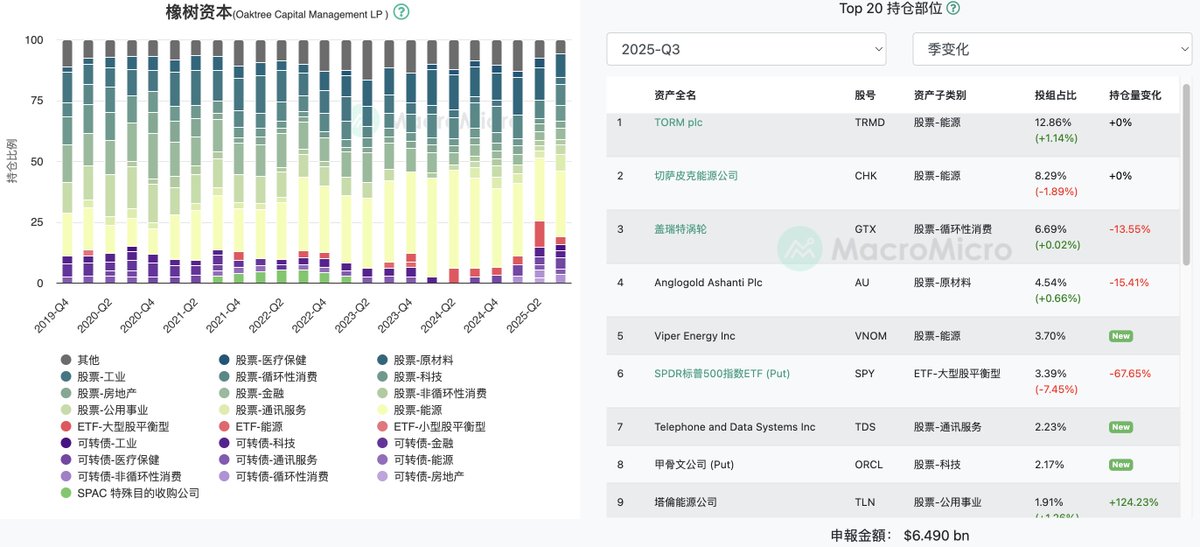

2️⃣ Oaktree: Betting on “energy + cycles,” shorting the US stock market. Oaktree Capital’s founder Howard Marks is an investor highly regarded even by Buffett. It is an “alternative investment giant,” specifically targeting “assets that others don’t want.” This quarter’s operations feel like “holding a knife over the US stock market.” Its Top 3 holdings are:

• TORM plc (#TRMD) 12.86%: A Danish oil shipping company, increased by 1.14%—oil shipping is a “barometer of the global economy,” and Oaktree is betting on “global trade recovery and a surge in oil shipping demand.”

• Chesapeake (#CHK) 8.29%: A US shale gas giant, position unchanged—energy stocks benefit from “inflation + geopolitical tensions,” and when conflicts arise in Ukraine or the Middle East, energy prices rise.

• Shorting S&P 500 ETF (SPY Put) 3.39%: This is “betting on a decline in the US stock market,” although it reduced its position by 67.65%, it remains the sixth largest holding. Oaktree’s message: “The overall risk in the US stock market is high, but individual energy stocks have opportunities, so short the market while buying energy stocks as a hedge.”

Looking at its “new moves”: Viper Energy (renewable energy) and Talen Energy (utilities) are being increased, while Garrett (GTX, turbochargers) and Anglogold (AU, gold) are being reduced—indicating Oaktree is shifting from “traditional cyclical stocks” to “renewable energy + utilities” (more stable cash flow).

Overall, Oaktree Capital resembles a “shrewd businessman,” betting on the energy cycle while hedging against a decline in the US stock market, suitable for investors looking for “certainty in a volatile market,” representing a conservative approach to hedging (as shown in Figure 2).

3️⃣ ARK: Crazy bets on “disruptive technology,” with the highest risk. This is consistently Cathie Wood’s style—aggressive and bold, with high volatility in its bets. ARK represents “tech gamblers,” with “disruptive innovation” as their investment creed, making their holdings resemble a “tech stock casino.” Its Top 3 holdings are:

• Tesla (#TSLA) 9.5%: Increased by 16.64%! Tesla is not just an electric vehicle company; it’s an “AI + robotics + energy” platform. ARK is betting that “Tesla will sell not just cars, but AI services in the future.”

• Coinbase (#COIN) 4.81%: A cryptocurrency trading platform, although reduced by 8.68%, it remains the second largest holding. ARK’s logic: “Cryptocurrency is the future financial infrastructure; short-term volatility doesn’t matter, it will definitely rise in the long term.”

• Roblox (#RBLX) 4.38%: A metaverse gaming company, reduced by 21.52%—not bearish, but “taking profits” (gaming stocks have risen a lot this year, so cashing out a bit now and buying back later at lower prices).

ARK’s risk appetite is very evident; its holdings include Palantir (AI big data), Roku (streaming), and Shopify (e-commerce SaaS), all “high-volatility tech stocks,” which soar when they rise and plummet when they fall. Moreover, it hardly touches stable growth sectors like consumer, finance, or real estate, relying solely on tech stocks to “bet on the future.”

ARK is more like “young people trading stocks,” with high risk and high returns, suitable for investors who can withstand a 30% drawdown and want to chase high returns—but definitely don’t go all in; treat it like a lottery (as shown in Figure 3).

4️⃣ Pershing Square: Stubbornly focused on “consumption + technology,” buying more as prices drop. Pershing Square resembles an eagle waiting for prey, specifically betting on companies that are “essential to the public and heavily invested in technology.” Its Top 3 holdings are:

• Uber (#UBER) 20% position: Don’t just think about rides; UBER is now “local life infrastructure”—food delivery, freight, and even future autonomous driving. As long as people need to go out, it makes money. The quarterly position only decreased by 0.1%, indicating that boss Ackman believes “workers can’t live without UBER, and consumers can’t escape it either.”

• Brookfield (#BN) 19% position: This company is a “global rental giant,” involved in commercial real estate and renewable energy infrastructure, a typical inflation hedge. Ackman increased his position by 0.67%, clearly betting that “in a high-interest environment, assets that can collect stable rents are more valuable.”

• Hilman (#HHH) 10% position: A real estate brokerage, position unchanged. The logic is simple: although US housing prices fluctuate, the demand for renting and buying houses is always there, making it a “reliable income” industry.

Looking at its other holdings: Alphabet (C shares) remained unchanged, Amazon also unchanged, but Alphabet (A shares) was reduced by 9.68%—this is not bearish on Google, but rather “adjusting the portfolio”: C shares have low voting rights but are cheap, while A shares have high voting rights but are expensive. During market fluctuations, switching to cheaper positions saves money for other targets (like Hilman).

Pershing Square employs a typical beta + alpha strategy, using consumer stocks for stable beta and tech stocks for high-return alpha, betting on “consumption recovery + tech monopoly,” with positions as stable as a rock, suitable for investors like me who “don’t want to watch the market every day, just want to hold onto a big tree” (as shown in Figure 4).

📝 Finally, let’s talk about my “copying homework” strategy—a four-step plan.

After reviewing the operations of these four funds, I offer some advice to ordinary US stock investors (which I am also following):

Conservative Type: Learn from Pershing Square, hold onto “consumption + tech giants” (like UBER, AMZN, GOOG), hold long-term, and earn a steady 8%-10% from dividends + stock price growth.

Cautious Type: Learn from Bridgewater, buy S&P 500 ETF (IVV/SPY) + diversify (healthcare, finance, emerging markets), and add some “tech growth stocks” (like LRCX, ADBE) for both offense and defense.

Aggressive Type: Learn from ARK, take small positions (no more than 20%) betting on “disruptive technology” (TSLA, COIN, RBLX), treat it like a lottery, doubling profits or losing as tuition.

Hedging Type: Learn from Oaktree, look for opportunities in energy (TRMD, CHK) and utilities (TLN), and appropriately short the market (like buying SPY Put) to guard against black swans.

Lastly, it’s important to note that the 13F only reports US stock holdings, so the “bonds, private equity, and non-US stock assets” of Bridgewater and Oaktree are not reflected. Therefore, don’t just look at the surface; consider their investment styles for judgment. As I often say: “Fund holdings are a map, not a destination; the key is to understand why they buy these targets and sell these targets.”

However, given the current market conditions, most US stocks have undergone a round of adjustments of about 20%, making them highly cost-effective. You can consider your different risk tolerances to make corresponding style allocations; it might be a great opportunity!

Currently, you can join our US stock community for free, limited to 10 people per week. You can message me to fill out a form and enter the US stock discussion and exploration community (the recent influx of new members may take time for assistants to review, thank you for your understanding) 🙏

If you are still limited by the inconvenience of opening a US stock account domestically, you can try using U to trade US stocks for a smooth experience. I am personally using the #RWA US stock tokenization platform #MSX to participate in the US stock market: http://msx.com/?code=Vu2v44

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。