Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The market's judgment on whether the Federal Reserve will cut interest rates in December is experiencing severe fluctuations. Initially, due to slowing inflation and weak labor data, the market widely expected a rate cut to be a foregone conclusion. However, a series of hawkish statements from Federal Reserve officials significantly cooled this expectation, with the probability of a rate cut dropping below 30%. Nevertheless, the dovish signals released by New York Fed President Williams on Friday brought the probability of a rate cut back to over 70%. Currently, among the 12 voting members, 5 are inclined to keep rates unchanged, creating a stalemate and making the December rate decision highly uncertain.

Michael Hartnett, Chief Investment Strategist at Bank of America, pointed out that the current liquidity tightening has impacted multiple asset classes, including cryptocurrencies, credit, and bank stocks. Its weak performance is sending signals similar to those seen in December 2018, which may force the Federal Reserve to shift towards easing. Looking back to 2025, global central banks collectively cut rates 316 times, creating a liquidity feast that directly fueled the AI investment frenzy and cryptocurrency speculation. Looking ahead to 2026, Hartnett predicts that the Federal Reserve will enact a "policy surrender," being forced to initiate a rate-cutting cycle, at which point long-term zero-interest bonds, Bitcoin as a liquidity "canary," and mid-cap stocks sensitive to financing costs will become the main beneficiaries.

In terms of Bitcoin, market sentiment is intertwined with panic and speculation. The price fell to a recent six-month low of $80,500 on Friday, confirming a "death cross" technical pattern. Analyst Mister Crypto noted that historical "death crosses" led to declines of 64%, 67%, and 71% in January 2022, March 2018, and September 2014, respectively. If the price cannot quickly rebound to the cost benchmark, it may confirm a deeper bear market trend, with Bitcoin's price potentially falling further to a low of $74,500. Analyst Rekt Capital also believes that Bitcoin's macro upward trend has been broken, with the current weekly closing price above $86,000, and the next target will challenge the resistance level of $93,000. Meanwhile, Han Mu Xia stated that $80,500 may have been an important low point in this bear market; however, this does not mean the bear market has ended. The current bear market has lasted over three months and is expected to continue for another 3 to 4 months. Despite the market's pessimism, Bitcoin rebounded strongly nearly 10% over the weekend to $88,000. Analysts like CryptoMichNL and Crypto Auris believe the price may first fill the CME gap at $85,200 before challenging the range of $90,000 to $96,000. Key resistance levels noted by Aegon are at $88,400, $93,600, and $99,420. Bitwise CEO Hunter Horsley revealed that he has increased his Bitcoin holdings at the $85,000 price level.

The Ethereum market also experienced significant volatility, with its price dropping 15% to a four-month low of $2,625, leading to the liquidation of $460 million in leveraged long positions. The spot ETF also recorded net outflows for nine consecutive trading days, totaling $1.33 billion. However, data from the derivatives market revealed a glimmer of optimism. Analyst Marcel Pechman pointed out that despite the price drop, the funding rate for ETH perpetual futures has stabilized, and large traders on the OKX platform are even increasing their long positions, suggesting that the market may be brewing a rebound towards $3,200. Analyst Man of Bitcoin believes the price target for ETH is $2,889, while Ted stated that if it can successfully reclaim the $2,800-$2,900 range, it is likely to advance towards $3,300-$3,400. Bitwise Chief Investment Officer Matt Hougan emphasized that the market is overlooking the upcoming Fusaka upgrade in December, which he believes is an undervalued catalyst that will significantly enhance Ethereum's value capture ability and may lead the next round of rebounds. Liquid Capital founder Yi Lihua also announced that he has fully invested around the $2,700 price level, positioning ETH as a core allocation in his major blockchain track.

Over the weekend, the controversy surrounding Strategy (MSTR) intensified due to a report from JPMorgan regarding MSTR's removal from the MSCI index, leading to resistance actions within the crypto community. Meanwhile, Bitmine Chairman Tom Lee analyzed that due to the exhaustion of on-chain derivatives liquidity, institutional investors are hedging risks by shorting MSTR shares, which hold 650,000 Bitcoins. Analyst RamenPanda indicated that MSTR, with over 77% of its assets in Bitcoin, may be removed from the MSCI index on January 15, 2026, potentially triggering a forced sell-off of $8-9 billion, further exacerbating liquidity and stock price pressure. Currently, MSTR's stock price has fallen 64% from its peak, and its "issue shares to buy coins" model is becoming unsustainable. Additionally, the new MSCI regulations (which will exclude companies with over 50% of their assets in digital assets from major indices) may also have potential impacts on other Bitcoin reserve companies.

In project updates, the decentralized AI data network Port3 Network was attacked by hackers due to a bridging vulnerability, resulting in the issuance of 1 billion tokens for on-chain sale, causing its token PORT3 price to plummet. Binance announced the delisting of PORT3 perpetual contracts, and Bybit also suspended related trading, with its market cap currently showing as zero. Meanwhile, the pump.fun project has been accused of cashing out approximately $400 million in funds over the past week, leading to its token PUMP's price breaking down and falling nearly 30% in the past week. On Friday, Coinbase announced the acquisition of the Solana-based trading platform Vector.fun, while the related Tensor (TNSR) surged from $0.0418 to a peak of $0.365 on November 19, but has since fallen back to $0.1485, with a 24-hour increase narrowing to 67%. Additionally, the highly anticipated Monad token sale on Coinbase has ended, and distribution will occur today, with trading set to launch on Solana.

2. Key Data (as of November 24, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $86,934 (YTD -7.03%), daily spot trading volume $51.05 billion

Ethereum: $2,839 (YTD -14.88%), daily spot trading volume $21.71 billion

Fear and Greed Index: 12 (Extreme Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 58.5%, ETH 11.5%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, TRUST, SOL

24-hour BTC long-short ratio: 49.31% / 50.69%

Sector performance: NFT sector up 1.1%, Meme sector up 1.09%

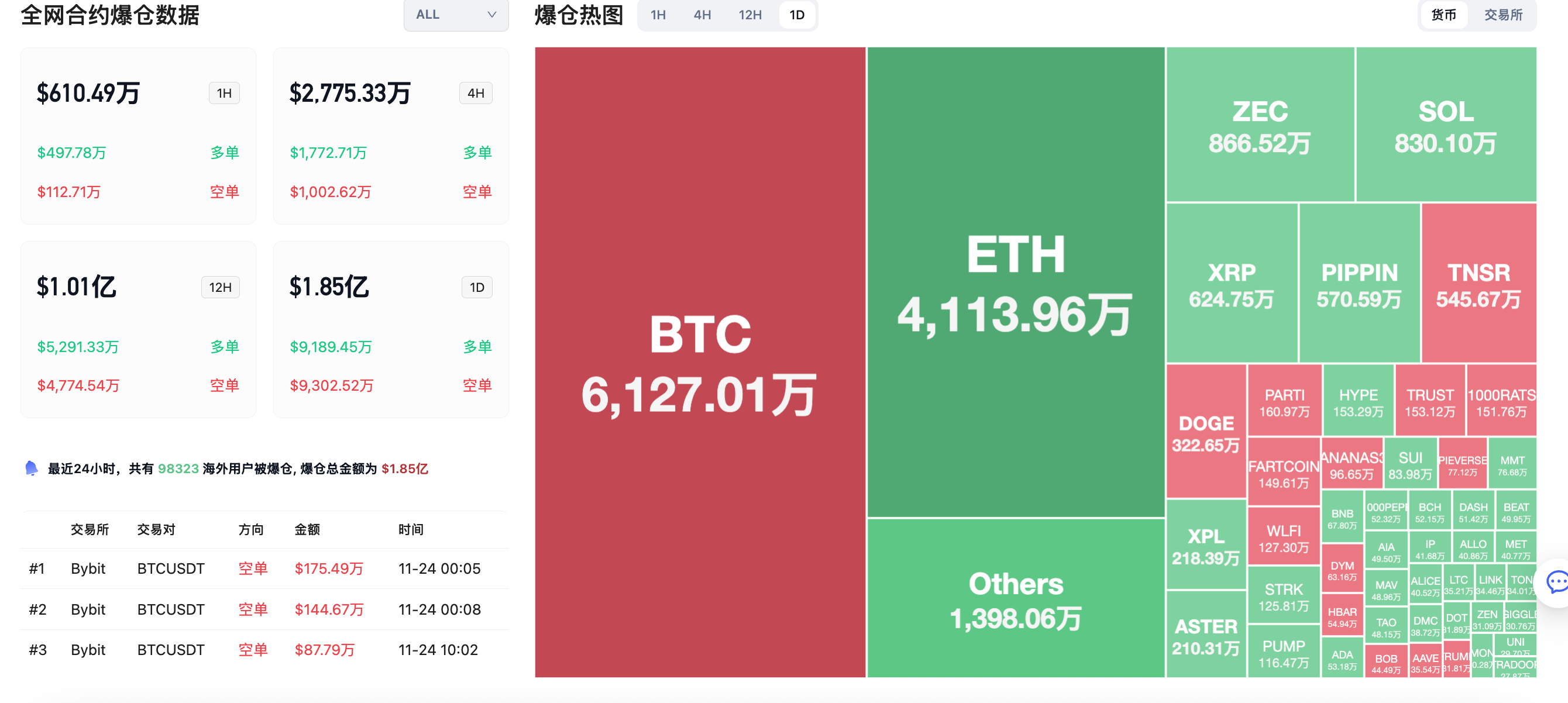

24-hour liquidation data: A total of 98,323 people were liquidated globally, with a total liquidation amount of $185 million, including $61.27 million in BTC, $41.14 million in ETH, and $8.365 million in ZEC.

3. ETF Flows (as of November 24)

Bitcoin ETF: Bitcoin spot ETF saw a net outflow of $1.22 billion last week, continuing four weeks of net outflows.

Ethereum ETF: Ethereum spot ETF saw a net outflow of $500 million last week, continuing three weeks of net outflows.

Solana ETF: SOL spot ETF saw a net inflow of $128 million last week, continuing four weeks of net inflows.

4. Today's Outlook

Monad plans to launch its Layer 1 blockchain mainnet and native token on November 24

Binance Alpha will launch Sparkle (SSS) on November 24 and Irys (IRYS) on November 25

Bloomberg analysts expect the Grayscale Dogecoin ETF to launch on November 24

Starknet v0.14.1 is set to launch its mainnet on November 25

Plasma (XPL) will unlock approximately 8.889 million tokens on November 25 at 9 PM, accounting for 0.89% of the total supply, valued at approximately $18.1 million;

WalletConnect Token (WCT) will unlock approximately 10.06 million tokens on November 25 at 8 AM, accounting for 10.07% of the total supply, valued at approximately $11.6 million;

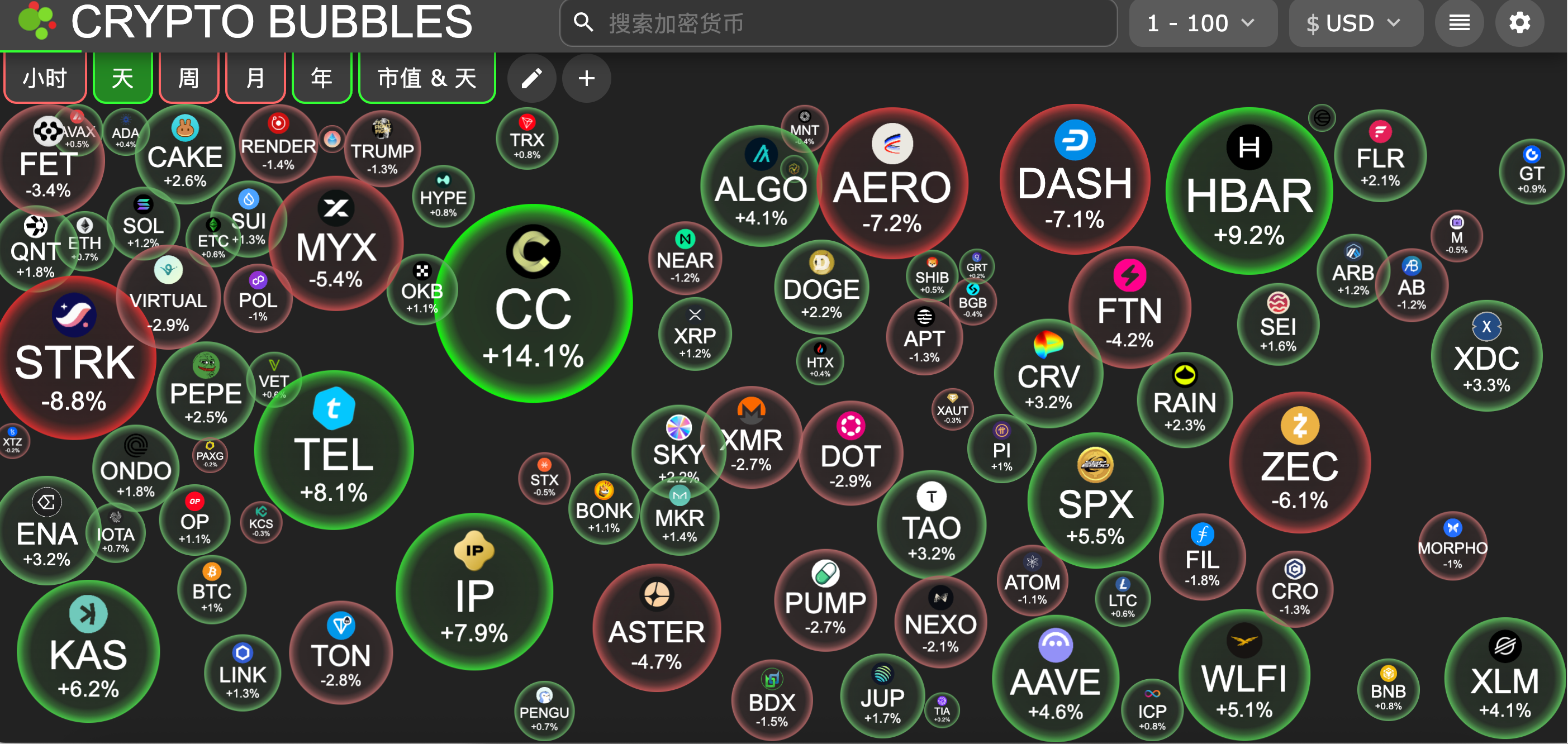

The largest declines among the top 100 cryptocurrencies by market cap today: Starknet down 8.8%, Aerodrome Finance down 7.2%, Dash down 7.1%, Zcash down 6.1%, MYX Finance down 5.4%.

5. Hot News

1inch Team Withdraws 7.56 Million 1INCH from Binance Again, Valued at $1.37 Million

Port3 Launches Token Migration Plan and Destroys Over 160 Million Tokens

Forward Industries Transfers 1.727 Million SOL to a Certain Wallet, Valued at Nearly $220 Million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。