Written by: Michael Nadeau, The DeFi Report

Translated by: Glendon, Techub News

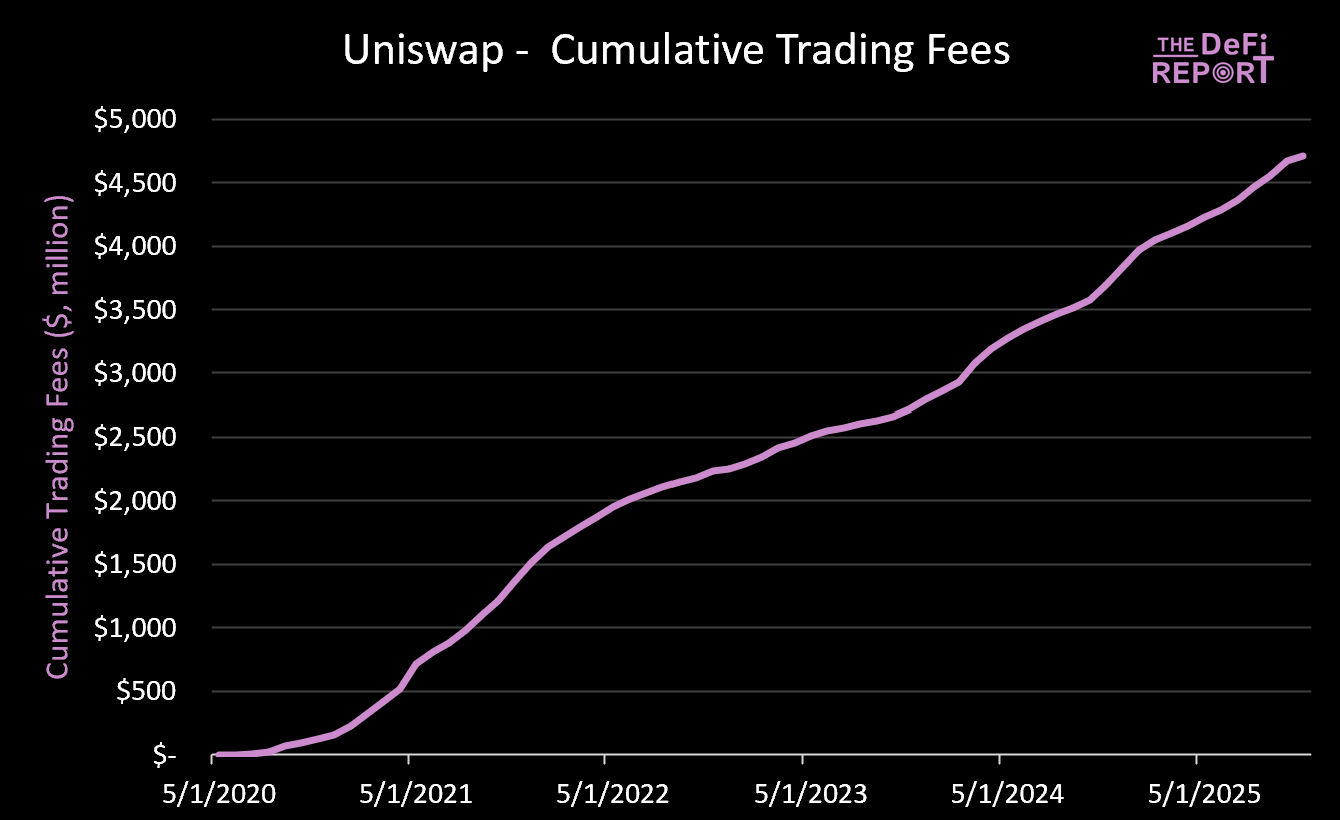

Uniswap, launched in 2018, is a groundbreaking innovation that enables the organic formation of bilateral markets for trading financial assets. Since its inception, the protocol has generated over $3.3 trillion in trading volume and $4.7 billion in trading fees.

However, we have always viewed Uniswap as a project not worth investing in.

Why is that?

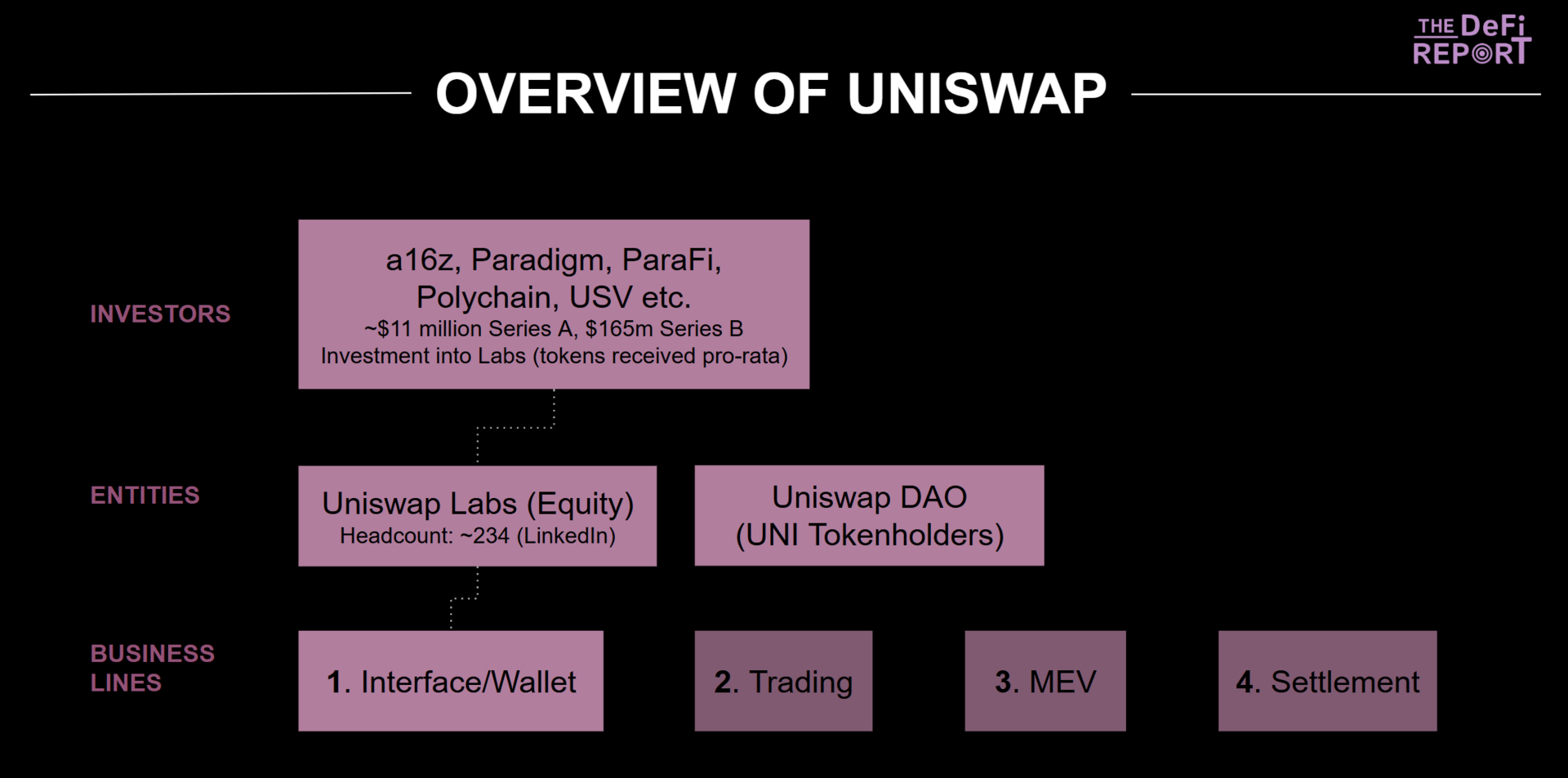

Uniswap has multiple capital tables, one for equity investors and one for token holders. This structure is not unique to Uniswap, but what is unique is that Uniswap often distributes revenue to equity holders rather than token holders.

This is a serious conflict of interest.

Interestingly, under a recent governance proposal put forth by Uniswap founder Hayden Adams, this all seems set to change. Today, we will analyze the implications of this governance proposal from the perspective of token holders and provide the latest data and information on Uniswap's fundamentals.

Uniswap Organizational Structure

Equity Holders vs. Token Holders (DAO)

In traditional finance, it is not uncommon for companies to issue multiple classes of stock. For example, in the event of a company liquidation, preferred shareholders typically have a higher claim on assets than common shareholders. In other words, investors generally believe that if a company performs well (with revenue and profit growth), the value it creates will be distributed proportionally among all classes of stock.

Therefore, ownership of Uniswap (or any crypto project or company) must belong to a single investment instrument. In this case, that investment instrument is the UNI token.

Why do we say this?

Because if Uniswap Labs (the core team + investors) were to derive revenue from various business lines without regard for UNI token holders (who have no legal rights), the market might lose trust in the governance of Uniswap DAO.

This is exactly what has happened in the past.

This is why we believe UNI is not worth investing in.

Now, let’s break down the various business lines and the potential changes they may undergo under the new proposal structure.

Uniswap Business Lines and Value Attribution

In this section, we will outline the current sources of revenue within Uniswap's organizational structure and how future revenue will be allocated if the governance proposal is approved (which currently has 100% support).

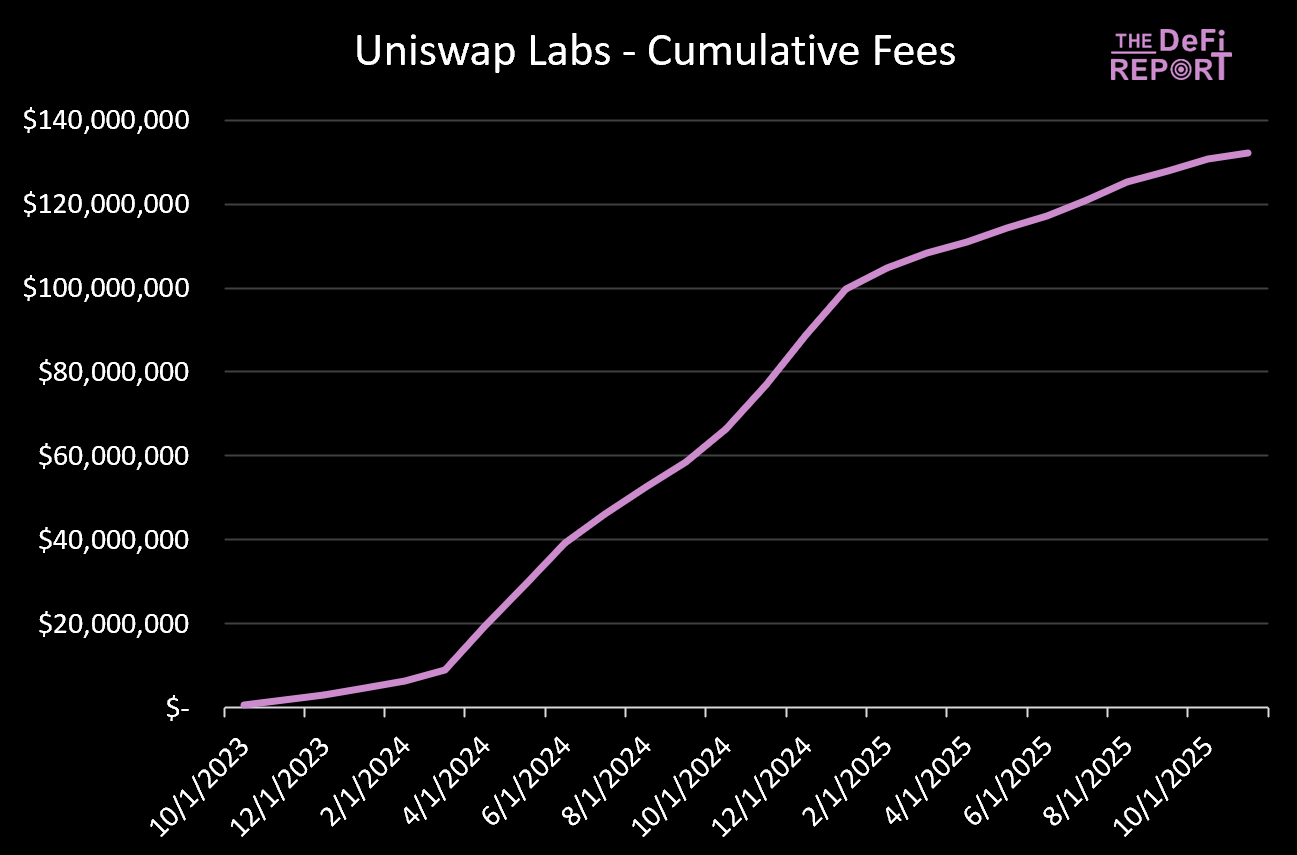

Interface/Wallet

In 2023, Uniswap Labs unilaterally charged a fee of 0.15% (later increased to 0.25%) for users interacting with Uniswap through the official website interface or Uniswap Wallet (mobile users).

To date, Uniswap Labs has accumulated $132 million.

However, UNI token holders had no say in this decision and no right to claim these fees. This situation clearly needs to change.

Key Points for Token Holders

Under the new proposal structure, Uniswap will eliminate its interface, wallet, and API fees.

Labs will also commit through contracts to pursue only initiatives that align with the interests of DUNI (DUNI is a new legal entity of the foundation established as a decentralized non-profit organization registered in Wyoming), thereby aligning with the interests of UNI token holders.

While aligning Labs with DUNI/token holders, this will eliminate the $132 million in fees generated since the beginning of 2023. If any of these fees were previously used to fund protocol development, those costs will now have to be borne by other sources.

Trading/Smart Contracts

Uniswap's primary source of revenue is its trading business. Since its inception, the protocol has generated over $4.7 billion in trading fee revenue.

100% of these fees have been paid to third-party liquidity providers (LPs). However, the governance proposal will open a "fee switch" for token holders as follows:

The protocol fee for V2 pools is 0.05%;

The protocol fee for 0.01% and 0.05% v3 trading pools is initially set at 1/4 of LP fees;

The protocol fee for 0.30% and 1% v3 trading pools is set at 1/6 of LP fees.

If approved, the fee switch will be gradually rolled out, first applied to V2 and V3 pools on the Ethereum mainnet, which account for 80-95% of liquidity provider fees. All fees generated from the new fee switch will be used to programmatically burn UNI tokens (thereby accumulating value for token holders).

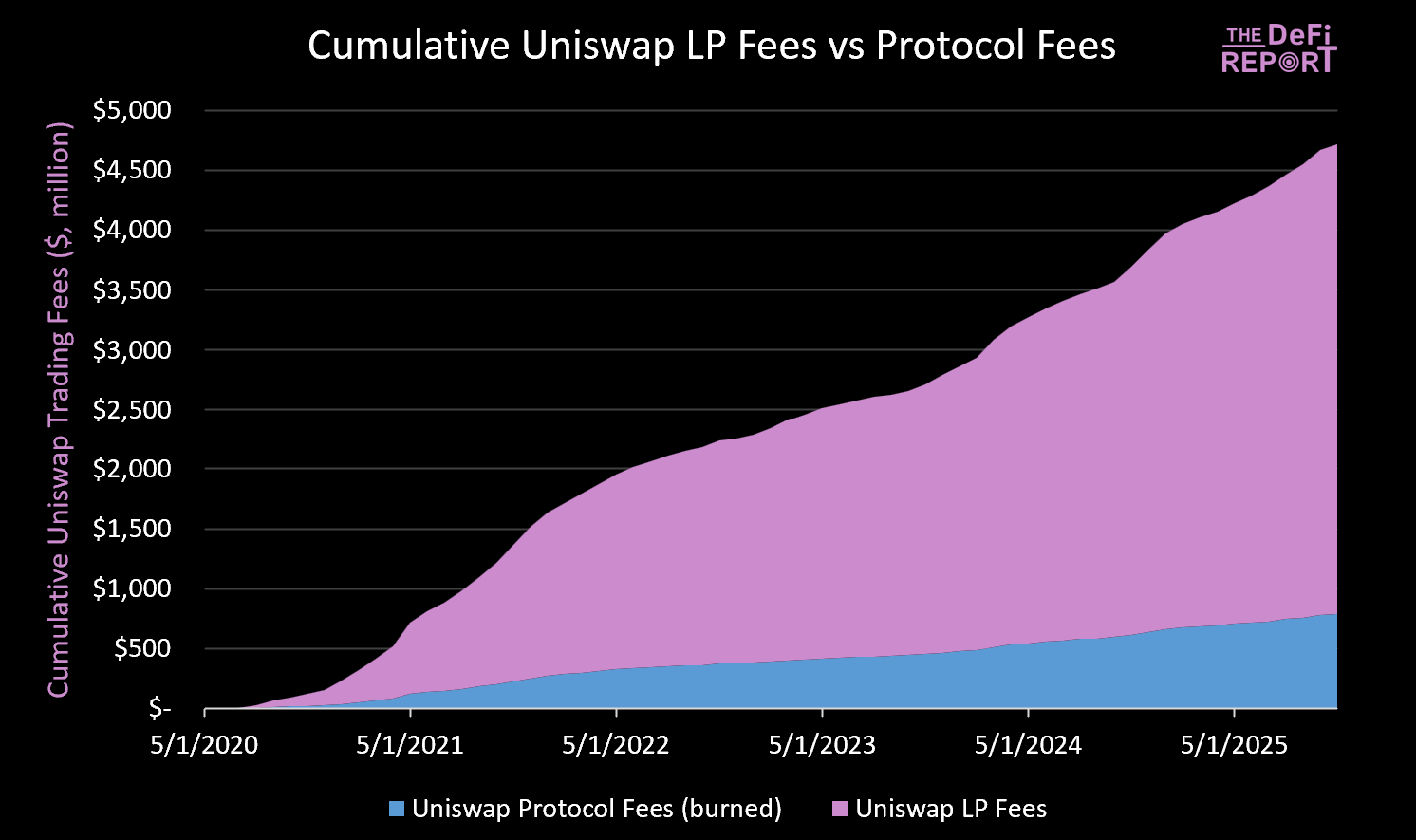

LP Trading Fees vs. Protocol Fees

The following diagram shows the fee distribution scheme that has applied between LPs and the protocol from the beginning. Protocol fees (in blue) will be burned, thereby reducing the circulating supply of UNI.

Key Points

In retrospect, we estimate that approximately $780 million worth of UNI tokens will be burned. If the governance proposal is approved, Uniswap will retroactively burn 100 million UNI tokens (valued at $663 million at the current UNI price).

This will reduce the existing token circulation by about 16%.

Impact on Liquidity Providers

While protocol fees will shift some trading fees away from liquidity providers, the governance proposal includes a fee mechanism designed to enhance LP performance by internalizing MEV and introducing new sources of fees.

In other words, the MEV captured by the protocol (which would originally be allocated to validators) will be burned after the upgrade (belonging to token holders rather than LPs).

Unichain

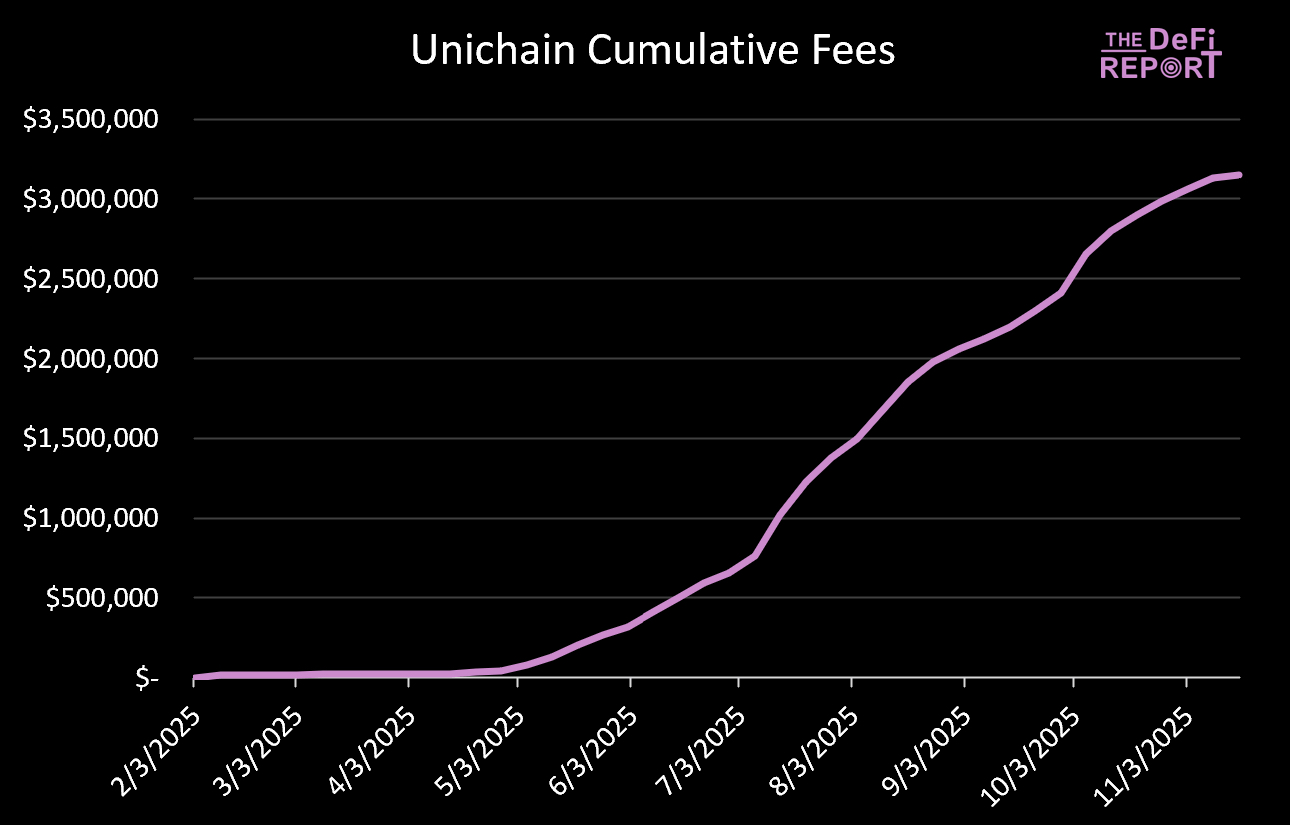

Unichain is a general-purpose Ethereum L2 launched by Uniswap 9 months ago.

It currently handles an annualized decentralized exchange (DEX) trading volume of $100 billion, generating over $3 million in sequencer fees.

Key Points

If the governance proposal is approved, these fees (after deducting L1 data costs and the 15% fee paid to OP) will also be converted into burned UNI.

Uniswap Fundamentals Update

This section will conduct a "health check" on Uniswap's key performance indicators (KPIs).

Trading Volume

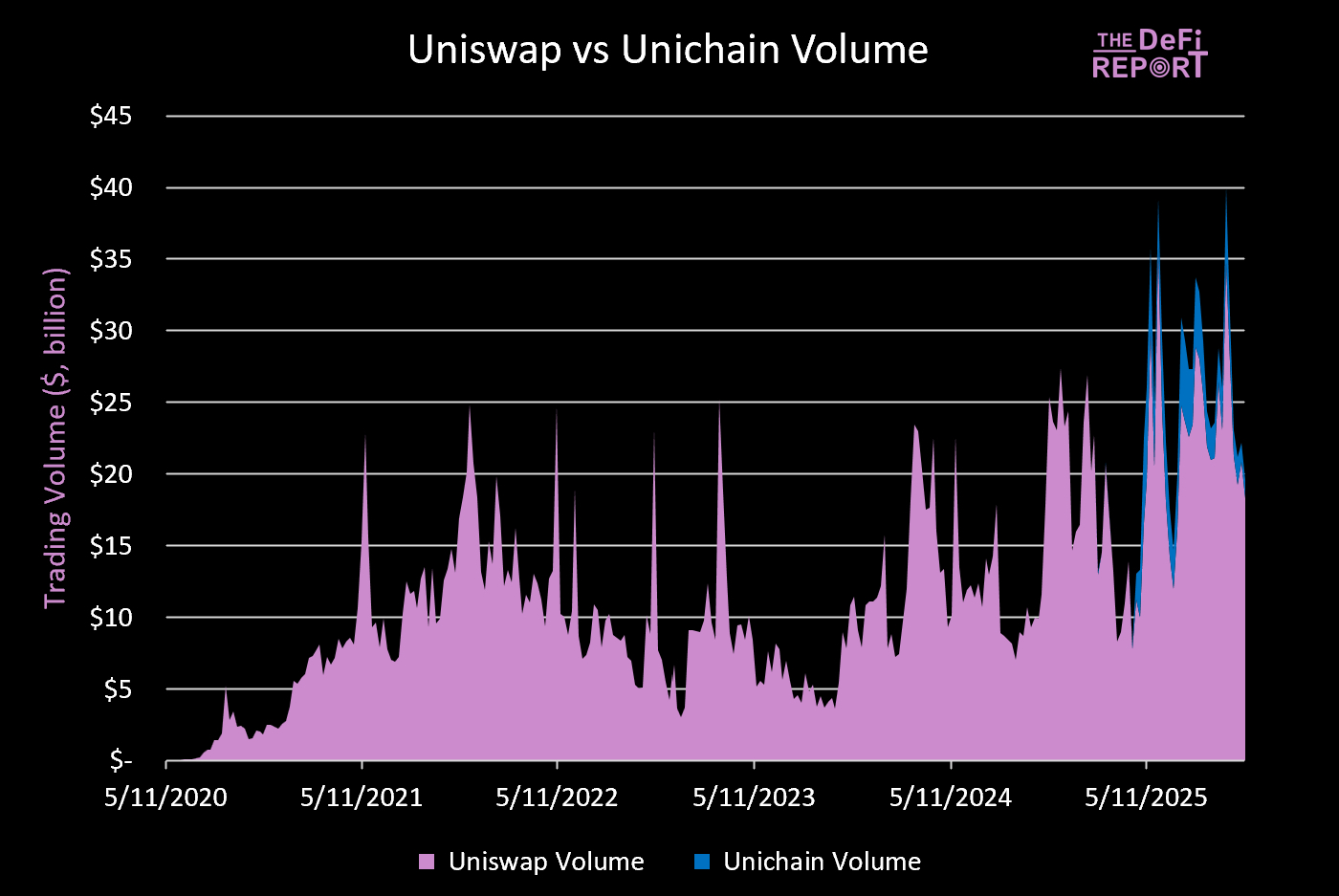

Despite most speculative activity in this cycle shifting to Solana and Hyperliquid, Uniswap's trading volume continues to grow. The protocol reached a peak trading volume of $34 billion in the week of October 6, a 50% increase from the best single-week trading volume in the 2021 cycle.

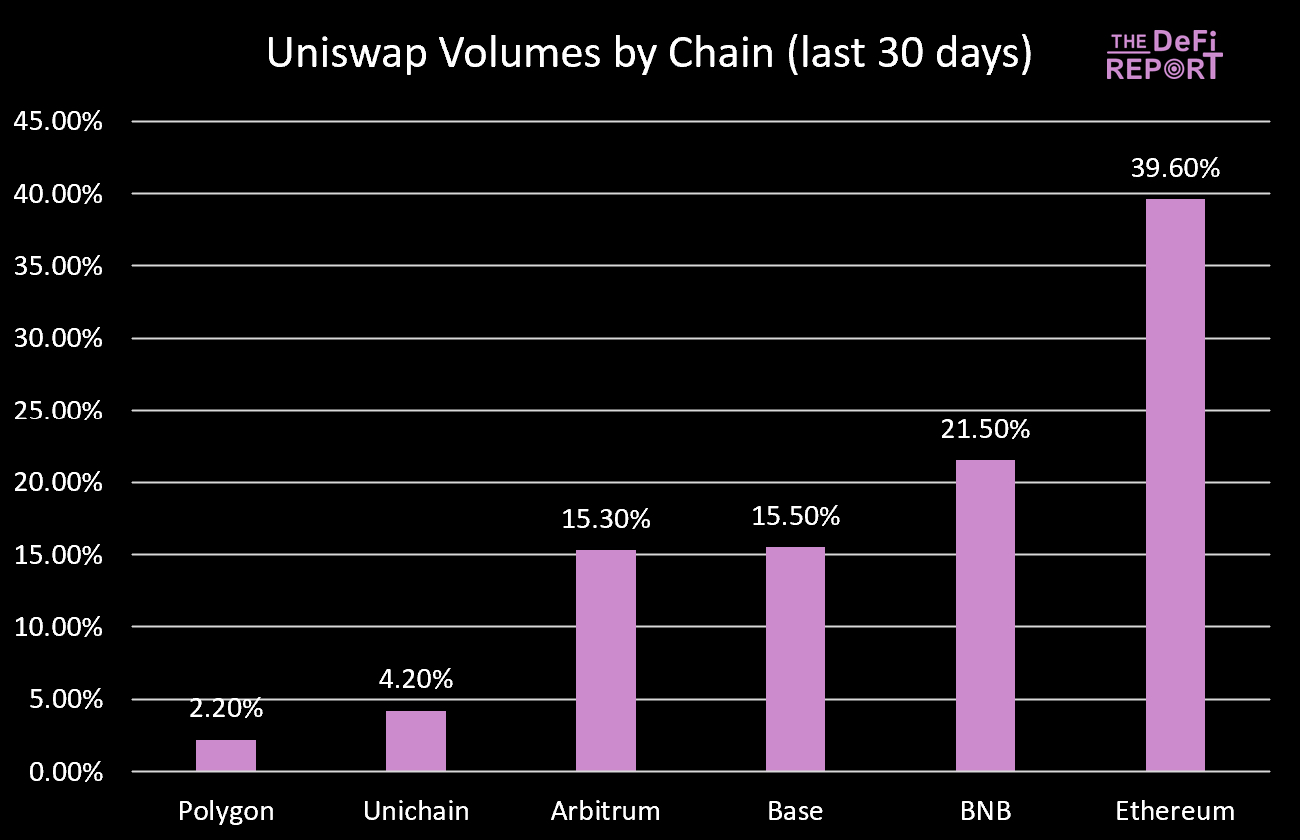

Trading Volume by Chain

Currently, 40% of Uniswap's trading volume comes from Ethereum, down from 55% last year.

For reference, the BNB chain's share has risen from 2% a year ago, and the Base chain's share has also increased from 15.3% a year ago. Finally, Unichain currently accounts for 4.2% of Uniswap's total trading volume.

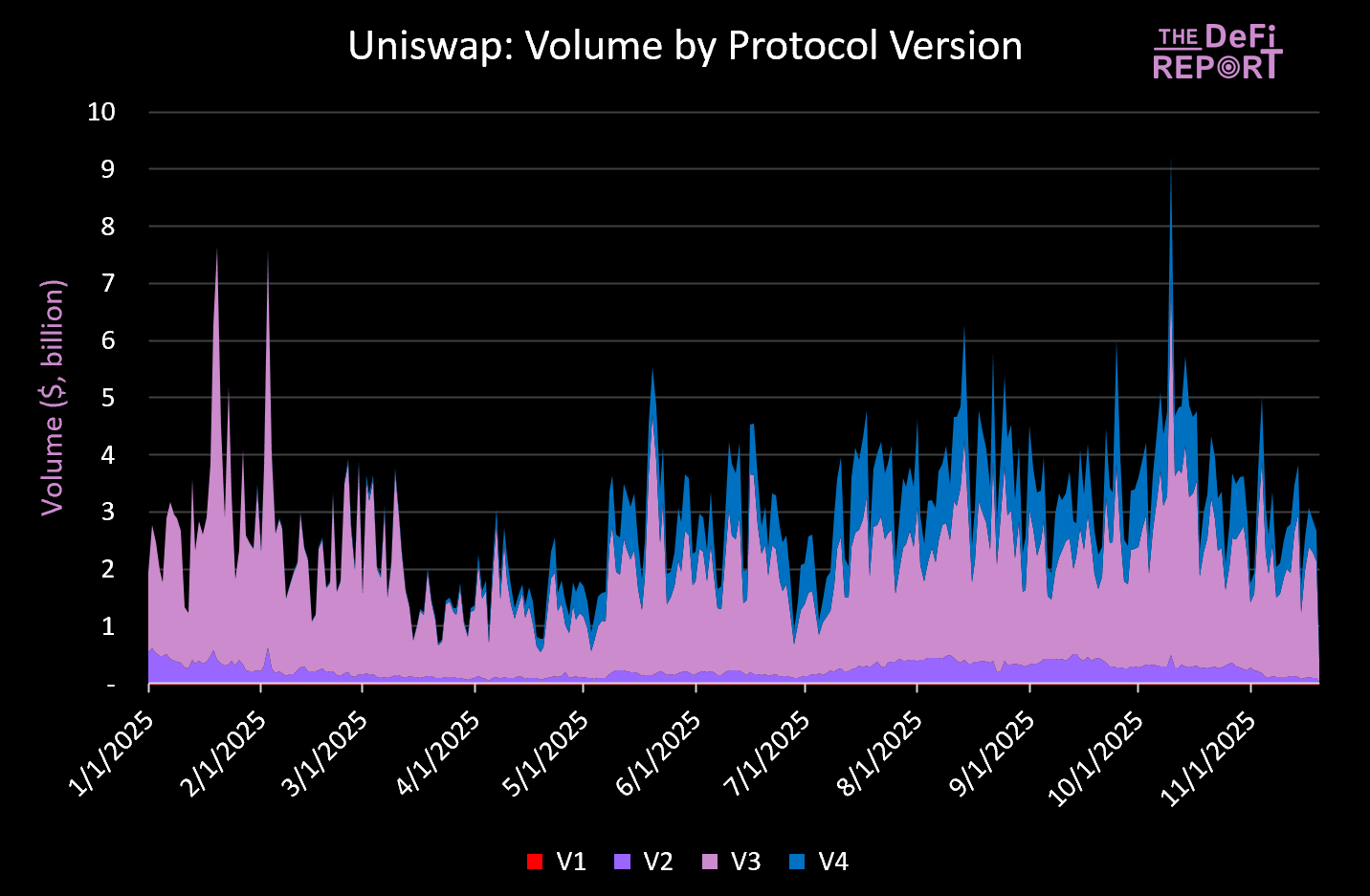

Trading Volume by Version

V3 (in pink) was launched in May 2021, and currently, 68.7% of Uniswap's trading volume operates through V3; V4 (in blue) was launched this January, currently accounting for 24.9% of trading volume; as for V2, launched in May 2020, it still accounts for 6.3% of trading volume at this stage.

"Organic Volume" vs. "Inorganic Volume"

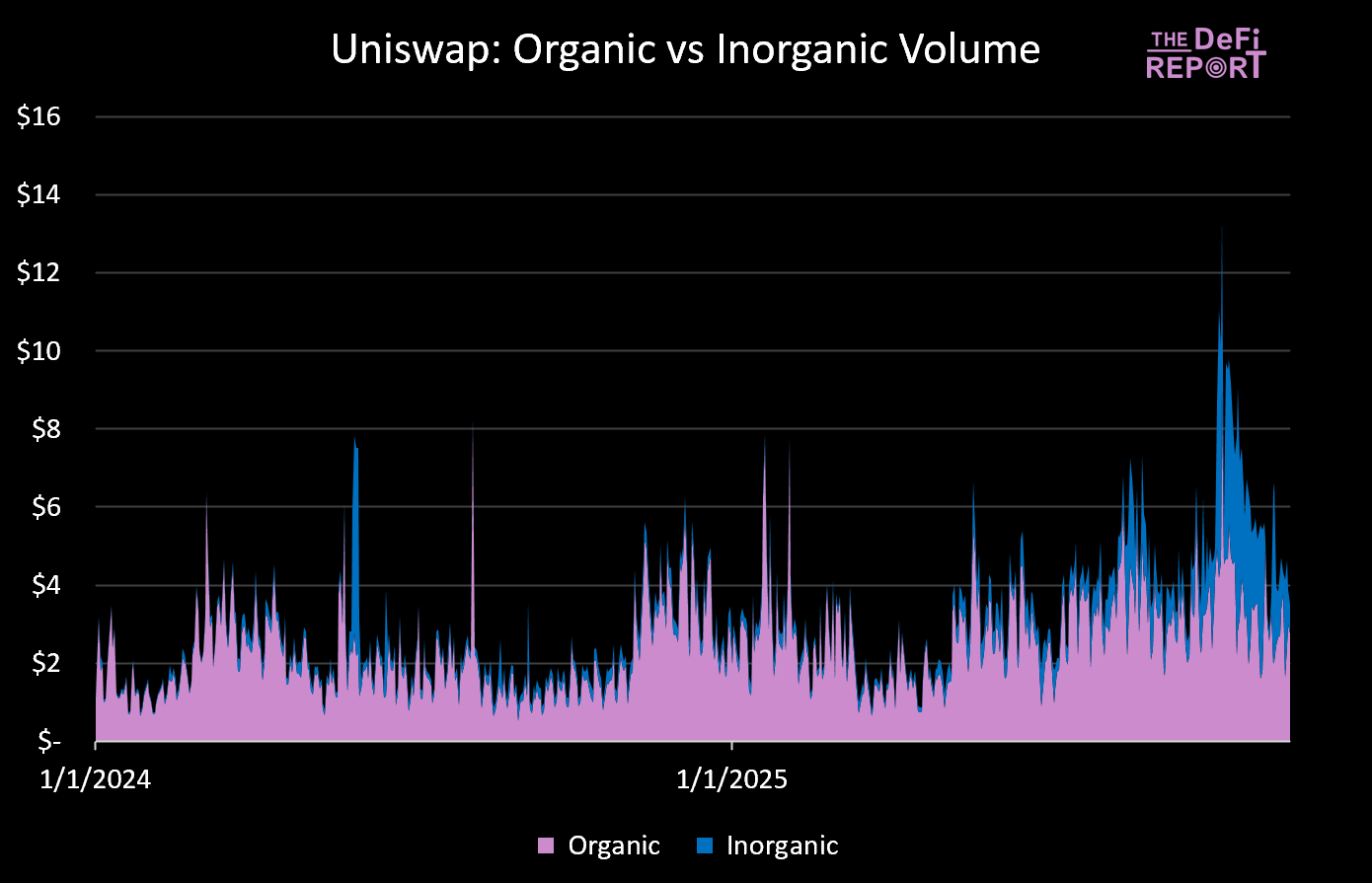

Uniswap's trading volume appears very healthy. However, we must clarify that this data actually includes "wash trading volume." Therefore, we hope to better understand Uniswap's true trading volume, distinguishing between "organic volume" and "inorganic volume."

This article derives "inorganic volume" by aggregating the trading volume of pools that meet the following criteria:

Fewer than 1000 unique addresses in the trading pool

Fewer than 10 days of trading

A single trader accounts for more than 30%

10 or fewer addresses account for more than 80% of total flow.

The median trading volume is less than $25,000.

By applying these filters, we find that 12.3% of Uniswap's trading volume in 2024 is "inorganic volume." In 2025, this proportion nearly doubled to 23.3%. More notably, after the liquidation event on October 10, "inorganic volume" surged significantly, reaching a peak of 43%.

This is why we believe that it may be due to the low market sentiment, with some lower-volume liquidity pools "faking" trading volume to attract new traders.

New Users vs. Old Users

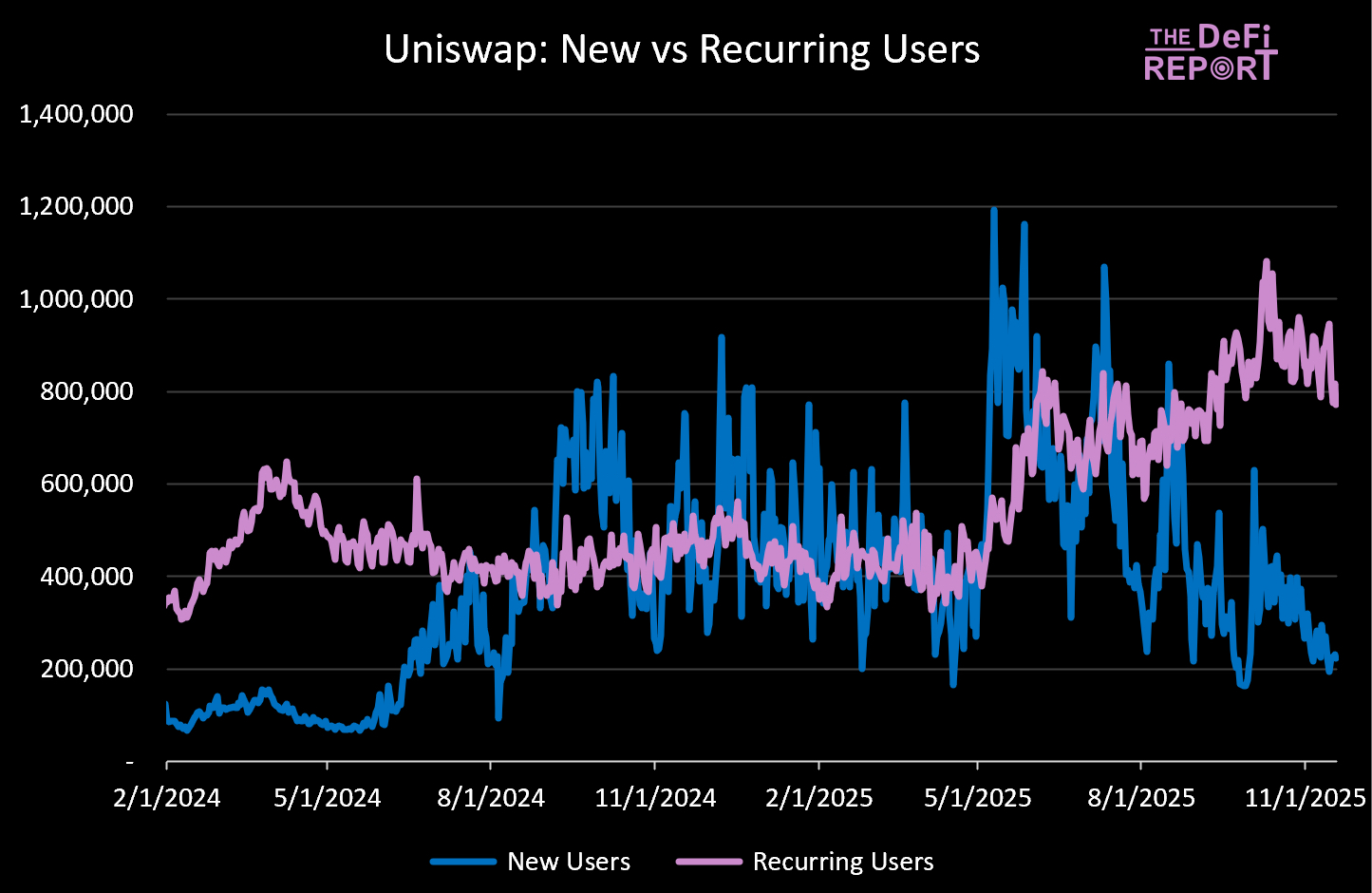

In the past 30 days, Uniswap's daily active user count has exceeded 857,000, up from 450,000 per day a year ago.

However, in terms of new users/trading addresses, the protocol currently averages 278,000 new users/trading addresses per day, down from 434,000 new users/trading addresses per day a year ago.

Final Thoughts

If the recent governance proposal is approved as expected, we will reassess Uniswap. Specifically, it will no longer be a protocol not worth investing in.

Moreover, this move may compel other protocols to take similar actions to align with the interests of token holders—this is a healthy development trend for the industry.

Core Impacts of the Governance Proposal

Impact on Uniswap Labs

Uniswap Labs will lose revenue from interface, wallet, and API fees, as their focus will shift to specifically serving the DAO/token holders. If the $132 million previously obtained from these revenue sources was used to fund protocol development, future funding will need to come from other channels. Uniswap users will undoubtedly be the biggest winners of this proposal.

Impact on Liquidity Providers (LPs)

Liquidity providers will lose about 16% of their trading fee share due to the protocol fee switch, but will benefit from the optimization of the Protocol Fee Discount Auction (PFDA). Uniswap estimates that the new auction mechanism could allow LPs to earn an additional $0.06 to $0.26 for every $10,000 in trading volume.

Impact on Token Holders/Token Economics

100 million UNI tokens (valued at $663 million at the current UNI price) will be burned. The circulating supply of UNI will decrease from 629 million to 529 million, and the token price is expected to rise to $7.88 due to the reduced circulation.

In the future, approximately 16% of trading fee revenue will be burned. So far this year, this will amount to the destruction of UNI tokens worth $136 million (20.5 million UNI). Additionally, $3 million in Unichain sequencer fees will also be burned (452,000 UNI).

These changes will have a positive impact on UNI holders.

Impact on Traders

Aside from achieving more efficient trade execution through the new PFDA auction mechanism, there should be no substantial impact on traders. Trading fees will remain unchanged.

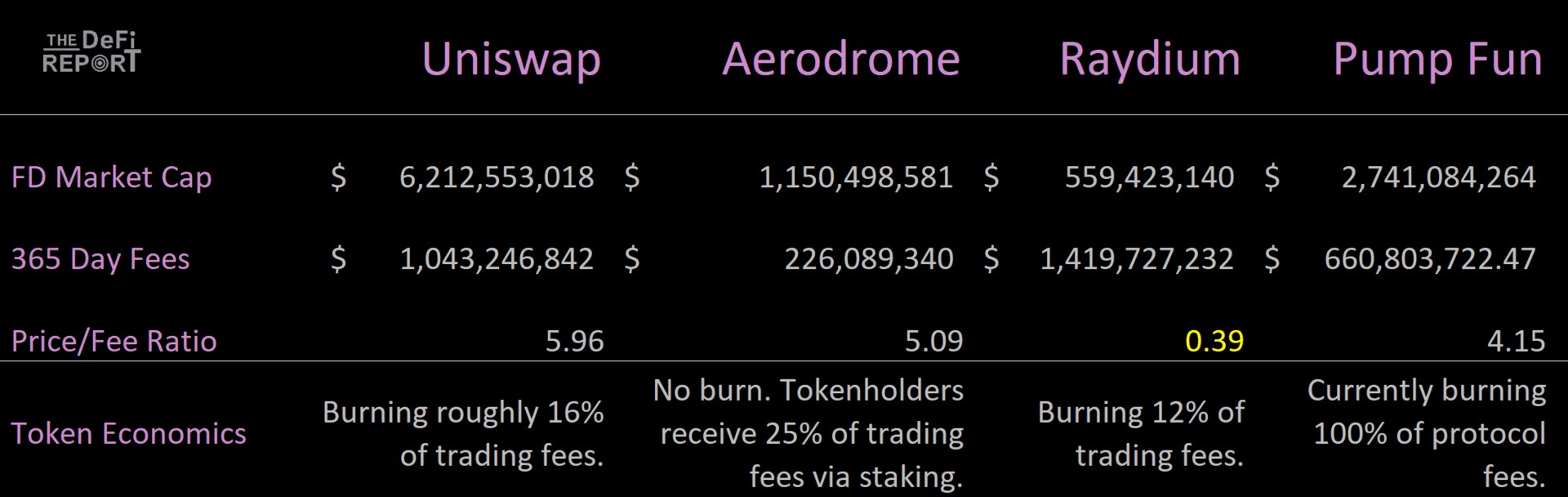

Current Valuation Comparison of Uniswap

Summary of Key Points

Compared to Aerodrome (Base), Raydium (Solana), or Pump (Solana), the proposed changes aligned with UNI holders have not affected Uniswap's relative valuation.

However, in terms of token economics and the appreciation of token holders, it now places UNI holders in a similar competitive environment. As shown above, Raydium appears to be significantly undervalued relative to its peers.

Future Outlook

What will determine the winners in the DEX category?

Ultimately, we believe it depends on where Wall Street decides to set up shop. We should start to get some answers in the next year or two.

At the end of the day, we think it comes down to where Wall Street decides to "build." We should see some answers in the next year or two.

One point we are closely monitoring is Uniswap's "hooks," which were introduced earlier this year in version 4. The "hooks" can enable the following functionalities:

Dynamic fees (fees that automatically adjust based on volatility);

On-chain KYC/permissioned pools (necessary for institutional users);

Time-weighted average market maker execution (allowing large orders to be executed slowly);

Oracle-enhanced pools (trading prices can reference external oracles);

Custom fee flows (automatically burning tokens or allocating them to stakers);

Circuit breaker mechanisms/risk rules (pausing trading during extreme volatility);

Automated concentrated liquidity (automatically rebalancing liquidity provider positions).

We believe that this (already built) infrastructure is precisely what institutions will consider when deciding where to position themselves. Uniswap was once "forgotten" in this trading cycle, but now that its foundation has been laid, it may reverse its fortunes in the next trading cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。