Author: Maryland HODL, Crypto KOL

Translation: Golden Finance

A struggle for monetary power is erupting in plain sight—but few realize the stakes involved. Here are my personal speculations.

In recent months, a new pattern has emerged in politics, markets, and media. Disparate news headlines suddenly connect, market anomalies no longer seem so coincidental, and institutional behavior exhibits unusual aggressiveness. Beneath the surface, deeper transformations appear to be at play.

This is not a normal monetary cycle.

This is not a traditional partisan struggle.

This is not "market volatility."

What we are witnessing now is a direct confrontation between two competing monetary systems:

The old order… centered around JPMorgan, Wall Street, and the Federal Reserve.

And the new order… centered around government bonds, stablecoins, and a Bitcoin-based digital architecture.

This conflict is no longer theoretical; it is real and intensifying. For the first time in decades, it has become public.

Here is an attempt to analyze the real battlefield… a battlefield that most analysts fail to see because they continue to apply the framework of 1970-2010 to a world that is breaking free from its constraints.

I. JPMorgan Steps Out of the Shadows

Most people think of JPMorgan as a bank. This is a misconception.

JPMorgan is the operational arm of global financial institutions… it is the entity closest to the core mechanisms of the Federal Reserve, influencing global dollar settlements and acting as the primary executor of the traditional monetary system.

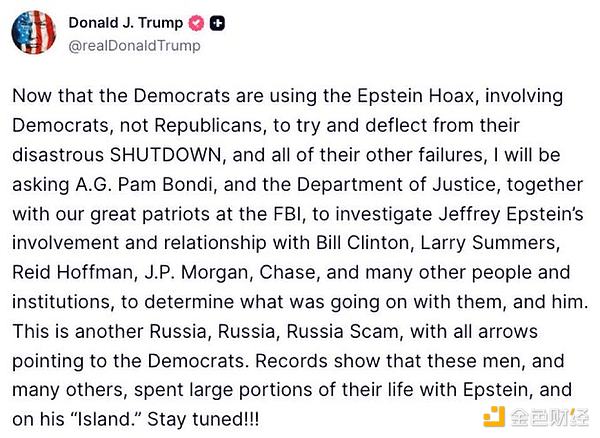

So, when Trump released information about the Epstein network and explicitly named JPMorgan (rather than viewing individuals in isolation), it was not a rhetorical exaggeration. He pulled deeply entrenched institutions within the system into this public relations storm.

At the same time:

JPMorgan is a major driver of shorting MicroStrategy ("MSTR"), while the macro narrative of Bitcoin threatens traditional monetary interests.

Clients attempting to transfer MSTR shares from JPMorgan are reflecting delivery delays, suggesting that the custody system may be under stress… such stress only appears when internal systems are overwhelmed. https://x.com/EMPD_BTC/status/1991886467694776531?s=20

JPMorgan occupies a central position in the strategic framework of the Federal Reserve, both structurally and politically. Weakening its position is tantamount to weakening the old monetary system itself.

None of this is normal.

All of this is part of the same story.

II. The Government's Quiet Shift: Returning Monetary Policy Power to the Treasury

The media is keen on shifting focus to culture wars, while the real strategic agenda is money.

This administration is quietly working to pull the center of currency issuance back to the U.S. Treasury… specific measures include:

Stablecoins integrated with government bonds

Programmable settlement rails

Bitcoin reserves as long-term collateral

This adjustment will not change the existing system.

It replaces the core power center of the system.

Currently, the Federal Reserve and commercial banks (led by JPMorgan) almost monopolize all dollar issuance and circulation. If government bonds plus stablecoins become the primary channels for issuance and settlement, the banking system will lose authority, profits, and control.

JPMorgan understands this.

They fully grasp the implications of stablecoins.

They understand what will happen if the Treasury becomes the issuer of programmable dollars.

So they do not rely on press releases but rather on market strategies to counter:

Derivative pressure,

Liquidity bottlenecks

Narrative suppression

Custody delays,

And political influence.

This is not a policy dispute.

This is a struggle for survival.

III. Bitcoin: An Unexpected Battlefield

Bitcoin is not the target… it is the battlefield.

The U.S. government wants to conduct low-key strategic accumulation before explicitly advancing a government bond-based digital settlement system. An early announcement would trigger a gamma squeeze, causing Bitcoin prices to soar and making accumulation costs prohibitively high.

The problem?

The old system employs suppression mechanisms similar to those used in gold trading to dampen Bitcoin signals:

An oversupply of paper Bitcoin derivatives,

Large-scale synthetic short positions,

Cognitive warfare

Liquidity shocks at key technical levels,

Custody bottlenecks at major brokers.

JPMorgan has spent decades mastering these techniques in the gold domain. Now, they are applying these techniques to Bitcoin.

Not because Bitcoin directly threatens bank profits… but because Bitcoin strengthens the Treasury's future monetary system, undermining the Federal Reserve's monetary system.

The government faces a brutal strategic choice:

Allow JPMorgan to continue suppressing Bitcoin, thereby retaining the ability to accumulate Bitcoin at low prices.

Make a strategic statement that triggers a Bitcoin price breakout, but lose the covert advantage before political alliances are solidified.

This is why the government remains silent on Bitcoin.

Not because they do not understand, but because they understand too well.

IV. Both Sides Are Fighting on a Fragile Foundation

This struggle occurs atop a monetary system built over sixty years:

Financialization

Structural leverage

Artificially suppressed interest rates

Asset-driven growth models

Concentration of reserves,

And institutional cartelization.

Historical correlations have broken down everywhere, as the entire system is no longer coordinated. Those traditional financial experts who view this as a normal cycle fail to realize that the cycle itself is disintegrating.

The regime is unraveling.

The plumbing system is unstable.

Incentive mechanisms on both sides have diverged.

Both factions—the traditional order of JPMorgan and the emerging order of the Treasury—are playing on the same fragile infrastructure. Any miscalculation could trigger a chain of turmoil.

This is why these actions appear so strange, so disjointed, so insane.

V. MSTR: The Conversion Bridge Under Direct Attack

Now we introduce a key aspect that most commentators have overlooked.

MicroStrategy is not just a company that holds Bitcoin.

It has become a conversion mechanism—a bridge between traditional institutional capital and the emerging Bitcoin government bond monetary architecture.

The structure of MSTR, its leveraged Bitcoin strategy, and its preferred stock products effectively convert fiat currency, credit, and government bond assets into long-term Bitcoin exposure. In this way, MSTR has effectively become a convenient entry point for institutional and retail investors into the Bitcoin market, those who cannot (or do not wish to) hold spot Bitcoin directly but need to escape the artificially suppressed yields of YCC.

This means:

If the government envisions a future where Treasury-supported digital dollars and Bitcoin reserves can coexist, then MSTR is the key corporate channel to realize this transition.

JPMorgan understands this as well.

So when JPMorgan:

Facilitates large-scale shorting,

Causes delivery delays,

Pressures MSTR's liquidity,

And fosters negative market sentiment,

this is not just an attack on Michael Saylor.

It is an attack on the conversion bridge that enables the government's long-term accumulation strategy.

There is even a plausible scenario (though still speculative, but increasingly logical) that the U.S. government will eventually intervene and make a strategic investment in MSTR. As recently suggested by @joshmandell6:

Acquiring ownership of MSTR in exchange for injecting U.S. government bonds,

This would explicitly support MSTR as a preferred vehicle and help improve its credit rating.

Doing so would carry political and economic risks.

But it would also send a signal that the world cannot ignore:

The U.S. is defending a key node in its emerging monetary system.

This alone explains why JPMorgan has launched such a fierce attack.

VI. Critical Window: Control Over the Federal Reserve

Next, time becomes very urgent.

As @caitlinlong recently pointed out: Trump needs to take control of the Federal Reserve's actual operations before Powell steps down. Currently, the situation is unfavorable for him… he is trailing by about three to four votes on the Federal Reserve Board.

Several bottlenecks are converging:

The lawsuit filed by Lisa Cook against the Supreme Court may last for months and delay critical reforms.

The Federal Reserve Board elections in February 2025 could solidify a hostile governance situation for years to come.

The underperforming Republican Party in the upcoming midterm elections will weaken the government's ability to adjust monetary policy.

This is why economic growth momentum is crucial now, not six months from now.

This is why the Treasury's issuance strategy is changing.

This is why stablecoin regulation has suddenly become critically important.

This is why the suppression of Bitcoin is so significant.

This is why the debate surrounding MSTR is not a trivial matter, but a structural issue.

If the Trump administration loses control of Congress, he will become a lame-duck president… unable to restructure the monetary system and instead bound by the institutions he originally sought to evade. By 2028, the window of opportunity will be gone.

Time is of the essence, and the pressure is immense.

VII. A Broader Strategic Picture

When you take a step back, patterns emerge:

JPMorgan is fighting a defensive battle to preserve the Federal Reserve banking system, as it is the primary global node of that system.

This administration is quietly transitioning, restoring the Treasury's monetary dominance through stablecoins and Bitcoin reserves.

Bitcoin is the proxy battlefield, price suppression protects the old system, while covert accumulation strengthens the new system.

MSTR is the conversion bridge, the institutional entry point that threatens JPMorgan's control over capital flows.

The governance of the Federal Reserve is a bottleneck, and political timing is a limiting factor.

Everything is happening on an unstable foundation, where any misstep could trigger unpredictable systemic consequences.

This is not financial news, nor is it political news.

This is a civilizational-level monetary transformation.

For the first time in sixty years, this conflict is no longer concealed.

Chapter VIII: Trump's Strategy

The government's strategy is becoming clearer:

Let JPMorgan overreach in its suppression efforts.

Quietly accumulate Bitcoin.

Defend and strengthen the MSTR bridge as much as possible.

Act swiftly to reshape the governance structure of the Federal Reserve.

Position the Treasury as the issuer of digital dollars.

Then wait for the right political moment (possibly the "Mar-a-Lago Agreement") to unveil the new framework.

This is not a mild reform; it is a complete upheaval of the 1913 order… returning monetary power to political institutions rather than financial institutions.

If this strategy succeeds, the U.S. will enter a new monetary era based on transparency, digital rails, and a hybrid Bitcoin collateral framework.

If it fails, the old system's control will strengthen, and the window for change may not reopen for another generation.

In any case, the war has already begun.

Bitcoin is no longer just an asset… it is the dividing line between two competing futures.

What both sides fail to understand is that ultimately, both will lose to absolute scarcity and mathematical truth.

These two giants are vying for control, preparing for contingencies, and watching their security.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。