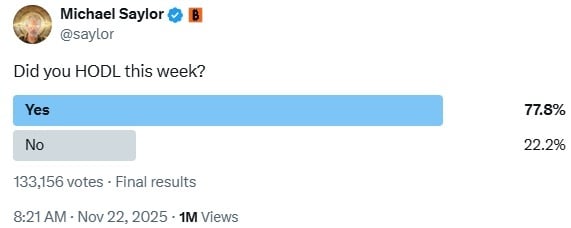

Strategy executive chairman Michael Saylor shared on Nov. 22 on social media platform X a poll conducted during a sharp bitcoin price drawdown, capturing how users responded while the asset was under pressure. The post highlighted behavior that often shapes short-term sentiment.

“Did you HODL this week?” launched the poll, circulating as bitcoin slipped toward key support zones earlier in the week. The drop unsettled traders, sending the price briefly into the low-$80,000s before rebounding near $86,550. Despite the turbulence, 77.8% of 133,156 respondents selected Yes. The reaction suggested many users maintained positions instead of exiting during the downturn, even as daily charts signaled persistent weakness.

Amid a bitcoin price dip, Saylor remains a staunch bull, saying his firm, Strategy (MSTR), which owns a massive bitcoin treasury, is “indestructible.” Concurrently, MSTR faces the risk of exclusion from MSCI indices because its digital asset holdings now exceed 50% of total assets. Such an index removal, warned by JPMorgan, could force billions in passive fund outflows, severely challenging Strategy’s bitcoin-centric strategy. Saylor insists MSTR is an operating business, not just a fund.

Read more: Strategy Faces MSCI Index Heat While Saylor Drives a Deeper Bitcoin Finance Push

Despite recent sharp drops, analysts and fund managers are projecting a strong bitcoin rebound, citing its long-term potential. Forecasts for 2025 often range up to $200,000, anchored by rising institutional adoption via exchange-traded funds (ETFs). They view the current volatility as a “healthy correction,” a natural consolidation phase driven by macroeconomic uncertainty. Continued onchain accumulation by large holders and a potential easing of global monetary policy are expected to fuel the next major rally.

- Why does Michael Saylor’s poll matter for bitcoin investors?

The overwhelming 77.8% “HODL” response signals strong investor conviction during volatility, reinforcing confidence in bitcoin’s long-term strength. - How could MSCI index exclusion impact Strategy (MSTR) and investors?

A potential MSCI removal could trigger billions in passive outflows, creating short-term pressure on MSTR despite Saylor’s insistence that it remains a viable operating business. - What does current bitcoin volatility indicate for long-term positioning?

Analysts view recent price swings as a healthy consolidation phase, supporting continued accumulation by institutional and long-term holders. - Why are 2025 price forecasts for bitcoin still bullish?

Rising institutional demand through ETFs, macro easing, and persistent onchain accumulation underpin projections that bitcoin could approach $200,000 in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。