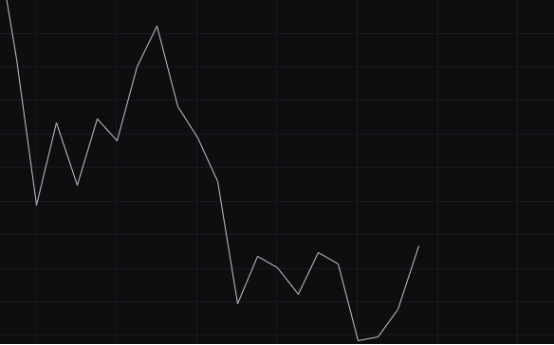

Today is Sunday, and currently, the market has risen by about 2 points. For a Sunday, such an increase is already quite good. Coupled with yesterday's doji, we can see that the market shows signs of stopping the decline, so our short positions are gradually exiting.

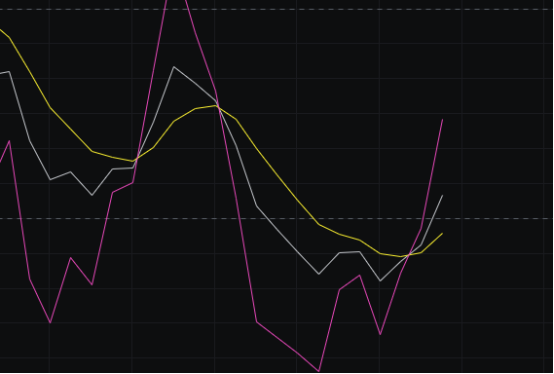

From the MACD perspective, the energy bars are retracting, and the fast line is also slowing down, indicating signs of stopping the decline.

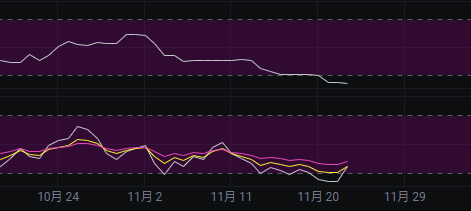

From the CCI perspective, the CCI has been rising for several days and is now above the previous low. This also shows that the CCI is stopping the decline.

From the OBV perspective, the OBV has rebounded, but the volume is relatively small. If we want to continue the upward trend, we need a significant influx of volume.

From the KDJ perspective, after the KDJ golden cross yesterday, we mentioned that to maintain the golden cross formation, the market needs to rise. Today, the market is indeed rising, which aligns with our judgment on the KDJ.

From the MFI and RSI perspective, the MFI is still in the oversold area, but the RSI has already exited the oversold area. Yesterday, we discussed that to stop the decline, the indicators need to be pulled out of the oversold area. Currently, the bulls are working towards this, and we will see if they can sustain it.

From the moving average perspective, several moving averages are still pressing down, but the fact is that the market is rising. Here, we can consider this as a lagging response of the moving average indicators, which is a normal phenomenon.

From the Bollinger Bands perspective, the Bollinger Bands are still within a downward channel. If the market is truly going to stop the decline, the downward channel will end in the near future. When we see the end of the downward channel, we will then assess whether the market has stopped declining.

In summary: Today, the market shows signs of stopping the decline, but to confirm this, we need to see how the market performs in the coming days. However, since we have already observed signs of stopping the decline, short positions should be prepared to exit. Today's resistance is seen at 87000-88500, and support is at 85000-83500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。