Bitcoin is currently maintaining a weak consolidation around the 85,000 level, with strong short-term price fluctuations. Both bulls and bears are interspersing back and forth, but the overall trend still revolves around weak oscillation, so a steady trend-following approach is sufficient. Since the cryptocurrency market is characterized by high risk and high reward, investors must do their homework before entering the market, learning comprehensive trend analysis. Below are some personal tips for watching the market summarized by Mr. Coin, which I hope will be helpful to everyone.

First, look at the bulls and bears: Whether you prefer to go long or short, closely monitor the highest and lowest points of the day, as well as the recent highs and lows. No breakthrough means the trend remains in consolidation, while high and low points converging towards the middle indicate a compression of the oscillation range. Conversely, if there is a breakthrough of the highest or lowest point, it means a change in the market. This is a simple distinction between bulls and bears. If the price continues to rise and refreshes new highs, forming a series of upward candles, it indicates that the current trend is leaning towards the upside.

Second, look at the strength: After a continuous rise or fall, if the trend changes significantly but does not break through key points, this trend is often not sustainable. For example, Bitcoin has been falling recently, and there has been no breakthrough of key resistance levels. As I mentioned in my article, do not blindly chase long positions; be wary of a market reversal, which could lead to a strong correction. This wave dropped from 126,000 to around 80,000 quickly, so be sure to pay attention to risk when trading. Focus on short-term gains.

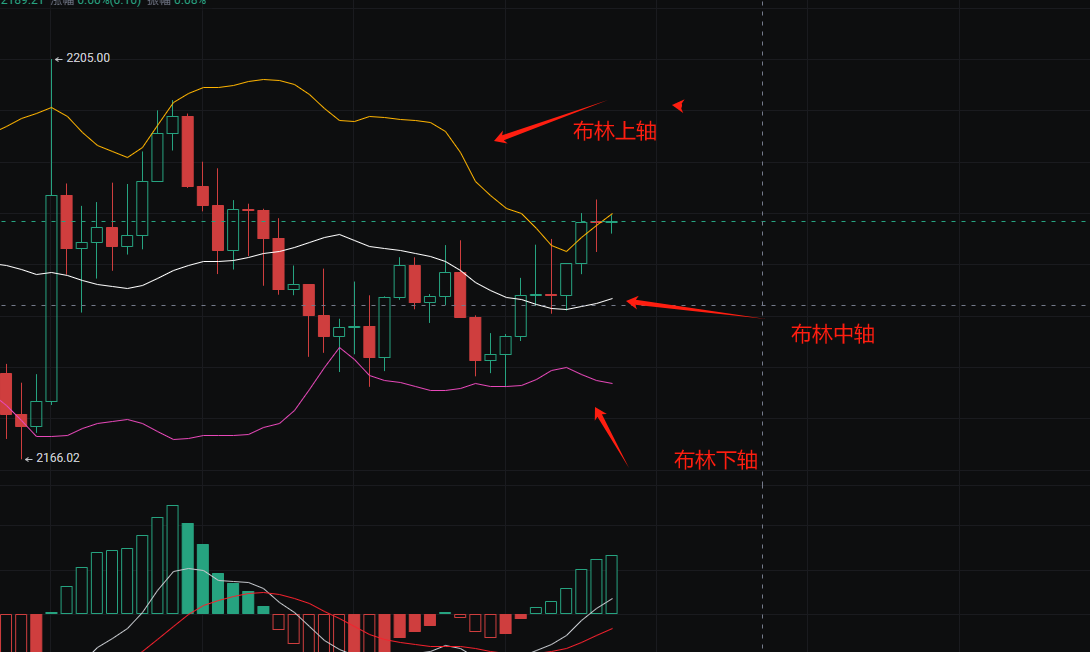

Third, look at the technicals: Understand the long-term patterns on daily and weekly charts, and for short-term analysis, look at the four-hour or hourly charts, comparing them with previous candlestick patterns for detailed analysis. The main focus should be on the changes between support and resistance. Based on market changes, adjust your trading strategy in a timely manner; being flexible and adaptable can help avoid investment blind spots.

Fourth, look at the trend: Although contract trading emphasizes short-term opportunities for both bulls and bears, you must make judgments about the larger market trend. For example, we are currently in a long-term consolidation phase before breaking upwards, with prices attempting to test the four-hour mid-axis resistance, allowing for further price increases. Therefore, it is not advisable to enter short positions until reaching key levels, and one should be cautious even when holding. This wave of trading should wait for stabilization before following the trend, but be mindful of the resistance area nearby and seize profits in a timely manner.

Fifth, look at the mindset: Market conditions vary daily, and trading strategies will also differ. If you do not understand the current trading mindset and defense lines, Mr. Coin suggests asking your teachers more questions or verifying today’s strategy based on yesterday’s thoughts combined with today’s trends. Remember that each teacher may have different strategies, so sometimes reading too many articles can be counterproductive. The essence lies in quality, not quantity.

Teaching someone to fish is better than giving them fish. Today, I briefly shared some tips for watching the market. I wonder if everyone has learned something? If there is anything you do not understand or if you need other tips, feel free to leave a message or privately consult Mr. Coin himself.

For more real-time trading strategies, online technical learning, and exit strategies, you can follow the mentor's public account (Mr. Coin on Cryptocurrency) to get the addition method: the first ten each day can receive free exit strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。