I still trust data more than feelings, even my own feelings which I find unreliable. Perhaps data won't provide a 100% answer, but it can better balance my feelings.

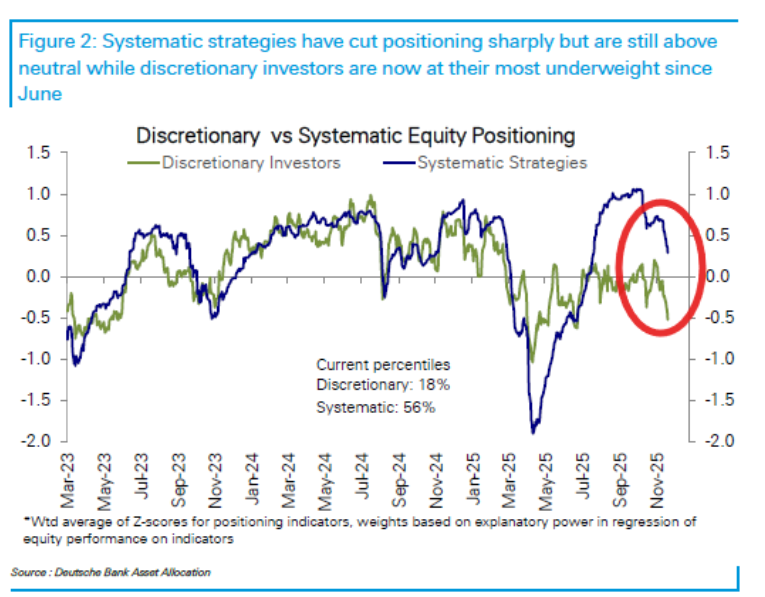

In this chart, there are two data points that I habitually refer to as active funds (green line) and strategy funds (blue line).

Investors in active funds include hedge funds and mutual funds, which rely on subjective judgment, fundamental analysis, and macro forecasts to decide on buying and selling, falling under the category of active management.

These investors are often influenced by emotions and macro factors to determine the direction of their trades.

Investors in strategy funds include quantitative funds, CTAs, risk parity funds, etc., which rely on algorithms, models, and preset rules to determine positions, belonging to the category of systematic management.

The position changes of these investors are usually more disciplined, based on trends or volatility indicators as trading references.

From the chart, it is clear that a gap began to appear between active funds and strategy funds starting in June 2025. In mid-April, faced with the dual uncertainties of tariffs and the Federal Reserve, both funds experienced significant declines, especially strategy funds which hit a low not seen in the past year and a half, reaching -2. This indicates that strategy funds were significantly reducing their holdings, with exposure close to zero.

This situation has only occurred with a probability of 2.3% in history, indicating that the reduction (decline) in April is a rare event historically, meaning that its model issued the highest level of risk alert and executed a historically significant reduction, representing one of the most extreme bearish signals.

While the reduction in active funds was not as aggressive, it was still the largest reduction in the past year and a half, with data reaching -1. This means that most active fund managers executed large-scale sell-offs and risk-reduction operations due to concerns about fundamentals, the macro economy, or Federal Reserve policies.

According to historical statistics, a -1 data point is lower than the position held by active funds 84% of the time, also indicating an extremely bearish sentiment among active funds.

In June and July, both funds rebounded, with active funds only returning to near the zero axis, indicating that the positions of active funds have only reached a normal level, without significant appreciation or the emergence of FOMO sentiment, suggesting that investors in active funds do not have very optimistic expectations for the future and are prepared to withdraw at any time.

However, strategy funds began to significantly increase their holdings, especially in September and October, marking the largest increase in the past year and a half. This gap led to both funds reducing their holdings after the Federal Reserve signaled in December that it would not cut interest rates, and while the reduction data was not significantly different, it is clear that the current position of active funds is already low (-0.5).

Although strategy funds are also pessimistic about the market and have shown a reduction in sentiment, their positions remain above normal (the zero axis). In simpler terms, strategy funds do not view the situation as entering a full-blown "bear market," especially compared to April, where strategy funds did not adopt a completely bearish stance.

While active funds are bearish, a low position in active funds means they are unlikely to sell off significantly again, as their positions are already limited. In simpler terms, it is very likely that the upcoming sell-off volume will not be very large, given that only 18% of the position remains. The following points are the focus of the entire piece:

The sell-off of active funds may not be significant, but the sell-off of strategy funds has not yet ended. If market sentiment remains pessimistic or there are actual negative factors, there is still considerable room for strategy funds to sell off. In simpler terms, if strategy funds sell off back to -2, prices could drop by around 15%. Correspondingly, the VIX is expected to be above 50.

The amount managed by active funds is larger. While active funds may not necessarily start buying when strategy funds are selling, once there is a reversal in sentiment or policy, active funds will enter more quickly and build positions earlier.

If Williams' speech is judged to be a market reversal point, then the magnitude of the rebound that may occur next could be larger. The core task of active funds is to assess systemic risk. The previous sell-off was due to concerns that the Federal Reserve might make mistakes leading to an economic recession (systemic risk). If it is found that the Federal Reserve can correct its course, it is very likely that they will begin to build positions again, and there is a high degree of consistency between active and strategy funds, meaning strategy funds will likely also end their sell-off.

It's getting a bit late today, and I will post another tweet tomorrow to discuss whether the recent decline is indeed due to market concerns about the Federal Reserve.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。