It's really the Federal Reserve whether the market rises or falls. After Powell announced that the Federal Reserve would not cut interest rates in December, the market has been in a downward trend. Investors are more concerned that high interest rates may trigger an economic recession, leading to significant declines in both the U.S. stock market and $BTC. However, today one of the Federal Reserve's key decision-makers, Williams, suddenly spoke out, indicating that given the current slightly tight monetary policy, there is still room for further adjustments in the short term.

This statement was interpreted by the market as Williams supporting a rate cut in December, and the reason given by Williams was a greater concern about the pressures facing the labor market, which aligns with my ongoing assertion that there is significant employment pressure in the U.S. Of course, this does not mean that the Federal Reserve will definitely cut rates in December, but at least a path to a rate cut has been seen.

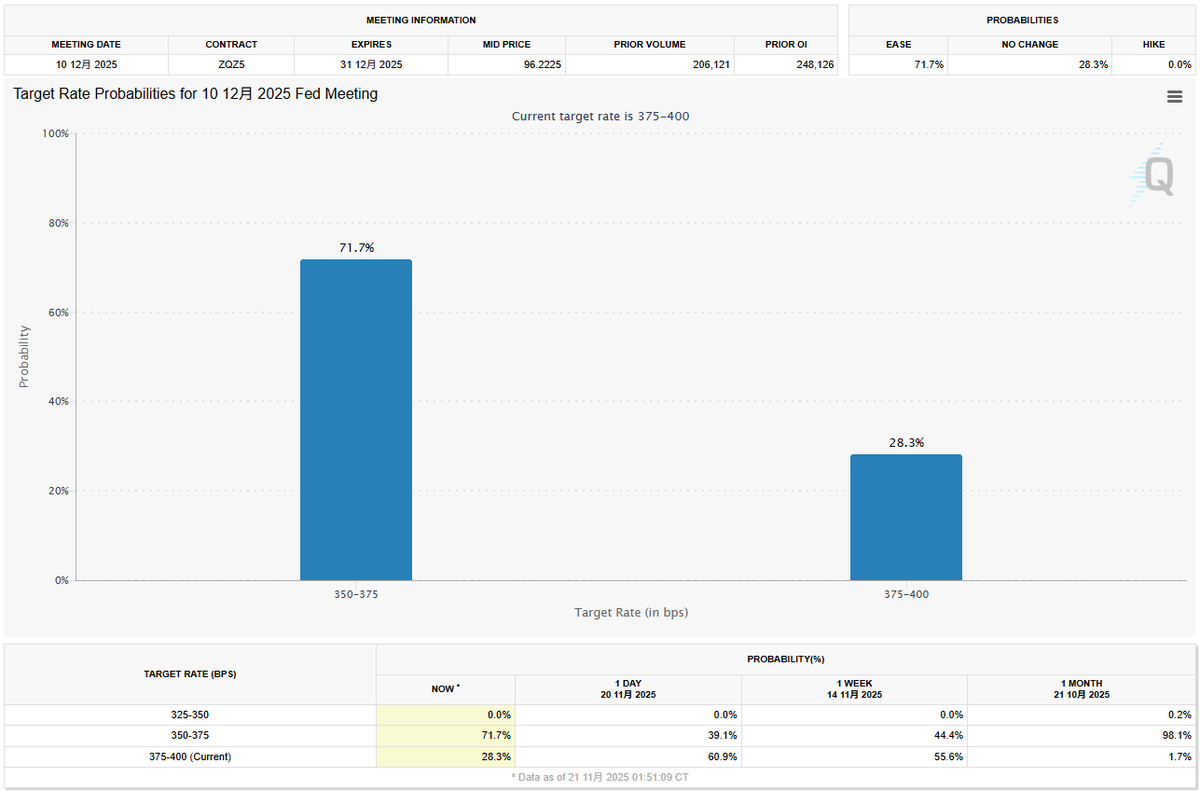

After Williams' speech, the CME raised the probability of a Federal Reserve rate cut in December to around 72%. Moreover, the Federal Reserve's spokesperson, Nick, not only retweeted Williams' comments but also directly indicated that Williams intends to cut rates in December, suggesting that Williams is a senior assistant to Powell, implying that this likely has Powell's approval.

As a result, the market rebounded. Although the U.S. stock market, especially tech stocks, has not yet erased the losses from yesterday, it has provided confidence to investors. More importantly, tomorrow is the weekend, which may not significantly help the U.S. stock market but could greatly alleviate the panic among cryptocurrency investors.

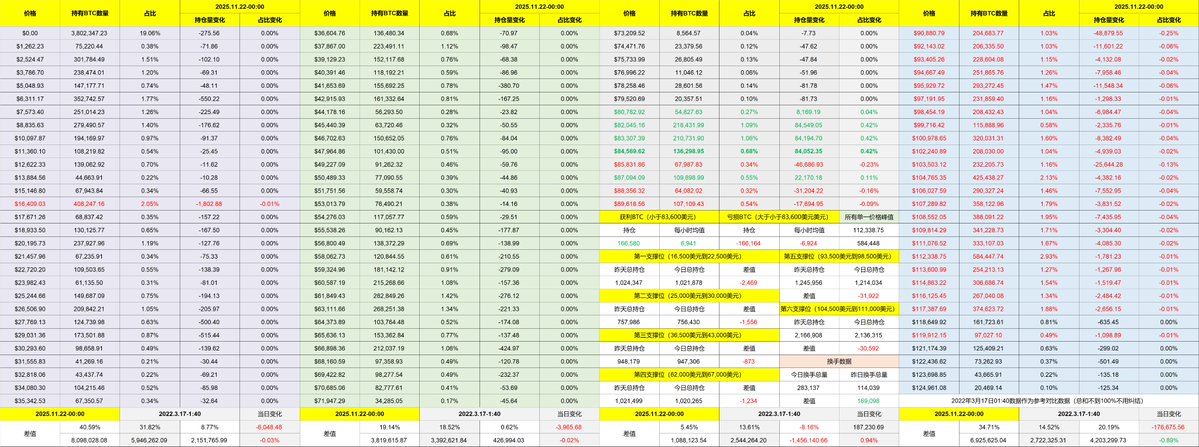

Looking back at Bitcoin's data, it nearly fell below $80,000 during the day, triggering market panic again, with turnover rates returning to high levels. On the same day, Williams' remarks pulled back some of the downward trend of $BTC. From the data, it appears that the panic is still being driven by short-term bottom-fishing investors, while those who are stuck with losses at high levels have not made much movement, similar to earlier investors.

Currently, the market is in a state of extreme uncertainty. Unlike the U.S. stock market, even during times of poor liquidity, Williams' remarks have concentrated the limited liquidity in the stock market, while the cryptocurrency market tends to lag behind. However, at least it has alleviated panic emotions, and the weekend should not be too bad.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。