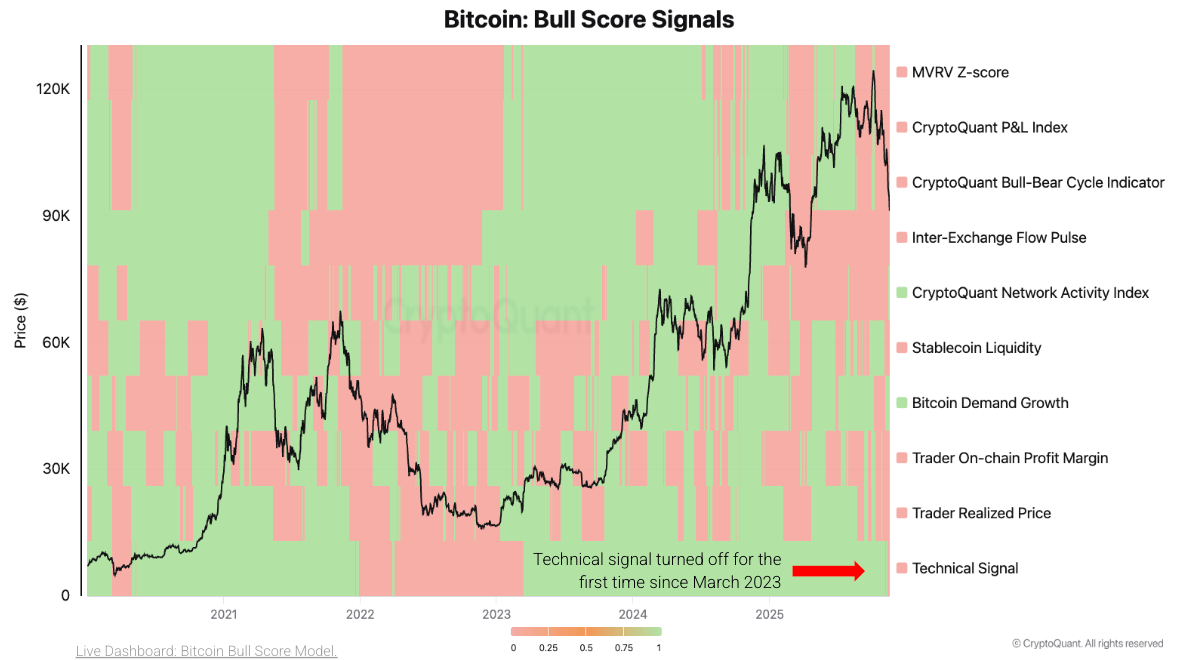

Bitcoin is showing its weakest conditions since the bull cycle began in early 2023, according to a detailed analysis from analysts at cryptoquant.com. With bitcoin now trading near $84,386 and down roughly 33% from its peak, the report outlines a set of technical and demand-based signals that collectively point to a strong bearish phase.

Cryptoquant highlights that its Bull Score Index has fallen to 20 out of 100, a level associated with deep market stress. The decisive break below bitcoin’s 365-day moving average forms the center of the technical deterioration, marking the first such breach since the confirmation of the 2022 bear market. Researchers emphasize that bitcoin has held that average through every correction of the current cycle until now, giving this breakdown additional weight.

Demand erosion is equally prominent. Cryptoquant notes that treasury-company buying—a major force earlier in the year—has effectively collapsed after those firms saw market capitalizations fall 70%–90%, removing their ability to raise capital and add bitcoin to their treasuries. Strategy’s accumulation has slowed dramatically as well, declining from 171,000 BTC in December 2024 to just 9,600 BTC today as its market cap approaches the value of its holdings.

Also read: Bitcoin Price Watch: Daily Downtrend Tightens Its Grip on Price Action

Exchange-traded fund (ETF) demand is losing steam too. Cryptoquant records that U.S. spot ETFs are growing at one of their slowest annual rates since launch, and some flows have turned negative. Institutions using ETFs for basis trades may unwind positions, adding more pressure to spot markets.

With bitcoin now 33% below its peak, the market has dipped into a new support range between $80,000 and $81,000. While bear markets can still deliver temporary rallies, researchers caution that the 365-day moving average is now a strong overhead resistance and will likely cap upside attempts.

Cryptoquant concludes that the major demand waves that drove bitcoin in 2024 and 2025 have largely passed, leaving the market without a clear new catalyst.

- What does Cryptoquant view as the primary bearish signal?

Cryptoquant identifies bitcoin’s break below the 365-day moving average as the strongest technical shift. - Why did treasury-company demand disappear?

Cryptoquant shows these firms saw market caps collapse 70–90%, making further bitcoin accumulation impossible. - Are ETFs still contributing to bitcoin demand?

No—Cryptoquant reports ETF demand is slowing and even turning negative in some periods. - Where is bitcoin’s new support?

Cryptoquant now places key support between $80,000 and $81,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。