Cryptocurrency News

November 22 Hot Topics:

1. Glassnode co-founder: The overall cycle structure remains intact, Bitcoin ETF still maintains net gains and cost basis is not damaged.

2. Grayscale Dogecoin ETF and XRP ETF will be listed on the NYSE on Monday.

3. U.S. Labor Department: The October CPI report will not be released, and the November report will be published on December 18.

4. Maple Finance denies the allegations made by CORE Foundation and states that it is actively taking legal action.

5. WLFI Reserve Company ALT5 Sigma will violate U.S. SEC regulations for failing to timely disclose executive suspensions.

Trading Insights

The underlying logic of making money in cryptocurrency trading: the right mindset leads to profits. Many people lose not because of their skills, but due to "impulsiveness" and "confusion"—chasing highs and cutting losses at lows are all symptoms of an imbalanced mindset. In fact, adhering to these three mindset principles is more effective than blindly staring at the market for 10 hours, helping you avoid pitfalls and secure profits:

Set a "loss limit" before discussing "profit targets." Before entering a trade, ask yourself: If I lose this money, will it affect my life? Mortgage payments, living expenses, and loans should never be touched; such funds will make you panic during market fluctuations. Only use "disposable" money that you won't regret losing; this amount gives you the confidence to stay calm and withstand volatility.

Don’t compete with the market; compete with yourself. Price movements have no "should be"; rises and falls are random, and no amount of impatience can change that. The real challenge is controlling your greed and fear: when prices reach your target, take profits as planned without being greedy; when prices hit your stop-loss, exit decisively without hoping for a reversal. If you can do these two things, you’ve already outperformed 80% of retail investors.

Accept "imperfection" to win in the long run. No one can buy at the lowest point or sell at the highest point, and no one can make a profit every time. Constantly trying to make up for missed gains or recover lost capital will only lead to more mistakes. Cryptocurrency trading is a long-term battle, not a one-time win or loss. Accept occasional losses and let go of opportunities that aren't meant for you, so you can patiently wait for quality market conditions and turn small profits into large ones. Ultimately, not losing in trading is the starting point for winning, and staying steady is the greatest skill. When your mindset is chaotic, even the best strategies will fail; when your mindset is stable, even a slow pace can lead to success.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White Community this week. Congratulations to those who followed along; if your trades aren't going well, you can come and test the waters.

The data is real, and each trade has a screenshot from the time it was sent.

**Search for the public account: *Big White Talks About Coins*

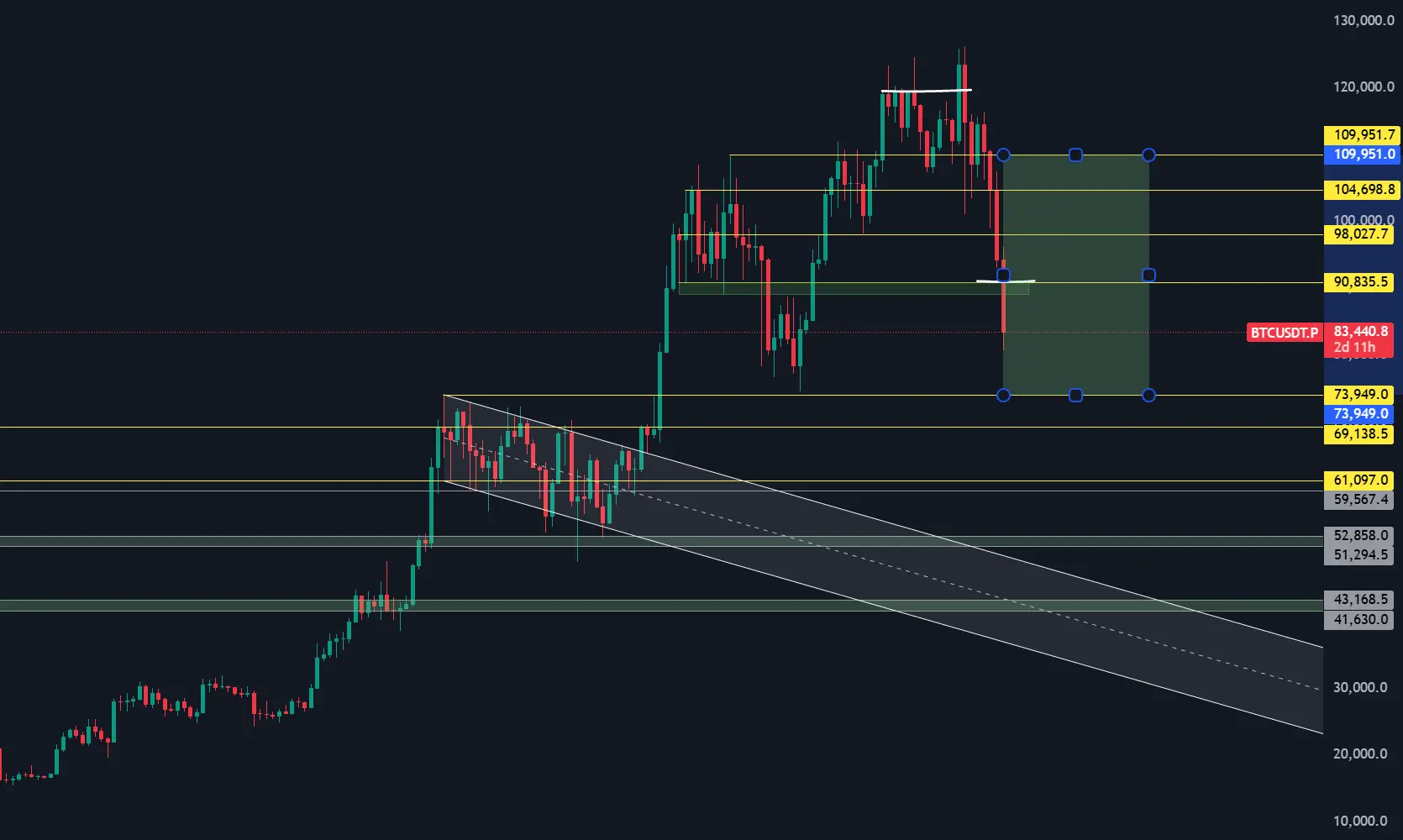

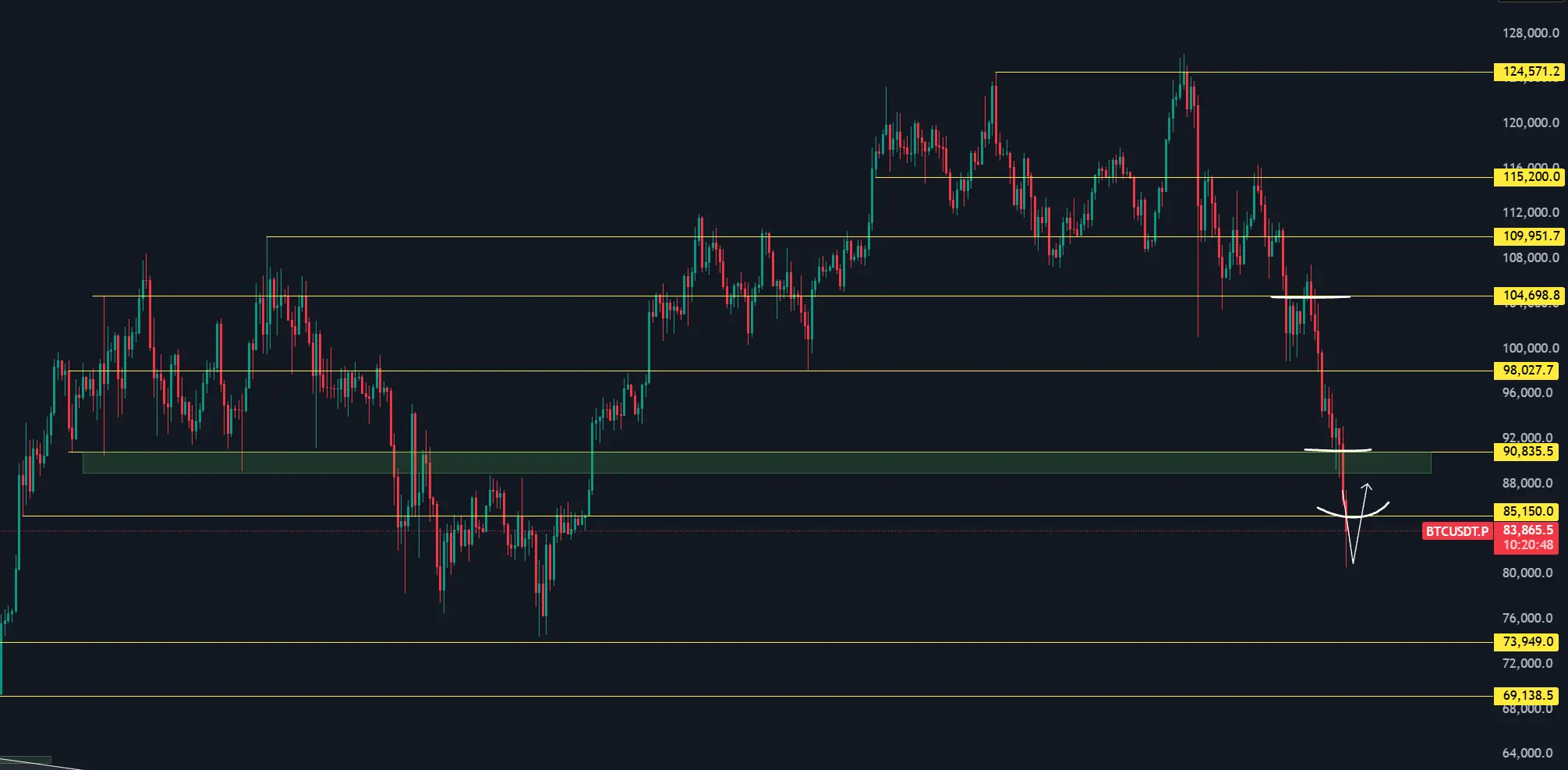

BTC

Analysis

The non-farm payroll data released today is still relatively favorable for a rate cut in December, but the market has still seen such a significant drop. Indeed, a drop without negative news is a signal that danger is beginning, often indicating that liquidity is starting to tighten. The last time this happened felt very much like early 2022; however, from the VIX data, it still looks quite awkward, currently at 26, which is a rather uncomfortable range.

On the weekly level: Yesterday continued to decline sharply, and the current weekly candlestick is approaching the weekend, still maintaining a large bearish candlestick pattern, with bears being quite strong. If the price continues to break down, we need to keep an eye on the most critical support below: the weekly Vegas + horizontal key support level, around the 75000-78000 area.

The support at 88800 has been broken, completing the support-resistance swap, and 88800 has now become resistance.

In the short term, we can expect a rebound around this area due to panic.

ETH

Analysis

Whether it rises or falls, it’s all about the Federal Reserve. After Powell announced that the Fed would not cut rates in December, the market has been in a downward position almost continuously. Investors are more concerned that high interest rates may trigger an economic recession, leading to significant declines in both the U.S. stock market and Bitcoin. However, today one of the Fed's core decision-makers, Williams, suddenly spoke out, indicating that given the current monetary policy is somewhat tight, there is still room for further adjustments in the short term. After Williams' speech, the CME raised the probability of a Fed rate cut in December to around 72%, and the Fed's spokesperson Nick not only retweeted Williams' comments but also directly stated that Williams intends to cut rates in December, indicating that Williams is a senior assistant to Powell, suggesting that this likely has Powell's approval.

The range of 2720-2811 for Ethereum is a significant support-resistance swap point, and we need to see how BTC will move; there is a chance for a rebound here. Currently, large ETH whales also show no signs of distribution.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific trading advice and does not bear legal responsibility. Market conditions change rapidly, and the article has a certain lag; if you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。