John Williams is not a name many will recognize, but when he talks, markets listen, and often, they also react. Williams is the president and CEO of the Federal Reserve Bank of New York, one of the most powerful positions at the U.S. Fed. On Friday, he gave a speech at the Centennial Conference in Santiago, Chile, held by that country’s central bank, and in his remarks were hints of a December cut.

(John Williams, CEO and President of the NY Fed, gave a speech on Friday that hinted at a possible December rate cut.)

“I fully supported the FOMC’s decisions to reduce the target range for the federal funds rate by 25 basis points at each of its past two meetings,” Williams said. Then he dropped the bombshell. “I still see room for a further adjustment in the near term to the target range for the federal funds rate.”

(Projections of a December interest rate cut nearly doubled after John Williams’ speech / cmegroup.com)

That last sentence was largely credited with lifting a sinking stock market, and perhaps it also saved bitcoin from falling below the $80K threshold. The reason for this might have something to do with the fact that the New York Fed occupies a privileged position at the central bank. There are twelve regional Fed branches whose presidents serve on the Federal Open Market Committee (FOMC), the elite group responsible for setting interest rate policy. But only the New York branch has a permanent seat at FOMC meetings; the other eleven participate on a rotational basis.

Read more: Did an Uptick in Unemployment Sink Bitcoin Again?

New York is the financial capital of the world, and Williams has the unique privilege of having his finger on the pulse of the markets. At a time when “risk-off” is the prevailing sentiment, his speech was enough to move the needle closer to “risk-on.” He probably saved stocks from a Friday bloodbath, and while bitcoin is still floundering, with liquidations teetering on $1 billion in the last 24 hours, it could have been worse without Williams’ speech.

“Sharp turns and unpredictable terrain have been an unavoidable part of our journey,” Williams said. “We must accept that shocks and uncertainty will continue to define our future.”

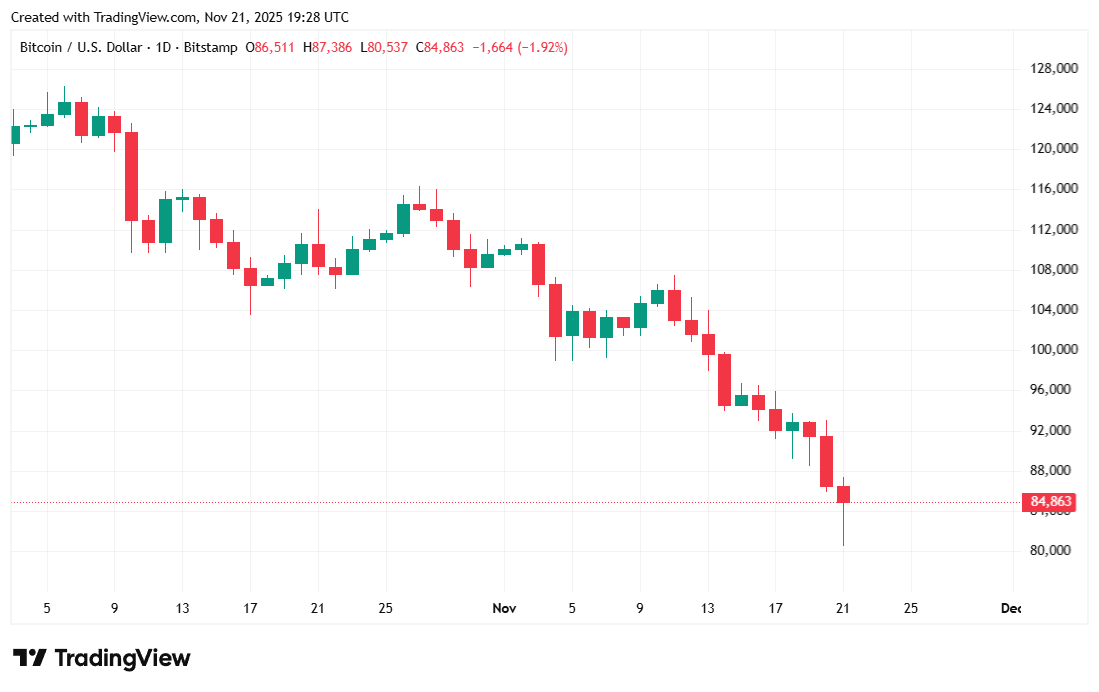

Bitcoin was priced at $84,791.82 at the time of reporting, a 2.27% decrease over the past day and an 11.43% slide since last week, Coinmarketcap data shows. The cryptocurrency fell all the way to $80,659.81 after trading as high as $88,126.81, all within a 24-hour period.

( Bitcoin price / Trading View)

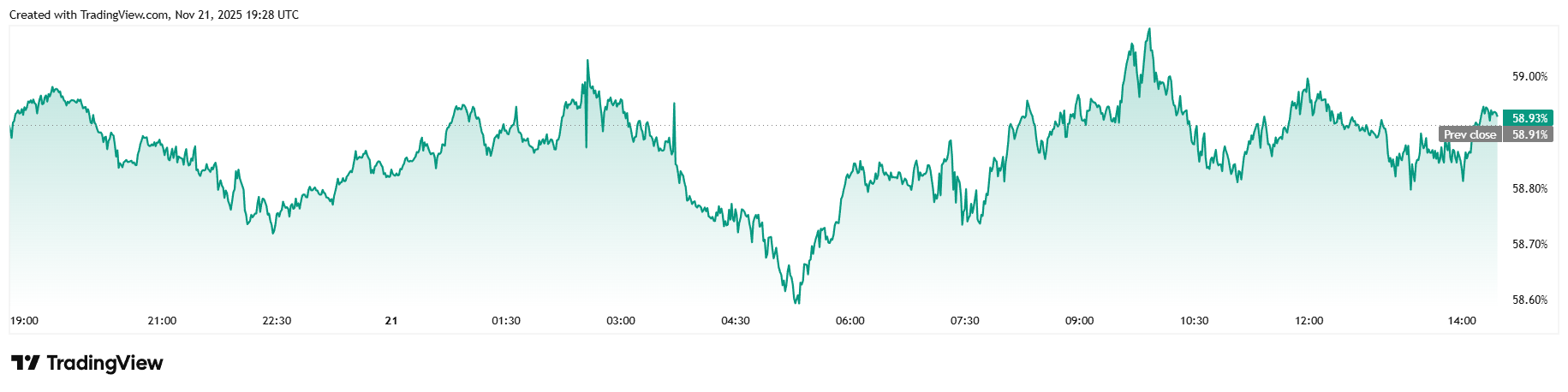

Daily trading volume jumped 35.13% to $131.37 billion in the wake of a market-wide sell-off, and market capitalization dropped to $1.69 trillion. Bitcoin dominance inched up 0.15% to reach 58.93%, as many altcoins underperformed relative to BTC.

( Bitcoin dominance / Trading View)

Total bitcoin futures open interest took a noticeable hit, tumbling all the way to $59.03 billion according to Coinglass, a decrease of 8.80%. Liquidations were the story of the day, surging to $885.67 million at the time of writing. Long investors caught off guard by bitcoin’s price drop lost $773.37 million in liquidated margin. Short sellers didn’t escape unscathed, however, suffering a smaller but non-trivial $112.31 million in losses.

- Why did bitcoin rebound after crashing to $80K?

A speech by New York Fed President John Williams hinted at a possible December rate cut, slightly shifting markets back toward “risk-on.” - What exactly did Williams say?

He stated he “still sees room for a further adjustment” to rates, widely interpreted as support for another near-term cut. - Why does Williams’ opinion matter so much?

The New York Fed holds the only permanent seat on the FOMC, giving his views outsized influence on monetary policy expectations. - How is bitcoin performing now?

BTC is hovering near $85K after heavy liquidations, but analysts say Williams’ comments likely prevented a deeper plunge below $80K.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。