Some days test the conviction of even the most resilient investors, and Thursday, Nov. 20, was undeniably one of them. The ETF market remained in a sharp split, with bitcoin and ether enduring heavy exits while solana continued its surprising run of consistent inflows.

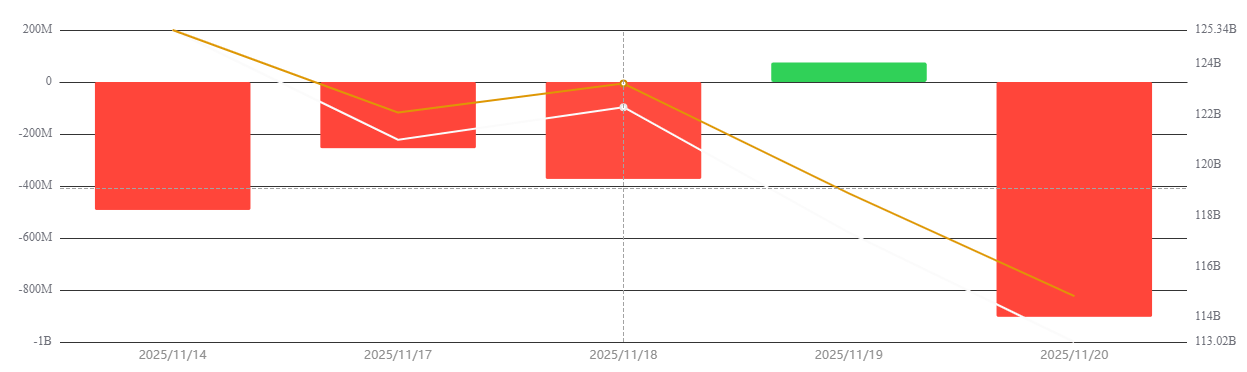

Bitcoin ETFs recorded a massive $903.11 million outflow, snapping their brief recovery and logging the second-largest exit day in the history of the product group. Blackrock’s IBIT led the downturn with a $355.50 million withdrawal. It was closely followed by huge exits from Grayscale’s GBTC at $199.35 million and Fidelity’s FBTC at $190.37 million, with the trio together accounting for more than half of the day’s damage.

Additional pressure came from Ark & 21Shares’ ARKB with $94.42 million in outflows, Vaneck’s HODL with $30.59 million, and Bitwise’s BITB with $21.17 million. Smaller but still notable exits of $7.51 million from Franklin’s EZBC and $4.20 million from the Grayscale Bitcoin Mini Trust rounded out the wave. Trading activity surged to $8.92 billion, and net assets slid to $113.02 billion.

Bitcoin ETFs have seen outflows worth $2 billion over five days.

Ether ETFs experienced yet another day of declines, marking their eighth consecutive outflow session with a total exit of $261.59 million. Blackrock’s ETHA posted the largest withdrawal at $122.60 million, followed by Fidelity’s FETH with $90.55 million. Additional red flows came from Vaneck’s ETHV at $18.67 million, Grayscale’s ETHE at $18.60 million, and Bitwise’s ETHW at $11.17 million. Total trading value reached $2.76 billion, with net assets settling at $17.43 billion.

Read more: Solana Soars With $55 Million Inflow as Bitcoin ETFs Break Losing Streak

Amid the turbulence, solana ETFs once again delivered stability and growth. The category brought in $23.66 million in inflows, extending its weeks-long positive trend. Bitwise’s BSOL led the pack with $20.12 million, while Fidelity’s FSOL added $2.34 million and 21Shares’ TSOL contributed $1.20 million. Trading volume hit $64.49 million, and net assets climbed to $744.64 million.

A day of sharp contrasts ended with bitcoin and ether deep in the red, but solana, steady and accumulating, continued to cement its role as the market’s surprise outperformer.

FAQ📊

- Why did Bitcoin ETFs see such a massive outflow today?

Bitcoin products suffered a historic $903 million exit driven by heavy withdrawals from major issuers. - What’s causing Ether ETFs to keep sliding?

Ether funds logged an eighth straight day of outflows as investors continued reducing exposure. - Why are Solana ETFs still attracting new capital?

Solana products pulled in over $23 million as demand for its ecosystem remains consistently strong. Does this divergence signal shifting market sentiment?

Investors are rotating sharply, retreating from BTC and ETH while keeping confidence in Solana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。