Highlights of This Issue

This week's newsletter covers the statistical period from November 14 to November 20, 2025. The RWA market is showing signs of a phase adjustment, with the total on-chain market capitalization slightly increasing to $35.67 billion, and the growth rate significantly slowing down. However, the number of holders is growing against the trend, reflecting a shift in the market from scale expansion to deepening existing user engagement. The total market capitalization of stablecoins has slightly declined, while transaction volume and monthly active addresses remain high, highlighting the rigid demand for on-chain payment settlements. The market has entered a "stock optimization" phase. On the regulatory front, improvements continue: the U.S. FDIC is working on guidelines for tokenized deposit insurance, a Russian court will rule on the property rights of USDT, and the legal foundation for stablecoins and RWA is being solidified from judicial and insurance perspectives. At the project level, companies under Jack Ma are making frequent moves: Alibaba's cross-border division plans to launch a stablecoin-like payment system, Ant International is collaborating with UBS in the cross-border payment settlement field, and Ondo Finance has received EU approval to operate, indicating that the industry is entering a phase of business integration and institutional convergence.

Data Insights

RWA Track Overview

According to the latest data from RWA.xyz, as of November 21, 2025, the total on-chain market capitalization of RWA reached $35.67 billion, a slight increase of 2.91% compared to the same period last month, with a noticeable slowdown in growth momentum; the total number of asset holders increased to 539,900, up 9.54% from the same period last month; the total number of asset issuers is 251, showing nearly zero growth, with an expanding investor base but stagnant asset supply.

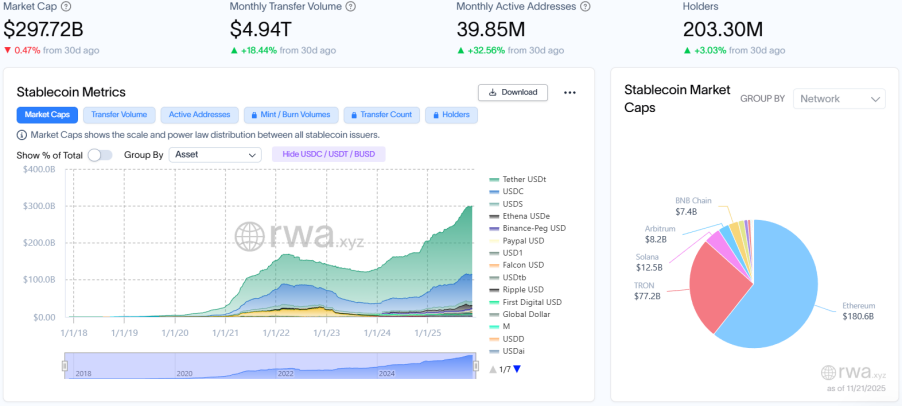

Stablecoin Market

The total market capitalization of stablecoins reached $297.72 billion, a slight decrease of 0.47% compared to the same period last month; monthly transaction volume remained high at $4.94 trillion, a significant increase of 18.44% compared to the same period last month; the total number of monthly active addresses further increased to 39.85 million, up 32.56% from the same period last month; the total number of holders steadily grew to 203 million, a slight increase of 3.03% compared to the same period last month. These figures collectively validate that market operational efficiency continues to improve—despite a slight contraction in scale, the efficiency of capital turnover and user activity remains strong, highlighting the rigid demand for on-chain payment settlements. Data indicates that the market has entered a stock optimization phase, with steady growth in transaction volume and an increase in active addresses showing ecological resilience, but continuous contraction in market capitalization may reflect that institutional allocation funds have not yet entered the market. The leading stablecoins are USDT, USDC, and USDS, with USDT's market capitalization slightly increasing by 0.22% compared to the same period last month; USDC's market capitalization slightly decreased by 1.92%; and USDS's market capitalization increased by 2.98%.

Regulatory News

The U.S. FDIC is developing guidelines for tokenized deposit insurance

According to Bloomberg, the head of the U.S. Federal Deposit Insurance Corporation (FDIC) stated that the agency is formulating guidelines for tokenized deposit insurance to assist financial institutions in expanding their digital asset businesses. Acting Chairman Travis Hill mentioned that deposits moving from the traditional financial world to the blockchain or distributed ledger world should not change their legal nature.

Hill made this statement while various parties were debating a question: how non-FDIC-insured fintech companies should fully compensate consumers if their funds are harmed. Many fintech companies collaborate with FDIC-insured banks to offer products that enjoy "penetrative deposit insurance" coverage, but if a partnered third party goes bankrupt, this protection may face challenges and fail to effectively safeguard consumer rights. The U.S. government's deposit insurance fund is a cornerstone of the financial system, aimed at protecting depositors in the event of bank failures.

According to DL News, the Russian Constitutional Court is hearing a case regarding a dispute over 1,000 USDT loans, focusing on whether citizens have property rights over stablecoins (such as USDT). Previously, three courts ruled that USDT does not fall under Russia's "Digital Financial Assets" (DFA) regulations, prompting the plaintiff to appeal to the Constitutional Court. The case has drawn significant attention from the Russian central bank, the Ministry of Finance, and anti-money laundering agencies, with the court expected to make a closed ruling in a few weeks. If the ruling determines that stablecoins do not belong to the DFA category, it may make them more suitable for everyday transactions, but the legal protection will be limited.

India plans to launch a debt-backed stablecoin ARC in early 2026

According to CoinDesk, India plans to launch a stable digital asset ARC pegged 1:1 to the rupee in the first quarter of 2026, developed jointly by Polygon and local fintech company Anq. ARC will operate on the basis of a central bank digital currency (CBDC) and will adopt a dual-layer structure, limited to corporate account issuance, aimed at curbing capital flow to dollar-pegged stablecoins and supporting domestic debt needs. The mechanism combines Uniswap v4 whitelist control to enhance compliance and safeguard monetary sovereignty.

Local Developments

According to CNBC, Alibaba Group Holding Ltd.'s cross-border e-commerce division is planning to launch an AI-based subscription service and is collaborating with JPMorgan Chase & Co. to trial a "stablecoin-like" payment solution aimed at improving cross-border settlement efficiency. This plan may allow customers to use this digital payment tool for international trade and service transactions, thereby reducing risks associated with exchange rate fluctuations and settlement times.

Ant International collaborates with UBS to explore blockchain-based cross-border payment settlements

According to the South China Morning Post, Singapore-based Ant International (a spin-off of Ant Group) is accelerating its global fund management business through a strategic partnership with UBS Group AG, while both parties also hope to explore innovations in tokenized deposits based on blockchain.

The two companies announced on Monday that, under a memorandum of understanding signed at UBS's Singapore office, Ant International will use its blockchain payment platform UBS Digital Cash, launched last year, for global fund management operations to enhance efficiency, transparency, and security. This collaboration will also explore joint innovations in tokenized deposits, including an interconnected solution involving Ant's self-developed blockchain-based Whale platform—its internal fund management system.

Project Progress

MoonPay will issue and manage stablecoins on behalf of clients

According to Bloomberg, cryptocurrency payment company MoonPay Inc. will begin issuing and managing stablecoins on behalf of clients. Zach Kwartler, the newly appointed head of stablecoin business at MoonPay, stated in an interview that the New York-based company will utilize its existing money transmission licenses to provide this service across various U.S. states. Kwartler noted that issuing its own stablecoin could help MoonPay's clients better manage their payment operations. MoonPay announced on Thursday that the issuance service will target corporate clients in the U.S., Asia, and Latin America, covering multiple blockchains.

According to Decrypt, the American Independent Community Bankers Association (ICBA) has written to the Office of the Comptroller of the Currency (OCC), requesting to block Sony Bank's Connectia Trust from applying for a national trust license to issue a dollar stablecoin. The ICBA claims that its stablecoin has "deposit-like" characteristics but is not subject to federal deposit insurance and CRA constraints, potentially triggering violations of the Bank Holding Company Act through debit card usage, and questions Sony Group's influence over Sony Financial. Companies like Coinbase, Circle, Ripple, Paxos, and Bridge (Stripe's stablecoin division) are also seeking federal licenses.

According to Bloomberg, the Trump Organization is planning to develop a luxury resort in the Maldives in collaboration with Saudi Arabian partners and intends to tokenize the hotel development project. The two companies stated in a joint announcement on Monday that the Trump International Hotel Maldives project will include 80 ultra-luxury beach villas and overwater villas, developed in partnership with Dar Global Plc.

Dar Global is a subsidiary of a Saudi developer listed in London. The Maldives resort is scheduled to open by the end of 2028, just a 25-minute speedboat ride from the capital, Male. The tokenization of the project will allow investors to participate in the development phase, offering digital shares that can be purchased in token form.

Southeast Asian ride-hailing giant Grab has signed a memorandum of understanding with Singapore's stablecoin platform StraitsX to create a Web3 wallet and stablecoin settlement network for the Asian market. The two parties will promote the integration of the Web3 wallet into the Grab App, allowing GrabPay merchants to accept stablecoins such as XSGD and XUSD, and enabling cross-border, real-time, compliant settlements. The system will introduce smart contracts and on-chain fund management, with all user assets managed by non-custodial wallets to meet regulatory requirements.

Deutsche Börse adds Societe Generale's stablecoin to its core market system

According to CoinDesk, Deutsche Börse Group (DB1) and Societe Generale's digital asset subsidiary SG-FORGE announced on Tuesday that they plan to introduce regulated euro and dollar stablecoins into their infrastructure. The two parties have signed an agreement to integrate SG-FORGE's euro and dollar stablecoin CoinVertible with Deutsche Börse's backend systems, including Clearstream. The first phase will test CoinVertible's performance as a settlement asset for securities and collateral workflows and explore its role in fund management functions.

Deutsche Börse also plans to list these tokens on its digital trading platform to enhance liquidity. The two parties will explore whether stablecoins can be used in Deutsche Börse's broader service lines, including clearing, custody, and data tools for banks, asset managers, and crypto companies. This collaboration is progressing in parallel with the wholesale central bank digital currency pilot project in which both companies are participating.

According to the official blog, stablecoin issuer Circle has announced the launch of a new interoperability infrastructure called Circle xReserve, which allows blockchain teams to deploy USDC-backed stablecoins that are fully interoperable with USDC. xReserve is supported by xReserve certification services, enabling developers and users to seamlessly transfer value between USDC-backed stablecoins and USDC on supported blockchains without relying on third-party bridging services. Partners Canton and Stacks will integrate with xReserve in the coming weeks.

HSBC to offer tokenized deposit services to clients in the U.S. and UAE

According to Bloomberg, HSBC Holdings Plc will begin offering tokenized deposit services to corporate clients in the U.S. and the United Arab Emirates in the first half of next year. Manish Kohli, HSBC's global head of payment solutions, stated that tokenized deposit services will allow clients to make domestic and cross-border fund transfers in seconds around the clock, without being limited to business hours, helping large enterprises manage liquidity more efficiently.

HSBC's tokenized services have already been launched in Hong Kong, Singapore, the UK, and Luxembourg, currently supporting transactions in euros, pounds, dollars, Hong Kong dollars, and Singapore dollars. Kohli mentioned that when the service expands to the Middle East next year, the UAE dirham will be added. According to Kohli, HSBC plans to broaden the application scenarios for tokenized deposits in programmable payments and autonomous treasury systems, which utilize automation and artificial intelligence to independently manage cash and liquidity risks; additionally, HSBC is also exploring the stablecoin industry and is currently in discussions with several stablecoin issuers to provide reserve management and settlement account services.

Ondo Finance announced that its subsidiary Ondo Global Markets has received approval from the Liechtenstein Financial Market Authority (FMA) to provide tokenized U.S. stocks and ETF services in the European Economic Area (EEA). This regulatory recognition means Ondo can compliantly offer on-chain stock and ETF products to over 500 million retail investors across 30 markets, including all EU countries, Iceland, Liechtenstein, and Norway.

Apex Group plans to acquire brokerage firm Globacap to boost its tokenization business in the U.S.

According to CoinDesk, two insiders revealed that financial services provider Apex Group, with over $30 trillion in assets under management, plans to acquire London-based investment platform Globacap, which has a U.S.-regulated brokerage. As professional investors show increasing interest in blockchain-based real-world assets (RWAs), this acquisition will help Apex lead U.S. regulated fund tokenization-related projects.

In March of this year, UK cryptocurrency exchange Archax claimed to have acquired Globacap's U.S. business division. However, a recent report citing insiders indicated that the deal did not go through, and new bidders have entered the fray.

Robinhood plans to allow DeFi App users to use tokenized stocks without permission

According to Cryptopolitan, Robinhood has announced a three-phase plan aimed at allowing DeFi App users to use tokenized stocks without permission and achieve compatibility through Arbitrum Stylus. The final phase will fully permit stock tokens, allowing users to use them across various dApps. AJ Warner, head of strategy at Offchain Labs, stated that Robinhood is laying the groundwork for the transition of traditional finance to a permissionless ecosystem, with the recently launched tokenized stock product in Europe being the first step, covering about 800 publicly traded securities, and plans to include private equity.

Currently in the first phase, EU users can buy tokenized stocks in the app but cannot transfer them out, as they are limited to in-app use. The second phase focuses on infrastructure, utilizing the acquired Bitstamp to enable 24/7 trading of stock tokens, breaking traditional trading time constraints. In the third phase, users and DeFi protocols can freely use permissionless tokens, such as using tokenized Apple stocks as collateral after withdrawal. This marks a shift in retail investment methods, with tokenized stocks becoming programmable modules in the open financial system, and this phase is part of a long-term strategy.

Swiss precious metals giant MKS PAMP plans to relaunch its gold token project

According to Bloomberg, Swiss precious metals giant MKS PAMP SA is set to relaunch its gold token after facing setbacks six years ago when it first attempted to issue gold tokens, aiming to capitalize on the growing market interest in digital physical gold. MKS PAMP has acquired Gold Token SA to restart its digital gold project.

MKS PAMP was one of the initial participants in 2019 to launch a token called DGLD, which also included CoinShares International Ltd. MKS PAMP CEO James Emmett stated that the timing of the initial launch was "too early," and the token has remained largely dormant for years. The relaunch will involve the company's trading division purchasing tokens and providing liquidity on exchanges. MKS PAMP will only issue DGLD tokens to certified institutions, which can then sell the tokens on secondary cryptocurrency exchanges, with the issuance and trading operations similar to other gold tokens. According to the company, the tokens can be redeemed for corresponding amounts of physical gold, with a minimum specification of 1 gram.

Securitize expands RWA coverage with Plume

According to CoinDesk, the modular Layer 2 blockchain Plume, focused on real-world assets (RWA), announced on Wednesday that tokenization giant Securitize will expand its coverage in the global real-world asset space by launching institutional-grade assets on Plume's Nest staking protocol. The asset launch plan will start with related assets from Hamilton Lane funds and continue until 2026, targeting a capital scale of $100 million. As part of the deal, Bitcoin financial platform Solv plans to invest up to $10 million in Plume's RWA vault, broadening Bitcoin-based yield products through regulated RWA exposure.

Tokenized stock trading platform MSX launches spot and contract targets across multiple sectors

According to official news, MSX has completed spot and contract trading for clean energy storage solution provider $EOSE.M, century-old multinational pharmaceutical company $MRK.M, and U.S. biotechnology company $ABBV.M; spot targets for space exploration company $LUNR.M and IIoT and drone system solution provider $ONDS.M, as well as contract targets for the S&P 500 ETF $SPY.M, have also been newly listed.

Insights Highlights

PANews Overview: Web3 incubator Obex has secured significant funding of $37 million, aiming to become the "YC for stablecoins" by systematically supporting and investing in projects that bring real-world assets onto the blockchain through a professional incubation model. The goal is to promote the development of the next generation of "yield-bearing stablecoins" and to bring the much-needed institutional-level risk control and underwriting standards to this high-risk area exposed by events like Stream Finance, thereby building a safer and scalable yield-bearing stablecoin infrastructure.

Why RWA Will Become a Key Narrative in 2025?

PANews Overview: RWA refers to turning valuable real-world assets (such as government bonds, houses, gold, corporate loans, and even stocks) into digital tokens that can be traded on the blockchain. It becomes so important in 2025 mainly due to its massive scale and rapid growth (the total value of on-chain RWA, excluding stablecoins, has reached $35 billion, with an annual growth rate exceeding 150%), and the validation from traditional financial giants entering the space (such as BlackRock issuing the BUIDL fund). Its core value lies in enhancing efficiency: through blockchain technology, it can reduce transaction costs, enable 24/7 trading, and make some traditionally illiquid and indivisible assets (like private credit and real estate) more accessible to global investors. Currently, the market is primarily dominated by two asset classes: private credit (offering higher yields) and U.S. Treasuries (providing stable low-risk returns), while the tokenization of gold, stocks, and real estate is also rapidly developing. However, the article also warns that RWA is not a panacea; it cannot create liquidity out of thin air, and its success heavily relies on clear regulations, reliable underlying assets, and strong market confidence. In summary, the long-term narrative of RWA is not to disrupt traditional finance but to enable traditional financial assets to operate "on-chain," thereby building a more efficient and inclusive new financial market.

PANews Overview: The on-chain transformation of real-world assets involves using blockchain technology to convert traditional assets like government bonds and real estate into tradable digital tokens, aiming to enhance asset liquidity and trading efficiency. Technically, it relies on smart contracts for automated management, oracles for reliable data, and cross-chain protocols to connect compliant chains with public chains for global circulation. However, the implementation of RWA still faces multiple bottlenecks: legally, there is a disconnect between token rights and the verification of off-chain assets, with prominent issues in cross-border regulation and data sovereignty; technically, cross-chain bridges and oracles pose security risks, and balancing performance with decentralization is challenging; in the market, the valuation of non-standard assets is difficult, liquidity mismatches are common, and the high compliance costs for institutions lead to RWA primarily being dominated by standardized assets like government bonds. In the future, breakthroughs in RWA will rely on "embedded compliance," multi-layer cross-chain architecture, and the continued participation of institutional capital to gradually build a trust system connecting traditional finance with the on-chain ecosystem.

PANews Overview: Japan's stablecoin market is being shaped by regulation into a "dual-track" development pattern: the first track is represented by JPYC, which is based on a "fund transfer business" license and follows a DeFi path. Although compliant and redeemable, it is limited by the legal stipulation that "single transactions cannot exceed 1 million yen," thus primarily serving small transactions, arbitrage, and on-chain micropayments within the global DeFi ecosystem; the second track is a stablecoin jointly promoted by three major banks, including Mitsubishi UFJ, based on "trust law" and issued through the Progmat platform, which has no transaction limits and aims to address pain points in traditional finance, such as B2B large-scale cross-border settlements and modernization of bank core systems, ultimately providing compliant on-chain settlement tools for the securities token (RWA) market, which has reached hundreds of billions of yen; this dual-track system is essentially a strategic design of Japan's financial top-level, on one hand, limiting Web3 innovation to retail and small-scale areas to control risks, and on the other hand, ensuring that high-value systemic financial operations remain firmly in the hands of traditional financial institutions, thereby building a "compliance moat" for traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。