Introduction

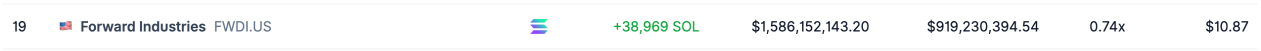

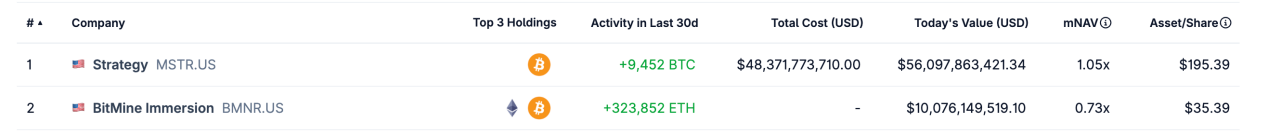

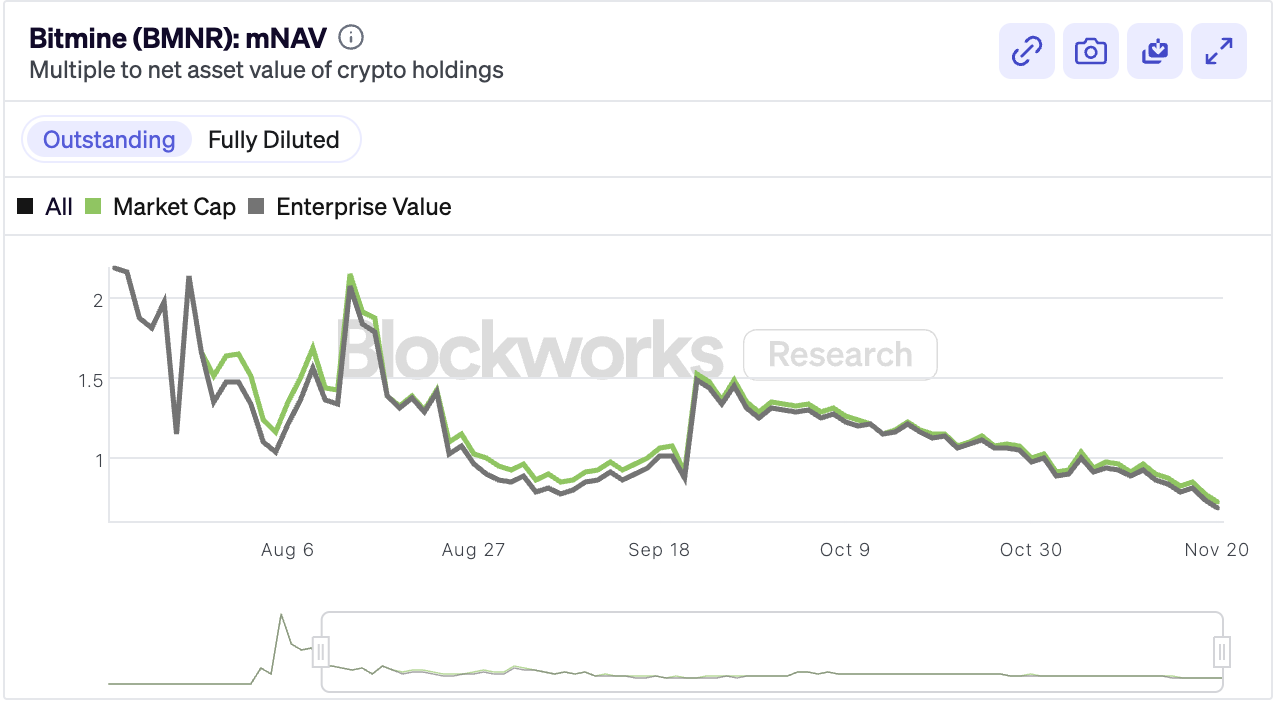

In this round of the cryptocurrency bull market, DAT (Digital Asset Treasury) companies have undoubtedly been a key force pushing coin prices to extremes. They have been hoarding cryptocurrencies like MicroStrategy (MSTR), making bold bets on ETH with Bitmine (BMNR), and wagering on SOL with Forward Industries (FWDI), collectively demonstrating a textbook "positive flywheel" model:

Attract external funds → Buy cryptocurrencies on a large scale → Asset appreciation boosts net assets and company market value → Reputation and valuation rise → Attract more and cheaper funds → Continue to increase positions.

This positive feedback loop continuously reinforces itself, converting off-chain incremental funds into on-chain holdings, creating an institution-led bull market pattern over the past two years.

However, when the market sharply declines from its peak, such as Bitcoin dropping over 35% from its peak, with ETH and SOL experiencing even larger declines, market sentiment quickly turns to panic. A fatal question is repeatedly raised: Will the flywheel that once drove the rise completely reverse in a downturn, forming a classic death spiral of "coin price decline → stock price halving → funding exhaustion → forced selling of coins to repay debts → further decline in coin prices"?

Figure - Recent decline in Bitcoin (Data source: AiCoin)

Just a single instance of Forward Industries transferring a large amount of SOL to Coinbase can trigger panic across the network within minutes, directly proving the fragility of market sentiment.

Figure - SOL treasury company transferring SOL to Coinbase (Data source: AiCoin News)

1. How Did the Flywheel of DAT Treasury Companies Start?

To understand how the flywheel of DAT treasury companies was initiated, the clearest and most classic example remains MicroStrategy (MSTR). Its path has been regarded as a standard template by all later entrants:

Stock price rises → Issue convertible bonds at extremely low cost → Almost fully invest in Bitcoin → BTC rises, generating huge paper profits → Market value and net assets expand simultaneously → Capital markets are more willing to subscribe to the next round of convertible bonds at lower interest rates and larger scales → Continue to increase positions.

During the upward phase, this cycle is nearly perfect: Bitcoin contributes paper gains, which push up market value, and the increased market value in turn makes capital markets willing to provide funds at extremely low costs, allowing MSTR to obtain a continuous stream of cheap funds, making the flywheel spin faster and faster.

However, the underlying driving force of this model has always been leverage. Whether it is MSTR or its later imitators, they are essentially using external funds to amplify their exposure to cryptocurrencies. MSTR's ability to continuously issue bonds to buy BTC during the bull market does not rely on cash flow from its software business, but rather on investors' expectations of BTC's continued rise, who are willing to buy its convertible bonds at extremely low or even close to 0% interest rates. It is important to emphasize that these convertible bond buyers are mostly professional arbitrage institutions, betting that "the structure of the convertible bonds is safe enough that they won't lose money regardless."

In addition, MSTR layered on a more covert "credibility leverage." The market is willing to lend it money at almost zero cost largely due to trust in the management, especially founder Michael Saylor—who has repeatedly publicly promised to "never sell a single Bitcoin." This almost religious personal credit itself becomes a key factor in attracting funds and stabilizing the flywheel.

In a bull market, this system operates seamlessly, with BTC's strong gains covering all aspects, causing stock and coin prices to spiral upward. But once the market reverses, the issues become exceptionally sharp: BTC declines → paper profits evaporate rapidly → market value contracts simultaneously → rapid downward spiral → financing costs soar, limits are imposed → the company struggles to maintain the "buy more as prices fall" rhythm → bonds mature, forcing the sale of coins to repay debts → coin prices fall. Once the flywheel starts to reverse, its destructive power will far exceed expectations.

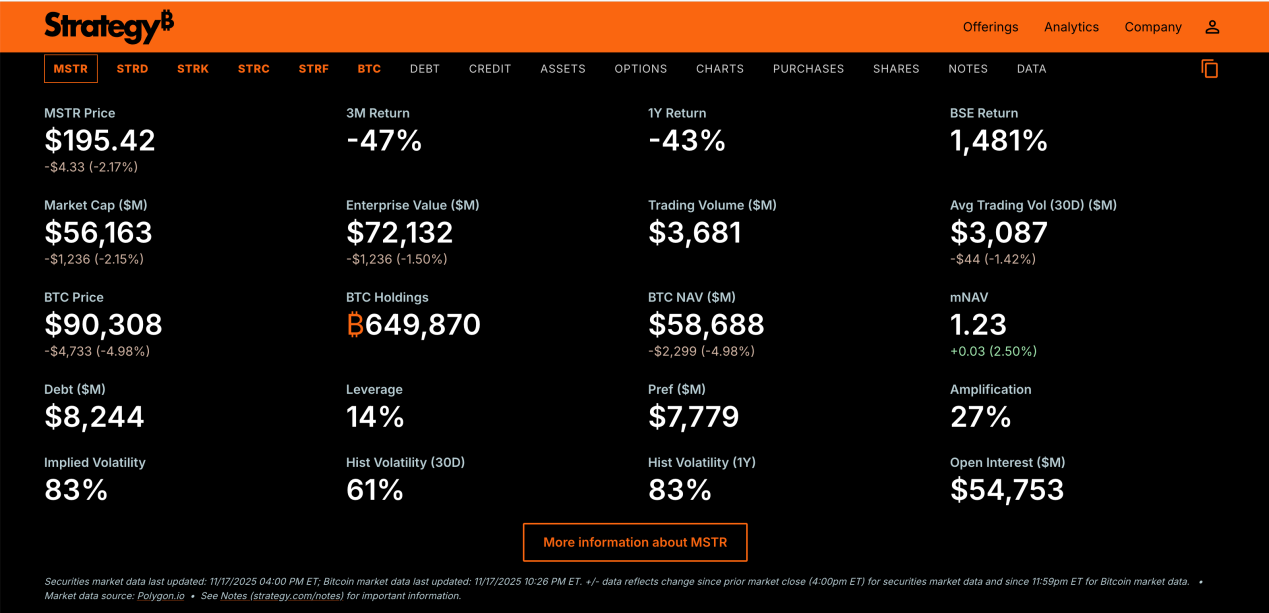

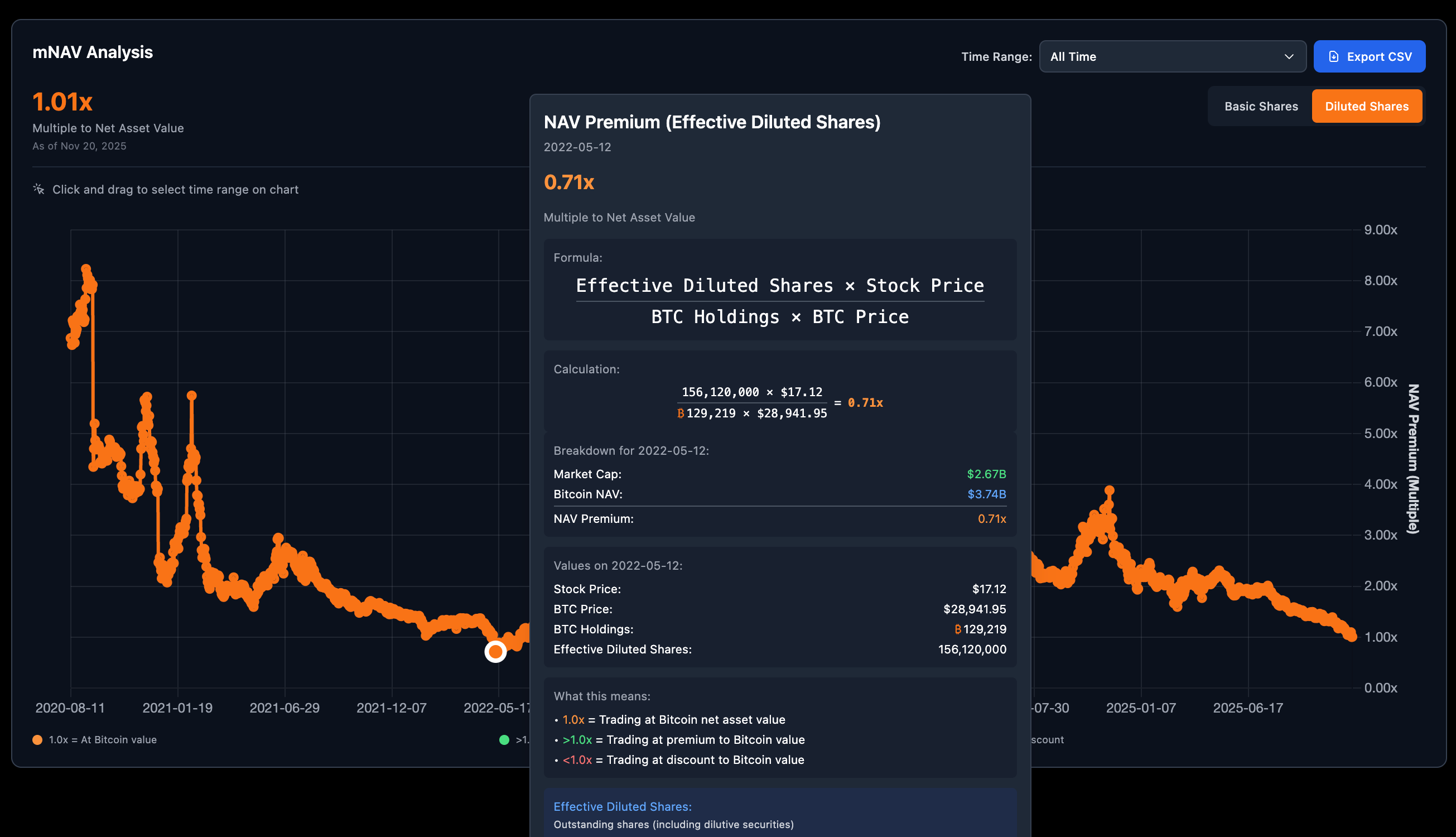

2. Core Indicator for Studying the Reverse Flywheel of DAT Treasury Companies: mNAV

Among all the analytical frameworks to determine whether DAT treasury companies will slide into a death spiral, there is only one core indicator that the market, short-selling institutions, convertible bond arbitrage players, and regulatory bodies are closely monitoring—mNAV (Market Cap to Net Asset Value Ratio), which is the "premium multiple of the company's total market value relative to the value of its cryptocurrency holdings."

Calculation formula:

mNAV ≈ Total market value of the company ÷ Real-time dollar value of held cryptocurrencies

This number almost determines everything:

Once mNAV consistently falls below 1x, market logic will instantly reverse:

All potential creditors and shareholders will ask the same question—"The coins you bought with new money can't even cover the principal, why should I continue to lend you money to bet on a rebound?"

The result is:

New bonds cannot be issued → Stock prices collapse rapidly → Hedge funds and convertible bond arbitrage positions are passively/actively shorted → mNAV further deteriorates → Market narrative shifts from "high-quality Bitcoin/Ethereum exposure" directly to "model bankruptcy."

This is not a theoretical deduction, but an ironclad rule that has been repeatedly validated over the past three years.

In summary: mNAV is the blood pressure monitor for DAT treasury companies; below 0.8x is critical care, and below 0.6x is essentially the time for the doctor to declare.

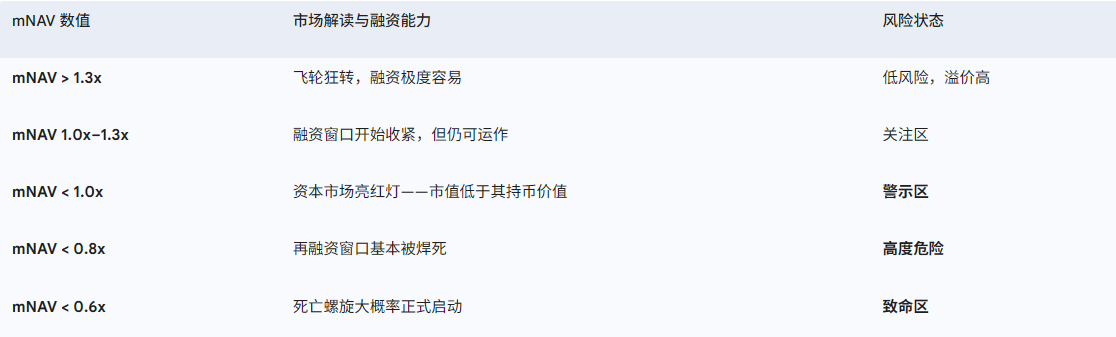

3. Why Did MSTR Manage to Hit the Brakes on the Edge of the Cliff in 2022?

2022 was the "life and death" moment for all treasury companies. Bitcoin fell from $69,000 to $15,600, a drop of 78%, and MSTR's stock price plummeted. Its mNAV once dropped to 0.71x—this was a highly dangerous prelude to a death spiral: the market value was only 71% of the value of the Bitcoin it held. The capital market's doors were half-closed, hedge funds were waiting to short, and the media was constantly speculating that "MicroStrategy is about to go bankrupt."

But ultimately, MSTR did not collapse, nor was it forced to sell a single Bitcoin; the reverse flywheel was forcibly jammed at the most dangerous edge. This was not a miracle, but rather that MSTR had embedded three "nuclear-level speed bumps" in its model design that others could not replicate.

First: Divine Debt Structure. The convertible bonds issued in 2020-2021 had conversion prices that were absurdly high ($397, $1156, $1497, etc.), while the stock price in 2022 dropped to a low of $116; bondholders converting their bonds would incur direct losses of 70%-90%. Who would convert? Their only rational choice was to hold onto the bonds until maturity. Therefore, MSTR faced almost no short-term repayment pressure, and the $2.4 billion 0% convertible bonds maturing in February 2025 were only dealt with right before their natural maturity. This batch of "poison pill" old debt became MSTR's thickest armor in the bear market, and later imitators could not issue bonds with such outrageous conditions.

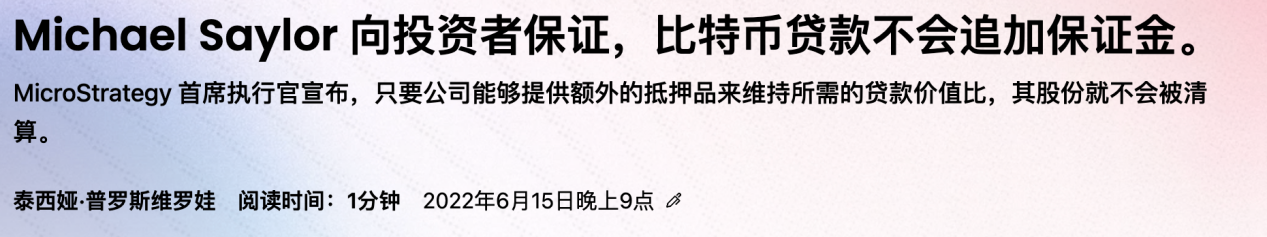

Second: Cash Flow + Ultra-Low LTV Mortgages as Dual Safety Nets. MSTR has decades of software business, sufficient to cover daily operations. Moreover, there was the legendary $205 million BTC mortgage from Silvergate Bank, with an LTV of only 25%, and a liquidation line around BTC $21,000. When Bitcoin plummeted to $17,600 in June 2022, the market thought it would explode, but Saylor assured investors: "There will be no margin call on the loan," and a month later Bitcoin rebounded, easily resolving the crisis. This combination of "cash flow + extremely low LTV" is something that later pure treasury companies simply do not have.

Third, and the most underrated: Saylor's personal belief became the last psychological defense line for the market. When mNAV dropped to 0.71x and the stock price crashed, Saylor continuously tweeted, gave interviews, and appeared on podcasts, repeatedly stating: "We will never sell a single Bitcoin." This almost obsessive declaration, during the darkest months of 2022, firmly anchored the confidence of some retail and institutional investors, preventing a panic collapse after mNAV fell below 0.6x. Other treasury company founders, who has such "personal brand as faith" capability? Almost none.

It was these three speed bumps that allowed MSTR to pull the "deadly zone" of mNAV down to extremely low levels in 2022 without triggering forced selling of coins. Once Bitcoin rebounded to $30,000, mNAV quickly returned to above 1.3x, and the flywheel began to turn positively again.

4. 2025: How Thin is the Moat of Bitmine and Forward Industries?

On November 21, 2025, the market has provided the answer with the coldest numbers:

Bitmine (BMNR, ETH treasury) mNAV 0.73x

Forward Industries (FWDI, SOL treasury) mNAV 0.74x

Below 0.8x is no longer "cheap," but rather a yellow warning light from the capital market; if it continues to decline, the light will turn into a glaring red. These two most aggressive MSTR imitators during the bull market are now simultaneously caught by three structural vulnerabilities, with the bear market amplifying each of their weaknesses infinitely.

First, the disadvantage of high entry costs is significant. Most positions were taken near the peak in 2025, with costs far exceeding MSTR's BTC from previous years. Bitmine's main ETH positions are concentrated in the $3,500–$4,500 range, with an average cost of about $4,000; Forward's SOL positions mainly fall in the $180–$250 range, with an average cost of about $232. With the same percentage decline, their absolute losses in both amount and proportion are 30%–70% higher than MSTR's at that time, which directly leads to a faster and deeper drop in mNAV below 1.0x, making it harder to return to a safe zone. Each time the coin price drops, it further exacerbates their high-cost disadvantage.

Second, the underlying assets have higher volatility, with a downward beta far exceeding BTC.

ETH and SOL have historically been 40%–80% more volatile than BTC, with a typical bear market characterized by "falling faster and harder." If ETH returns to the 2022 low of $800, Bitmine's mNAV will be instantly compressed to 0.3x–0.4x; if SOL repeats history and falls below $10, Forward's mNAV will likely plummet to 0.1x–0.2x. Once mNAV is compressed to such extreme levels, the collateral ratios, put options, or early repayment clauses in the debt terms will be triggered, making forced on-chain coin sales almost inevitable—this will further drive down coin prices, creating a true chain reaction. The same market pressure may only make BTC treasury "very uncomfortable," while ETH/SOL treasuries could be "directly fatal."

Third, the most critical point: low mNAV has rendered their most powerful self-rescue weapon—"buying more as prices fall, continuously lowering costs"—ineffective.

During the darkest days of 2022, MSTR was still able to rely on 0% old debt and ultra-low-cost new debt to continue increasing positions, keeping the average cost firmly at $11,000.

However, as soon as Bitmine and Forward's mNAV drops below 0.8x, the capital market almost shuts down: new bond interest rates soar, limits are significantly compressed, and they may not be able to issue new bonds at all. They find it difficult to dilute high entry costs through "borrowing new money to buy coins," and those glaring $4,000 and $232 are permanently nailed to the ledger.

Each time the coin price declines, they can only endure the floating losses without any means to dilute them—this is the most brutal blow that leaves them hanging in mid-air.

On AiCoin, you can search for K-lines of major treasury companies or other cryptocurrency stocks, along with related news and tweets, to stay updated on their dynamics in real-time.

5. Conclusion

In 2022, MSTR used three unique moats to pull mNAV back from 0.71x, proving that the treasury model can survive a bear market; however, Bitmine and Forward Industries in 2025 face a completely different situation:

Significantly higher entry costs;

Greater underlying asset volatility;

Low mNAV makes the traditional self-rescue path of "buying more as prices fall, continuously diluting" exceptionally difficult.

Currently, with mNAV at 0.73x-0.74x, a yellow warning light has been lit, but it has not yet entered the true red danger zone. As long as ETH and SOL do not significantly drop towards the extreme lows of 2022, and as long as the liquidity environment does not further deteriorate, they still have a certain probability of stabilizing their positions through cost-cutting, optimizing debt structures, or even small-scale targeted financing, waiting for the next rebound.

However, their buffer space is no longer as ample as MSTR's in 2022, and the margin for error is visibly low. For investors, the most rational approach is to treat mNAV as a real-time blood pressure monitor:

Above 0.8x: still considered a normal exposure;

0.7x-0.8x: requires high vigilance, consider reducing positions;

Below 0.6x: likely to prepare for the worst-case scenario.

The treasury model has never been a one-way street; in a bull market, it’s about who runs faster, while in a bear market, it’s about who has a deeper moat. In 2022, MSTR proved through practice that this model can survive; in 2025, Bitmine and Forward Industries remind everyone: the premise of survival is that "bear resistance" capabilities must be written into the genes in advance. The market will always leave the most prepared one standing, and will not show mercy to any latecomer imitators.

We just need to keep an eye on the mNAV numbers; the rest will be answered by time.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group: https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。