Author: Nancy, PANews

The crypto market is in turmoil, with Bitcoin's weakness dragging down the overall market sentiment and accelerating the clearing of bubbles, leaving investors walking on thin ice. As one of the important indicators in the crypto space, the leading DAT (Digital Asset Trust) company Strategy (MicroStrategy) is facing multiple pressures, including a significant contraction in mNAV premiums, weakened coin accumulation, executive stock sales, and the risk of being delisted from indices, all of which are putting market confidence to a severe test.

Strategy Faces a Crisis of Trust, Potential Delisting from Indices?

Currently, the DAT sector is experiencing its darkest hour. As Bitcoin prices continue to decline, the premium rates of several DAT companies have plummeted, stock prices remain under pressure, and accumulation activities have slowed or even come to a halt, putting their business models to the test. Strategy has not been spared and is caught in a crisis of trust.

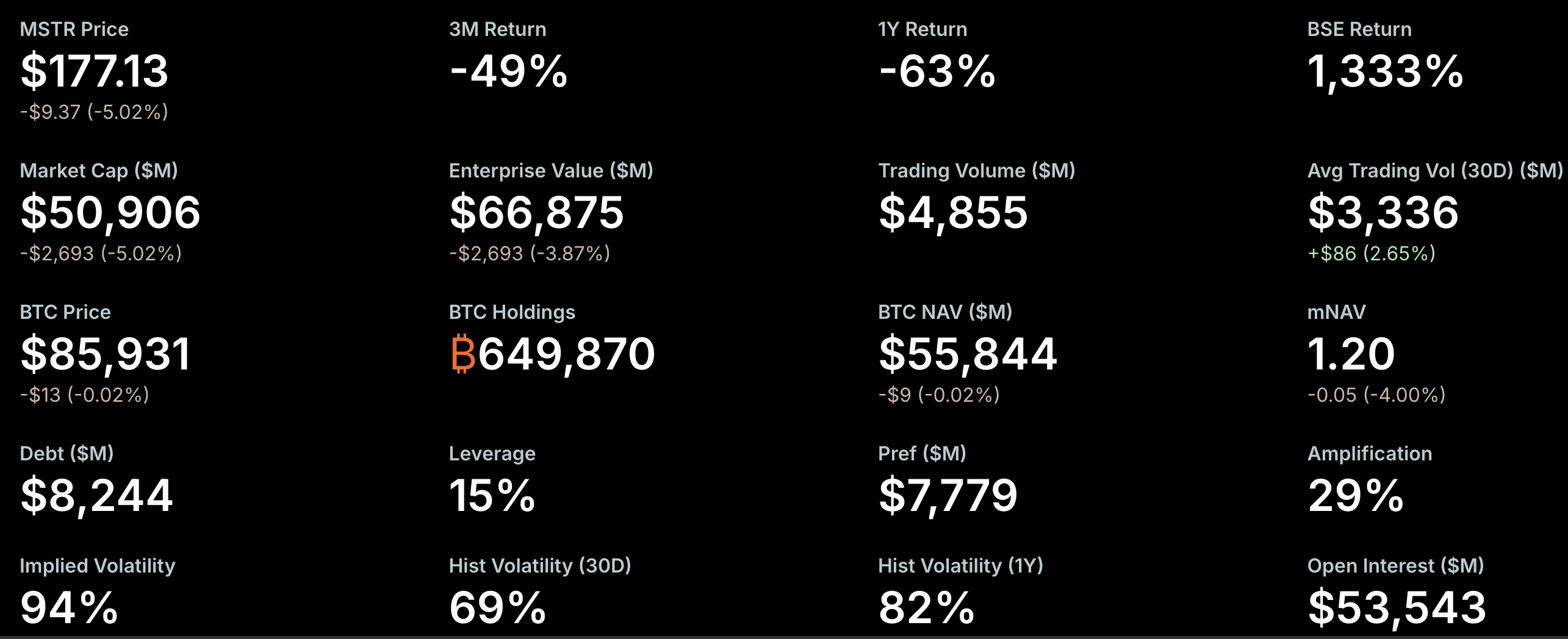

mNAV (market net asset value) is one of the key indicators for measuring market sentiment. Recently, Strategy's mNAV premium has rapidly contracted, coming close to the brink of survival. According to StrategyTracker data, as of November 21, Strategy's mNAV was 1.2, having previously dipped below 1, representing a decline of approximately 54.9% from its historical high of 2.66. As the largest and most influential DAT company, the failure of Strategy's treasury premium has triggered market panic, primarily because the decline in mNAV has weakened its financing ability, forcing the company to issue stock that dilutes existing shareholders' equity, putting further pressure on stock prices and causing mNAV to drop even more, creating a vicious cycle.

However, Greg Cipolaro, Global Research Director at NYDIG, pointed out that mNAV has limitations as an indicator for evaluating DAT companies and should even be removed from industry reports. He believes that mNAV can be misleading because its calculation does not take into account the company's operational business or other potential assets and liabilities, and is typically based on assumed circulating shares, not covering unconverted convertible debt.

Poor stock performance has also raised market concerns. According to StrategyTracker data, as of November 21, Strategy's MSTR stock had a total market capitalization of approximately $50.9 billion, which is below the total market value of its nearly 650,000 Bitcoin holdings (with an average holding cost of $74,433) of $66.87 billion, indicating that the company's stock price has entered a "negative premium" territory. Since the beginning of this year, MSTR's stock price has dropped by 40.9%.

This situation has sparked concerns in the market about its potential delisting from indices such as the Nasdaq 100 and MSCI USA. JPMorgan predicts that if the global financial index company MSCI removes Strategy from its stock index, related fund outflows could reach as high as $2.8 billion; if other exchanges and index compilers follow suit, the total outflow could reach $11.6 billion. Currently, MSCI is evaluating a proposal to exclude companies whose primary business is holding Bitcoin or other crypto assets, and where such assets account for more than 50% of their balance sheet, with a final decision expected by January 15, 2026.

However, the risk of Strategy being removed is relatively low at this time. For example, the Nasdaq 100 index undergoes market capitalization adjustments every year on the second Friday of December, retaining the top 100 companies, while those ranked 101-125 must have been in the top 100 the previous year to retain their position, and those ranked beyond 125 are unconditionally removed. Strategy remains within a safe range, ranking in the Top 100 by market capitalization, and recent financial reports indicate a solid fundamental position. Additionally, several institutional investors, including the Arizona State Retirement Fund, Renaissance Technologies, the Florida State Pension Fund, the Canada Pension Plan Investment Board, Swedbank, and the Swiss National Bank, have disclosed holdings of MSTR stock in their Q3 reports, which has also supported market confidence to some extent.

Recently, Strategy's pace of accumulation has noticeably slowed, interpreted by the market as a sign of "insufficient ammunition," especially as the Q3 financial report showed its cash and cash equivalents at only $54.3 million. Since November, Strategy has accumulated a total of 9,062 Bitcoin, far below the 79,000 Bitcoin accumulated during the same period last year, which is also influenced by the rising Bitcoin prices. Notably, this month's accumulation mainly came from a recent purchase of 8,178 BTC last week, while other transactions involved only hundreds of Bitcoin.

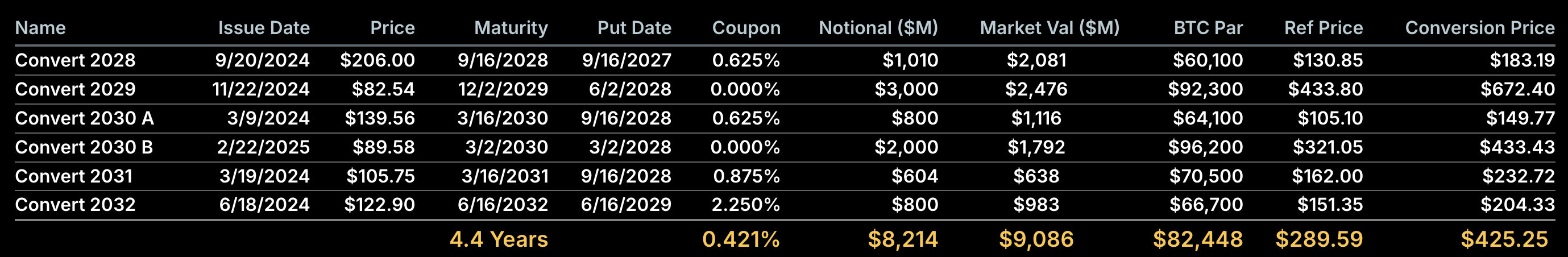

To supplement its funds, Strategy has begun seeking financing in international markets and launched a new financing tool, perpetual preferred shares (which require high dividends of 8-10%). Recently, the company raised approximately $710 million by issuing its first euro-denominated perpetual preferred shares, STRE, to support its strategic layout and Bitcoin reserve plans. It is worth mentioning that as of now, the company has six outstanding convertible bonds, with maturity dates ranging from September 2027 to June 2032.

Additionally, the movements of internal executives have also drawn market attention. Strategy disclosed in its financial report that Executive Vice President Wei Ming Shao will leave the company on December 31, 2025, and since September of this year, he has sold MSTR stock worth $19.69 million through five transactions. However, these sales were conducted under a pre-arranged 10b5-1 trading plan. According to U.S. SEC rules, a 10b5-1 trading plan allows company insiders to trade stocks under pre-set buy-sell rules (which must specify quantity, price, or timetable), thereby reducing the legal risks of insider trading.

Multiple Analyses Suggest Debt Risks Are Overstated, High Premium Investors Under Significant Pressure

In the face of the crypto market's gloomy sentiment and multiple concerns regarding the DAT business model, Strategy founder Michael Saylor reiterated the "HODL" philosophy, expressing optimism about the recent decline in Bitcoin prices and maintaining a bullish outlook for the future, even emphasizing that unless Bitcoin falls below $10,000, Strategy will not sell its holdings, in an effort to boost market confidence.

At the same time, the market has provided analyses of Strategy from various angles. Matrixport pointed out that Strategy remains one of the most representative beneficiaries in this round of the Bitcoin bull market. The market has previously worried whether the company would be forced to sell its Bitcoin holdings to repay debts. However, based on the current asset-liability structure and debt maturity distribution, it assesses that the probability of "being forced to sell Bitcoin to repay debts" in the short term is low and is not the main source of current risk. The most pressured group is the investors who bought in during the high premium phase. Most of Strategy's financing occurred when the stock price was close to its historical high of $474, and the net asset value (NAV) per share was at its peak. As NAV gradually declines and premiums compress, the stock price has retreated from $474 to $207, leaving investors who entered during the high premium range facing significant unrealized losses. In reference to the current Bitcoin price increase, Strategy's stock price has significantly corrected from its previous highs, making its valuation relatively more attractive, and the expectation of being included in the S&P 500 index in December still exists.

Crypto analyst Willy Woo further analyzed Strategy's debt risk and expressed "high skepticism" about its potential liquidation during a bear market. He stated in a tweet that Strategy's debt is primarily composed of convertible preferred notes, which can be repaid in cash, common stock, or a combination of both. Among these, Strategy has approximately $1.01 billion in debt maturing on September 15, 2027. Woo estimates that to avoid needing to sell Bitcoin to repay debts, Strategy's stock price at that time must be above $183.19, roughly equivalent to a Bitcoin price of around $91,502.

Ki Young Ju, founder and CEO of CryptoQuant, also believes that the probability of Strategy going bankrupt is extremely low, bluntly stating, "MSTR can only go bankrupt if an asteroid hits the Earth. Saylor will never sell Bitcoin unless shareholders demand it; he has emphasized this multiple times publicly."

Ki Young Ju pointed out that even if Saylor were to sell just one Bitcoin, it would undermine MSTR's core identity as a "Bitcoin treasury company," triggering a dual death spiral for both Bitcoin and MSTR stock prices. Therefore, MSTR shareholders not only hope for Bitcoin's value to remain strong but also expect Saylor to continue employing various liquidity strategies to ensure MSTR's price rises alongside Bitcoin.

In response to market concerns about debt risks, he further explained that most of Strategy's debt consists of convertible bonds, and not reaching the conversion price does not imply liquidation risk. It simply means that the bonds need to be repaid in cash, and MSTR has multiple ways to handle its upcoming debt maturities, including refinancing, issuing new bonds, obtaining secured loans, or using operating cash flow. Failure to convert does not trigger bankruptcy; it is merely a normal situation regarding debt maturity and is unrelated to liquidation. While this does not mean that MSTR's stock price will remain high indefinitely, the notion that they would sell Bitcoin to boost stock prices or face bankruptcy is entirely absurd. Even if Bitcoin drops to $10,000, Strategy would not go bankrupt; the worst-case scenario would only involve a restructuring of its debt. Additionally, MSTR could choose to use Bitcoin as collateral to raise cash, although this would carry potential liquidation risks and would be considered a last resort.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。