Gold reserves of $12.9 billion have surged by $7.6 billion in nine months. This stablecoin giant is hoarding gold at a pace that surpasses sovereign nations, building an unprecedented "borderless central bank" system.

The issuer of the world's largest stablecoin, USDT, Tether, is accumulating physical gold at an astonishing rate. According to the Q3 2025 report, its gold reserves have skyrocketed from approximately $5.3 billion at the end of 2024 to $12.9 billion, a net increase of over $7.6 billion in just nine months.

This accumulation rate even exceeds that of the vast majority of sovereign central banks.

Tether is no longer just a simple cryptocurrency company. By using U.S. Treasury bonds as a profit engine and gold and Bitcoin as "hardcore" value, it is constructing an unprecedented "borderless central bank" system.

1. Gold Empire: Scale and Layout

Tether's gold strategy is reflected not only in its holdings but also in its penetration of the entire gold industry chain, from gold mining to trading, creating a complete ecosystem.

Gold Reserves Surpassing Nations

Tether's speed of gold accumulation is astonishing. Market analysis indicates that Tether has increased its gold holdings by more than one ton per week over the past year, a pace that even surpasses that of most sovereign central banks.

● As of Q3 2025, Tether's gold reserves have reached $12.9 billion, an increase of over 140% from approximately $5.3 billion at the end of 2024.

● This scale of gold holdings places Tether among medium-sized gold-holding countries, with reserves exceeding those of nations like Indonesia.

Full Industry Chain Layout

● In June 2025, Tether Investment announced the acquisition of a strategic stake of up to 37.8% in the Canadian-listed gold mining royalty company Elemental Altus Royalties Corp., retaining the right to increase its stake to 51.8%.

● This royalty model allows Tether to obtain a stable share of gold production over the coming decades without bearing the risks of operating mines, ensuring the security of its gold supply from the source.

● In addition to upstream gold mining resources, Tether also "poached" two of the world's top precious metals traders from HSBC, including Vincent Domien, the global head of metals trading at HSBC and a current board member of the London Bullion Market Association (LBMA).

Gold Tokenization Products

● Tether has also launched the gold tokenization product Tether Gold (XAUT), which has a market capitalization exceeding $2.1 billion. This token is backed by physical gold, allowing users to hold and trade gold digitally.

● Tether has partnered with Singapore financial services company Antalpha to raise at least $200 million for a project called "Digital Asset Treasury" (DAT), aimed at establishing an "institutional-grade gold-backed lending solution" for the XAUT token.

2. Business Model: "U.S. Treasury Bonds - Gold" Closed Loop

Tether has constructed a nearly perfect closed-loop business model, making it one of the most efficient profit-making companies globally.

Absorbing Global Dollar Funds

● Tether has absorbed nearly $180 billion in funds from the global market by issuing the USDT stablecoin. This provides a massive funding pool for subsequent investments.

Profiting from U.S. Treasury Bonds

● The vast majority of the funds absorbed by Tether are invested in highly liquid and secure U.S. Treasury bonds. As of Q2 2025, its total exposure to U.S. Treasury bonds has reached $127 billion, making it one of the largest private holders of U.S. government debt globally.

● This scale of holdings places it as the seventh-largest holder of U.S. Treasury bonds, surpassing countries and regions like Canada and Taiwan.

● During the Federal Reserve's high-interest rate cycle, Tether can easily earn billions of dollars in "risk-free" interest from its Treasury bond holdings each year. In Q2 2025 alone, Tether achieved a net profit of $4.9 billion.

Converting Profits into Gold

● Tether uses part of its profits to hoard gold and invest in the gold industry to hedge against the depreciation of U.S. Treasury bonds or interest rate cuts. By accumulating gold and Bitcoin, Tether achieves an excess reserve ratio, further solidifying the security and brand value of the stablecoin market, ultimately promoting more stablecoin issuance.

3. Financial Performance: Sources of Billions in Profit

Tether's financial performance in 2025 is remarkable, with net profits exceeding $10 billion in the first nine months, pushing Tether's valuation to $500 billion, comparable to OPENAI.

Profit Composition Analysis

● Tether's profits primarily come from two sources: stable interest income generated from its holdings of approximately $135 billion in U.S. Treasury bonds, and substantial unrealized gains from its gold and Bitcoin reserves during the bull market of 2025.

● The potential income from U.S. Treasury bonds is estimated to be around $4 billion (based on a 4% annual yield). The contribution from gold is particularly significant. At the beginning of 2025, the gold price was approximately $2,624 per ounce, and by September 30, the price had surged to $3,859, an increase of 47%.

● Based on Tether's gold holdings of $5.3 billion at the end of 2024, this portion of "old gold" alone generated approximately $2.5 billion in unrealized gains. Combined with the newly purchased gold in 2025, $3 to $4 billion of Tether's billions in profit came from the appreciation of gold.

Bitcoin Contribution

● The unrealized gains from BTC are approximately $2 billion. This diversified asset allocation allows Tether to maintain strong profitability across various market environments.

4. Cracks in the Perfect Empire

Behind the seemingly perfect business empire, Tether's vision of a "borderless central bank" faces triple threats from regulation, market conditions, and competition.

Regulatory Wall

Gold reserves have brought Tether massive profits but have also become its biggest stumbling block on the path to compliance.

● In July 2025, the U.S. signed the GENIUS Act, which explicitly requires that stablecoin issuers operating in the U.S. must have their reserves fully backed by "high-quality liquid assets," namely cash in U.S. dollars or short-term U.S. Treasury bonds.

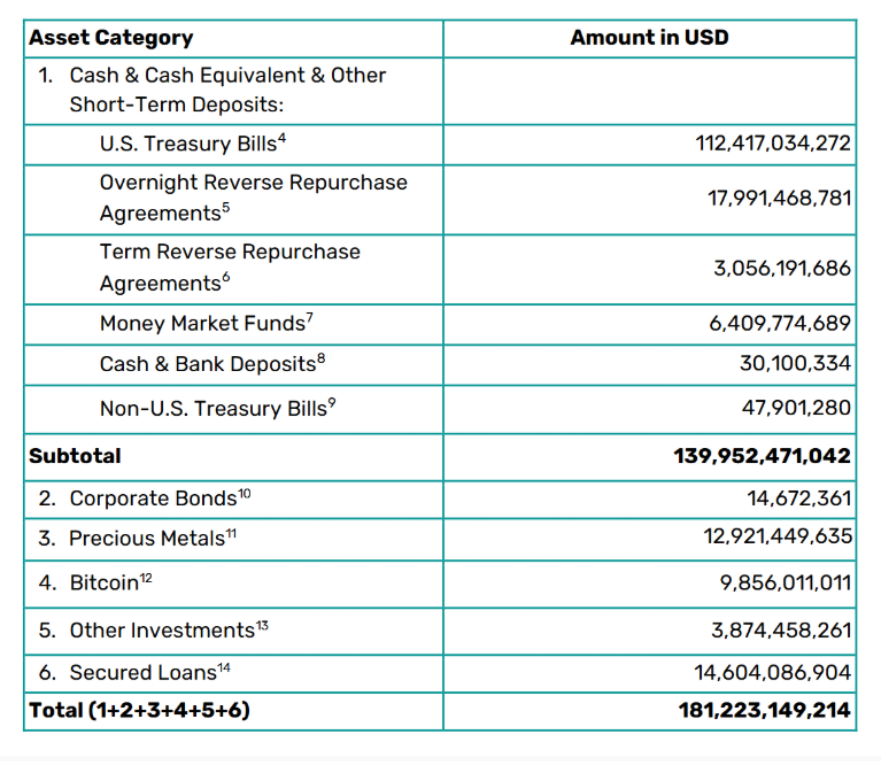

● According to Tether's Q3 report, its total reserves amount to $181.2 billion, with issued USDT at $174.4 billion. Among these, $12.9 billion in gold and $9.9 billion in Bitcoin are classified as "non-compliant assets" under the GENIUS Act's definition.

● This scenario has already played out in Europe. Due to Tether's reserves not complying with the EU's MiCA regulations, nearly all mainstream exchanges, including Coinbase, have delisted USDT in the European Economic Area (EEA) from the end of 2024 to March 2025.

● As the details of the GENIUS Act are gradually implemented over the next 18 months, all compliant exchanges in the U.S. will be forced to make similar choices. Tether's response has confirmed the reality of this threat. In September 2025, Tether announced the establishment of Tether America and plans to launch a new stablecoin called USAT in December. This USAT will be 100% compliant (holding only Treasury bonds) and specifically aimed at the U.S. market.

Market Risks

● Tether's profit composition also carries significant risks. If market conditions shift in 2026, Tether's profit growth may slow or even turn into losses. Several mainstream financial institutions predict that the Federal Reserve will enter a rate-cutting cycle in 2026. Estimates suggest that a 25 basis point cut in rates could reduce Tether's annual income by $325 million.

● On the other hand, the gold and Bitcoin markets experienced a frenzied bull market in 2025, and if these two assets enter a bear market cycle, Tether's earnings will also significantly shrink.

Competitive Threats

● The tightening of regulations is reshaping the stablecoin market landscape. The biggest beneficiary is Circle's USDC. As a leader in compliance, USDC has been welcomed by regulators.

● Circle's Q3 2025 financial report shows that its USDC circulation reached $73.7 billion at the end of the quarter, achieving a remarkable year-on-year growth of 108%.

● In contrast, while Tether remains dominant, its growth has shown signs of fatigue. At the current rate of stablecoin issuance growth, USDC is expected to surpass USDT around 2030.

5. Strategic Choices at a Crossroads

Facing multiple challenges, Tether stands at a strategic crossroads. Its future development direction may depend on several factors:

Regulatory Adaptability

● Tether has begun to address regulatory challenges, including the establishment of Tether America to handle U.S. compliance operations and the launch of the USAT stablecoin, which is 100% backed by U.S. Treasury bonds.

● This "dual-track" strategy—protecting the global USDT's gold and Bitcoin reserve strategy while entering the U.S. compliant market with USAT—may be Tether's main development direction in the future.

Asset Allocation Optimization

● Despite facing regulatory pressure, Tether has not abandoned its gold strategy. On the contrary, it continues to expand both Bitcoin and gold assets in parallel. The company retains most of its reserves in liquid instruments, such as U.S. Treasury bonds, ensuring strong liquidity while increasing protection through hard assets.

Market Outlook

● According to institutions like JPMorgan and Goldman Sachs, the Federal Reserve's rate-cutting cycle in 2026 may not trigger a bear market but could instead serve as "fuel" for pushing gold and Bitcoin prices to new highs. If the market develops along this script, Tether's "gold strategy" will help it reach new heights.

Tether's "U.S. Treasury Bonds - Gold" closed-loop model challenges the traditional financial system and reshapes the future of decentralized finance. Its gold reserves contributed $3 to $4 billion in unrealized gains in the first three quarters of 2025, becoming a key pillar of its billions in profit.

With regulatory walls rising, Tether has begun to set up defenses—establishing Tether America and preparing to launch a fully compliant USAT stablecoin. Whether this dual-track path can navigate the narrow channel of compliance and innovation will determine how far this "borderless central bank" can go.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。