Original | Odaily Planet Daily (@OdailyChina)

Yesterday, the U.S. non-farm payroll report for September was released, showing an increase of 119,000 jobs, significantly higher than the expected 50,000. However, the unemployment rate for September recorded at 4.4%, exceeding the market expectation of 4.3%, marking the highest level since October 2021.

Following the data release, the cryptocurrency market faced another severe downturn. BTC fell below $87,000, hitting a low of $86,100, with a 24-hour decline of 6.22%; ETH dropped below $2,800, reaching a low of $2,790, with a 24-hour decline of 6.1%; SOL saw a 24-hour decline of 6.18%; BNB fell below $900, with a 24-hour decline of 4.48%. The altcoin market was even more dismal, with data from Quantifycrypto showing that 90% of the top 200 cryptocurrencies by market capitalization were in a downtrend over the past 24 hours.

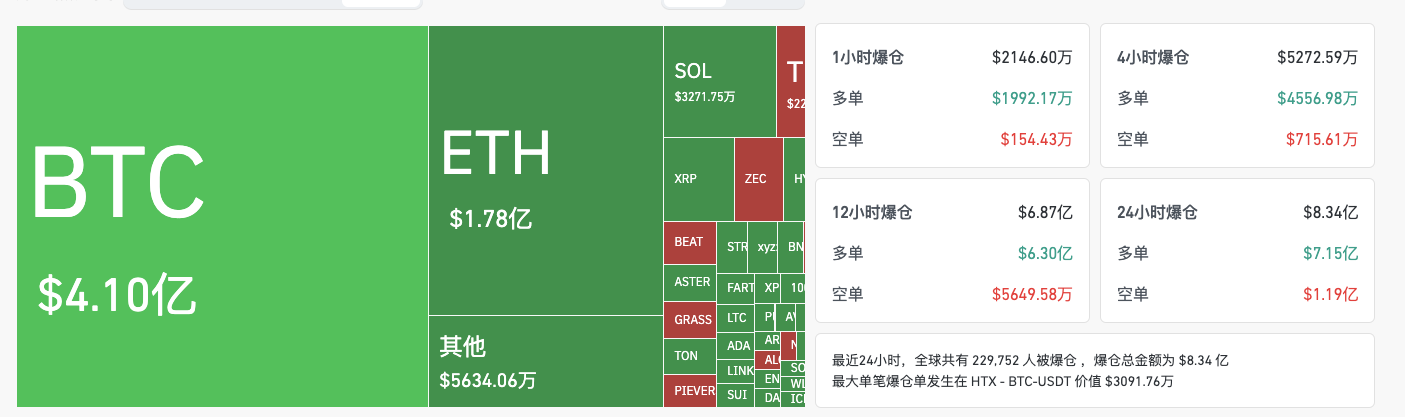

In terms of derivatives, according to Coinglass, the total liquidation amount across the network in the past 24 hours reached $833 million, with long positions accounting for $714 million and BTC liquidations amounting to $410 million.

However, it wasn't just the cryptocurrency market that suffered; global financial markets also faced challenges.

Yesterday, all three major U.S. stock indices closed lower, with the Dow Jones down 0.84% at 45,752.26 points, the S&P 500 down 1.56% at 6,538.76 points, and the Nasdaq down 2.15% at 22,078.05 points. Tech stocks also took a hit, with Nvidia dropping over 3%. U.S. Treasury yields collectively fell, with the 2-year Treasury yield down 5.25 basis points to 3.533%, the 3-year down 5.84 basis points to 3.525%, the 5-year down 5.76 basis points to 3.646%, the 10-year down 4.83 basis points to 4.085%, and the 30-year down 2.98 basis points to 4.723%.

“Mixed Signals” Complicate Fed Decision-Making

This September non-farm payroll report is the first economic indicator released by the U.S. Bureau of Labor Statistics since the end of the federal government shutdown. Investors initially thought it would provide clear risks for the Federal Reserve's interest rate cut decision, but it turned out to complicate matters further.

The September non-farm payroll report presented “mixed signals.” On one hand, the non-farm employment figure of 119,000 far exceeded the expected 50,000. Looking at the sub-data, healthcare added 43,000 jobs, outpatient services added 23,000, and hospitals added 16,000 jobs. Hiring in food services and drinking places was also very active, adding 37,000 jobs, indicating that U.S. employment is steadily growing, which may lead the Fed to focus more on inflation levels.

On the other hand, the U.S. unemployment rate for September recorded at 4.4%, the highest since October 2021. This indicator suggests that the U.S. job market remains weak; despite an increase in job openings, the number of unemployed individuals remains high, indicating that the Fed should pay more attention to employment.

The reason for such seemingly contradictory data lies in the different statistical criteria for non-farm employment and the unemployment rate. Non-farm employment primarily surveys the number of company positions, and short-term part-time jobs are also counted as new positions, meaning one person can hold multiple jobs. This is one reason why non-farm employment figures may deviate from the unemployment rate.

At the same time, the unemployment rate primarily counts individuals, and if a person is not working, they are not considered unemployed. However, once they start looking for a job, they are counted as unemployed. Therefore, when the job market improves, it attracts more people to seek employment, which can lead to an increase in the unemployment rate.

However, such “mixed signals” increase the uncertainty of a rate cut by the Fed in December. According to CME's “FedWatch,” the current probability of a 25 basis point rate cut by the Fed in December is 35.6%, while the probability of maintaining the current rate is 64.4%. Betting on Polymarket also shows a 65% probability that the Fed will keep rates unchanged in December.

Analysts' expectations for the Fed's decision indicate that the “no rate cut” camp currently holds an advantage.

Morgan Stanley analyst Michael Gapen stated that strong employment reduces the risk of rising unemployment and no longer expects the Fed to cut rates in December. He currently anticipates three rate cuts in January, April, and June of next year, maintaining the final rate expectation at 3-3.25%.

B. Riley Wealth analyst Art Hogan noted that the U.S. September non-farm report is significantly lagging, and the next non-farm report will not be released until after the December Fed rate decision. This puts the Fed in a decision-making dilemma and does not significantly increase the probability of a rate cut in any direction. The market's rise was primarily driven by solid earnings reports from Nvidia and Walmart, indicating that market reactions stem more from corporate profits than economic data.

Ali Jaffery, an analyst at Canadian Imperial Bank of Commerce Capital Markets, stated that the Fed's decision to pause rate hikes in December largely depends on insufficient data, pushing policy decisions to next year to act when complete data is available. This may be a wiser choice, especially in light of legal challenges to tariffs.

However, some institutions still hold hope for a rate cut in December.

Goldman Sachs Asset Management's fixed income head, He, stated, “Given the persistent weakness in the labor market reflected by the unemployment rate, the possibility of a Fed rate cut in December still exists.”

Wells Fargo analyst Sarah House suggested that the Fed should cut rates by 25 basis points in December, citing easing inflation and a weakening labor market. She pointed out that hawkish individuals may oppose a rate cut due to inflation being above target and robust job growth, but the Fed still maintains its stance while acknowledging that it is a “50-50” decision.

Before the September non-farm report was released, the market had significant confidence in a Fed rate cut in December. Although this data did not clearly lean towards “no rate cut,” any ambiguous news would trigger a rapid market adjustment given the market's heavy betting on a rate cut.

While the September non-farm report is ambiguous, it remains the only non-farm macro information we can rely on before a December rate cut, with the next non-farm report not due until after December.

Currently, the cryptocurrency market has fallen into extreme panic, with the fear and greed index at 11, marking a new low for 2023. Therefore, this market decline may just be a short-term emotional downturn triggered by macro factors, but as investors, it is crucial not to blindly bottom-fish; safeguarding your finances is better than charging in blindly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。