Crypto Capitulation May Be the Fuse for Bitcoin’s Next Explosive Rally

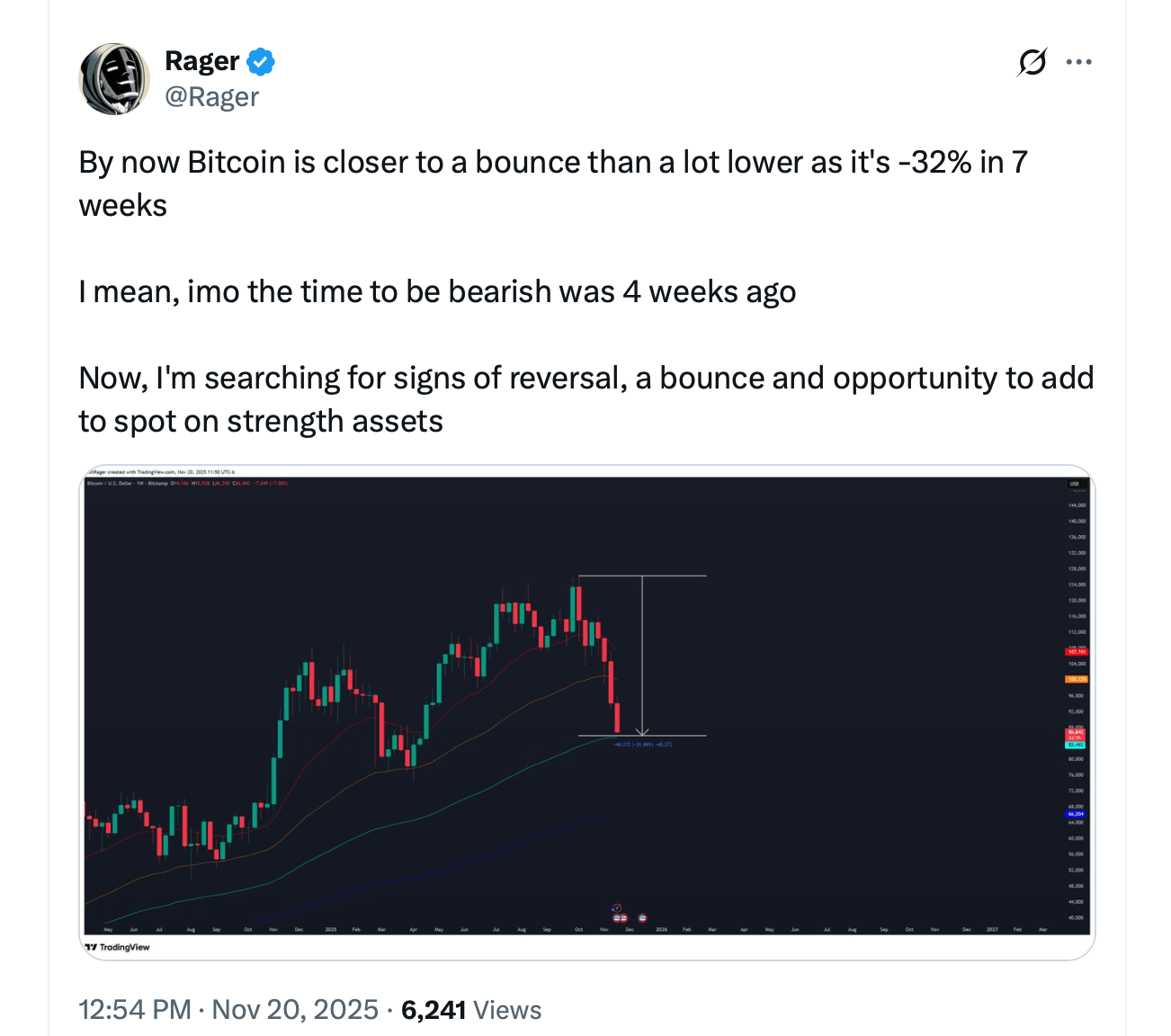

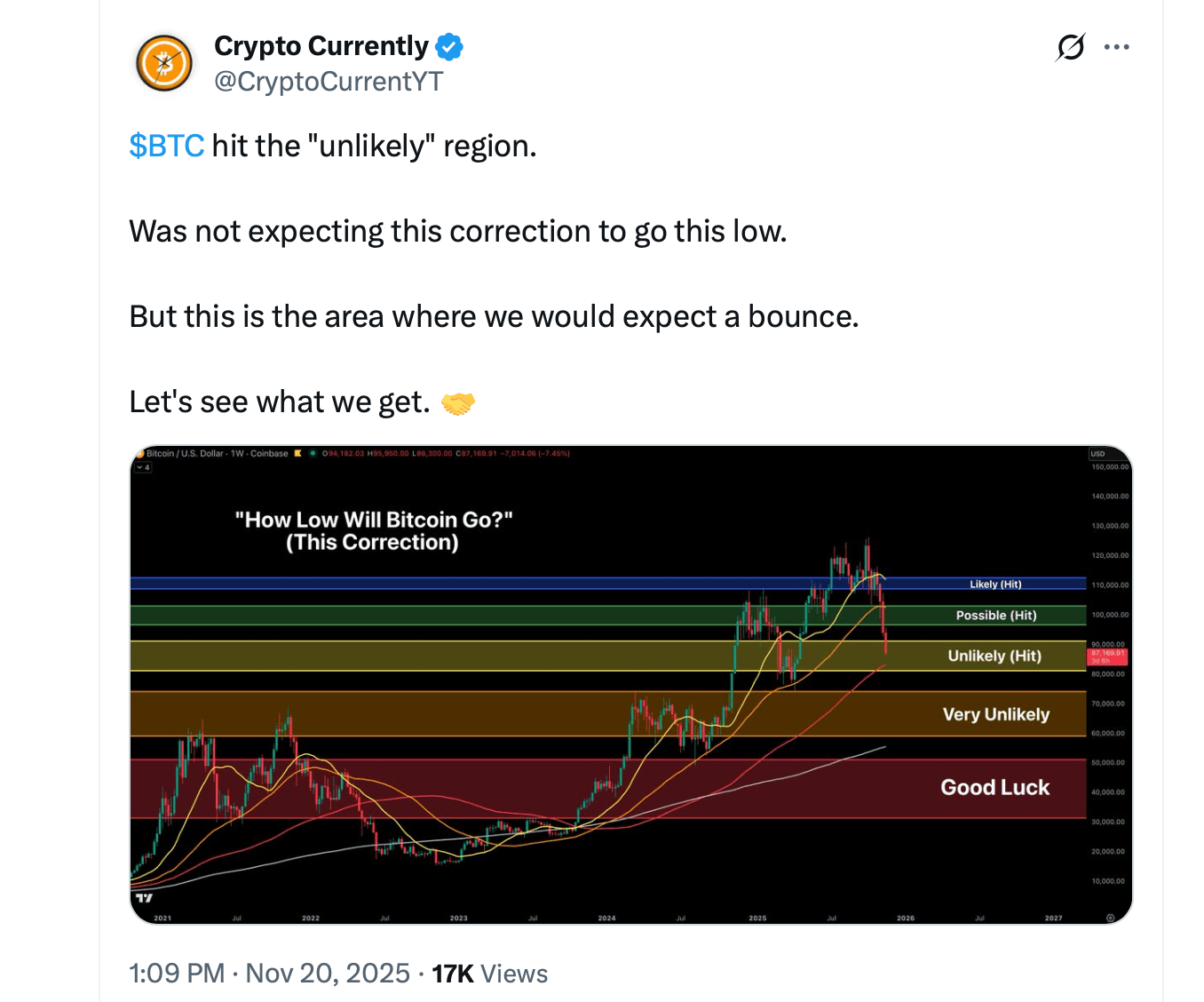

A quick scroll through social media on Thursday makes it clear plenty of crypto loyalists not only buy into this theory — they’re happily promoting it like it’s the next big thing.

Bitcoin’s sell-off has pushed the market into full-blown capitulation territory, a setup that historically acts as the slingshot for some of the asset’s strongest upside moves. And based on the latest onchain and sentiment data, this downturn is looking less like a trend reversal and more like the classic dunk before liftoff.

“History is whispering: bitcoin is near a bottom,” one proponent posted on X today. “[Net Unrealized Profit/Loss] just hit 0.47. The exact level that triggered 3 violent reversals in the past. This is where fear peaks… And bitcoin begins its next move. Same setup. Same opportunity. This signal rarely misses,” the individual added.

Short-term holders are now waving the white flag, dumping coins at losses so steep they’ve pushed the profit-and-loss ratio to its lowest reading on record. Recent buyers—typically the quickest to panic—have spent weeks unloading bitcoin below cost, a behavior that has reliably marked cycle bottoms. When this cohort gets flushed out, supply tightens dramatically, giving even modest inflows the power to send prices ripping higher.

Oversold technicals are adding fuel to that setup. The 14-day relative strength index (RSI) has cratered to levels not seen since August 2023, slipping into the mid-20s. In bull-market conditions, readings this low almost always precede fierce rebounds as sellers run out of steam and shorts get caught leaning too far. It’s the technical equivalent of compressing a spring.

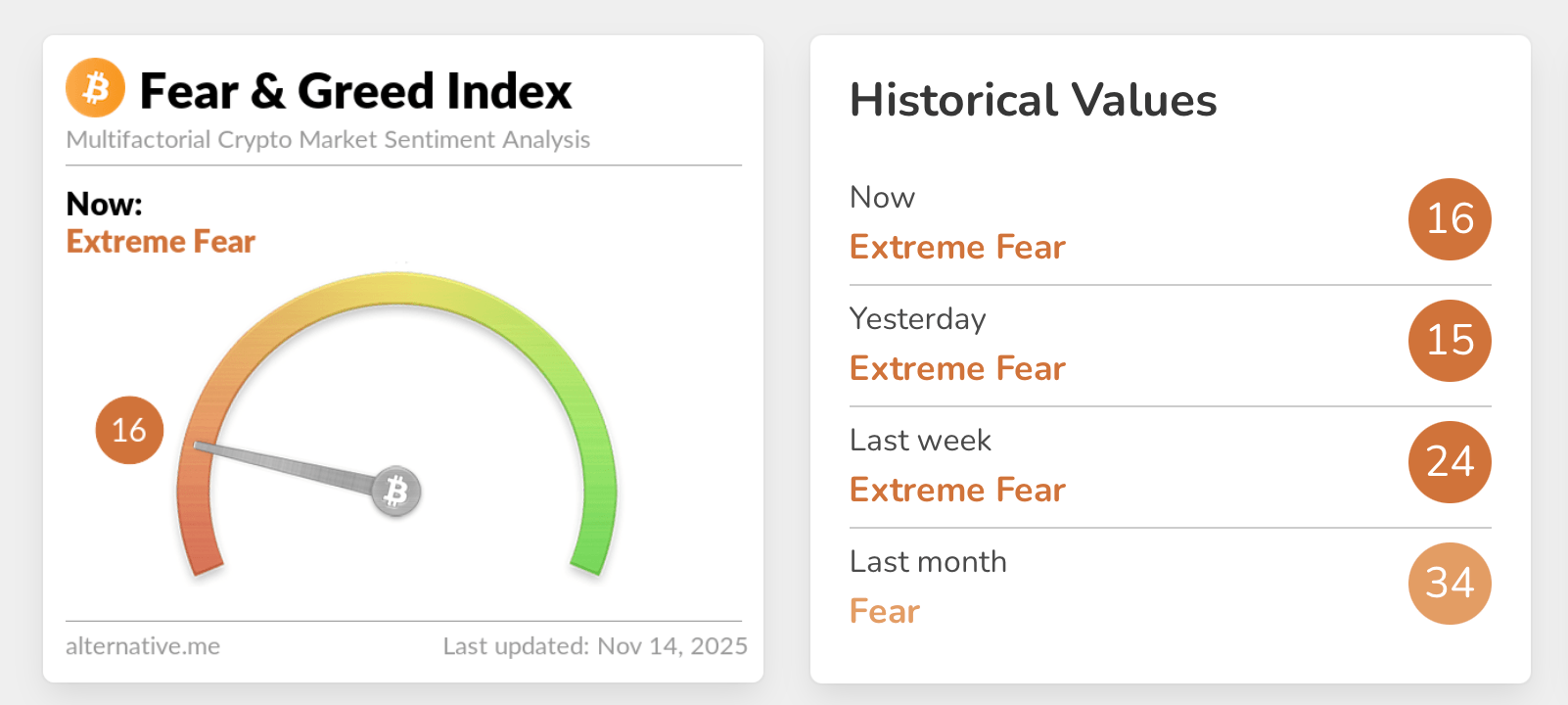

Sentiment gauges paint an even bleaker picture—ironically bullish in the world of crypto. The Fear & Greed Index has slid into the single digits, registering levels lower than those seen during the FTX collapse. Extreme fear at this depth is rare, and it signals the same dynamic seen at prior major turning points: widespread panic followed by a swift pivot as buyers regain control.

Crypto Fear and Greed Index (CFGI) on Nov. 20, 2025, according to alternative.me.

What makes this washout even more compelling is the absence of a clear negative catalyst. There’s no regulatory bombshell, no exchange meltdown, no macro shock. Instead, this move appears to be driven by heavy long liquidations and cascading stops—a classic leverage flush. Markets typically reverse sharply once the forced sellers are gone and shorts begin to overstay their welcome. At the moment, $897.07 million has been wiped out across crypto derivatives markets, and a hefty $680.06 million of that came from long positions getting steamrolled.

Also read: Blackrock Opens Door to Staked Ethereum ETF With Fresh Trust Filing

Stats also reveal that 225,611 traders were cleared out today, and $372.40 million of the $680.06 million in wipeouts came straight from BTC longs getting flattened. Capitulation metrics sourced from Glassnode-style indicators also show signs of a bottom forming. Realized losses have spiked, short-term holder cost bases have been breached, and the latest capitulation index is flashing signatures consistent with late-stage corrections. Things did not look good today, when BTC’s spot price slid to an intraday low of $85,912 on Bitstamp.

Historically, these signals peak shortly before the market rebounds, often leading to 50% to 100% upside in the following one to three months. Institutional demand remains seemingly intact as well. Spot exchange-traded fund (ETF) flows have softened but not reversed, and post-halving structural supply constraints are still present. With long-term holders increasing their share of supply and panic sellers nearly exhausted, the conditions look primed for a sharp reversal.

Even bitcoin’s intraday drop toward the high-$85,000 range fits the pattern. Historically, late-cycle corrections tend to sweep liquidity below key round numbers before snapping back violently as sidelined capital rushes in. Capitulation lows often form not with a whimper but with a dramatic, fear-driven spike down.

If the pattern repeats—and the data strongly suggests it may—the next major move could be a rapid, aggressive rebound. The deeper the flush, the fiercer the recovery.

FAQ ❓

- Why is a bitcoin rebound likely after this drawdown? Years of data show major rallies often begin immediately after extreme capitulation phases.

- What indicators suggest a bottom is forming? Oversold RSI, deep fear readings, and historic short-term holder losses signal exhaustion among sellers.

- Does the lack of negative news make this move unusual? Yes—drops without headlines often signal leverage unwinds rather than structural weakness.

- How large could the rebound be? Prior post-capitulation rallies have delivered 50% to 100% gains within months.

- Is it possible that there won’t be a rebound? When it comes to BTC markets, anything is possible, and nothing is certain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。