Written by: Glendon, Techub News

Despite the ongoing downturn in the cryptocurrency market, which is shrouded in panic, the development of the altcoin ETF market has not come to a halt.

Yesterday, the 21Shares Solana ETF (ticker TSOL) was officially listed on the Chicago Board Options Exchange (CBOE) after receiving approval from the U.S. SEC. This fund supports cash or physical redemptions, has a management fee of 0.21%, and allows Solana to provide additional returns through staking. Its initial assets under management were $100 million, with a trading volume of $400,000 on its first day, and its net asset value has now risen to $104 million.

After TSOL began trading, the total number of U.S. Solana spot ETFs increased to six, far surpassing other altcoin ETFs in number. Notably, while Bitcoin and Ethereum spot ETFs in the U.S. have seen continuous outflows in recent days, the Solana spot ETF recorded a net inflow of $55.61 million yesterday, marking the third-highest net inflow in history, only behind the $70.05 million on November 3 and $69.45 million on October 28. Considering the current sluggish state of the cryptocurrency market, the performance of the Solana spot ETF is quite impressive.

In addition to Solana, during the same period, the first XRP, HBAR, and LTC spot ETFs were also listed, officially opening the door for altcoin ETFs. So, how are the currently listed altcoin ETFs performing? Is the wave of altcoin ETFs about to arrive?

Solana: The "Leader" of Altcoin ETFs

Currently, there are six U.S. Solana spot ETFs trading, namely Bitwise Solana Staking ETF (BSOL), Grayscale Solana Trust (GSOL), Fidelity Solana Fund ETF (FSOL), VanEck Solana ETF (VSOL), Canary Marinade Solana ETF (SOLC), and 21Shares Solana ETF (TSOL). According to SoSoValue data, as of today, the total net inflow for U.S. Solana spot ETFs is approximately $476 million, with total net assets reaching about $715 million, accounting for about 0.97% of SOL's market capitalization.

The Bitwise BSOL ETF was listed on the NYSE on October 28, making it the first Solana spot ETF in the U.S. This fund has a management fee of 0.99% and an initial investment of up to $220 million. It is a "staking" ETF that not only allows investors to hold SOL but also earns returns for investors through staking, achieving asset appreciation.

On its first day of trading, BSOL reached a trading volume of $56 million, setting a record for the highest trading volume among nearly 850 newly listed ETFs this year, with a net inflow of $69.45 million on the same day. Its performance was even stronger on the second trading day, with trading volume climbing to $72.4 million. This impressive figure undoubtedly marks a good start for the Solana spot ETF. As of now, BSOL has taken the lead, with cumulative net inflows reaching $424 million, accounting for 89% of the total net inflow.

Following closely is the Grayscale GSOL ETF, which successfully transitioned from a trust product to an ETP and was listed on NYSE Arca on October 29. GSOL has a management fee of 1.5% and features SOL staking capabilities. The fund's trading volume on its first day was approximately $4 million, which, while far less than BSOL, is still considered decent overall. Currently, GSOL has accumulated a net inflow of about $41.05 million.

In November, the Solana spot ETF market welcomed four more ETFs. On November 17, the VanEck VSOL ETF was listed on Nasdaq with a management fee of 0.3%. On its first day, the fund had no net inflow. This fund also supports providing investors with returns from staking Solana assets and has adopted an aggressive fee strategy: it waives its 0.3% management fee until February 17 or until the fund's assets reach $1 billion, attempting to attract investors' attention with low fees. However, as of today, VSOL's net asset value is only $10.26 million, still far from its target asset size.

The Fidelity FSOL ETF was listed on the NYSE on November 18, with a management fee of 0.25%. This ETF tracks the Fidelity Solana Reference Index (FIDSOLP) and includes staking returns from SOL. Its initial seed capital was 23,400 SOL, valued at approximately $3.3 million at the time. In the two days since its listing, the net inflow has been $7.49 million, and FSOL's net asset value is currently about $10.46 million.

The Canary SOLC ETF, launched in collaboration between Canary Capital and Marinade Finance, is a spot ETF that was listed on Nasdaq on the same day as FSOL. This ETF has a management fee of 0.5% and supports on-chain staking, using part of its SOL holdings for staking to earn network rewards, which are then distributed to investors. However, in the two days since its listing, this ETF has seen zero net inflow, with a net asset value of only $763,800, indicating poor market performance.

From the above data, it is clear that although the overall cryptocurrency market is weak, the Solana spot ETFs have seen nearly $500 million in net inflows in just half a month, demonstrating the potential of the SOL ETF market. It is worth mentioning that since the first Solana ETF was listed on October 28, the SOL spot ETFs have shown net inflows every trading day, achieving a continuous net inflow for 17 consecutive days.

In addition to Solana, the U.S. market has also officially launched three other altcoin spot ETFs, namely XRP, HBAR, and LTC. So, how do these altcoin ETFs perform compared to SOL?

XRP, HBAR, and LTC Spot ETFs

Unlike the dismal performance of the Canary Marinade Solana ETF (SOLC), the Canary XRP ETF (ticker XRPC), also issued by Canary Capital, presents a different picture.

The Canary XRP ETF was officially listed on Nasdaq on November 13, making it the first single-token XRP spot ETF in the U.S. and currently the only XRP spot ETF. It supports cash and physical redemptions, with a management fee of 0.50%. On its first day of trading, the ETF recorded a trading volume of $58 million, setting a new record for first-day trading volume among nearly 900 newly listed ETFs this year, even surpassing the previously highly anticipated Bitwise BSOL ETF.

Although XRPC had no net inflow on its first day, the next day it achieved a net inflow of $243 million through cash or physical subscriptions, a figure that far exceeded the highest single-day net inflow of BSOL (approximately $69.45 million). As of the time of writing, XRPC has only been listed for five trading days, with cumulative net inflows reaching $293 million and total net assets of approximately $269 million.

Despite currently having only one XRP ETF, XRPC's performance in the altcoin ETF space is as unique as that of BSOL. Currently, asset management companies such as Bitwise, 21Shares, and Grayscale have submitted applications for XRP spot ETFs, and related products are in preparation. For instance, Bitwise has announced details of its XRP ETF today, which will be listed on the New York Stock Exchange (ticker XRP), with a management fee of 0.34%, and it will waive management fees until the asset management scale reaches $500 million. This indicates that Ripple's potential is not inferior to that of Solana.

In contrast, the asset scale and prospects of the other two altcoins appear much dimmer compared to these two leaders.

The Canary HBAR ETF (HBR) and the Canary Litecoin ETF (LTCC), also issued by Canary Capital, are the first U.S. spot ETFs for their respective tokens and were officially listed on Nasdaq on October 28. On their first day, HBR and LTCC recorded trading volumes of $8 million and $1 million, respectively.

HBR has a management fee of 0.95%, and since its listing, it has accumulated net inflows of approximately $75.29 million, with total net assets of about $58.1 million. As noted by Bloomberg senior ETF analyst Eric Balchunas, most ETFs tend to see a decline in trading volume after the initial hype on their first day, and HBR's performance perfectly aligns with this trend.

Specifically, HBR achieved a total net inflow of $69.93 million in its first seven trading days, showing strong momentum. However, it subsequently experienced several days of zero net inflow and even some days of net outflow. This series of changes indicates that the altcoin ETF market is already showing signs of fatigue and lack of follow-through.

Compared to HBAR, the situation of LTC, as a "veteran" token, is even more dire with its first U.S. spot ETF "LTCC." This ETF also sets a management fee of 0.95% and introduces a staking mechanism, allowing investors to earn on-chain returns through holding LTC. Unfortunately, this ETF has clearly not attracted much interest from investors. As of today, LTCC's total net inflow is only $7.26 million, with total net assets of just $7.74 million. Furthermore, data from SoSoValue shows that LTCC's daily net inflows are mostly just a few hundred thousand dollars, with over half of the days experiencing zero net inflow.

Thus, while several altcoin ETFs have successfully entered the market at this stage, the existing data is insufficient to strongly support the view that a wave of altcoin ETFs is about to sweep in. The situation of the altcoins themselves, as well as the overall trend of the cryptocurrency market, will have a profound impact on the development direction of this specific market. So, how will the altcoin ETF market develop?

Short-term Pressure, Long-term Potential

Objectively speaking, the current cryptocurrency market has entered a "short-term bear market" phase, but the performance of SOL and XRP ETFs still has its highlights. For example, yesterday, the U.S. Solana spot ETF achieved a net inflow of $55.61 million, and the U.S. XRP spot ETF also saw a net inflow of $15.82 million. However, the relatively optimistic data from the ETFs has not significantly boosted the prices of the tokens.

Taking SOL and XRP as examples, as of the time of writing, the market shows that since October 28, SOL and XRP have fallen by more than 30% and 20%, respectively. In the current market environment, investors have a strong risk-averse sentiment towards altcoins, and the inflows into ETFs are more driven by long-term allocation needs rather than short-term speculative behavior, leading to more cautious capital flows.

From the perspective of negative factors, the development trend of the Bitcoin investment product market is not optimistic. A recent report from research firm K33 indicates that the Bitcoin derivatives market is showing a "dangerous" pattern. The reason is that traders are increasingly adding aggressive leverage as Bitcoin prices continue to pull back. Data shows that open interest in perpetual futures surged by over 36,000 Bitcoin last week, marking the largest single-week increase since April 2023, while funding rates continue to rise, indicating that traders are using high leverage to "bottom fish." K33's research director, Vetle Lunde, stated that these leveraged long positions have become a potential source of selling pressure in the market, significantly increasing the risk of heightened volatility due to forced liquidations.

Additionally, Bitcoin is facing ongoing outflows of ETF funds, which will transmit pressure throughout the entire cryptocurrency market. In such a macro trend, market liquidity decreases, making it difficult for altcoins like SOL and XRP to stand out, and token prices cannot receive effective boosts, further restraining the ETF market from expanding its capital inflows.

However, this market is not without positive signs. Yesterday, the total net inflow for Bitcoin spot ETFs reached $75.47 million, ending a previous five-day streak of net outflows, which undoubtedly sends a positive signal to the market that institutional investors have not completely lost confidence in the ETF market.

Overall, the development of the altcoin ETF market is constrained, primarily due to the ongoing downward trend in the cryptocurrency market. Therefore, in the short term, this sector will still need to bear the pressure brought by the overall decline in the cryptocurrency market, but looking at the long term, there may be a turning point.

21Shares analyst Maximiliaan Michielsen believes that the current decline in the cryptocurrency market is merely a short-term adjustment and not the beginning of a deep or long-term bear market. Although volatility and consolidation may continue until the end of the year, the fundamental factors driving this cycle remain solid and support its long-term positive outlook. Historical data shows that such a magnitude of pullback typically ends within 1 to 3 months and often indicates that a consolidation phase before the next round of increases has already arrived.

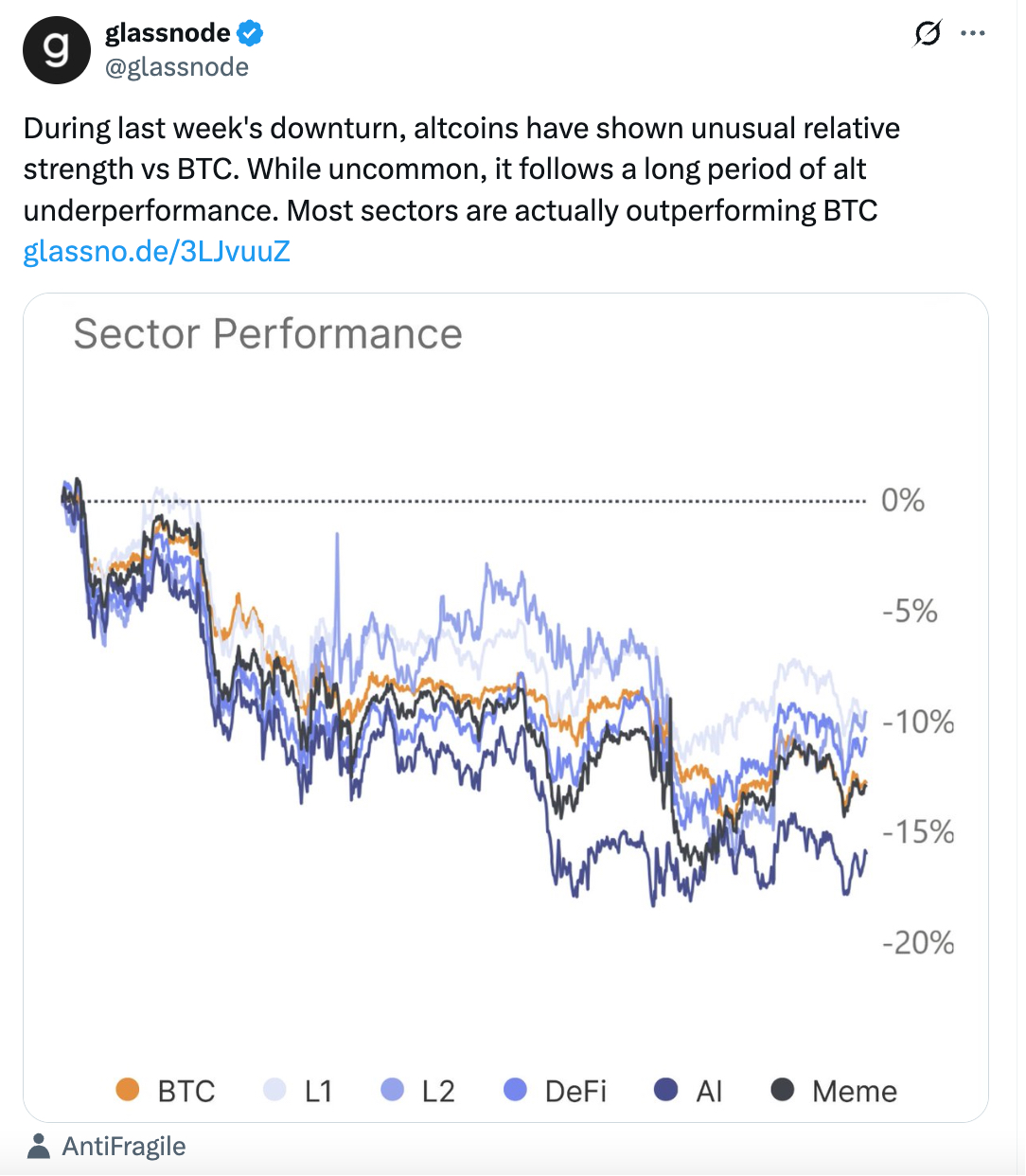

Moreover, while altcoins have inherent drawbacks such as high volatility and insufficient liquidity, their performance relative to Bitcoin has remained relatively strong during the recent downturn. Glassnode points out that during the market's deep sell-off phase, the relative profits of altcoins tend to stabilize. Although this situation is not common, it has emerged after a prolonged period of poor performance for altcoins. In fact, most altcoin sectors have recently outperformed Bitcoin.

Based on the current situation, the altcoin ETF market faces numerous constraints in the short term, including downward trends, spreading panic sentiment, and liquidity pressures, but there are also many positive factors for long-term development.

On one hand, the increasingly clear U.S. regulatory policies have accelerated the development of ETFs. Currently, the U.S. SEC has approved general listing standards for cryptocurrency ETFs and issued relevant guidelines to simplify the approval process. This move has attracted more institutions to participate in the ETF market, speeding up the approval or listing process for dozens of cryptocurrency ETFs. According to incomplete statistics, over 130 ETP products are awaiting listing, such as Grayscale's anticipated launch of the first Dogecoin ETF on November 24.

Additionally, the U.S. cryptocurrency market structure bill has also made progress. Tim Scott, chairman of the U.S. Senate Banking Committee, recently revealed that the bill is expected to complete reviews and votes in two committees by the end of the year and be submitted to the full Senate for review early next year for President Trump's signature. A clear regulatory framework helps reduce market uncertainty and encourages capital to shift from high-risk derivatives to compliant spot products.

On the other hand, the staking function of ETFs may stimulate demand from institutional investors. It is not difficult to see from the previously mentioned ETF products that almost all have introduced staking features to attract investors. The staking function provides investors with an additional income channel, increasing the product's appeal and helping to attract more capital inflows.

Will Peck, head of digital assets at WisdomTree, expects that ETFs holding diversified cryptocurrency portfolios will fill a significant gap in the market in the coming years and are likely to become one of the next waves of investment. Peck explains that while many new investors now understand the concept of Bitcoin, they often struggle to assess the value of the "next 20 assets." A diversified cryptocurrency portfolio allows them to engage with the field while reducing the "specific risk" of investing in a single token.

From a long-term perspective, the accelerated advancement of regulatory policies and a slowdown or reversal of the market's downward trend will provide growth momentum for the ETF market. If market sentiment can be restored and investor confidence rebounds, capital will be more willing to flow into the altcoin ETF market. It is expected that early next year, under the dual influence of favorable policies and improved market sentiment, altcoin ETFs are likely to usher in a true explosive period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。