Capital is torn between panic and greed, and the business model of digital asset treasury companies is facing a severe test.

Digital asset treasury companies are undergoing unprecedented stress tests. As the cryptocurrency market continues to languish, companies that buy Bitcoin, Ethereum, and other cryptocurrencies through borrowing or fundraising have seen their stock prices drop far more than the value of the tokens they hold.

In the past month, MicroStrategy's stock price fell by 25%, BitMine Immersion dropped over 30%, while Bitcoin's decline during the same period was 15%. This extreme performance has raised doubts about the business model of "leveraging cryptocurrency."

1. Capital Torn: Some Escape, Some Hold Firm

In the winter of the crypto market, institutional investors have shown starkly different attitudes towards digital asset treasury companies.

● Peter Thiel's Founders Fund reduced its stake in BitMine (BMNR) by half, while Cathie Wood's ARK Invest and JPMorgan chose to increase their positions against the trend.

● On November 6, ARK Invest increased its holdings by 215,000 shares of BitMine, valued at approximately $8.06 million. This capital divergence highlights the market's differing views on the prospects of digital asset treasury companies.

● Wall Street's well-known short seller Jim Chanos has been shorting MicroStrategy while buying Bitcoin, believing that investors have no reason to pay a premium for Saylor's company. However, last Friday, he told clients it was time to close this trade. Chanos stated that while treasury company stocks are still overvalued, the premium level is no longer extreme, "the logic of this trade has basically played out."

2. BitMine's Predicament: $3 Billion in Unrealized Losses and Cash Burn

As the second-largest cryptocurrency treasury company after MicroStrategy, BitMine is under immense market pressure.

● As of November 20, BitMine holds 3.56 million Ethereum, accounting for nearly 3% of the circulating supply, having surpassed half of its long-term target of 6 million. However, based on an average purchase price of $4,009, BitMine's unrealized losses are nearing $3 billion.

● The company's stock price has fallen about 80% from its July peak, with a current market capitalization of approximately $9.2 billion, below its ETH holding value of $10.6 billion (based on ETH at $3,000). Its mNAV (modified net asset value) has dropped to 0.86, reflecting market concerns about the company's unrealized losses and cash sustainability.

● Investors' focus has shifted from "how much more can we buy" to "how much longer can we hold out." Currently, BitMine's cash reserves are about $607 million, with the company's funding primarily coming from crypto asset earnings and secondary market financing.

3. MicroStrategy's Aggressive Strategy: Continued Bottom Fishing and Innovative Financing

Unlike BitMine, MicroStrategy (now renamed Strategy) continues to maintain an aggressive buying strategy amid market declines.

● From November 10 to 20, Strategy acquired 8,178 Bitcoin, valued at approximately $835.6 million, marking the company's largest Bitcoin purchase since the end of July.

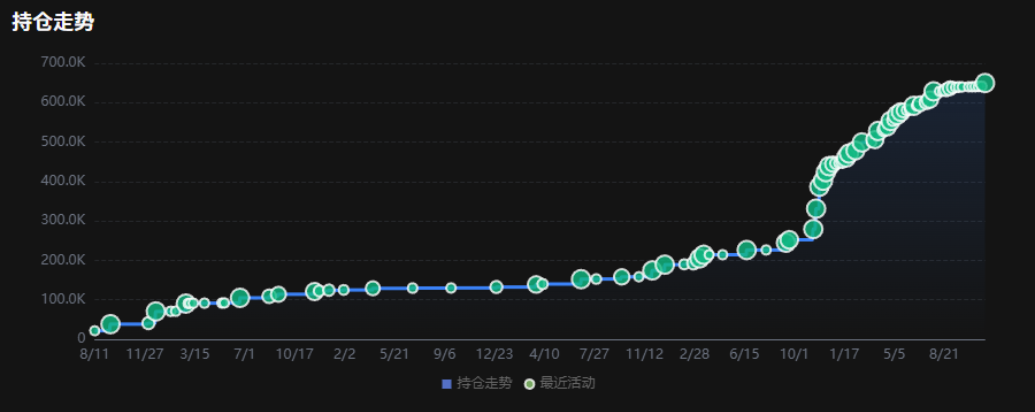

● This purchase brings Strategy's total holdings to 649,870 Bitcoin, accounting for over 3% of the total Bitcoin supply. The total cost of these Bitcoins is approximately $48.37 billion, with an average purchase price of $74,433.

● Strategy's latest acquisition was primarily financed through the proceeds from its new preferred stock issuance. The company raised about $715 million through its STRE or "Stream" series, expanding its high-yield tools to European investors. It also secured an additional $131.4 million through its STRC or "Stretch" preferred series.

4. Leverage Effect and Disappearing Premiums

The core issue for digital asset treasury companies is that investors are effectively paying a premium far above the net asset value for companies holding cryptocurrencies.

● Brent Donnelly, president of Spectra Markets, bluntly stated: "This whole concept makes no sense to me. You're just buying a $1 bill for $2. Ultimately, these premiums will be compressed."

● The leverage effect is magnified during declines. Matthew Tuttle noted, "Digital asset treasury companies are essentially leveraged crypto assets, so when cryptocurrencies fall, they fall even more." The MSTU ETF he manages aims to provide double the returns of MicroStrategy, but the fund has plummeted 50% in the past month.

● When digital asset treasury companies first emerged, they provided a channel for institutional investors who previously found it difficult to invest directly in cryptocurrencies. However, cryptocurrency exchange-traded funds launched in the past two years have been able to offer the same solutions, undermining the unique value proposition of treasury companies.

5. Buying Power Retreats Across the Board

The current environment facing the crypto market is exceptionally severe, with major buying powers retreating.

● There has been a continuous outflow of funds from Bitcoin and Ethereum spot ETFs. On November 19, the spot Bitcoin ETF saw an outflow of $254.5 million, while the spot Ethereum ETF experienced an outflow of $182.8 million. This marks the fourth consecutive day of net outflows for the Bitcoin ETF and the fifth consecutive day for the Ethereum ETF.

● Nick Ruck, director of LVRG Research, stated: "This outflow trend indicates a cautious attitude among institutional investors, reflecting broader macroeconomic headwinds, such as fiscal uncertainty and rising interest rate expectations, which are eroding the 'store of value' narrative for these traditional assets."

On-chain data from Glassnode shows that long-term holders (addresses holding for over 155 days) are currently selling about 45,000 ETH daily, amounting to approximately $140 million. This is the highest selling level since 2021, indicating a weakening bullish sentiment.

6. Value Mismatch Debate: BitMine's Potential Opportunities

Amid the market's pessimism, voices suggesting that BitMine has a value mismatch are gradually emerging.

● Compared to MicroStrategy's path, BitMine has chosen a completely different approach. MicroStrategy heavily relies on convertible bonds and preferred stock for secondary market fundraising, with annual interest burdens in the hundreds of millions, while its profitability depends on the unilateral rise of Bitcoin.

● Although BitMine has diluted its equity through new stock issuance, it has almost no interest-bearing debt, and its held ETH contributes approximately $400-500 million in staking income annually, providing relatively rigid cash flow.

● As one of the largest institutional holders of ETH globally, BitMine can fully utilize staked ETH for restaking (earning an additional 1-2%), operating node infrastructure, locking in fixed income through yield tokenization, or even issuing institutional-grade ETH structured notes. These are operations that MicroStrategy's BTC holdings cannot achieve.

● Currently, BitMine's U.S. stock market value is trading at a discount of about 13% to its ETH holding value. Within the entire DAT sector, this discount is not the most extreme but is significantly lower than the historical pricing center for similar assets.

As of November 20, Bitcoin has fallen back to $91,253 after significant volatility, while Ethereum has dropped below the key support level of $3,000. Amid the market's lament, Strategy's Michael Saylor continues to assert on social media that Bitcoin is currently "on sale."

Treasury company stock prices have fallen to historical lows, with BitMine's mNAV at 0.86 and Strategy's mNAV at approximately 0.93. The market stands at a crossroads, with one side facing the potential end of the treasury model being replaced by ETFs, and the other side presenting a rare opportunity for valuation recovery.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。